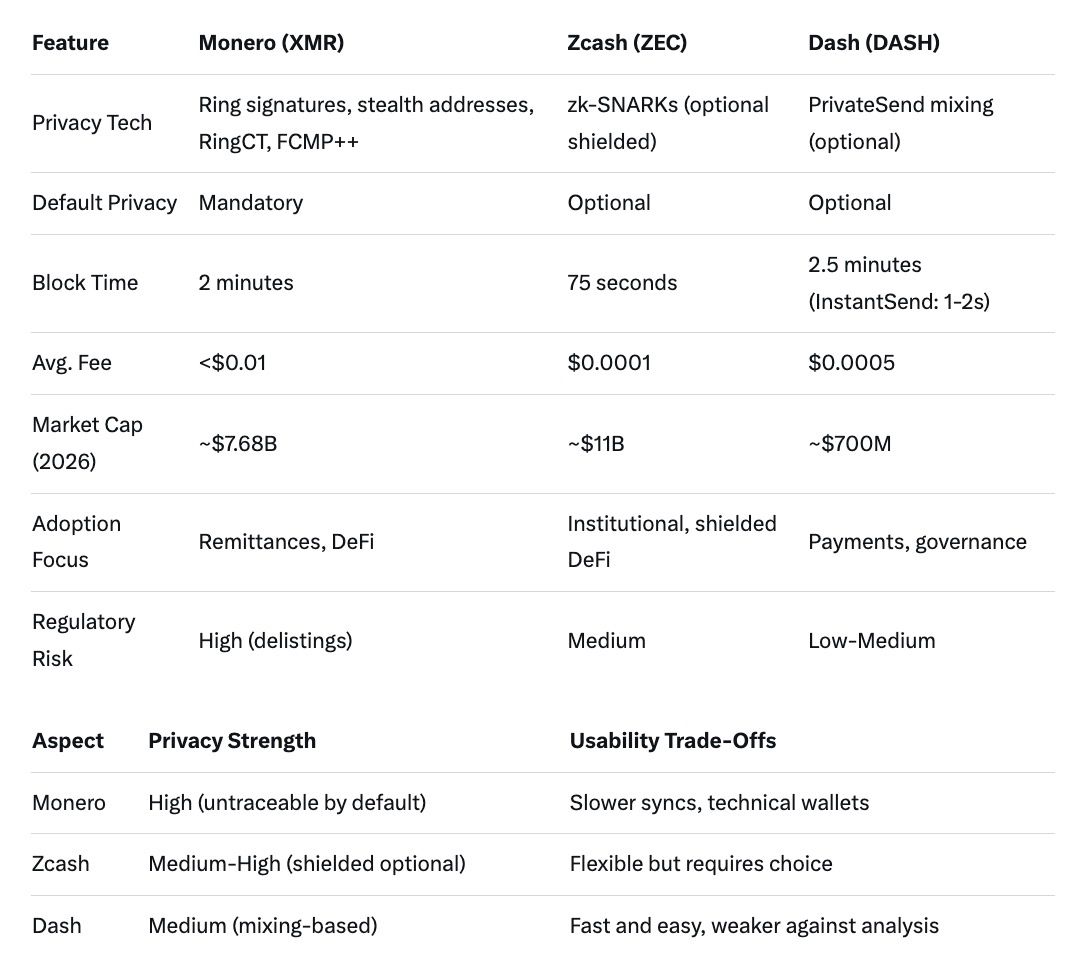

In 2026, Monero leads as the best privacy coin with mandatory anonymity via ring signatures and FCMP++ upgrades, offering unbreakable untraceability at low fees ($0.01) but facing delistings. Zcash provides optional zk-SNARKs privacy with institutional appeal and faster speeds, though adoption lags due to optional features. Dash excels in usability with quick transactions (1-2 seconds) and governance, but its mixing-based privacy is weaker against analysis. Choose Monero for ultimate privacy, Zcash for flexibility, Dash for payments—regulatory risks persist across all.

