Welcome! If you are exploring the world of decentralized finance (DeFi) and looking for a quick way to move your assets between Ethereum (ETH) and Solana (SOL), you have come to the right place. In this guide, we will walk you through how an ETH to SOL swap works and introduce you to the best cross-chain swap tools available in 2025. By the end, you will know how to pick the right solution for your wallet, save on fees, and keep your transfers as secure and efficient as possible.

Cross-chain swaps let you convert ETH to SOL directly or with bridging, cutting down the steps and time usually needed to move assets between blockchains.

In 2025, new protocols and hybrid platforms have streamlined these swaps so you can complete transfers in seconds.

Fees vary by network traffic, protocol, and the type of swap. Always compare total costs before committing.

Security is the main priority in DeFi. Look for trusted platforms that enforce robust audits, smart contracts, and clear documentation.

Tools such as baltex.io stand out for their hybrid approach, combining aggregator routes with bridging methods for a faster and seamless user experience.

Why cross-chain swaps matter

Cross-chain swaps open the door to efficient movement of digital assets across different blockchains. The DeFi ecosystem thrives on liquidity, and being able to jump between Ethereum, Solana, and other major networks helps you:

Access more tools

Avoid high fees on congested blockchains

Tap into opportunities where yields are better

Diversify assets in multiple ecosystems

Before cross-chain swaps, moving tokens from Ethereum to Solana required a series of manual steps. You often needed to bridge your tokens to an intermediary chain or stablecoin, then transfer them into the second network, and finally swap those tokens for SOL. This was time-consuming and introduced more risk. By contrast, an ETH to SOL swap solution condenses those steps into a more direct approach.

The DeFi landscape is expanding at an astounding rate. In 2025, many DeFi apps run on multiple chains at once. Ethereum remains a hub for established dApps and liquidity, while Solana offers speed and low transaction fees. By bridging the networks, you can get the best of both worlds. For instance, you might stake SOL in a Solana-based protocol for near-instant transactions, but also hold ETH to access Ethereum’s deep liquidity pools and well-known DeFi platforms.

Choosing the right cross-chain method helps you stay agile and competitive in an ever-changing market. Instead of manually juggling tokens between networks, you can accomplish your goals in seconds with the right swap tool.

How instant ETH to SOL swaps work

Instant swaps remove much of the hassle behind bridging tokens. Instead of withdrawing your funds to a centralized exchange, switching networks, and converting them manually, these services automate the process on the back end.

Bridging: You lock your tokens on Chain A and mint wrapped tokens on Chain B. When you want to redeem them, you unlock the original tokens by burning the wrapped assets. Bridging usually involves specialized protocols such as Wormhole or Allbridge. While bridging is reliable, it can be slower and involve additional fees depending on traffic.

Direct swapping: Some platforms aggregate liquidity across chains and auto-route your transaction to ensure the swap happens almost instantly. These platforms handle wrapping, bridging, and unwrapping behind the scenes. For you, it simply appears as a single transaction from ETH to SOL.

Public cross-chain protocols: These protocols are open to anyone with network access. They rely on decentralized infrastructure and transparent smart contracts.

Private cross-chain protocols: These are generally built for enterprise or specialized use cases. They might require certain permissions to become a validator or aggregator.

For most retail DeFi trades, public cross-chain protocols are the go-to. They give you the freedom to move funds on your own terms, often with lower fees and no sign-up requirements.

Key protocols enabling ETH to SOL swaps in 2025

As of 2025, multiple protocols specialize in streamlining the ETH to SOL swap process. While new players continue to emerge, here are some established names in cross-chain swapping:

A well-known bridging protocol that connects Ethereum, Solana, and other major blockchains.

It locks tokens on one chain and releases wrapped tokens on another.

Used widely for cross-chain NFT minting, stablecoin transfers, and more.

Simplifies token transfers by offering a unified interface.

Supports multiple blockchains, including Ethereum, Solana, Binance Smart Chain, and others.

Known for relatively low bridging fees and reliable transaction times.

Combine bridging with instant swap capabilities.

Typically offer routes that minimize fees by comparing different liquidity sources.

Great for one-click conversions from ETH to SOL without manually interacting with bridging contracts.

Some DeFi platforms build their own cross-chain bridges.

They run specialized validators or rely on a network of nodes to confirm transactions across different chains.

