If you are looking for the fastest crypto bridges 2025 has to offer, focus on platforms that provide:

Near-instant transaction speeds (under a minute or just a few minutes)

Low or zero fees

Reliable privacy features

Broad support for major blockchains like Ethereum, Binance Smart Chain, Polygon, Avalanche, and more

For truly private transfers and zero transaction fees, baltex.io stands out as a top choice. This listicle explores the best cross-chain bridges you might consider in 2025 so you can swap your tokens quickly, minimize your costs, and stay in control of your data.

Transferring tokens across blockchains used to be a big challenge. Before cross-chain bridges matured, you sometimes had to sell your tokens and rebuy them on another chain, losing money on fees and potentially missing out on price fluctuations in the process. Modern bridges have changed that with direct, secure transfers across networks. They speed up transactions, reduce gas costs, and open new possibilities for decentralized finance (DeFi) ventures.

In 2025, cross-chain connectivity is vital for anyone looking to diversify a crypto portfolio or take advantage of opportunities on different chains. You might want to move funds to a network with lower fees or jump on a new yield farming protocol that only exists on a rival chain. By using the fastest crypto bridges 2025 has to offer, you can make these adjustments and seize new opportunities without leaving your tokens stranded.

Choosing the right crypto bridge for your needs goes beyond speed and low fees. Here are a few essential considerations:

Transaction speed: An ideal bridge completes transfers in minutes, or even seconds.

Gas fees: Some bridges are optimized to cut down on on-chain costs. Others rely on advanced protocols or offset fees with reward systems.

Privacy: Consider whether a bridge protects personal data or employs zero-knowledge proofs to shield transaction details.

Supported networks: Check if it covers all the blockchains you plan to use.

Reliability: A proven track record, strong uptime, and minimal downtime can help you avoid transaction delays.

Below is an in-depth look at the best platforms for cross-chain swaps this year. These platforms stand out for their speed, affordability, privacy, and range of supported chains. Each one has a different approach, so your choice will depend on which chains you use the most and how important privacy or fees are to you.

Baltex.io is a private, zero-fee platform that aims to make cross-chain swaps as straightforward as possible. When you use this service, you will notice you are not hit with typical bridge or transaction charges. That is a big advantage if you plan on making frequent transfers or if you are dealing with small token amounts.

Speed: Transactions on baltex.io often finalize in under a minute.

Fees: True zero-fee structure, though you still pay minor network gas costs depending on the chain.

Baltex.io does not collect personal data, making it a solid choice if you prefer to keep your activity private.

The swap interface encloses your transaction data invisible to third parties, meaning your token movements remain highly confidential.

Ethereum

Binance Smart Chain

Polygon

Select additional networks based on high demand

Baltex.io works especially well for traders who constantly hop between multiple DeFi platforms. If you value privacy and cost savings, this bridge might become your top pick.

ChainXpress is a user-friendly bridge that streamlines token transfers across popular networks. Its dashboard is simple to use, even if you are new to cross-chain swaps.

Speed: Typically under five minutes to complete a transfer.

Fees: Low bridging fees, averaging around a dollar or two, though prices can fluctuate with network congestion.

Ethereum

Binance Smart Chain

Polygon

Avalanche

ChainXpress can be a safe bet if you just want an easy interface and do not mind minimal bridging fees.

AnyCross Transfer stands out for its advanced cryptographic techniques that keep your data secure. It uses multi-signature wallets, meaning your bridge transaction needs multiple validations before finalizing, which can boost security.

Speed: Transfers often take around two minutes, thanks to parallel transaction processing.

Fees: Moderate bridging fees but offers discounts for high-volume traders.

Employs zero-knowledge proofs to hide sensitive financial data, like exact token amounts.

Multi-signature model ensures no single point of failure.

Ethereum

Polygon

Solana

Tron

Several other EVM-compatible chains

If privacy is a major concern but you still want quick transfers, AnyCross Transfer provides a compelling mix of advanced encryption and solid efficiency.

