Funding Polymarket anonymously with Monero (XMR) in 2026 involves swapping XMR to Polygon USDC via privacy-focused non-KYC aggregators or DEXs, minimizing traceability through ring signatures and stealth addresses. Common paths include direct swaps on platforms like Baltex.io with "Private Swap" mode for under 1% fees, limits up to 50 XMR, and speeds of 5-30 minutes. Risks encompass volatility and scams—use test transactions and verified wallets. Compare routes in the routing options table and costs in the fees and limits table. Baltex.io streamlines this with multi-chain routing, delivering USDC directly to your Polygon wallet before depositing to Polymarket.

In 2026, Polymarket stands as a premier decentralized prediction market on the Polygon network, enabling users to wager on global events using USDC while benefiting from low fees and fast settlements. For privacy-focused crypto enthusiasts holding Monero (XMR)—the gold standard for anonymous transactions—funding Polymarket positions without leaking personal data or transaction histories is paramount. Monero's ring signatures, stealth addresses, and confidential transactions obscure origins, making it ideal for value transfer, but bridging to Polygon's USDC ecosystem requires careful routing to preserve anonymity. This step-by-step guide details practical methods to convert XMR into Polygon USDC, covering swap mechanics, routing paths, associated fees, limits, speeds, and inherent risks. By emphasizing non-KYC tools and safety protocols, users can minimize operational errors, such as address mismatches or exposure to chain analysis, while optimizing for cost and efficiency. Whether you're hedging on elections or sports outcomes, these strategies ensure your Polymarket funding remains private, aligning with Monero's ethos in an era of heightened regulatory scrutiny.

The process begins with understanding Polymarket's deposit mechanics: users connect a Polygon-compatible wallet, like MetaMask or Phantom, and send USDC to a unique deposit address on the Polygon chain. Direct fiat onramps exist but compromise anonymity, so XMR holders turn to crypto-to-crypto swaps. In 2026, advancements in multi-chain aggregators have simplified this, allowing atomic swaps that execute in one transaction without intermediaries. However, privacy leakage can occur if swaps involve traceable assets or centralized services, underscoring the need for obfuscated paths. This guide prioritizes end-to-end anonymity, from XMR wallet export to Polymarket confirmation, equipping users to avoid common pitfalls like high slippage or regulatory flags.

Anonymous funding of Polymarket via Monero leverages XMR's built-in privacy features to shield transaction details, ensuring that your betting activities remain unlinked to personal identities. In 2026, with chain analysis tools like those from Chainalysis becoming more sophisticated, direct XMR-to-USDC swaps on non-private platforms could expose patterns, but routing through privacy-enhanced mechanics mitigates this. Polymarket itself doesn't require KYC for basic use, operating non-custodially on Polygon, where USDC serves as the stable medium for positions. The goal is to convert XMR—held in wallets like Atomic Wallet or Monero GUI—into Polygon USDC without creating on-chain footprints that reveal sources.

Key considerations include swap mechanics: atomic swaps ensure trades settle simultaneously across chains, reducing custody risks, while privacy mixers integrate Monero's obfuscation. Fees typically range from 0.5-2%, influenced by network congestion and aggregator premiums, with limits varying by platform—often unlimited for small batches but capped for anti-fraud. Speeds average 5-60 minutes, depending on confirmations (Monero needs 10 for security). Risks involve volatility during swaps, where XMR price fluctuations could erode value, or operational mistakes like sending to wrong networks. By using non-KYC services, users avoid data submission, but must verify platform reputations to dodge scams. This approach suits privacy maximalists, enabling seamless Polymarket entry while preserving financial sovereignty.

Routing XMR to Polygon USDC in 2026 offers multiple paths, each balancing anonymity, efficiency, and cost. A direct path uses non-KYC aggregators supporting XMR inputs, converting to USDC via intermediate privacy layers before Polygon delivery. For instance, platforms aggregate liquidity from DEXs and atomic swap protocols, executing trades without holding funds. Another route swaps XMR to BTC on privacy-focused exchangers, then BTC to USDC on Polygon DEXs like QuickSwap, adding a hop for extra obfuscation but increasing fees.

