In 2026, swapping Bitcoin (BTC) to Monero (XMR) prioritizes privacy, with atomic swaps offering trustless exchanges via protocols like Farcaster (30-90 minutes, network fees only) for maximum anonymity but slower speeds. Instant swappers like GhostSwap and Baltex.io provide non-custodial, no-KYC routes (5-30 minutes, 0.5-2% fees) with high limits. Bridges are limited due to Monero's privacy design, often relying on wrapped assets with higher risks. Centralized exchange routes like Kraken enable instant trades (0.1-0.5% fees) but involve custody and potential KYC. For self-custody safety, use hardware wallets, test small amounts, and enable Tor. Baltex.io excels in multi-chain routing for fast, private BTC-to-XMR swaps before cash-outs.

As cryptocurrency adoption surges in 2026, swapping Bitcoin to Monero has become a staple for users seeking enhanced privacy. Bitcoin's transparent blockchain exposes transaction histories, making it vulnerable to chain analysis, while Monero's ring signatures, stealth addresses, and confidential transactions obscure sender, receiver, and amounts. This makes XMR ideal for confidential holdings or spending, especially amid rising regulatory scrutiny on traceable assets. With BTC hovering around $68,000 and XMR at $335, a typical swap yields about 207-216 XMR per BTC, depending on market rates.

The process involves converting BTC on its native chain to XMR on Monero's, often requiring intermediaries or protocols to bridge the gap. Users holding BTC in self-custody wallets like Electrum or Ledger can initiate swaps without surrendering control, minimizing risks. Key considerations include fees, which eat into returns; speed, crucial during volatility; custody risks, where platforms hold funds temporarily; privacy leakage, from IP tracking or metadata; and failure scenarios like depegs or hacks. In a year where Monero volumes exceed $2 billion daily, choosing the right method balances these factors for secure, efficient trades.

Atomic swaps represent the most decentralized approach, using hash time-locked contracts (HTLCs) to ensure either both parties fulfill or the trade reverses atomically. Instant swappers aggregate liquidity from DEXs for quick conversions. Bridges attempt cross-chain transfers but struggle with Monero's opacity, often wrapping BTC as tokens on compatible networks. Exchange routes leverage order books for precision but introduce centralization. Each method suits different needs: atomic for purists, swappers for convenience, bridges for multi-chain ecosystems, and exchanges for high-volume traders.

Atomic swaps shine for their trustless nature in 2026, with protocols like Farcaster and EigenWallet enabling direct BTC-XMR trades without intermediaries. These use cryptographic proofs to lock funds, releasing them only upon mutual confirmation, eliminating custody risks. However, setup requires technical know-how, such as running nodes or using Tor for anonymity, and speeds lag at 30-90 minutes due to blockchain confirmations. Fees are minimal—just network gas for Bitcoin (around 10-30 sat/vB) and Monero (0.00003 XMR)—making them cost-effective for large amounts. Limits are unbound by platforms but constrained by liquidity pools, and privacy is unparalleled as no third-party logs data. Risks include failed swaps from timeouts or volatility, potentially locking funds temporarily, though refunds are built-in.

Instant swappers, dominant for retail users, operate as non-custodial aggregators pulling rates from multiple sources. Platforms like ChangeNOW, SimpleSwap, and GhostSwap handle BTC-to-XMR in under 30 minutes, with no registration needed. Fees range from 0.5-2%, inclusive of spreads, and speeds benefit from off-chain processing before on-chain settlement. Liquidity is high, supporting unlimited swaps for most, though some cap at $10,000-$100,000 per transaction to mitigate AML flags. Privacy remains strong via wallet-to-wallet transfers, but IP exposure is a risk without VPNs. Failure scenarios involve rate slippage during dumps or platform downtime, though atomic-like mechanics reduce loss chances.

Bridges for BTC to Monero are niche in 2026, hampered by XMR's privacy features that resist wrapping. Options like Chainspot or Symbiosis support limited cross-chain routes, often converting BTC to wrapped versions on EVM chains before swapping to XMR equivalents. Fees climb to 1-3% plus gas, with speeds at 10-60 minutes across networks. Limits vary by bridge capacity, typically $1,000-$50,000, and privacy suffers from traceable wrapped tokens. Custody risks arise during locking phases, and failures like bridge exploits—recalling 2025's $300M hacks—pose severe threats. These suit multi-chain portfolios but aren't ideal for pure privacy swaps.

Exchange routes via centralized platforms like Kraken or CoinEx offer instant order-book trading, with BTC/XMR pairs executing in seconds. Fees are low at 0.1-0.5%, and liquidity is unmatched for large orders. However, KYC is often mandatory for withdrawals over $10,000 daily, leaking privacy through identity ties. Custody risks are high as funds sit on-platform, vulnerable to hacks or freezes. Speeds excel for market orders, but volatility can cause slippage. Failure scenarios include account bans or delistings, as seen with Binance's 2025 XMR removal in Europe.