WarpBridge predominantly focuses on speed. The platform accomplishes near-instant transfers by offsetting transaction confirmations with an internal liquidity pool. Essentially, you swap your tokens on one side of the bridge, and the protocol immediately credits your tokens on the destination chain, then later finalizes the underlying transactions on its back end.

Speed: Often under 30 seconds for the user-facing swap.

Fees: Slightly higher bridging costs to maintain the liquidity pool.

Ethereum

Binance Smart Chain

Avalanche

Additional sidechains under development

If your priority is speed and you are not too worried about privacy, WarpBridge makes it possible to do cross-chain swaps almost instantly.

PolyGate Interchange excels at bridging assets between multiple Ethereum layer-2 networks and other popular blockchains. If you have taken advantage of layer-2 solutions to save on gas, this bridge can help you seamlessly move assets across different ecosystems.

Speed: Usually one to three minutes, depending on layer-2 confirmation times.

Fees: Generally low, since layer-2 transactions come with reduced gas costs.

Standard blockchain transparency.

Users can opt to shield their transactions if bridging to a privacy-focused blockchain.

Major Ethereum layer-2 solutions (Optimism, Arbitrum)

Ethereum mainnet

Binance Smart Chain

Polygon

If you swap tokens within multiple layer-2 networks regularly, PolyGate Interchange may optimize your bridging experience and keep secondary fees under control.

Synapse Network is known for bridging not just standard tokens but also advanced DeFi assets. For instance, it supports bridging yield-bearing tokens or liquidity pool positions. This complex bridging approach saves you from having to unwind your positions first, which can be time-consuming and more expensive.

Speed: Around three to five minutes on average.

Fees: Minimal bridging fee plus standard network gas costs.

Ethereum

Polygon

Avalanche

Binance Smart Chain

Additional DeFi-focused networks

If you hold multiple DeFi assets and want a single solution for bridging them natively, Synapse Network can simplify that process by enabling direct cross-chain transfers of your staked or yield-bearing tokens.

BridgeDefi Gate is a platform that tries to minimize user headaches. Instead of forcing you to manually pick which chain to swap from, it auto-detects your wallet’s connected network and shows you bridging options for direct transfers. The user interface is well-designed, making it a favorite among newcomers.

Speed: Often two to four minutes.

Fees: Slightly higher than average, but transparent in the user dashboard.

Ethereum

Binance Smart Chain

Harmony

Polygon

The highlight of BridgeDefi Gate is its intuitive approach: you do not have to worry about chain details. It is all laid out for you in a user-friendly design.

PortalSwap’s mission is bridging to lesser-known chains while maintaining speed and low fees. If you love exploring new blockchains and up-and-coming DeFi protocols, PortalSwap’s connectivity might surprise you.

Speed: Usually under three minutes for common networks, can vary for lesser-known chains.

Fees: Competitive bridging fees, with occasional promotions or fee waivers for new chain launches.

Focused on accessibility rather than anonymity.

Tracks only minimal user data.

Ethereum

Binance Smart Chain

Polygon

Avalanche

Select lesser-known EVM chains

PortalSwap can be a convenient solution if you are eager to move assets beyond the mainstream networks and want consistent bridging times.