Hybrid paths incorporate bridges: swap XMR to ETH anonymously, bridge ETH to Polygon via official portals, then swap to USDC. This maintains privacy if the initial swap uses Monero's features, but bridges can introduce traceability if not routed privately. In 2026, with Polygon's enhanced interoperability, some aggregators handle the entire flow atomically, minimizing exposure. Speeds vary—direct swaps take minutes, while multi-hop routes extend to hours if awaiting bridge confirmations. Limits depend on liquidity pools, often 10-100 XMR per trade to avoid slippage. Risks include front-running on DEXs or delays from Monero's probabilistic confirmations, mitigated by setting slippage tolerances and using reputable tools. These paths ensure XMR's anonymity transfers to Polymarket, where USDC deposits appear as standard inflows.

Swap mechanics for funding Polymarket with XMR center on preserving Monero's privacy while navigating to Polygon USDC. Atomic swaps, powered by protocols like those in Atomic Wallet, allow cross-chain exchanges without trust, where XMR is locked in a hashed timelock contract until the counterparty delivers USDC. This ensures no single point of failure, with privacy intact via ring signatures that mix your transaction with others. In 2026, enhanced mechanics include "private swap" modes on aggregators, routing through Monero nodes to break links before final output.

For Polygon-specific delivery, mechanics involve layer-2 wrapping: XMR converts to a bridgeable asset, then lands as USDC on Polygon without exposing the Monero origin. Fees embed in quotes, covering gas (under $0.50 on Polygon) and premiums (0.1-0.5%). Limits scale with pool depths, supporting up to 50 XMR for majors. Speeds benefit from Monero's 2-minute blocks and Polygon's sub-second finality. Risks like oracle failures in price feeds are rare but addressed by multi-oracle aggregators. Overall, these mechanics empower anonymous funding, transforming XMR's opacity into secure Polymarket positions.

Fees for XMR-to-Polygon USDC swaps in 2026 average 0.5-1.5%, comprising swap spreads, network gas, and privacy premiums, with Polygon keeping costs low at fractions of a cent per transaction. Limits vary: non-KYC platforms cap at 20-100 XMR to comply with internal policies, while DEXs have no hard limits but practical ones from liquidity. Speed shines on fast chains—Monero confirmations take 20 minutes, Polygon swaps seconds—yielding end-to-end times of 10-45 minutes.

Risks span volatility, where XMR-USDC rate shifts during processing could result in losses, countered by fixed-rate options on some exchangers. Privacy leakage threatens if paths use traceable intermediates, but Monero routing minimizes this. Operational risks include wallet mismatches or scams on fake sites—verify URLs and use hardware wallets. Regulatory risks, though low for personal use, could arise in anti-privacy jurisdictions. By diversifying small batches and monitoring, users navigate these effectively for anonymous Polymarket funding.

The primary step-by-step flow starts with preparing your Monero wallet: Export XMR from a secure app like Atomic Wallet, ensuring sufficient balance for fees. Next, select a non-KYC aggregator, connect non-custodially, input XMR as source and Polygon USDC as target, activate privacy mode if available, and preview the quote for rates and gas. Approve the swap, sending XMR to the generated address—wait for confirmations before the USDC arrives in your Polygon wallet.

Once funded, open Polymarket, connect your wallet, navigate to the deposit page, copy the Polygon USDC address, and transfer from your wallet, confirming on Polygonscan. For a multi-hop flow: Swap XMR to BTC via a privacy exchanger, send BTC to a Polygon DEX wallet, swap to USDC, then deposit. Each step includes safety pauses—double-check addresses, start with $50 tests, and monitor for anomalies. Speeds align with chain times, risks reduced by incremental execution.

Safety checks are essential for anonymous Polymarket funding with XMR. Begin with wallet hygiene: Use hardware like Ledger for signing, enable stealth addresses in Monero settings. Before swaps, verify aggregator legitimacy via community feedback, avoiding phishing by bookmarking sites. During routing, confirm network compatibility—Polygon USDC only—and set slippage limits to 1% max.

