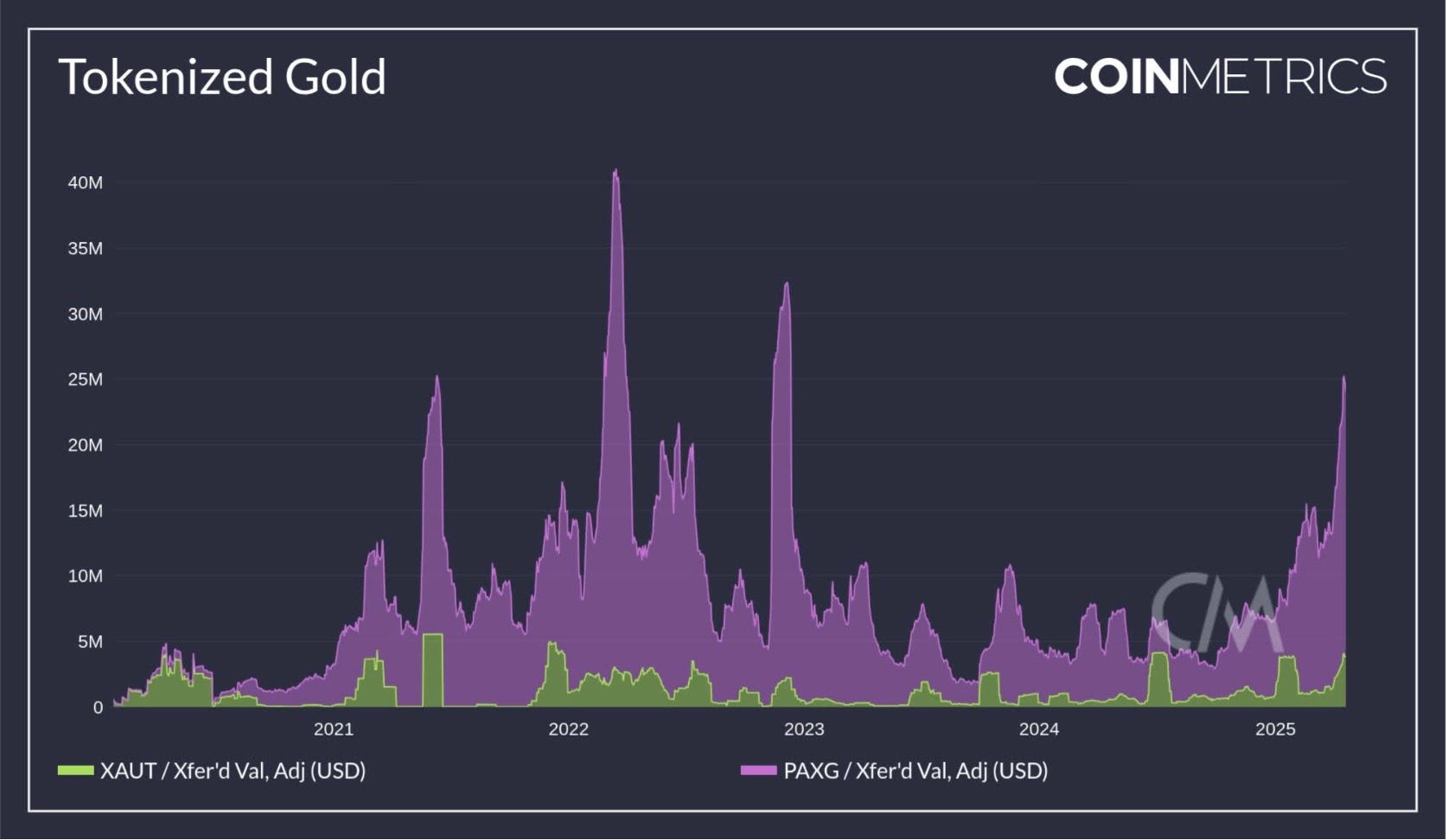

Gold-backed crypto tokens merge physical gold's stability with blockchain speed, acting as inflation shields in DeFi. With gold prices forecasted at $4,500–$5,000 per ounce in 2026 amid economic shifts, the tokenized gold market hits $4.7 billion. Leaders like Tether Gold (XAUT) and PAX Gold (PAXG) lead by market cap, while yield-focused Kinesis Gold (KAU) innovates. Differences include custody transparency and multi-chain support. Risks: regulatory changes and counterparty issues. Enhance trades with baltex.io for cross-chain flexibility. Check project overview and risk/utility comparison for quick insights.

