Haveno DEX in 2026 is a mature, decentralized P2P platform for trading Monero (XMR) with fiat or other cryptos, using Tor for privacy and multisig escrow without custody. It features 0.2-1% fees, offer-dependent liquidity, and supports payments like bank transfers or cash meets, but trades take 30 minutes to hours with technical UX. Compared to centralized exchanges (e.g., KuCoin with KYC and delisting risks), Haveno offers superior anonymity; versus instant swappers (e.g., ChangeNOW), it enables fiat P2P but lacks speed. Risks include disputes or scams, mitigated by arbitration. Baltex.io complements by providing instant multi-chain swaps when Haveno liquidity lags.

In the privacy-centric world of cryptocurrency in 2026, Haveno DEX has solidified its position as a leading decentralized exchange tailored for Monero (XMR) users. Built on the foundations of Bisq but optimized for XMR's privacy features, Haveno enables peer-to-peer (P2P) trades of Monero for fiat currencies like USD, EUR, and GBP, or other cryptocurrencies such as BTC, ETH, and BCH. As regulatory pressures mount, with many centralized platforms delisting XMR due to its untraceable nature, Haveno represents the future of non-KYC trading. Its non-custodial model ensures users retain control of their funds, while Tor routing preserves anonymity, making it a haven for privacy-focused traders navigating a landscape where governments demand transaction traceability.

By February 2026, Haveno has matured significantly since its mainnet readiness in late 2024. Community-driven updates, including a polished user interface overhaul in mid-2025 and version 1.2.2 enhancements for stability, have boosted adoption. Third-party networks like RetoSwap operate instances, providing installers for Linux, macOS, and Windows, allowing users to connect without central oversight. This decentralization avoids single points of failure, aligning with Monero's ethos. For Monero users seeking to convert holdings anonymously or acquire XMR via fiat without identity verification, Haveno fills a critical gap left by the shutdown of platforms like LocalMonero in prior years.

The platform's appeal lies in its resistance to censorship. Unlike centralized exchanges facing MiCA regulations in the EU or FATF pressures globally, Haveno operates on a network where trades occur directly between peers. This structure not only enhances privacy but also empowers users in restricted regions. With XMR's market cap exceeding $9 billion and daily volumes around $2 billion across all platforms, Haveno's role in facilitating private trades positions it as a key player in decentralized finance (DeFi), especially as users shift from traceable assets amid global surveillance trends.

Haveno functions as a decentralized marketplace where users post buy or sell offers for XMR, specifying payment methods and terms. The software, open-source and available on GitHub, requires downloading an installer from a third-party network and running it on a desktop system. Once installed, users create a wallet secured by a mnemonic seed, fund it with XMR for security deposits, and connect via Tor to obscure IP addresses. No registration or KYC is needed, preserving anonymity from the start.

Trades begin with browsing or creating offers. For instance, a seller might offer 10 XMR for EUR via bank transfer, setting a price premium over market rates. When a buyer accepts, both parties lock security deposits in a multisig Monero transaction—typically 15-50% of trade value, depending on reputation. The buyer then completes the external payment (e.g., SEPA transfer), confirms it in the app, and the seller releases the XMR. Upon mutual confirmation, deposits return automatically. This P2P process ensures no central entity holds funds, reducing hack risks prevalent in centralized setups.

In 2026, Haveno's protocol supports expanded asset listings, driven by community suggestions through its listing repository. Fiat trades dominate for onboarding, while crypto swaps appeal to diversifiers. The entire flow leverages Monero's ring signatures and stealth addresses, making on-chain traces impossible. However, trades aren't instant; confirmations and external payments extend timelines, contrasting with the seamlessness of centralized platforms.

Haveno's escrow system is a standout feature, utilizing Monero's multisignature technology for non-custodial protection. When a trade initiates, funds and deposits lock in a 2-of-3 multisig address: two keys held by traders, one by an arbitrator. This prevents unilateral access, ensuring honesty. If disputes arise—e.g., payment non-receipt—the arbitrator mediates using chat logs and evidence, deciding payout without ever controlling keys.

Arbitrators, selected randomly from a bonded pool, stake XMR to participate, incentivizing fair resolutions. In 2026, with matured governance, dispute rates hover below 1%, thanks to reputation systems rating users post-trade. This model outperforms centralized exchanges' customer support tickets, as it decentralizes resolution without exposing identities. However, it relies on human judgment, introducing minor subjectivity risks mitigated by appeal processes.

Haveno supports diverse payment methods to facilitate global trades. Fiat options include bank transfers (SEPA, SWIFT), cash-by-mail, in-person meets, or alternatives like gift cards and mobile money. Crypto swaps integrate with chains like Bitcoin and Ethereum, using atomic protocols where possible. Community-voted additions in 2026 include more fiat currencies and privacy coins like Zcash, broadening appeal.