As you explore these protocols, keep in mind that each solution has different transaction speeds, security audits, and liquidity pools to draw from. Your decision often depends on which platform you already trust or the one that offers the best rates at the time of your swap.

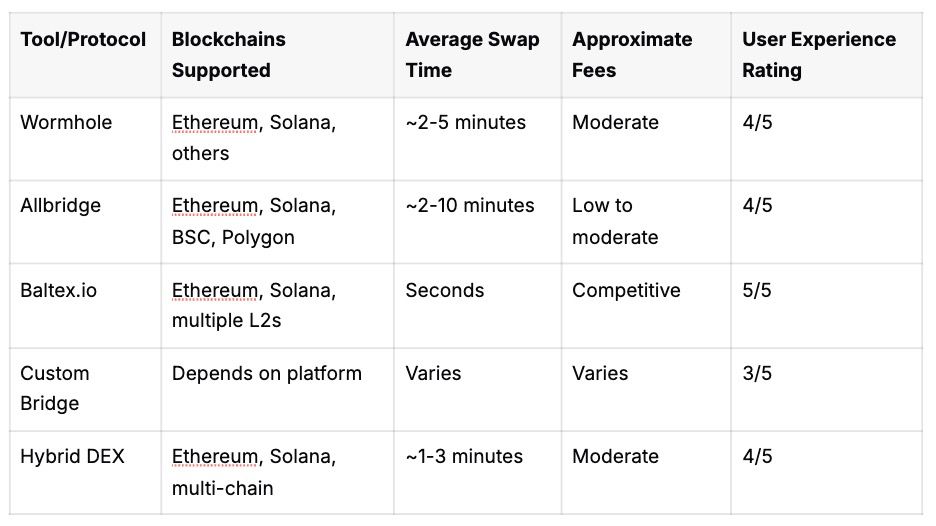

Comparing leading ETH to SOL swap tools

In 2025, cross-chain swapping has matured into a competitive market. Below is a quick overview of some popular solutions, along with their distinguishing features. This table is designed to help you gauge which platform may suit you best:

Wormhole: Excellent if you want a transparent bridging experience and do not mind a few extra minutes to move your tokens.

Allbridge: Provides a user-friendly interface with a moderate fee structure.

Baltex.io: A fast hybrid swap platform that draws on aggregator routes and bridging solutions. It is ideal if you need near-instant ETH to SOL swaps.

Custom bridge solutions: Evaluate carefully to ensure your platform has a solid reputation and security track record.

Hybrid DEX: Offers multi-chain liquidity for various pairs, not just ETH/SOL. Typically faster than basic bridges but might carry slightly higher fees.

Navigating fees and hidden costs

One of the biggest concerns traders have with any swap is how much you will pay in fees. When dealing with cross-chain swaps, multiple factors can influence your total costs.

Each blockchain charges transaction fees (gas fees) to reward validators for processing your transaction. Ethereum gas fees can spike when the network is congested, making swaps expensive. Solana’s transaction costs are typically lower but can still rise depending on traffic.

Ethereum: Gas fees can be significant, especially when the network is busy. You might pay up to tens of dollars or more per transaction if conditions are extreme.

Solana: Known for very low fees (fractions of a cent to a few cents) but keep an eye on the variable rate if the network experiences a surge in activity.

Beyond gas, certain platforms charge a service fee or use a spread-based model. A spread-based model means you will see a slight difference between the expected price of the token and the final execution price.

Instant swap service fees: Some tools bake the fees into the price you receive for your tokens.

Slippage and spreads: If liquidity is low, your trade might settle at a less favorable rate. Check the liquidity levels before confirming the swap.

Bridging can involve deposit and redeem fees. While these charges may be small per transaction, they can stack up if you do multiple swaps. Be sure to read the platform’s documentation on bridging to see if additional fees apply.

Security and best practices

Security is a top priority when you are moving real value across networks. Whether you are using a bridging protocol or a hybrid aggregator, here are a few ways to stay safe.

Audit checks: Look for platforms that have undergone thorough security audits. Smart contract vulnerabilities can lead to loss of funds.

Reputation: New solutions can be tempting, but check if they have a credible team and track record. Skim through user reviews or feedback from the DeFi community.

Two-factor authentication (2FA): If a platform offers additional security layers for your account or wallet, set them up.

Smart contract approvals: Some aggregator platforms require token approvals. Limit these approvals when possible so they cannot move more tokens than necessary.

