For retail investors seeking inflation hedges in 2026, PAXG and XAUT remain leading gold-backed tokens. PAXG excels with strong U.S. regulation, monthly audits, and zero storage fees, suiting compliance-focused long-term holders. XAUT leads in liquidity, multi-chain presence (Ethereum, TRON, and beyond), and trading volume, ideal for active traders. Both have tracked gold's ~70% rise in 2025, reaching near $4,600/oz. Key edges: PAXG for transparency, XAUT for flexibility. To maximize efficiency—especially when swapping between PAXG and XAUT or converting to fiat—baltex.io stands out for instant, private multi-chain swaps across 200+ networks, enabling quick optimization before cash-out without bridges or KYC.

In the evolving 2026 landscape, gold-backed cryptocurrencies continue to attract retail investors as robust inflation hedges amid ongoing volatility. These tokenized assets merge gold's enduring value with blockchain's speed and accessibility, allowing fractional ownership without physical handling. PAXG (Pax Gold) and XAUT (Tether Gold) lead the space, with the tokenized gold market exceeding $4 billion. As gold sustains highs around $4,600 per ounce—fueled by central bank demand and fiat concerns—these tokens provide direct exposure. This guide compares PAXG and XAUT across mechanics, custody, fees, liquidity, redemption, risks, history, and use cases, with special emphasis on leveraging baltex.io for seamless multi-chain management of these assets.

These tokens appeal to retail portfolios by offering stability in crypto-native form. Unlike volatile assets like Bitcoin, they maintain close pegs to gold's spot price, serving as diversification tools. With real-world asset tokenization booming, PAXG and XAUT dominate due to reliability and integration. Practical tools like baltex.io enhance their utility by enabling fast swaps across chains, crucial for timing entries/exits or shifting between tokens in response to market shifts.