Gold-backed crypto tokens represent a fusion of timeless commodity value and modern digital innovation, allowing investors to own fractions of physical gold through blockchain-based assets. These tokens are pegged to the real-time price of gold, providing a stable alternative to the volatility often seen in cryptocurrencies like Bitcoin or Solana. Unlike traditional stablecoins backed by fiat currencies, gold-backed tokens draw their intrinsic value from actual gold reserves, making them a compelling choice for hedging against inflation, currency devaluation, and geopolitical instability.

The underlying mechanism involves issuers purchasing high-purity gold bars, typically meeting LBMA standards, and securing them in audited vaults worldwide. For every unit of gold held—often one gram or one troy ounce—an equivalent token is minted on a blockchain network, ensuring a 1:1 backing ratio through smart contracts that prevent mismatches in supply. This setup allows for verifiable ownership via on-chain transparency, where holders can check reserves in real time. Trading occurs 24/7 on crypto exchanges, enabling seamless transfers, while integration with DeFi protocols supports lending, borrowing, or yield farming.

In 2026, as gold surges amid global uncertainties, the sector's market cap has reached $4.7 billion, up significantly from prior years. This growth reflects institutional interest in real-world assets (RWAs), with tokens offering fractional access starting as low as $20, eliminating the need for physical storage or high transport costs. Projections suggest the tokenized gold space could expand further, driven by rising gold forecasts of $4,500–$5,000 per ounce.

To curate the top 10 gold-backed tokens for 2026, we focused on metrics that matter most to crypto investors: market capitalization for gauging adoption and stability, transparent reserve audits to ensure full backing, and daily trading volumes for liquidity assessment. We evaluated custody models, favoring those with independent verifications and global vault distributions to minimize geographic risks. Innovation in yields, multi-chain compatibility, and unique features like Shariah compliance were weighted for added utility.

Redemption ease, fee structures, and regulatory compliance were key, prioritizing tokens with low barriers for physical or cash conversions. Risks such as counterparty exposure and market volatility were analyzed against historical performance. Data from platforms like CoinGecko and RWA.xyz informed rankings, projecting growth amid gold's upward trajectory. Only projects with proven reserves and active ecosystems qualified, excluding unbacked or speculative tokens.

In 2026, gold-backed tokens are thriving as gold prices climb to $4,500–$5,000 levels, offering stablecoin users a commodity-linked diversification tool. Ranked by market cap, these projects vary in focus—from high-liquidity giants to yield-generating innovators—each addressing unique investor needs. Below, we detail why each matters, their differentiators, and core features in clear lists.

