In 2025, Baltex and Binance represent contrasting approaches to crypto trading: Baltex offers decentralized, privacy-focused swaps with no KYC, instant execution, and minimal custody risks, ideal for anonymous cross-chain movements. Binance provides centralized deep liquidity for superior execution quality, but with mandatory KYC, higher data exposure, and counterparty risks. Baltex features optimized low fees through aggregation, while Binance charges 0.1% trading fees with BNB discounts. For privacy and quick rebalancing, choose Baltex; for high-volume liquidity and limits, Binance excels. See our comparison tables for quick insights.

Crypto users in 2025 face a pivotal choice between decentralized platforms emphasizing privacy and centralized exchanges prioritizing liquidity. Baltex, accessible through baltex.io, embodies the decentralized privacy model with non-custodial, wallet-to-wallet swaps that avoid KYC and data collection. This appeals to those wary of surveillance while needing efficient trading, rebalancing, cross-chain transfers, and cash-out preparations. Binance, as a centralized giant, counters with unmatched liquidity depth, enabling tight spreads and high-volume trades, but at the cost of custody risks and regulatory compliance.

This guide delves into their differences through the lens of decentralized privacy versus centralized liquidity. We'll examine fees, spreads, liquidity depth, execution speed, slippage risks, limits, custody and counterparty risks, KYC and data exposure, supported chains, deposits and withdrawals, and common failure scenarios. Step-by-step flows for swapping, bridging, and fund movements, along with safety checks, will provide practical insights. Multiple tables offer clear comparisons, and a dedicated section highlights Baltex's multi-chain capabilities. By understanding these elements, users can select the platform that best mitigates risks while optimizing execution for their strategies.

The decentralized vs. centralized debate intensifies in 2025 amid regulatory pressures. Baltex's privacy-centric design reduces exposure to hacks or freezes, while Binance's liquidity ensures reliable fills in volatile markets. Both support diverse assets, but their risk profiles diverge sharply.

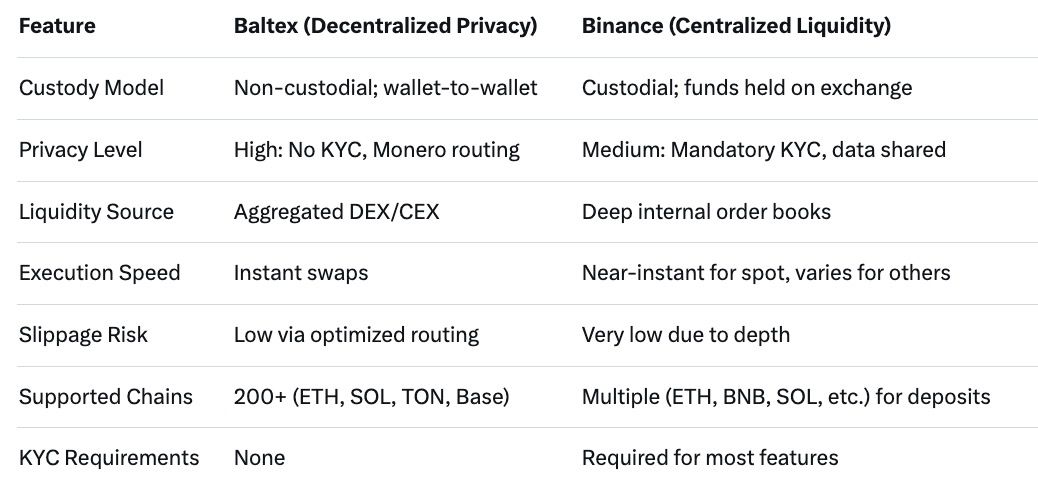

This table summarizes key features, highlighting privacy and liquidity contrasts in 2025.

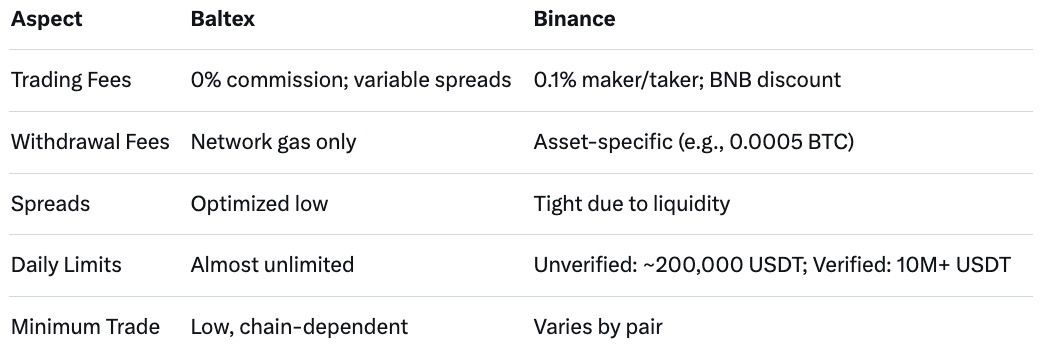

Fees and spreads directly impact execution quality. Baltex operates without fixed platform commissions, instead optimizing spreads through hybrid DEX and CEX aggregation for minimal costs. Users review variable fees, often low due to no overhead, during transaction approval. This decentralized approach keeps effective rates competitive, especially for privacy-focused swaps.

Binance charges a standard 0.1% for both maker and taker trades, reducible by 25% with BNB holdings. Spreads are tight thanks to massive liquidity, minimizing hidden costs in high-volume markets. However, withdrawal fees vary by asset and chain, adding to overall expenses.