As cryptocurrency adoption surges in 2026, privacy coins like Monero (XMR), Zcash (ZEC), and Dash (DASH) remain vital for users seeking to shield transactions from surveillance. With global regulations tightening—such as the EU's MiCA framework and U.S. CLARITY Act—transparent blockchains expose users to chain analysis, making privacy a necessity for financial sovereignty. Monero emphasizes default anonymity, Zcash offers selective shielding, and Dash focuses on fast, optional privacy for everyday use. This guide compares their privacy models, costs, speeds, adoption, risks, and trade-offs, helping crypto holders decide which fits their needs amid 2026's evolving landscape, where privacy demand drives rallies but invites scrutiny.

These coins have seen explosive growth: Monero hit all-time highs above $667, Zcash surged to $654 with institutional backing, and Dash climbed to $59 amid sector rotation. Yet, their differences in technology and philosophy create distinct user experiences. Privacy-focused holders must weigh untraceability against usability, especially as DeFi and remittances demand seamless, secure transfers. By understanding these dynamics, you'll navigate 2026's privacy meta effectively.

Monero's privacy model revolves around mandatory obfuscation, using ring signatures to mix real spends with decoys, stealth addresses for one-time recipients, and Ring Confidential Transactions (RingCT) to conceal amounts. In 2026, the FCMP++ upgrade elevates this to full-chain membership proofs, proving ownership across millions of outputs without revealing details, achieving mathematical untraceability. This global approach eliminates probabilistic weaknesses, making Monero ideal for users needing ironclad anonymity in high-stakes scenarios like cross-border payments.

Zcash employs zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs), allowing "shielded" transactions where sender, receiver, and amount are hidden while proving validity. Unlike Monero, privacy is optional—users can choose transparent or shielded pools, enabling compliance-friendly features. In 2026, upgrades like NU6.1 enhance shielded efficiency, with institutional tools such as Grayscale's ZEC ETF filings boosting appeal. However, the optional nature means unshielded transactions remain traceable, potentially tainting the ecosystem.

Dash uses PrivateSend, a CoinJoin-inspired mixing protocol where masternodes blend user funds into indistinguishable outputs. This provides optional privacy for select transactions, layered on Dash's proof-of-service model with masternodes ensuring network integrity. While effective for basic obfuscation, Dash's model is vulnerable to advanced analysis, as mixing pools are smaller than Monero's chain-wide sets. In 2026, Dash's focus remains on payments, with privacy as an add-on rather than core, appealing to users prioritizing speed over absolute anonymity.

Monero stands out with default anonymity—every transaction is private by design, fostering true fungibility where all XMR units are interchangeable without history taint. This "always-on" approach protects against statistical attacks, and with FCMP++ in Q1 2026, anonymity sets expand to over 150 million outputs, rendering tracing computationally impossible. For privacy holders, this means seamless protection without user intervention, though it complicates audits.

Zcash's default is transparency, with shielded transactions requiring explicit choice via wallets like cashZ, launched in early 2026. While zk-SNARKs offer strong untraceability in shielded pools—proving transactions without data leaks—the optional framework allows metadata exposure in unshielded ones. This flexibility aids regulatory compliance but reduces overall anonymity, as adoption of shielded features hovers around 20-30% in 2026, per network metrics.

Dash lacks default privacy; users must activate PrivateSend for mixing, which obfuscates but doesn't fully hide amounts or addresses like Monero or Zcash. Its untraceability relies on pool size and participation, making it susceptible to correlation if mixes are infrequent. In 2026, Dash's InstantSend complements this for fast confirmations, but privacy remains probabilistic, better for casual users than those facing intense surveillance.

Transaction fees in Monero average under $0.01 in 2026, thanks to dynamic block sizing and efficient proofs, though FCMP++ initially increases sizes by 20-30%, potentially spiking costs during congestion. Speeds clock in at 2 minutes per block, with confirmations in 10-20 minutes—suitable for most uses but slower than rivals. Post-upgrade optimizations, like logarithmic verification, keep it competitive for DeFi.

Zcash boasts low fees around $0.0001, benefiting from smaller shielded transaction sizes via zk-SNARKs. Block times of 75 seconds enable faster confirmations (under 5 minutes), making it agile for real-time applications. In 2026, wallet upgrades like cashZ reduce computational overhead, enhancing mobile usability without fee hikes.

Dash leads in speed with 1-2 second InstantSend confirmations via masternodes, ideal for point-of-sale. Fees sit at $0.0005, scalable through ChainLocks for security. PrivateSend adds minimal cost but extends times to 1-2 minutes for mixing, balancing efficiency with privacy.