Cold wallet storage: Only keep what you need in a hot wallet. You can always store the majority of your funds in a cold or hardware wallet until ready to swap.

Impersonation websites: Make sure you have the correct URL for the swap platform. Fake sites are prevalent, especially for popular protocols.

Phishing attempts: If you receive unsolicited messages on social media or email offering private deals, be cautious. Official platforms do not usually approach users out of the blue.

Rushed confirmations: Always double-check the token amounts and addresses in your wallet before you approve any swap transaction.

Tips for choosing a reliable cross-chain swap tool

When deciding on the right tool to handle your ETH to SOL swap, keep a few considerations in mind.

An intuitive dashboard or interface can help you avoid mistakes.

Clear instructions for bridging, swapping, or transferring tokens are a plus.

Confirm that the swap tool supports your favorite wallet, such as MetaMask or Phantom.

Some platforms have a direct integration that makes the process even smoother.

Platforms that aggregate multiple liquidity pools can often guarantee better rates.

Make sure your chosen tool does not have a history of liquidity crunches.

In the event of a hiccup, you want prompt assistance.

Look for a protocol with clear documentation, community channels, and a help desk.

Baltex.io: A fast hybrid swap solution

One of the standout tools in 2025 for an ETH to SOL swap is baltex.io. Here is what you can expect:

Hybrid aggregator approach Baltex.io seamlessly switches between bridging networks and aggregator routes behind the scenes. It is engineered for speed, letting you complete cross-chain swaps in just a few clicks.

Competitive fees Because it compares multiple liquidity pools, baltex.io can automatically route your trade where fees are lowest and execution is fastest.

Easy user experience The interface is refreshingly simple. You choose which tokens to swap, connect your wallet, and confirm the transaction. The platform handles the rest.

Scalable to multiple chains Baltex.io does not just stop at ETH and SOL. It also connects with popular layer-2 solutions, so you have plenty of flexibility for your portfolio.

Baltex.io’s design makes it particularly appealing if you are looking for a single solution that covers most cross-chain scenarios without juggling multiple bridging portals. While it is always good to do your own due diligence, the swift speed and aggregator approach can make it a solid option for daily DeFi usage.

FAQ about ETH to SOL swaps

Here are a few common questions you might have about cross-chain swapping. Feel free to explore further if you need more detail.

How long does an ETH to SOL swap take? It can vary from seconds to a few minutes, depending on the congestion of the networks and the protocol you use. Hybrid solutions like baltex.io often provide near-instant swaps.

Do I need a special wallet for cross-chain swaps? Not necessarily. Most swap tools support common wallets like MetaMask on Ethereum and Phantom on Solana. You might need to approve transactions on each network.

Are cross-chain swaps expensive? Costs depend on gas fees (especially on Ethereum), platform spreads, and bridging fees. During peak traffic times, Ethereum transaction fees can spike considerably, so always check the rates before you swap.

Is bridging safer or riskier than direct swapping? Both carry some risk, but bridging requires additional steps, which can open the door to more vulnerabilities. Reliable direct swap tools aim to minimize risk by simplifying the process and using trusted smart contracts.

What if the swap fails? If a swap fails or times out, you typically keep your original tokens, but check with the platform’s support or documentation to confirm. Some aggregators automatically refund transactions when a step is not completed.

Can I swap tokens other than ETH and SOL on these platforms? Yes. Most cross-chain swap tools support a wide range of tokens. Baltex.io and similar aggregators let you swap different Ethereum-based or Solana-based assets, as well as tokens on other supported chains.

Conclusion

Congrats! By reading this guide, you have learned the essentials of an ETH to SOL swap and how cross-chain tools are reshaping DeFi in 2025. Whether you are an active trader hunting for cross-chain arbitrage opportunities or simply looking to diversify your holdings, fast and secure swaps make the process a breeze.

Remember that fees, security, and user experience are the key elements to evaluate when choosing any cross-chain swap solution. Baltex.io stands out for its hybrid aggregator routing that handles bridging in the background, delivering near-instant transfer times.

Ultimately, it pays to keep an eye on new developments, as DeFi technology evolves rapidly. Always do your due diligence, stay informed about gas rates, and choose well-audited platforms that align with your goals. Now that you know the basics, you are ready to seamlessly convert between ETH and SOL, unlocking powerful cross-chain options for your crypto wallet.