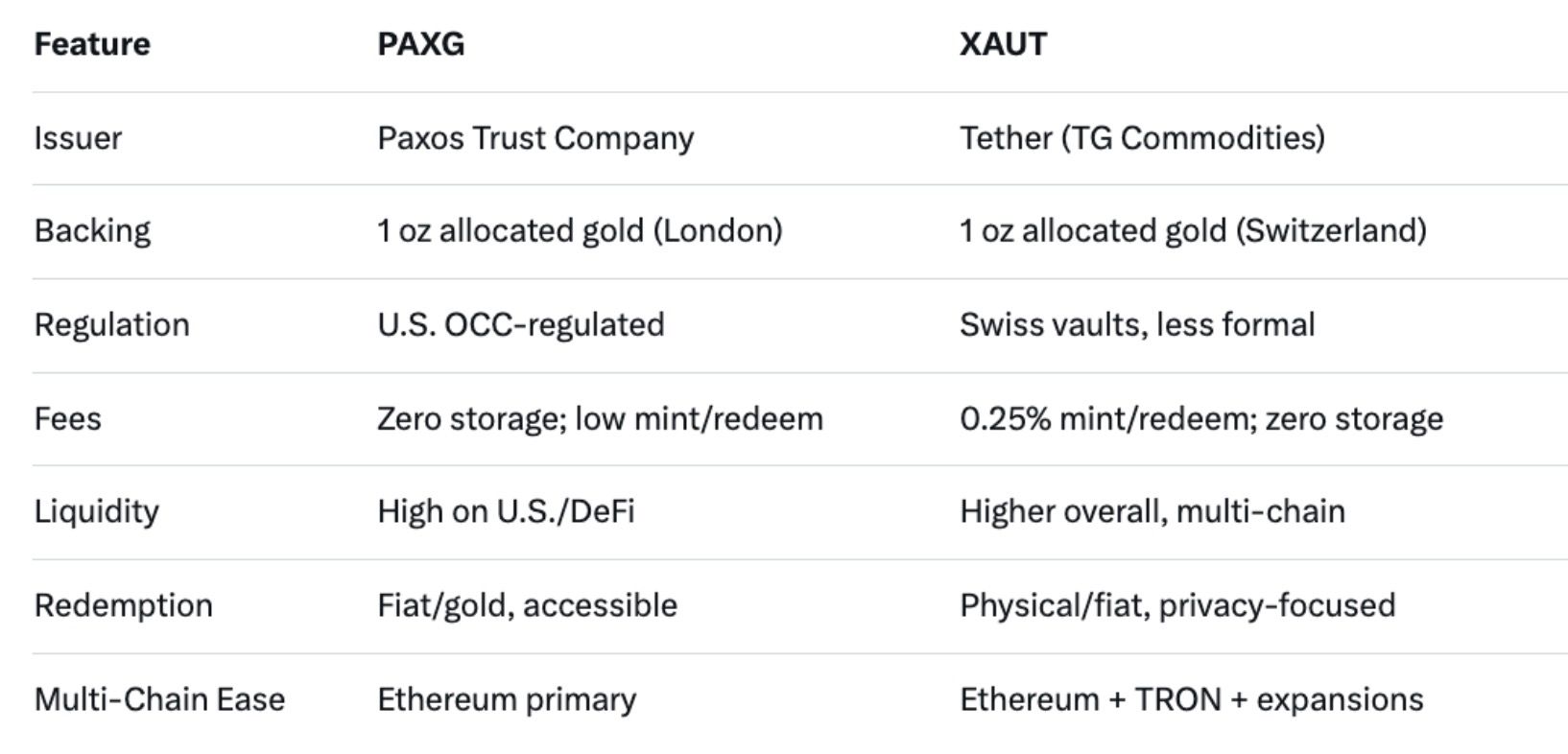

PAXG and XAUT tokenize physical gold, each representing one fine troy ounce of LBMA-certified bullion, pegged 1:1 to spot prices. PAXG, from Paxos, operates primarily as an ERC-20 on Ethereum, with gold allocated in London vaults. Minting occurs via Paxos or exchanges, enabling DeFi participation like lending or staking while holding gold exposure.

XAUT, from Tether, supports Ethereum and TRON natively, with expansions making it more chain-agnostic. This multi-chain design facilitates faster, cheaper transfers. Both allow fractional ownership (down to tiny amounts), instant global trades, and real-time pricing synced to gold markets. In 2026, their mechanics shine in multi-chain environments, where tools like baltex.io simplify moving PAXG (Ethereum-focused) to XAUT (multi-chain) or other assets without manual bridging, reducing friction for retail users optimizing positions.

baltex.io has become essential for retail investors holding PAXG or XAUT in 2026, offering instant multi-chain swaps across Ethereum, Solana, TON, Base, TRON, and 200+ networks—without bridges, wrapped tokens, or delays. As a non-custodial hybrid aggregator, it pulls liquidity from DEXs and optimized routes for best rates, low slippage, and fast execution.

For PAXG (Ethereum-heavy) and XAUT (multi-chain), baltex.io enables seamless swaps between them or to/from stables like USDT/USDC, privacy coins, or majors—ideal before cashing out. Choose "Efficient" mode for speed or "Private Swaps" using Monero rails for anonymity, breaking address links and shielding trades. No KYC, no sign-ups: connect wallet, select pair (e.g., PAXG to XAUT or XAUT to fiat gateway), and execute wallet-to-wallet.

Fiat integration supports buy/sell with Apple Pay, cards, or transfers in 100+ currencies, delivering directly to wallets. This streamlines exiting gold positions—swap PAXG/XAUT to preferred chain/fiat pair, minimize fees/volatility exposure, then off-ramp. With 10,000+ tokens supported, baltex.io optimizes tokenized gold management in multi-chain reality. Visit baltex.io to swap securely and privately.

PAXG's gold rests in allocated London vaults under OCC-regulated Paxos, with monthly third-party audits and public serial-number lookup for transparency. XAUT uses Swiss vaults for privacy and neutrality, with allocated backing and on-demand tracking via Tether's site. Both minimize personal risks like theft, but PAXG's U.S. oversight appeals to regulated preferences, while XAUT's Swiss base offers jurisdictional diversity. In multi-chain scenarios, secure custody pairs well with platforms like baltex.io, which handles non-custodial, wallet-to-wallet swaps to maintain control during transitions.

PAXG features zero storage fees and low mint/redeem costs, favoring holders. Ethereum gas applies for transfers, but optimizations keep it manageable. XAUT charges ~0.25% on mint/redeem but zero storage, with TRON reducing network fees. Both beat gold ETF expenses. For cross-chain moves—e.g., swapping PAXG to XAUT—baltex.io's aggregator routes often secure lower effective fees and slippage, making it cost-efficient before fiat conversion.

