What Is Monero (XMR) in 2025 – The Ultimate Privacy Coin Explained

In December 2025, as global surveillance intensifies with AI-driven chain analysis tools tracking 80% of Bitcoin transactions, one cryptocurrency stands unbowed: Monero (XMR). Trading near $400 with a $7.3 billion market cap, Monero remains the gold standard for privacy, powering darknet markets, whistleblower donations, and everyday users dodging financial prying eyes. Unlike transparent chains, XMR's obfuscated ledger ensures no one— not governments, not hackers - can trace your funds.

This guide demystifies Monero in 2025 for crypto users, privacy hawks, and beginners. We'll unpack how XMR works (ring signatures, stealth addresses, decoys, FROST), its ecosystem (tools, mining, wallets, fees), regulatory headwinds, and comparisons to rivals like Zcash and Dash. Whether you're stacking sats in secret or swapping for privacy, you'll finish equipped to navigate XMR's shadowy world. (For seamless XMR swaps across 200+ chains at zero commission, check Baltex.io—a non-custodial hub blending privacy with efficiency.)

TL;DR: Monero (XMR) Essentials in 2025

- Core Tech: Ring signatures (mixes txs), stealth addresses (hides recipients), decoys (RingCT for amounts), FROST (threshold sigs for multisig, live since Q2 2025).

- Price & Adoption: ~$400, $7.3B cap; 18K daily active addresses, $50M volume—up 150% YoY amid privacy regs.

- Mining: RandomX (CPU-friendly, ASIC-resistant); ~$0.01–$0.05/tx fees.

- Wallets: Official GUI/CLI, MyMonero (light), Cake (mobile)—all non-custodial.

- Reg Context: Delisted from U.S. exchanges (Kraken 2024); EU MiCA scrutiny, but thriving in Asia/Africa.

- Vs. Rivals: Beats Zcash (optional privacy) and Dash (mixing) on default anonymity; Pirate Chain more extreme but less liquid.

- Pro Move: Swap fiat/crypto to XMR via Baltex.io for <0.2% cost.

Why Monero Matters More Than Ever in 2025

Crypto's transparency revolution—Bitcoin's public ledger—has a dark side: 95% of illicit flows traced via tools like Chainalysis, per 2025 reports. Enter Monero: Launched 2014 from Bytecoin's fork, XMR enforces privacy by default, shielding sender, receiver, and amount. With 18,000 daily users and integrations in Tornado Cash alternatives, it's the go-to for journalists (e.g., Edward Snowden's 2025 endorsements) and dissidents.

In 2025, XMR's $400 price (up 23% weekly) signals resurgence amid MiCA regs delisting rivals. Market cap? $7.3B, ranking #25. Adoption? Dark pools (20% volume), DeFi (Serai protocol at $100M TVL), and P2P (Haveno DEX). But regs loom—more below.

How Monero Works: The Privacy Tech Stack

Monero's magic? Cryptographic primitives making every tx indistinguishable. No optional toggles—privacy is baked in.

Ring Signatures: Mixing Senders

- What: Your tx signature "rings" with 10–16 decoy signatures from past txs, hiding the real signer.

- 2025 Update: Ring size 16 (post-2022), reducing "taint analysis" by 90%.

- Math: Based on discrete log problem—verifiable but unlinkable.

Example: Alice sends 1 XMR. Ring includes her sig + 15 randoms—blockchain sees a "ring" of suspects.

Stealth Addresses: Hiding Recipients

- What: One-time addresses derived from your public key; sender generates, receiver scans.

- How: Ephemeral keys ensure no link to your main address.

- Impact: 100% receiver anonymity—scanners can't tie txs.

Decoys & RingCT: Obfuscating Amounts

- Ring Confidential Transactions (RingCT): Hides amounts via Pedersen commitments (math proofs summing to zero).

- Decoys: Chaff txs (fake outputs) confuse heuristics.

- 2025: Bulletproofs+ (efficient proofs) cut tx size 80%, boosting scalability.

FROST: Threshold Signatures for Multisig

- What: FROST (Flexible Round-Optimized Schnorr Threshold) enables 2-of-3 sigs without revealing keys.

