Buying Bitcoin for the first time in 2025 is safe and straightforward. Use beginner-friendly exchanges like Coinbase or Kraken. Fund with bank transfers for low fees (0-1.5%) or cards for speed (2-4% fees). Verify your account, buy BTC starting from $10, and transfer to a secure wallet like Exodus or Ledger. Always enable 2FA. After buying, use baltex.io for private, no-KYC multi-chain swaps.

Welcome to the world of Bitcoin! In late 2025, Bitcoin is trading around $88,000-$90,000, solidifying its position as digital gold amid institutional adoption and spot ETFs. If you're a complete beginner, don't worry—this guide breaks down everything in simple steps.

We'll cover the easiest ways to buy BTC using credit/debit cards or bank transfers, top exchanges, wallets, fees, limits, and crucial safety tips. You'll get clear, step-by-step instructions from purchase to secure storage. By the end, you'll confidently own your first Bitcoin.

(For Bitcoin basics, see our Bitcoin explained simply.)

Bitcoin (BTC) is the original cryptocurrency, a decentralized digital asset not controlled by any government or bank. It runs on blockchain technology for secure, peer-to-peer transactions.

In 2025, Bitcoin appeals to first-timers because:

Remember: Bitcoin is volatile—prices can drop 20%+ quickly. Only invest money you can afford to lose. Start small, like $50-$100.

The simplest and safest method for first-timers is using a reputable centralized exchange (CEX). These platforms handle everything securely and offer buyer protection.

Top beginner-friendly exchanges:

Avoid complex decentralized exchanges (DEXs) or P2P at first.

Cards are the fastest way—instant BTC—but come with higher fees.

Pros: Immediate access, no waiting. Cons: 2-4% fees, possible bank blocks.

Step-by-Step (Using Coinbase):

Fees: ~3-4% total. Limits: $1,000+ daily after verification.

Cheaper but slower (1-5 days).

Pros: Low/no fees, higher limits. Cons: Delay in getting BTC.

Step-by-Step (Using Kraken):

Fees: 0-1.5%. Limits: Up to $100,000+ verified.

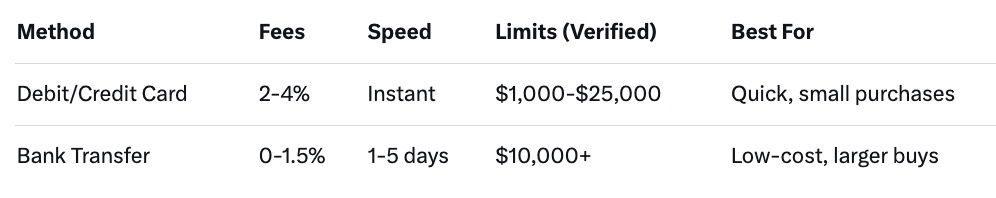

Comparison Table:

Other options like Cash App: Buy instantly with linked bank, ~1-2% fees.

Fees add up—here's what to watch:

Minimize costs:

Limits: Unverified ~$100-500; full KYC unlocks thousands daily.

Security first—crypto scams are common.

Must-do checks:

Many exchanges offer insurance for holdings.

Never leave BTC on exchanges long-term—transfer to your own wallet ("not your keys, not your coins").

Types:

Top beginner wallets 2025:

Step-by-Step Transfer to Wallet:

For holdings over $1,000, use hardware like Ledger.

After owning BTC, you might want to swap it for other cryptos (e.g., ETH, SOL) or move across chains privately.

baltex.io is a non-custodial, privacy-focused multi-chain swap platform perfect for this.

Key features for beginners/post-purchase:

Why use after buying BTC?

Step-by-Step on Baltex.io:

Ideal for first-timers wanting more from their BTC without complexity.

Most platforms start at $10-50. Buy fractions (satoshis)—no need for a whole BTC.

Yes, for amounts over ~$100 on reputable exchanges (KYC for safety/compliance).

Yes in most countries, including the US. Track for taxes.

Card for instant/first buy; switch to bank for savings.

Card: Minutes. Bank: Days for funds, then instant buy.

Irreversible—double-check addresses!

Kraken for transfers; Coinbase for ease.

Limited—exchanges require KYC; some P2P/ATMs for small amounts.

Buying Bitcoin for the first time in 2025 is easier and safer than ever. Start with a trusted exchange like Coinbase, use bank transfers to keep fees low, and move to a personal wallet like Exodus or Ledger. Prioritize security with 2FA and small starts.

Once you have BTC, platforms like baltex.io open doors to private multi-chain swaps and more crypto adventures.

You're joining a global movement—congrats! Invest responsibly and enjoy learning.