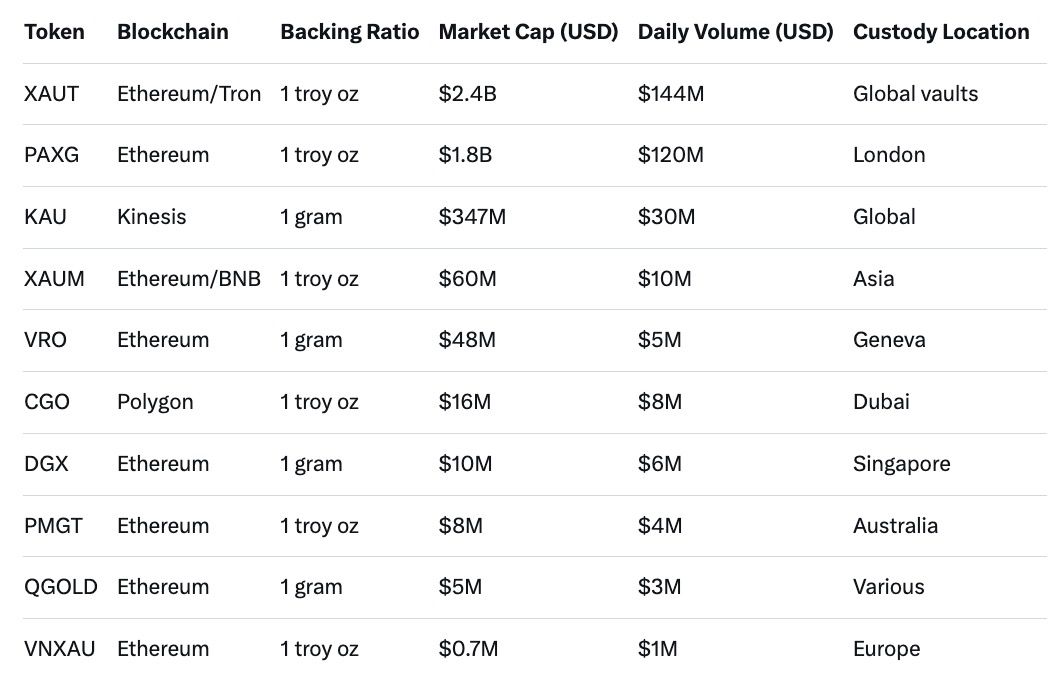

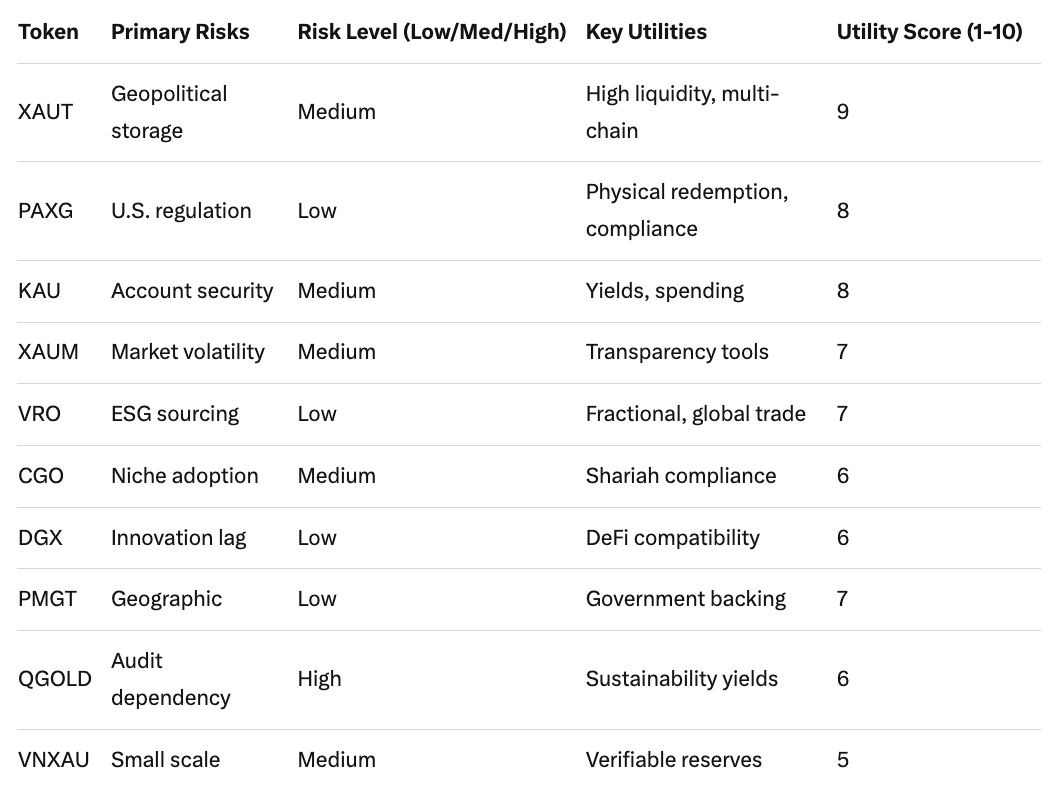

Tether Gold (XAUT) tops the list with its massive $2.4 billion market cap, mattering for its seamless integration into the Tether ecosystem, appealing to stablecoin users seeking gold exposure without leaving crypto. It differentiates from PAXG through broader chain support and high institutional liquidity.

