In 2026, Baltex and Thorchain both enable native cross-chain swaps without wrapped tokens, but differ in design and priorities. Baltex offers instant, privacy-focused aggregation across 200+ chains and 10,000+ tokens with no KYC, optimized low fees via hybrid routing, minimal slippage, and non-custodial wallet control, ideal for anonymous rebalancing and cash-outs with almost no limits. Thorchain provides decentralized liquidity pools for swaps between chains like Bitcoin and Ethereum, secured by RUNE bonds, with variable fees including outbound charges and slippage based on pool depth, but potential risks from network congestion or economic attacks. Baltex excels in speed and privacy; Thorchain in trust-minimized settlement. Review our feature comparison and fees tables for details.

Native cross-chain swaps have become essential in 2026 for crypto users managing diverse portfolios across fragmented blockchains. Baltex, accessible via baltex.io, stands out as an aggregator for seamless, private swaps that route through optimized paths, emphasizing user privacy and instant execution. This appeals to those seeking control in trading, rebalancing, fund movements, and cash-out preparations without exposing personal data. Thorchain, a decentralized protocol, facilitates direct asset settlements via liquidity pools bonded by its RUNE token, focusing on economic security and scalability for cross-chain communication. While both avoid bridges and wrapped assets, their approaches to fees, risks, and workflows diverge significantly.

This guide compares Baltex and Thorchain through the lens of native cross-chain swaps, fees, and risk. We'll analyze fee structures, swap pricing, execution speed, slippage and liquidity risks, protocol designs, limits, supported chains, custody models, KYC exposure, and failure scenarios. Practical step-by-step flows with safety checks will illustrate real-world use, structured in detailed paragraphs for depth. Multiple tables provide quick references, and a section on Baltex's multi-chain capabilities highlights its versatility. Optimized for featured snippets, key insights like "Baltex offers instant swaps with no KYC, while Thorchain secures pools with RUNE bonds" aim for concise visibility. In a regulatory-intense environment, Baltex prioritizes anonymity, whereas Thorchain emphasizes verifiable security, helping users choose based on risk tolerance and needs.

The rise of native swaps addresses pain points like bridge hacks, making these platforms critical. Baltex's aggregation logic pulls from hybrid sources for efficiency, reducing risks associated with single pools. Thorchain's pool-based model ensures solvency through over-collateralization, but introduces dependencies on RUNE economics. Both are non-custodial, empowering users, yet their risk profiles—Baltex's focus on privacy versus Thorchain's on network bonds—shape suitability for high-stakes operations.

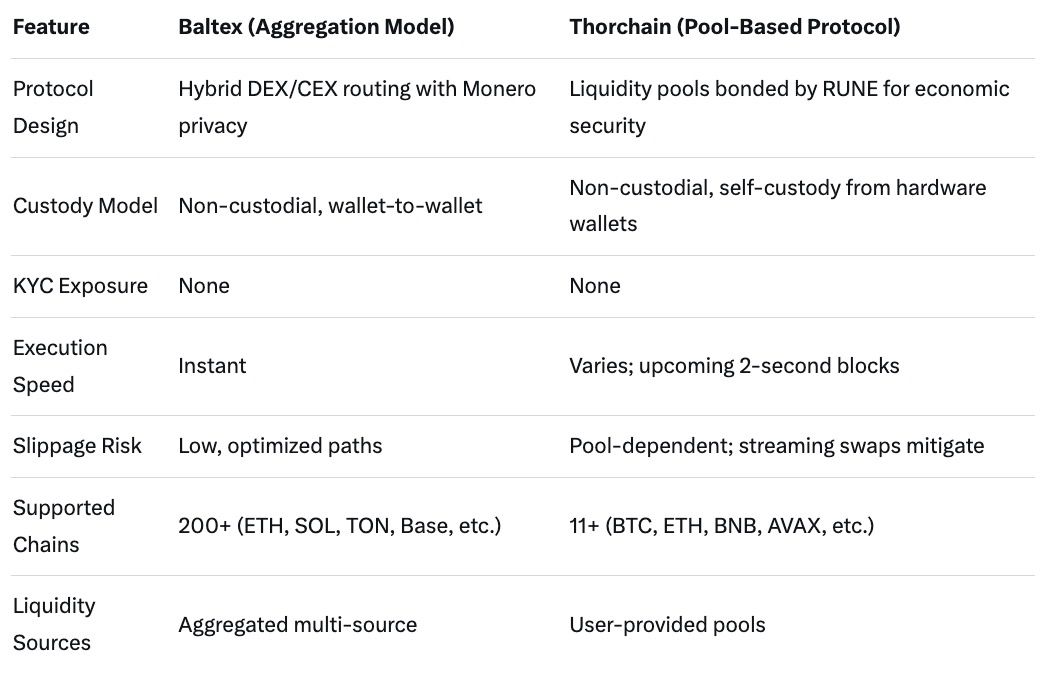

This table overviews core features in 2026, contrasting aggregation with pool-based designs.