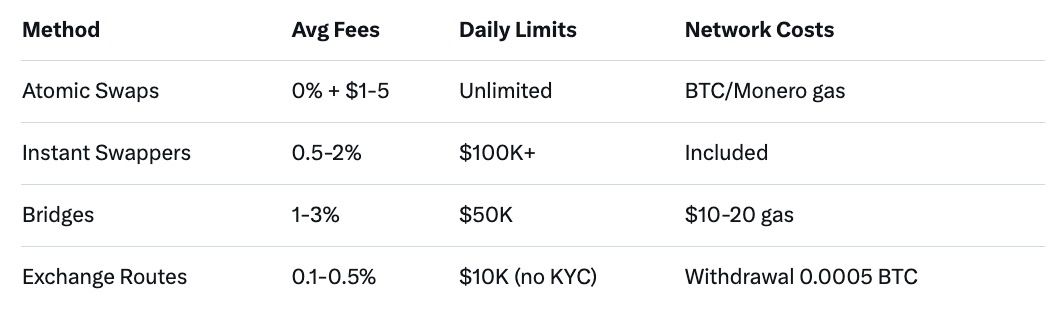

Fees for BTC-to-XMR swaps in 2026 average 0.5-2% across methods, but atomic swaps undercut with blockchain-only costs: Bitcoin's median fee at $1-5 per transaction, Monero's under $0.01. Instant swappers like Swapzone add 0% platform fees but include provider markups, while bridges layer cross-chain costs up to $10-20 in gas. Exchanges boast the lowest at 0.2% but offset with withdrawal fees (0.0005 BTC). Limits favor swappers and atomics with no hard caps, though practical thresholds prevent overload; bridges and exchanges enforce $1,000-$100,000 based on verification.

Risks demand vigilance: custody in exchanges exposes to insolvency, as in FTX's 2022 fallout; privacy leakage via swappers can occur without obfuscation tools. Volatility amplifies all, with XMR's 20% daily swings causing unfavorable rates mid-swap. For investors, diversifying methods mitigates; atomic for core holdings, swappers for quick pivots.

For atomic swaps via EigenWallet: Download the app, connect over Tor, select BTC-to-XMR, enter amount, and generate a swap offer. Scan for peers, lock BTC in HTLC, wait for XMR confirmation, then claim. Safety: Use fresh subaddresses, verify hashes, start with $100 tests.

Instant swapper flow on GhostSwap: Visit site, choose BTC to XMR, input amount, provide XMR wallet. Send BTC to deposit address; XMR arrives in 5-30 minutes. Checks: Bookmark URL, use VPN, confirm rates pre-send.

Bridge example with Symbiosis: Wrap BTC on source chain, approve transfer, select Monero route, confirm. XMR unwraps post-bridge. Safety: Audit bridge code, avoid peak congestion.

Exchange route on CoinEx: Register email-only, deposit BTC, trade XMR pair, withdraw. Checks: Enable 2FA, withdraw immediately, use mixer post-trade.

Self-custody essentials: Hardware wallets for keys, Tor/VPN for IPs, small tests for platforms, multisig for large sums.

Baltex.io emerges as a powerhouse in 2026 for BTC-to-XMR swaps, leveraging multi-chain routing to deliver instant, private conversions. Its non-custodial design routes BTC across 200+ networks, converting directly to XMR via Monero rails that obfuscate trails through ring signatures. Users initiate by selecting BTC-XMR, toggling Private Swap mode for enhanced anonymity—no KYC, no logs, ephemeral sessions. Fees hover at 0.3% plus gas, with speeds under 15 minutes for most trades.

For cash-outs, Baltex excels: Swap BTC to XMR, then route to stablecoins like USDT on Solana or Ethereum for fiat ramps. Example: Enter 1 BTC, choose XMR output, approve route; funds hit wallet atomically. Multi-chain paths minimize slippage, pulling liquidity from DEXs. Privacy hides trades from explorers, ideal before off-ramps. Risks are low due to decentralization, but users should verify addresses. Baltex suits agile investors, bridging BTC's liquidity to XMR's secrecy seamlessly.

Atomic swaps via Farcaster offer top privacy, while instant swappers like Baltex.io balance speed and anonymity.

Atomic: 30-90 min; swappers: 5-30 min; exchanges: instant.

Only network fees, around $1-5 total.

Higher custody during wrapping, potential exploits.

It routes BTC via 200+ networks to XMR, enabling fast, private conversions.

Swapping BTC to XMR in 2026 empowers users with privacy in a traceable world, from atomic's trustlessness to swappers' efficiency. Platforms like Baltex.io streamline the process, ensuring seamless transitions. As markets evolve, adapt strategies for resilience.