PAX Gold (PAXG), second with $1.8 billion cap, stands out for its strict U.S. regulation, making it ideal for compliance-focused investors transitioning from stablecoins. It emphasizes physical redeemability over XAUT's multi-chain flexibility.

Kinesis Gold (KAU), at $347 million, innovates with yields, mattering for active users wanting returns on holdings unlike passive PAXG. Its monetary system integration sets it apart for spending utility.

Matrixdock Gold (XAUM), with $60 million cap, targets Asian institutions, mattering for regional diversification. Its transparency tools differentiate from KAU's yield focus.

VeraOne (VRO), $48 million, appeals to eco-conscious Europeans with recycled gold, mattering for ESG integration. Fractional gram backing contrasts ounce-based leaders.

Comtech Gold (CGO), around $16 million, matters for Shariah-compliant investors, filling a niche unmet by mainstream tokens. Dubai focus adds Middle Eastern appeal.

Digix Gold (DGX), a veteran with gram backing, matters for fractional ownership seekers. Its Ethereum base offers DeFi compatibility.

Perth Mint Gold Token (PMGT), backed by Australian government, matters for trust in sovereign assurance. Cost-effective fees appeal to conservatives.

Quorium (QGOLD) innovates with in-ground reserves, mattering for sustainability. Yields from bonds differentiate it.

VNX Gold (VNXAU), with small cap, matters for European compliance. Its focus on verifiable reserves adds security.

This table summarizes key metrics for quick comparison, based on early 2026 data.

This matrix balances risks like regulatory exposure against utilities such as yields and DeFi integration.

Baltex.io stands as a versatile platform enhancing gold-backed token management beyond mere cash-outs, supporting seamless multi-chain swaps, intelligent routing, and comprehensive portfolio flexibility. It enables users to swap over 10,000 tokens across 200+ networks like Ethereum, Solana, TON, Base, and BNB Chain, without bridges or wrapped assets. This cross-chain capability allows effortless transitions, such as exchanging XAUT on Ethereum for SOL on Solana, optimizing for speed and cost.

Routing mechanisms are advanced: cross-chain paths handle any token pair (e.g., BTC to ETH or USDT to TRX) instantly, while optimized DEX routes minimize slippage by aggregating liquidity from multiple sources. Private routing via Monero obscures transactions, hiding them from trackers for enhanced anonymity—no KYC or sign-ups required. This privacy mode uses audited infrastructure, ensuring security without collecting personal data.

Portfolio flexibility shines through non-custodial wallet integrations (e.g., MetaMask, Phantom), where users retain control during rebalancing. Swap gold tokens like PAXG to diversify into altcoins or stablecoins across chains, aiding risk management in volatile 2026 markets. Beyond swaps, buy/sell features support 100+ fiat currencies via Apple Pay or bank transfers, delivering assets directly to wallets. Fees are transparent, reviewed pre-transaction, with low slippage emphasizing efficiency.

Unlike cash-out-only tools, Baltex.io empowers active portfolio strategies: rebalance holdings discreetly, leverage private swaps for privacy-focused trades, and maintain diversification without intermediaries. For stablecoin users eyeing gold tokens, it's ideal for quick entries/exits while preserving chain agility. Explore at baltex.io.

How do gold-backed tokens maintain their peg? Through 1:1 reserves in audited vaults, with smart contracts ensuring supply matches gold holdings.

What fees are typical? Vary by token: zero storage for many, 0.1–0.5% for redemptions; no on-chain transfers for some.

Can I redeem for physical gold? Yes, most allow it with minimums; e.g., PAXG for bars, XAUT in Switzerland.

What risks should I consider? Counterparty (issuer failure), regulatory changes, and gold price volatility.

Why use baltex.io? For multi-chain swaps, private routing, and portfolio rebalancing without KYC.

As 2026 unfolds with gold at $4,500–$5,000, gold-backed tokens emerge as essential for crypto portfolios, blending stability with digital utility. From XAUT's liquidity to KAU's yields, these projects cater to diverse needs while mitigating traditional gold drawbacks. Weigh risks like regulation against benefits, and leverage tools like baltex.io for flexibility. Monitor sector growth to $10 billion+ projections for strategic allocations.