Best practices include splitting large amounts into batches to test flows, using VPNs for IP privacy, and recording transaction IDs for disputes. Post-swap, scan for malware and diversify holdings. These measures prevent mistakes like irreversible sends, ensuring your anonymous path remains secure.

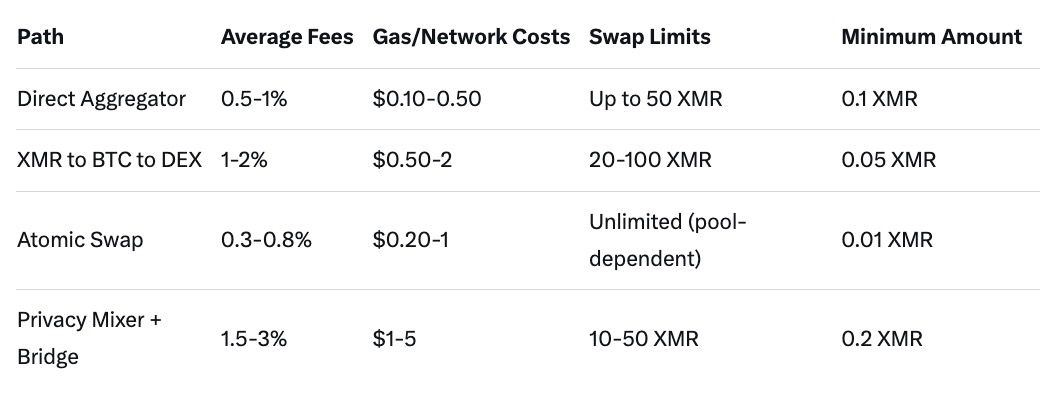

Various routing options cater to different privacy and efficiency needs when converting XMR to Polygon USDC for Polymarket.

This table guides selection based on tolerance for complexity versus speed.

Costs and constraints vary across methods, impacting feasibility for Polymarket funding.

These figures highlight cost-effective direct paths for most users.

Baltex.io revolutionizes anonymous Polymarket funding in 2026 by facilitating fast, multi-chain swaps from XMR directly into Polygon assets like USDC, all without KYC or custody. As a non-custodial aggregator connected to over 200 networks, it aggregates liquidity from DEXs and atomic protocols, enabling seamless XMR-to-Polygon USDC conversions in atomic transactions. Users activate "Private Swap" mode, which routes incoming XMR through Monero's ring signatures and stealth addresses, breaking any origin links before delivering clean USDC on Polygon.

In a funding workflow, visit baltex.io, connect your Monero and Polygon wallets temporarily, select XMR as input and Polygon USDC as output, toggle private mode for enhanced anonymity, and execute after reviewing quotes—fees under 1%, speeds 5-30 minutes. This eliminates bridge vulnerabilities, with limits up to 50 XMR and minimal slippage via multi-pool sourcing. Risks are low due to ephemeral sessions, making it ideal for privacy users. Baltex.io thus positions itself as the go-to for efficient, anonymous pre-funding swaps, ensuring Polymarket deposits appear untraceable.

Use Baltex.io's Private Swap mode for direct XMR-to-Polygon USDC routing, leveraging Monero privacy features.

Typically 5-30 minutes on aggregators, depending on Monero confirmations and Polygon finality.

No platform fees, but Polygon gas costs $0.01-0.50 per transfer.

Volatility, scams, and operational errors—mitigate with tests and verified tools.

Yes, via batched swaps on unlimited platforms, but cap at 50 XMR per trade for safety.

Funding Polymarket anonymously using Monero on Polygon in 2026 is a streamlined process empowered by privacy tools and multi-chain aggregators like Baltex.io. By mastering routing paths, swap mechanics, and safety checks, users minimize fees, risks, and privacy leaks while efficiently converting XMR to USDC. The outlined flows and comparisons equip you to navigate this with confidence, preserving anonymity in prediction markets. As crypto privacy evolves, staying vigilant ensures sustained access, bridging Monero's secrecy with Polymarket's opportunities.