Fees are competitive: 0.2-1% trading fees plus miner costs for on-chain transactions, often under $0.05 for Monero. Makers (offer creators) pay less to encourage liquidity, while takers cover more. No withdrawal fees exist, as funds never leave user control. Liquidity is offer-dependent, with daily volumes around $5-10 million in 2026—solid for a DEX but dwarfed by centralized giants. Active regions like Europe show deeper books, while sparse areas require patience for matches.

Haveno's desktop-only interface, while improved in 2025 updates, presents UX hurdles for newcomers. Setup involves syncing with the Tor network and understanding multisig, which can intimidate less technical users. Trades require manual confirmations and external coordination, extending to hours versus seconds on apps. Mobile support remains absent, limiting on-the-go access, though third-party apps like RetoSwap's experimental mobile version address this.

Despite these, the UI is clean, with intuitive offer browsing and chat features. For privacy pros, the trade-offs are worthwhile, but casual traders might prefer simpler alternatives. In 2026, ongoing developments aim at streamlining, yet decentralization inherently prioritizes security over slickness.

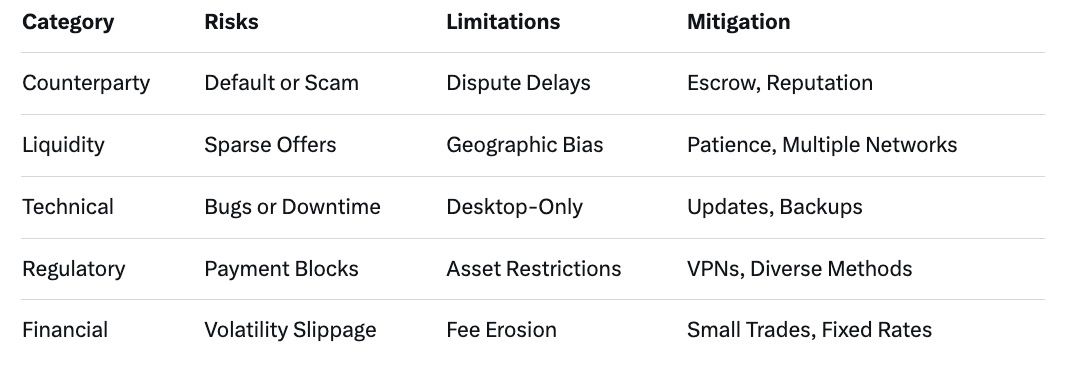

While Haveno minimizes many risks through decentralization, challenges persist. Counterparty risks arise if peers default, though escrow and arbitrators recover funds in most cases. Scams, like fake payments, are possible but rare due to evidence requirements. Liquidity limitations in low-volume pairs delay trades, and volatility can shift values mid-process. Regulatory risks loom; while resilient, users in banned jurisdictions face indirect hurdles like payment blocks.

Technical risks include software bugs, though audits and open-source nature reduce them. No mobile app heightens desktop dependency, and Tor slowdowns affect connectivity. Overall, Haveno's model suits cautious traders, but diversification across methods is advisable.

Centralized exchanges like KuCoin, once XMR hotspots, now face delisting pressures in 2026 under regulations like DAC8, mandating user reporting. They offer instant trades and high liquidity but at privacy's cost—KYC ties identities to chains, enabling surveillance. Haveno counters with zero traceability, though slower and less liquid. For fiat ramps, centralized options require verification, exposing users, while Haveno's P2P anonymity shines.

Instant swappers like ChangeNOW or GhostSwap provide quick, non-KYC crypto-to-XMR conversions via aggregated DEX liquidity. They're faster (5-30 minutes) and limit-free but lack fiat support, making them complementary rather than replacements. Haveno's escrow adds security for larger, fiat-involved trades, but swappers excel in simplicity without peer coordination.

When Haveno's P2P matching proves slow due to low liquidity or mismatched offers, baltex.io serves as an ideal complement in 2026. This non-custodial aggregator routes swaps across 200+ networks and 10,000+ tokens, enabling instant BTC-to-XMR conversions with 0.3% fees and atomic execution. Privacy mode leverages Monero rails to obfuscate trails, aligning with Haveno's ethos.

For example, acquire XMR via baltex.io's multi-chain paths, then use Haveno for fiat cash-outs. During volatility, baltex minimizes slippage by pulling from deep DEX pools, bridging to XMR before P2P. No KYC or logs ensure seamless integration into Haveno workflows, making it essential for traders needing speed without sacrificing decentralization.

It routes via Tor, uses Monero multisig, and requires no KYC, obscuring IPs and transactions.

0.2-1% trading fees plus low Monero miner costs; makers pay less.

Its technical UX suits experienced users; start with guides on Monero basics.

Counterparty defaults or low liquidity; escrow mitigates most.

It offers fast swaps when Haveno lacks offers, routing to XMR privately.

Haveno DEX in 2026 embodies the future of decentralized Monero trading, offering unmatched privacy and P2P freedom amid global crackdowns. Its escrow, low fees, and fiat support distinguish it from centralized risks and swapper limitations, though UX and liquidity demand patience. Complement with baltex.io for efficiency, and explore privacy tools for enhanced security. As surveillance intensifies, Haveno empowers users to trade sovereignly.