Monero's adoption thrives in privacy-centric communities, with over 7.68 billion market cap and integrations in darknet markets, remittances, and DeFi via atomic swaps. However, delistings from exchanges like Binance limit accessibility, pushing users to DEXs and P2P. In 2026, FCMP++ and Cuprate node boost decentralization, fostering ecosystem tools like mobile wallets.

Zcash sees institutional adoption, with market cap over $11 billion briefly in 2025, driven by Winklevoss donations and ETF pursuits. Ecosystem includes shielded DeFi on Ztarknet, appealing to enterprises valuing compliance. Yet, developer exits and governance shifts slow progress, with adoption concentrated in tech-savvy users.

Dash's ecosystem emphasizes payments, with masternode governance funding projects and broad exchange availability. Market cap around $700 million reflects utility in Latin America for remittances. In 2026, on-chain voting enhances community-driven updates, but privacy adoption trails, positioning Dash as a hybrid rather than pure privacy play.

All three face regulatory risks in 2026, with privacy coins targeted for AML concerns. Monero's mandatory anonymity invites the most scrutiny, leading to delistings and banking conflicts, heightening volatility. Quantum threats loom, though FCMP++ adds forward secrecy.

Zcash's optional privacy offers a compliance buffer, reducing delisting risks, but shielded pools still attract audits. Institutional ties mitigate exposure, yet developer turmoil poses internal risks.

Dash's mixing draws less heat due to transparency options, but masternode centralization risks DoS attacks. Regulatory tolerance is higher, but as privacy demand grows, scrutiny may intensify.

For everyday holders, Monero's untraceability demands technical savvy—wallets require syncing, and churning for extra privacy adds steps. It's perfect for sovereign transfers but less user-friendly for novices.

Zcash balances trade-offs with optional features: shielded for privacy, transparent for ease. Practical for compliant DeFi, but users must actively shield, risking errors.

Dash prioritizes usability—fast sends suit merchants, with PrivateSend as a toggle. Trade-off is weaker privacy, ideal for payments over storage.

In 2026, choose based on needs: Monero for max privacy, Zcash for versatility, Dash for speed.

Baltex.io, a non-custodial swap service, enhances privacy coins like Monero, Zcash, and Dash by enabling seamless multi-chain routing with no-KYC anonymity. For Monero users, it aggregates liquidity for XMR swaps, breaking trails via internal XMR hops before payout in assets like BTC or ETH. Zcash holders benefit from shielded-to-transparent conversions, preserving privacy during cross-chain moves. Dash's fast sends integrate with baltex.io's atomic-like mechanics for quick, mixed routes.

Before cash-out, baltex.io's private mode routes through privacy coins—e.g., convert DASH to XMR-hopped USDT—ensuring untraceable fiat ramps. Fees at 0.4% plus gas, unlimited limits, and 5-20 minute speeds complement these coins' strengths, mitigating delisting issues by bypassing CEXs. In 2026, as regulations tighten, baltex.io empowers holders to maintain sovereignty. Discover multi-chain strategies.

Monero offers the strongest with mandatory, chain-wide proofs via FCMP++, making tracing impossible.

Dash is fastest at 1-2 seconds with InstantSend, Zcash at under 5 minutes, Monero at 10-20 minutes.

Monero under $0.01, Zcash $0.0001, Dash $0.0005— all low but vary with network demand.

Monero due to default privacy, leading to exchange delistings; Zcash and Dash have more compliance options.

Yes, with optional transparency and ETF filings, appealing to regulated entities.

It prioritizes fast payments and governance, making it more accessible for everyday transactions.

Absolutely, via no-KYC multi-chain routing through XMR or ZEC before cash-out.

In 2026, Monero emerges as the top privacy coin for unyielding anonymity, Zcash for balanced flexibility, and Dash for practical speed—each excelling in niches amid rallies and regulations. Weigh trade-offs: Monero's strength against usability hurdles, Zcash's institutional edge versus optional privacy, Dash's efficiency over robustness. With tools like baltex.io bridging gaps, privacy holders can thrive. Stay informed as the sector evolves, prioritizing sovereignty in an surveilled world.