In privacy vs. liquidity terms, Baltex's no-fee model suits low-exposure users, while Binance's structured fees benefit from economies of scale.

Liquidity depth defines trade reliability. Baltex draws from aggregated sources, providing sufficient depth for most swaps but potentially less during niche pair volatility. Execution is instant, with tokens arriving wallet-direct post-approval, reducing timing risks.

Binance's centralized pools offer unparalleled depth, supporting billions in daily volume for seamless large orders. Speed is near-instant for spot trades, though network confirmations apply to withdrawals.

Decentralized Baltex prioritizes speed for privacy, while centralized Binance leverages depth for quality.

Slippage erodes value in volatile conditions. Baltex mitigates it with real-time routing, keeping risks low (<0.3% typical). Limits are virtually unlimited, fostering flexibility.

Binance's depth ensures minimal slippage even on large trades. Limits tie to KYC: unverified users may face caps like 200,000 USDT daily withdrawals, escalating to 10M+ for verified.

Privacy users favor Baltex's no-limits approach; liquidity seekers appreciate Binance's scaled caps.

Detailed comparison of costs and constraints.

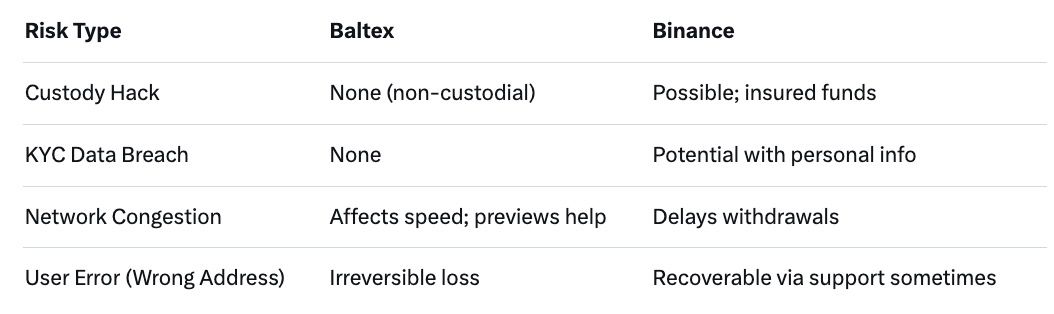

Custody risks highlight the core divide. Baltex's non-custodial model eliminates counterparty exposure; users retain keys throughout, avoiding hacks like those plaguing centralized platforms.

Binance holds funds, introducing risks despite insurance and audits. Past incidents underscore potential freezes or losses.

Decentralized privacy minimizes these; centralized liquidity demands trust in safeguards.

KYC embodies privacy trade-offs. Baltex requires none, collecting no data and using Monero for anonymity.

Binance mandates KYC for full access, involving ID submission and potential data sharing, heightening exposure.

Users prioritizing anonymity lean toward Baltex.

Chain support enables cross-network operations. Baltex integrates 200+ chains natively for bridgeless swaps. No deposits needed; swaps are direct.

Binance supports multiple chains for deposits/withdrawals, like ETH, BNB Chain, but requires funding accounts first.

Baltex simplifies movements; Binance offers broader fiat gateways.

Failures vary by model. Baltex risks include wallet errors or network congestion, mitigated by previews. No custody means no platform hacks.

Binance scenarios involve account freezes, withdrawal delays, or exchange outages. KYC mismatches can lock funds.

Safety lies in understanding these.

Overview of potential pitfalls.

Swapping on Baltex: Select tokens/chains on baltex.io. Connect wallet. Review rate, fees, slippage—key safety check. Approve; receive instantly. Safety: Verify addresses, use hardware wallet.

On Binance: Deposit via supported chain. Place order (market/limit). Execute trade. Withdraw to wallet. Safety: Enable 2FA, whitelist addresses.

Bridging with Baltex: Inherent in cross-chain swaps; no separate step. Safety: Confirm chain compatibility.

Binance bridging: Use Binance Bridge or third-party; deposit first. Safety: Check fees, confirm networks.

Moving funds between: From Baltex to Binance—swap to desired asset, withdraw to Binance address. Reverse: Withdraw from Binance, swap on Baltex. Safety: Test small amounts, monitor tx.

Baltex.io revolutionizes multi-chain operations in 2025 with instant, privacy-preserving swaps across 200+ networks. For portfolio rebalancing, users can shift ETH to SOL seamlessly without bridges, aggregating liquidity for optimal rates and low slippage. This decentralized approach keeps funds non-custodial, reducing risks during volatile adjustments.

Cross-chain routing thrives on Baltex's bridgeless design, enabling direct transfers like TON to Base with Monero privacy layers to obscure trails. Traders exploit arbitrage opportunities swiftly, bypassing wrapped tokens that introduce fees and delays.

Preparing for cash-outs, Baltex facilitates anonymous accumulation—swap to stablecoins or fiat-ramp assets wallet-direct. No KYC means no exposure before off-ramping elsewhere. Overall, Baltex empowers efficient, secure strategies in a multi-chain world.

Specific applications and benefits.

0.1% for makers and takers, with discounts for BNB holders.

No, it operates without any KYC for full privacy.

Binance, due to its centralized deep pools.

Instant, with no waiting periods.

Funds are held by the exchange, exposing to potential hacks.

Baltex's decentralized privacy model outshines for users valuing anonymity and control, while Binance's centralized liquidity dominates for execution quality and volume. Weigh your priorities—privacy reduces risks like data exposure, but liquidity ensures tight trades. For more, check our no-KYC guides or centralized exchange reviews. Test both cautiously to align with your crypto journey.