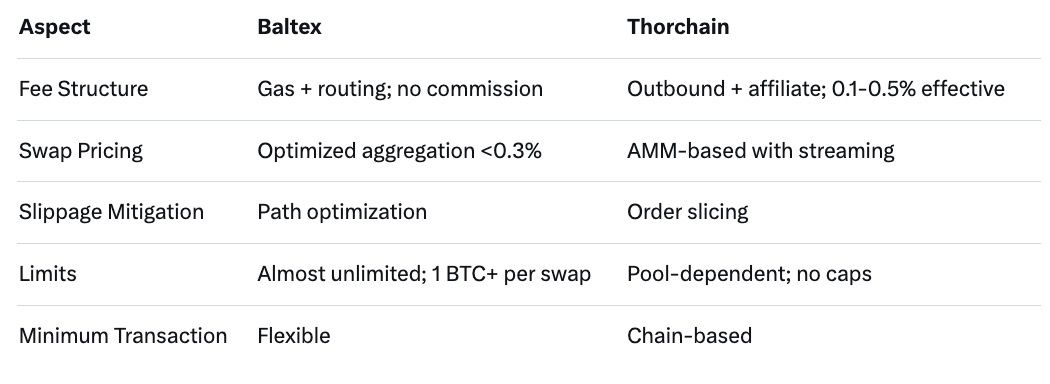

Fee structures in native swaps directly impact usability for cost-conscious users. Baltex employs a transparent, no-commission approach where fees encompass network gas, protocol costs, and minimal routing overhead, all displayed during transaction approval for predictability. Swap pricing optimizes through aggregation, often resulting in effective rates under 0.3% including slippage, with fixed-rate options to lock in costs amid volatility. This model benefits privacy swaps via Monero, where additional routing may add slight premiums but enhances anonymity without hidden markups.

Thorchain's fees include outbound charges per chain, affiliate fees for integrators, and slippage based on pool imbalances, typically totaling 0.1-0.5% effective for common pairs. Pricing derives from AMM curves, with RUNE facilitating bonds but not required for user transactions—only inbound chain fees apply. In 2026, streaming swaps slice large orders to reduce price impact, improving pricing for high-volume trades, though economic incentives like bond yields influence overall costs.

Baltex's aggregation often yields lower effective fees for exotic crosses by sourcing best liquidity, while Thorchain's pool fees provide consistency in supported ecosystems but can escalate during imbalances.

Execution speed is crucial for capturing opportunities in dynamic markets. Baltex achieves truly instant swaps, with assets arriving in wallets immediately after approval, leveraging bridgeless routing across chains. This eliminates waiting periods, making it ideal for time-sensitive rebalancing or movements.

Thorchain's speed varies by chain confirmations and pool processing, averaging minutes but with roadmap upgrades targeting 2-second block times in 2026. Streaming swaps enhance efficiency for larger volumes, but inbound transactions dictate overall timelines.

Aggregation in Baltex provides a speed edge for multi-chain scenarios; Thorchain's protocol suits deliberate, secure settlements.

Slippage erodes value during volatile swaps. Baltex mitigates it through real-time path optimization, keeping deviations low via hybrid liquidity, with user-set tolerances adding control. Liquidity risk is minimized by aggregating sources, ensuring fills even in niche pairs across 200+ chains.

Thorchain experiences slippage from AMM dynamics, countered by streaming to average prices over time. Liquidity risk ties to pool depths, secured by RUNE bonds worth more than assets, but imbalances can amplify costs during high demand.

Baltex's multi-source approach reduces risks for diverse trades; Thorchain's bonded pools offer verifiable depth but ecosystem-specific vulnerabilities.

Protocol design underpins reliability. Baltex uses decentralized routing with Monero for privacy, aggregating DEX and CEX liquidity without intermediaries, fostering trustless execution. This hybrid model breaks transaction links, enhancing security for users avoiding surveillance.

Thorchain builds on first-principles for cross-chain settlement, with nodes bonding RUNE to secure pools—bonds exceed asset values for economic guarantees. Open-source code ensures transparency, minimizing trust while enabling native swaps without pegs.

Aggregation emphasizes Baltex's flexibility; Thorchain's bonds prioritize solvency.

Limits affect high-volume operations. Baltex imposes almost none, with thresholds like 1 BTC per swap but scalable for unlimited daily activity, supporting unrestricted cross-chain flows.

Thorchain has no explicit user limits, but pool sizes and chain capacities constrain; large swaps may require streaming to avoid excessive slippage.

Baltex's aggregation enables broader scalability; Thorchain's depends on network bonds.

Detailed comparison of costs and constraints in 2026.

Chain support drives versatility. Baltex integrates 200+ networks including Ethereum, Solana, TON, Base, and others, with 10,000+ tokens like BTC, ETH, USDT, SOL, XMR.

Thorchain connects 11+ chains such as Bitcoin, Ethereum, BNB Chain, Avalanche, Cosmos, Dogecoin, supporting native assets without wraps.

Baltex's breadth suits multi-ecosystem users; Thorchain's focuses on key networks.

