Buying gold-backed crypto in 2026 is straightforward: Research tokens like PAXG or XAUT, set up a wallet (e.g., MetaMask or Ledger), choose a platform like Kraken or Coinbase, fund your account, and buy. Store securely in non-custodial wallets to avoid custody risks. Fees average 0.1–0.5%; watch for counterparty and regulatory risks. Use baltex.io for multi-chain swaps and portfolio management. See platform comparison and fees and risks for details. Gold prices hover at $4,500–$5,000/oz, boosting appeal as hedges.

Gold-backed cryptocurrencies are digital tokens pegged 1:1 to physical gold reserves, combining blockchain efficiency with gold's stability. In 2026, amid gold prices at $4,500–$5,000 per ounce, these assets like PAXG (Pax Gold) and XAUT (Tether Gold) offer inflation protection without physical storage hassles. Each token represents a fraction or ounce of LBMA-certified gold in audited vaults.

Issuers mint tokens matching reserves, verifiable via blockchain explorers or issuer portals. Benefits include 24/7 trading, fractional ownership (as low as $50), and DeFi utility for lending/yields. The market cap exceeds $4.5 billion, up from prior years due to institutional adoption. However, they track gold volatility and carry counterparty risks if issuers falter.

Custody models vary: Allocated (specific bars tied to tokens, e.g., PAXG) vs. unallocated (pooled reserves, potentially lower fees but shared claims). Beginners should prioritize audited, regulated options for safety.

Before buying, understand basics to avoid pitfalls.

This step takes 1–2 hours; use free tools like CoinMarketCap.

Secure storage starts with a wallet.

Setup: 10–30 minutes. Hardware adds shipping time.

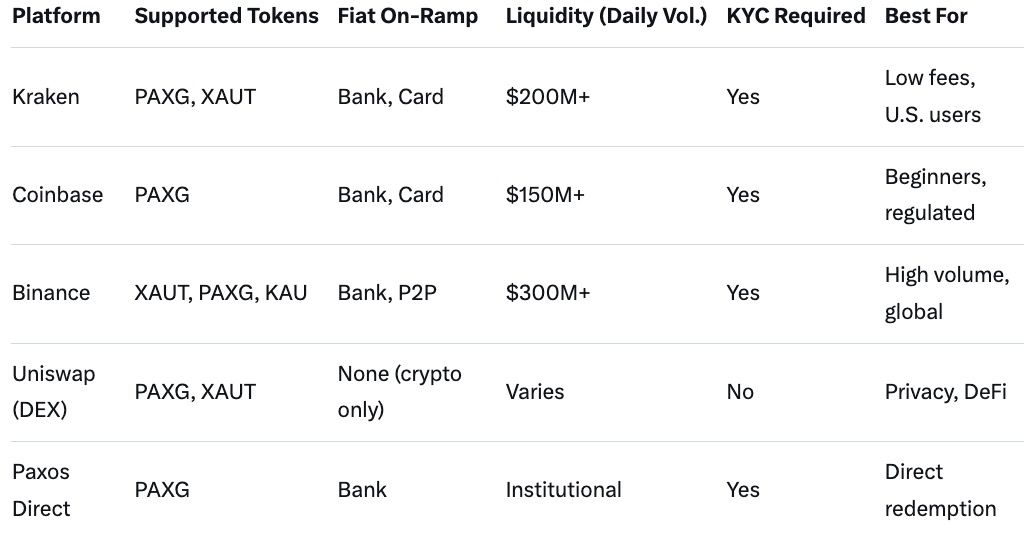

Select based on fees, security, liquidity.

Research: 30 minutes; signup: 1–3 days for verification.

Compare top platforms for buying gold-backed crypto in 2026.

Kraken edges for balance of security/liquidity.

Execute the purchase.

Time: 5–15 minutes post-funding.

Secure and monitor holdings.

Ongoing: Weekly checks.

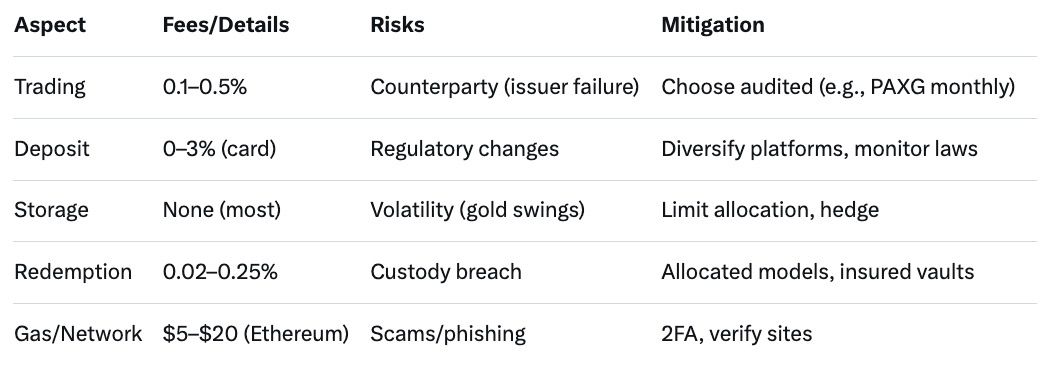

Key costs and pitfalls.

Total costs: <1% annually for holders.

Baltex.io enhances gold-backed crypto management by enabling seamless swaps, intelligent routing, and dynamic portfolio flexibility beyond basic cash-outs. This non-custodial platform supports over 10,000 tokens on 200+ chains like Ethereum, Tron, Solana, and BNB, allowing direct swaps without bridges—e.g., exchange PAXG (Ethereum) for XAUT (Tron) in seconds.

Routing optimizes trades: It aggregates liquidity from multiple DEXs for best rates, minimizing slippage (e.g., route PAXG-to-USDT via Uniswap and others). Private routing via Monero hides transactions from trackers, ensuring anonymity—no KYC needed. This suits privacy-focused users swapping during volatility.

Portfolio tools integrate with wallets (MetaMask, Phantom) for rebalancing: Swap gold tokens to altcoins/stablecoins across chains, diversifying without custody loss. Buy/sell with 100+ fiats via Apple Pay adds entry/exit ease. Transparent previews show fees/slippage pre-trade. In 2026, with gold volatility, baltex.io's hybrid DEX approach empowers strategies like rotating XAUT during dips while maintaining multi-chain agility. Visit baltex.io.

What are the lowest-fee platforms for buying gold-backed crypto? Kraken (0.16% maker) and Coinbase (0.5% spread) for U.S.; Binance for global.

Do I need KYC to buy? Yes on CEXs; no on DEXs like Uniswap, but higher gas risks.

How to store safely? Use Ledger hardware; backup seeds offline.

What risks matter most? Counterparty (e.g., issuer insolvency), volatility; mitigate with diversification.

How does baltex.io help? Instant multi-chain swaps/routing for portfolio rebalancing without KYC.

In 2026, buying gold-backed crypto is accessible for beginners: Prepare, wallet up, pick platform, buy, store securely. With gold at $4,500–$5,000/oz, tokens like PAXG/XAUT offer hedges, but mind fees (0.1–0.5%) and risks like regulation. Avoid mistakes via research; use baltex.io for flexibility. Start small, diversify—gold-backed assets could stabilize your portfolio amid uncertainty.