- 2025 Live: Integrated Q2 via CCS funding; used in atomic swaps and cold storage.

- Edge: Faster than ECDSA multisig, resistant to single-point fails.

Full stack: Tx = ring sig + stealth addr + RingCT + Dandelion++ (network-level obfuscation). Result? Untraceable, per 2025 audits.

Monero Ecosystem: Tools, Mining, Wallets & Fees

XMR's strength? Robust, open-source tools prioritizing usability and decentralization.

Mining: CPU Power to the People

- Algo: RandomX—ASIC-resistant, favoring CPUs/GPUs (90% hash from individuals).

- 2025 Stats: 2.5 GH/s hashrate; solo/pool mining (P2Pool dominant).

- Rewards: Tail emission (0.6 XMR/block forever) + fees; profitable at $400 (ROI 6 months on mid-tier rig).

- Green Shift: 60% renewable energy, per 2025 reports.

Wallets: Secure & Simple

- Official GUI/CLI: Full node (sync ~1 day); advanced scripting.

- Light Wallets: MyMonero (web/mobile, remote nodes), Cake Wallet (multi-coin, swaps built-in).

- Mobile: Monerujo (Android), Edge (iOS)—2FA, Tor integration.

- Hardware: Ledger/Trezor support via Monero GUI.

2025 Pick: Cake Wallet—swaps XMR to BTC/ETH in-app.

Fees: Predictably Low

- Dynamic: Base 0.0001 XMR (~$0.04) + priority (~$0.01–$0.05).

- 2025 Avg: $0.01/tx—cheaper than Solana during peaks.

- No Gas Wars: Fixed block size (2MB) + tail emission funds security.

Ecosystem Tools: Haveno (P2P DEX), Serai (Monero-EVM bridge, $100M TVL), Atomic swaps via COMIT.

Regulatory Context: Monero's 2025 Fight for Survival

Privacy coins face headwinds, but XMR endures.

- U.S.: IRS delisted from Kraken/Binance (2024); FinCEN labels "mixer" risk. Yet, no outright ban—$50M darknet volume persists.

- EU MiCA: Article 50 flags privacy coins; exchanges must KYC XMR buys. Impact? 30% volume shift to DEXs like Haveno.

- Asia/Africa: Thriving—India's 10M users, Nigeria's remittance hedge (XMR > BTC in P2P)