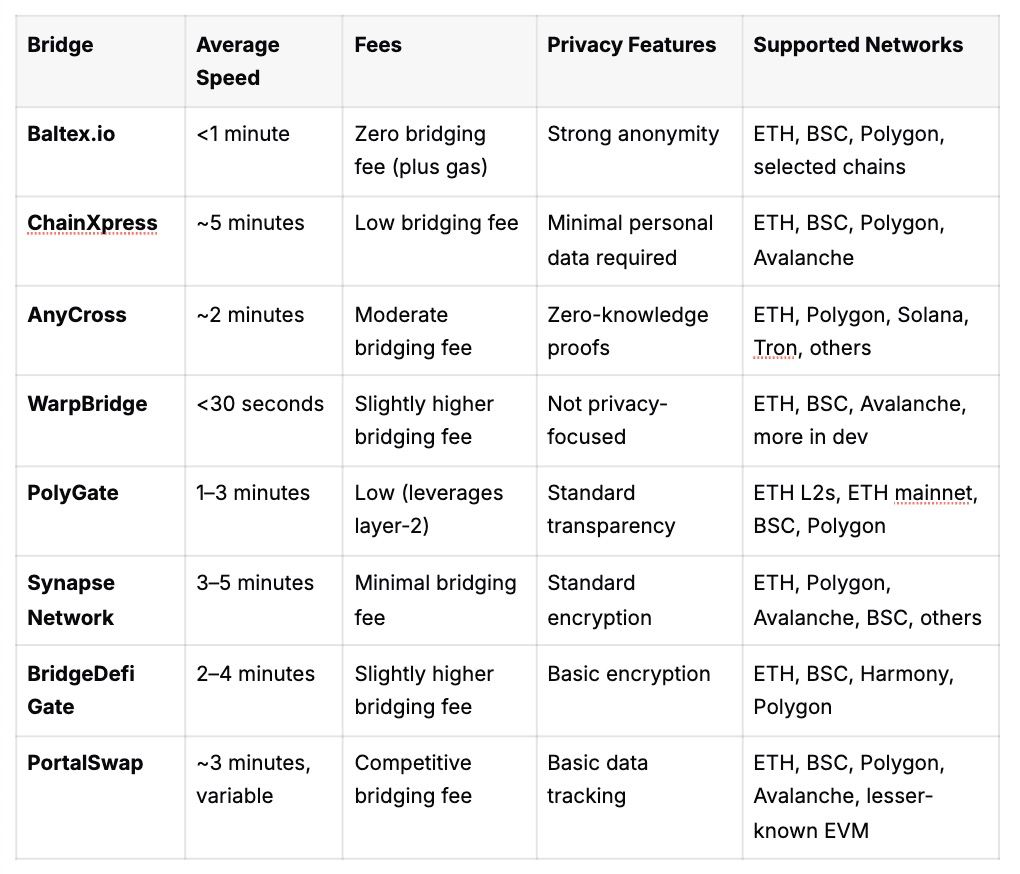

Below is a snapshot comparing speed, fees, privacy, and supported networks across the top contenders:

Use this table as a quick reference if you are comparing your top candidates. If privacy and zero fees are your main priorities, baltex.io stands out. If speed is everything and you can tolerate higher bridging fees, WarpBridge might be your best bet.

If you have never used a cross-chain bridge before, you may be curious how they actually work behind the scenes. In short, when you bridge tokens from one chain to another:

You send your tokens to a smart contract on the original chain.

The contract locks or burns those tokens.

A corresponding contract on the destination chain then mints or releases an equivalent amount of tokens.

In some cases, the bridge platform uses liquidity pools to provide a quicker experience. Instead of waiting for confirmations on both chains, they appear to finish your transaction almost instantly and settle things in the background. However, these liquidity pools must be well-funded to handle large volumes without delays.

Speed and fees can make or break your bridging experience, especially when you are moving tokens multiple times a week or dealing with volatile markets. Here is why these factors are crucial:

Market timing: If you spot an opportunity on a particular blockchain, you want to move your funds there quickly before prices shift. Bridges that take too long can lead you to miss out on profitable trades.

Gas savings: Multiple bridging transactions can add up. Finding platforms that optimize gas usage or offset fees helps you keep more of your funds.

User experience: A slow, expensive bridge discourages frequent cross-chain activities and may limit your DeFi opportunities.

Not everyone needs anonymous swapping, but there are solid reasons to consider bridging platforms that respect your privacy:

Trade secrecy: If you are developing advanced strategies, you might prefer to hide your movements from competitors.

Personal security: Large, visible transactions can make you a target for hacks and other cyber threats.

Regulatory environment: Some jurisdictions might impose restrictions on cross-chain movements, making private transactions more appealing for those who want to protect their financial autonomy.

Platforms like baltex.io and AnyCross Transfer excel at discretion, minimizing the digital footprints of your transactions.