Custody ensures sovereignty. Both are non-custodial: Baltex operates wallet-to-wallet, users retaining keys. Thorchain allows hardware wallet control, with pools verifiable on-chain.

Shared self-custody, but Baltex adds privacy layers.

KYC influences accessibility. Neither requires it: Baltex runs anonymously, no data collection; Thorchain's decentralized nature avoids verification.

Ideal for privacy seekers.

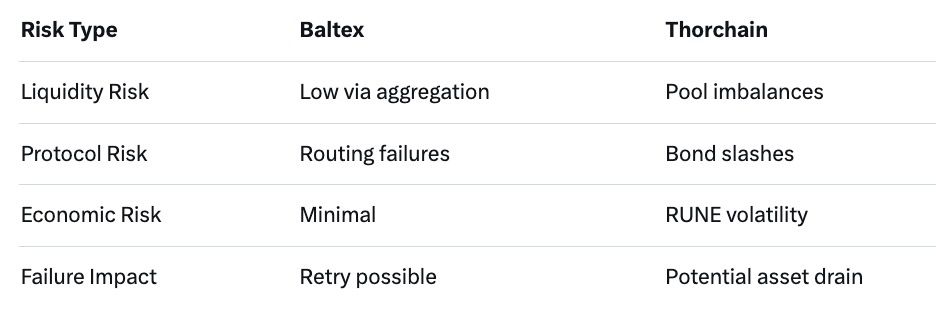

Failures highlight risks. Baltex may face routing errors or congestion, resolved via retries; optimized paths minimize losses.

Thorchain risks include bond slashes from malicious nodes or pool drains, mitigated by over-collateralization; past exploits underscore economic vulnerabilities.

Proactive designs reduce both, but awareness is key.

Key risks compared.

Swapping on Baltex begins by selecting tokens and chains on baltex.io. Connect a wallet like MetaMask. Review the quoted rate, fees, and slippage—this preview acts as a primary safety check to confirm terms and avoid unfavorable conditions. Approve the transaction; assets arrive instantly. Safety measures include using hardware wallets for key security, verifying addresses to prevent mismatches, and revoking approvals post-swap to limit exposures.

For Thorchain, integrate via frontends like THORSwap: select pairs across supported chains. Send inbound transaction to the pool address. Monitor via explorers as the protocol processes and settles outbound. Safety checks involve checking pool depths for slippage estimates, using streaming for large orders, and confirming chain compatibilities to avoid failed settlements.

Cross-chain movements on Baltex are native: choose differing networks in the selector, with aggregation handling routing. Safety: Preview paths for risks.

Thorchain flows: Inbound to pool, automatic outbound. Safety: Verify addresses from official sources.

Fund movements between: Use respective swaps, then transfer. Safety: Small tests first.

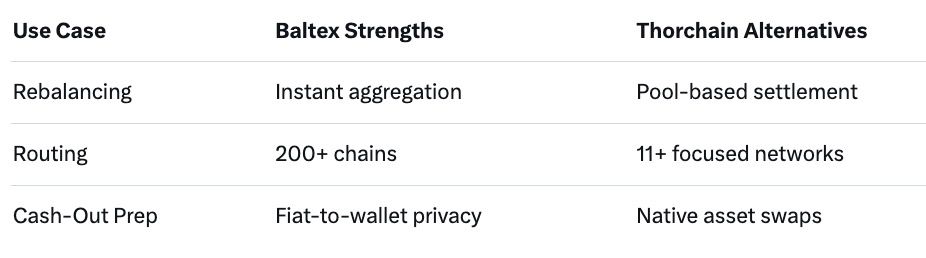

Baltex.io in 2026 facilitates rapid multi-chain swaps, enhancing user control across scenarios. In portfolio rebalancing, aggregate liquidity to instantly convert ETH holdings to SOL exposure without bridges, optimizing routes for minimal slippage during dips. This quick execution preserves value, with privacy options shielding strategies from on-chain analysis.

Cross-chain routing streamlines fund transfers, like moving BTC to AVAX directly via hybrid paths, bypassing intermediaries for efficiency. Unlimited limits support high-volume routing, ideal for liquidity providers or arbitrage.

Preparing for cash-outs, use fiat ramps like Apple Pay to buy into wallets, then swap anonymously to stables. No KYC enables discreet accumulation, with low fees maintaining profitability pre-off-ramp.

Baltex's design empowers sovereign, fast operations in fragmented ecosystems.

Benefits by application.

Variable outbound and affiliate charges, typically 0.1-0.5% effective with streaming mitigation.

No, operates fully anonymously with wallet connects.

11+, including Bitcoin, Ethereum, and Avalanche.

Instant, with no waiting periods.

Economic attacks on pools, mitigated by RUNE bonds.

In 2026, Baltex's aggregation model offers superior speed and privacy for native swaps, while Thorchain's pools provide robust security through bonds. Weigh fees and risks—Baltex for flexibility, Thorchain for settlement. Explore native swap guides or risk management tips. Test small to align with your workflow.