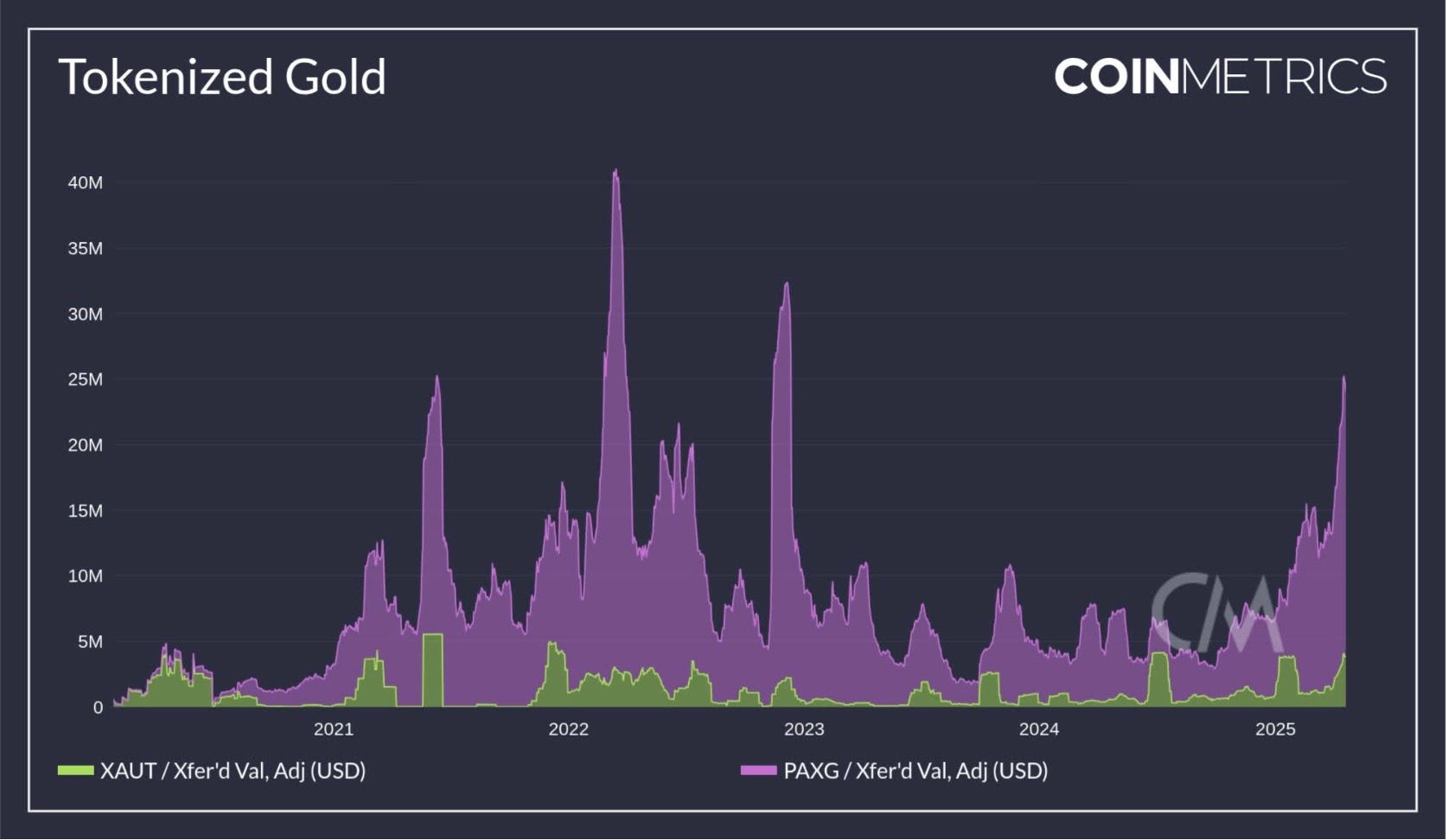

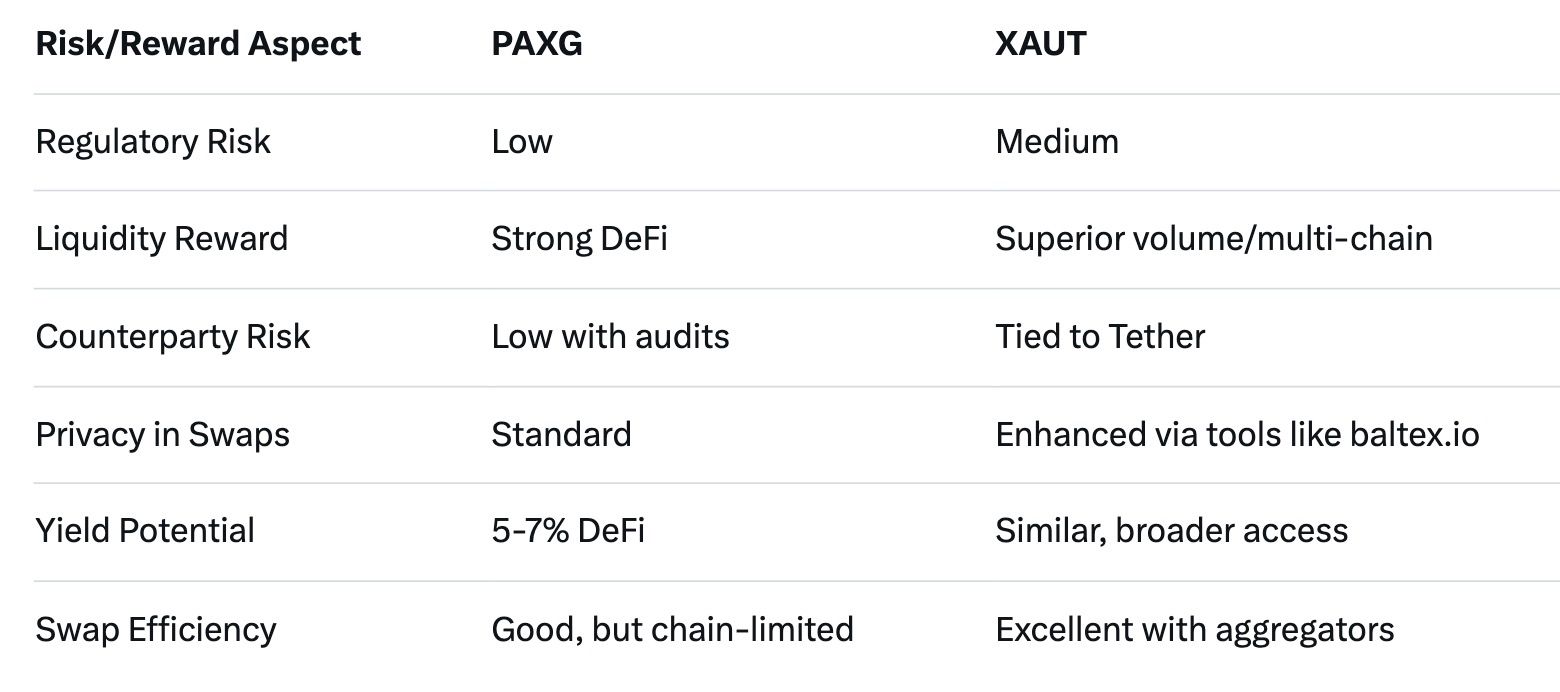

XAUT holds higher liquidity (~$2.3B+ market cap, billions in monthly volume) thanks to broad exchange listings and multi-chain support. PAXG (~$1.7B) thrives on U.S. platforms and DeFi. XAUT's edge suits frequent traders; PAXG fits steady holders. baltex.io boosts liquidity further by aggregating routes across 200+ networks, enabling instant PAXG/XAUT swaps with minimal slippage—even for smaller retail sizes.

PAXG allows quick fiat redemption via Paxos or gold delivery for institutions. XAUT emphasizes physical Swiss delivery or fiat options. Both support efficient exits, but multi-chain flexibility aids prep: use baltex.io to swap to preferred fiat ramps or stablecoins first.

Risks include counterparty (mitigated by audits), gold volatility, and blockchain issues. Rewards: inflation protection, DeFi yields (5-7%), and diversification. PAXG lowers regulatory risk; XAUT boosts liquidity rewards. baltex.io's privacy mode (Monero-integrated) adds protection for sensitive swaps.

Both tokens mirrored gold's 70%+ 2025 surge, holding firm in downturns unlike crypto peers. XAUT saw faster adoption growth. In 2026, stability persists; multi-chain tools like baltex.io help capitalize on shifts by enabling rapid repositioning.

Use for hedging, DeFi yields, remittances, or wealth preservation. XAUT suits privacy/trading; PAXG compliance. baltex.io enhances all by allowing quick swaps—e.g., PAXG to USDT on Solana for yields, or XAUT to fiat ramps.

What differentiates PAXG and XAUT? PAXG prioritizes U.S. regulation and audits; XAUT offers better liquidity and multi-chain options.

Best for beginners? PAXG for simplicity; use baltex.io for easy swaps regardless.

Physical redemption? Yes—PAXG via London, XAUT Swiss.

Inflation hedge performance? Both strong, tracking gold's gains.

Swapping between them? baltex.io enables instant, low-fee multi-chain swaps.

2026 liquidity leader? XAUT, enhanced by aggregators like baltex.io.

See our Stablecoin Strategies for more hedging tips.

PAXG and XAUT offer premier gold-backed exposure in 2026, with PAXG for regulated stability and XAUT for liquidity/flexibility. Amid gold's strength, they bolster portfolios. To unlock full potential—especially multi-chain efficiency and quick cash-outs—integrate baltex.io for private, instant swaps. Assess your needs, start small, and use these tools for agile management in dynamic markets.