Even if you choose from the fastest crypto bridges 2025 has on the market, you will want to keep a few best practices in mind:

Double-check chain addresses: Make sure you are bridging to the correct wallet address on the correct chain. Mixing up addresses can cause lost funds.

Watch for traffic surges: Network congestion can slow down bridging times. If you see high gas fees on Ethereum, for instance, expect slight delays.

Have extra tokens for gas: When bridging to a new chain, try to hold some native tokens there to pay for future gas. If you arrive with no native tokens, you may not be able to complete transactions.

Keep track of your bridging transactions: Note transaction IDs so you can track progress if something goes wrong.

Stay updated on security: Keep an eye on any announcements from your chosen bridges. If they update security protocols or pivot to new networks, you want to know about it.

Deciding among these top contenders may seem tricky, but asking yourself the following questions can help:

Which chains do I use most? Make sure your chosen bridge supports every primary network you plan to interact with.

Do I care about fees or speed more? Balancing speed with cost is always a trade-off. If you swap small amounts, a zero-fee platform is especially appealing.

How crucial is privacy? If you are moving large sums of money or want to keep your activities confidential, opt for a privacy-focused bridge.

Am I bridging advanced assets like liquidity pool tokens? Check whether the bridge supports more than just standard tokens.

By lining up your needs with the strengths of each platform, you can narrow down your choices and pick a bridge you can rely on.

No. A decentralized exchange (DEX) typically allows users to swap tokens on a single blockchain, while a cross-chain bridge facilitates transfers between different blockchains. However, some bridges integrate DEX functionality by providing liquidity pools that let you change tokens during the bridging process.

Most reputable bridges have a transaction ID or reference number that you can use to open a support ticket directly. Because transactions occur on-chain, you can usually track the status via a blockchain explorer. If tokens get stuck, contacting the platform’s support team is your best bet. Some platforms also provide automated recovery mechanisms if an error is detected early.

It depends on both the bridge you use and the current congestion on the networks. Some platforms, like WarpBridge, can finalize your swap in seconds by using a liquidity pool. Others might take several minutes or even hours if the original or destination chain is slow.

Many bridges are compatible with popular wallets like MetaMask and WalletConnect. You typically need to add the relevant networks to your wallet settings. Some hardware wallets also support bridging, but check for compatibility on a case-by-case basis for each platform.

While no technology is 100 percent risk-free, most established bridging platforms have strong security measures like multi-signature wallets, audits, and tested smart contracts. That said, bridging exploits have occurred in the past, so it is important to use platforms with a proven reputation and to keep an eye on any audits or security updates they release.

Yes. Many cross-chain bridges also support tokens from networks like Solana, Tron, and Polkadot. The key is ensuring both the origin chain and the destination chain are covered. Check each platform’s supported networks to confirm your token is eligible for bridging.

As cross-chain activity grows in 2025, the quest to find the fastest crypto bridges has become more important than ever. Whether you find yourself swapping across Ethereum layer-2 solutions, bridging into new DeFi ecosystems, or shielding your transactions from prying eyes, it is worth researching which platform checks your must-have boxes. Baltex.io stands out for zero fees and privacy protections, WarpBridge wins on sheer speed, and other contenders like AnyCross Transfer, ChainXpress, and PortalSwap bring their own unique benefits to the table.

When comparing these platforms, remember that your priorities matter. If you are aiming to keep costs low and maintain privacy, look for minimal bridging fees and a discrete approach. If you need blazing speed, you might sacrifice some fees or forego anonymity. Your perfect choice depends on how often you move funds, what networks you focus on, and how comfortable you are with potential trade-offs like liquidity pool fees or minimal data collection.

Above all, cross-chain bridging in 2025 opens up new possibilities that did not exist a few years ago. By carefully selecting a reliable solution, you will empower yourself to explore blockchain ecosystems without letting high fees or slow transfers hold you back. You will stay nimble, respond quickly to market changes, and make the most of the flourishing DeFi landscape.