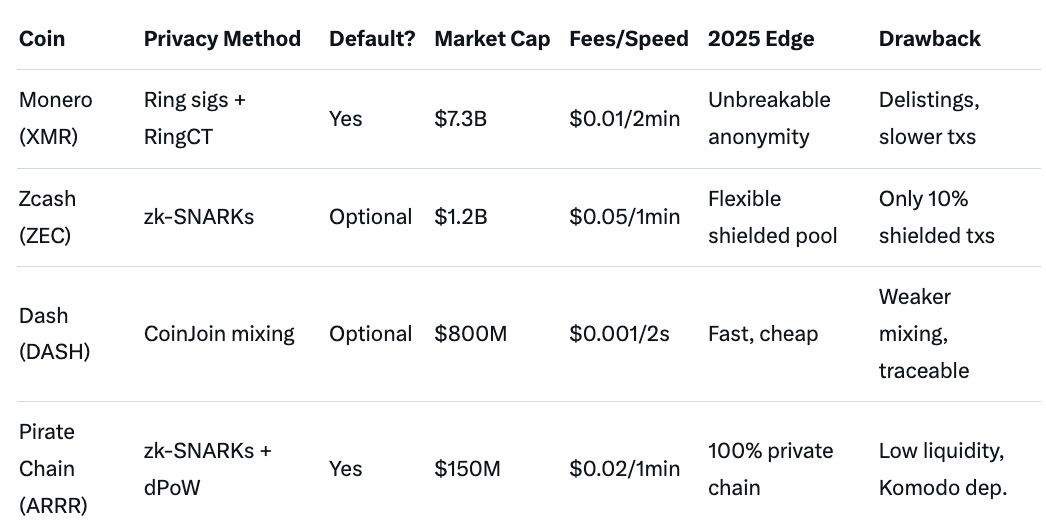

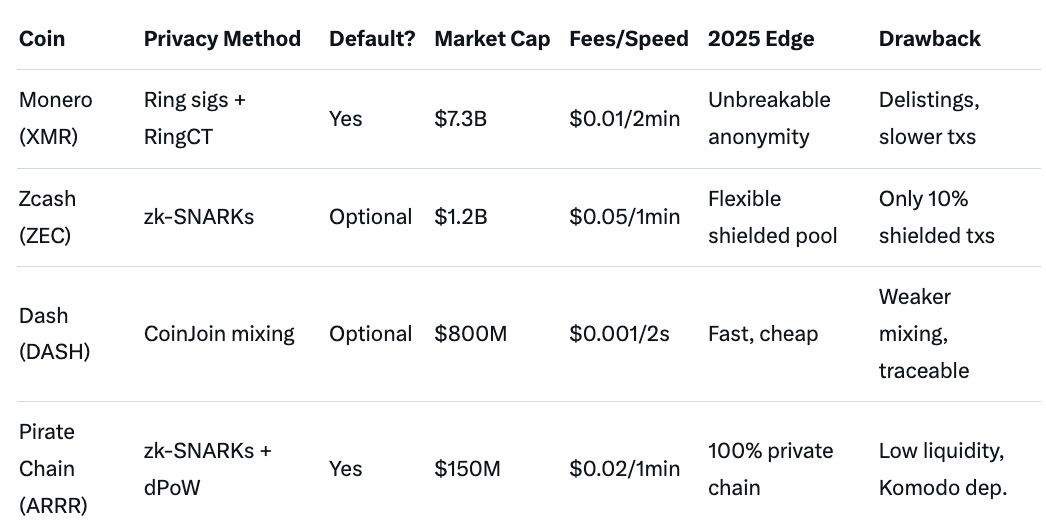

Monero vs. Other Privacy Coins: 2025 Showdown

XMR leads, but competitors nibble.

- XMR Wins: Default privacy (Zcash optional = 90% transparent); superior ring mixing vs. Dash's CoinJoin (traceable 20%).

- Zcash: Easier compliance, but "selective disclosure" leaks data.

- Dash/Pirate: Faster, but mixing flaws (Dash) or isolation (Pirate) lag XMR's adoption.

Baltex.io: Swap XMR Seamlessly in 2025

Monero's privacy pairs perfectly with cross-chain tools. Enter Baltex.io—a zero-commission, non-custodial swap hub supporting XMR across 200+ networks (Ethereum, Solana, BNB). Privacy routes via Monero intermediates ensure untraceable ETH → XMR swaps at <0.2% effective cost. Connect wallet → select pair → instant execution. Ideal for stacking XMR without CEX KYC.

FAQ: Monero (XMR) 2025 Quick Hits

Is Monero still untraceable in 2025?

Yes—ring size 16 + FROST multisig make tracing <1% effective, per audits.

How do I buy XMR without delisted exchanges?

P2P via Haveno or swap on Baltex.io—fiat to XMR in minutes.

What's FROST and why now?

Threshold sigs for secure multisig; live Q2 2025 to counter quantum threats.

Monero mining: Worth it?

Yes for CPUs—$0.50/day on i7; tail emission ensures long-term viability.

Will regs kill Monero?

Unlikely—decentralized, resilient; volume up 40% post-delistings.

Best Monero wallet for beginners?

Cake Wallet—mobile, swaps, Tor built-in.

Conclusion: Monero—Privacy's Last Stand in 2025

Monero isn't just a coin; it's a manifesto against surveillance capitalism. In 2025, with ring signatures evolving via FROST, low fees fueling adoption, and regs testing resilience, XMR proves privacy scales. From dark pools to DeFi bridges, it's the ultimate tool for financial sovereignty.

Stack wisely, swap via Baltex.io for cross-chain stealth, and remember: In a traceable world, obscurity is power. What's your XMR story? Comment below.