Crypto Exchange vs Wallet: Key Differences and Which One You Should Use in 2025

Whether you’re just buying your first Bitcoin or already juggling a dozen altcoins, one of the earliest and most important decisions you’ll make is: Should I keep my crypto on an exchange or move it to a wallet?

The short answer: It depends on what you’re doing.

Most beginners (and even many experienced users) end up needing both — but for very different reasons.

This ultimate 2025 guide explains everything you need to know.

TL;DR

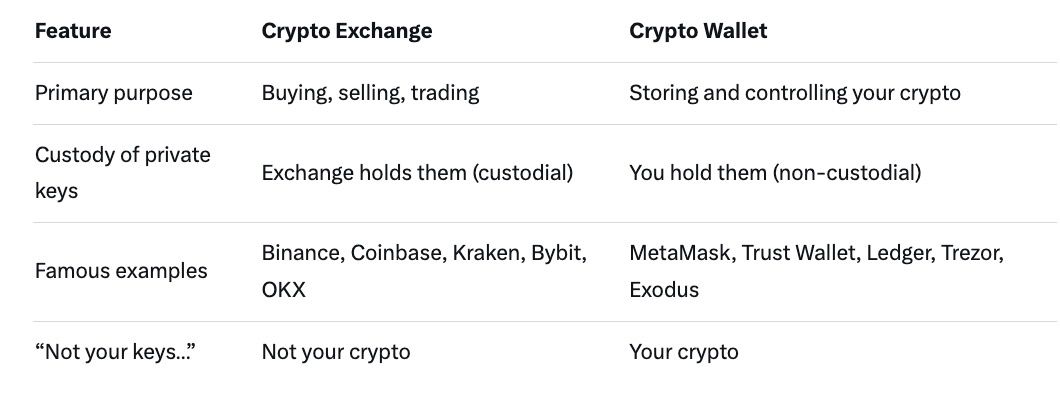

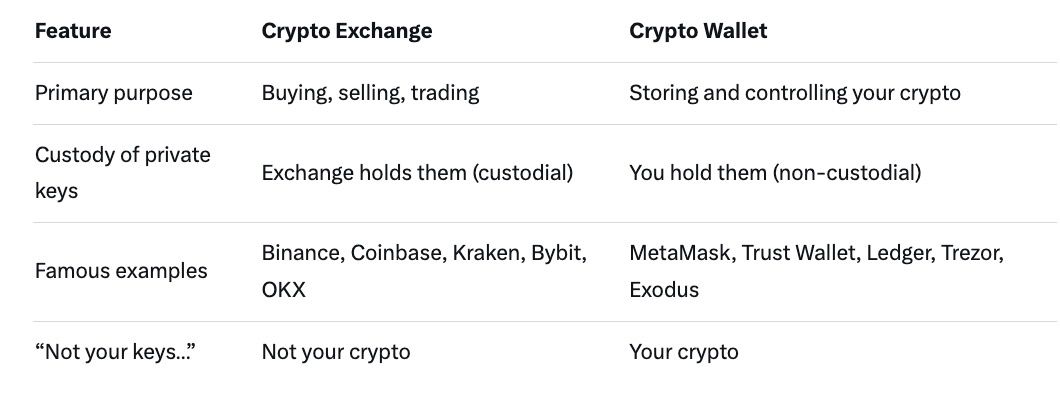

- Exchanges = Great for buying, selling, trading, and earning yield. You do not own the private keys (“not your keys, not your crypto”).

- Wallets = Great for long-term storage and full control. You are the bank — 100% custody.

- Best practice: Buy/trade on an exchange → Withdraw to your own wallet for anything you’re not actively using.

→ Jump to: Security Comparison | Fees Comparison | When to Use Which | FAQ

1. What Is a Crypto Exchange the Same as a Wallet?

No — they solve completely different problems.

Think of it like this:

- An exchange is like an online brokerage account (e.g., Robinhood or eToro).

- A wallet is like a personal safe in your house.

2. Core Differences Explained

A. Custody & Ownership

- Custodial (Exchanges) → The platform controls your private keys. You own the assets legally, but you can’t move them without the exchange’s permission.

- Non-Custodial (Wallets) → Only you have the private keys (usually a 12- or 24-word seed phrase). Nobody can freeze or seize your funds (except you if you lose the phrase!).

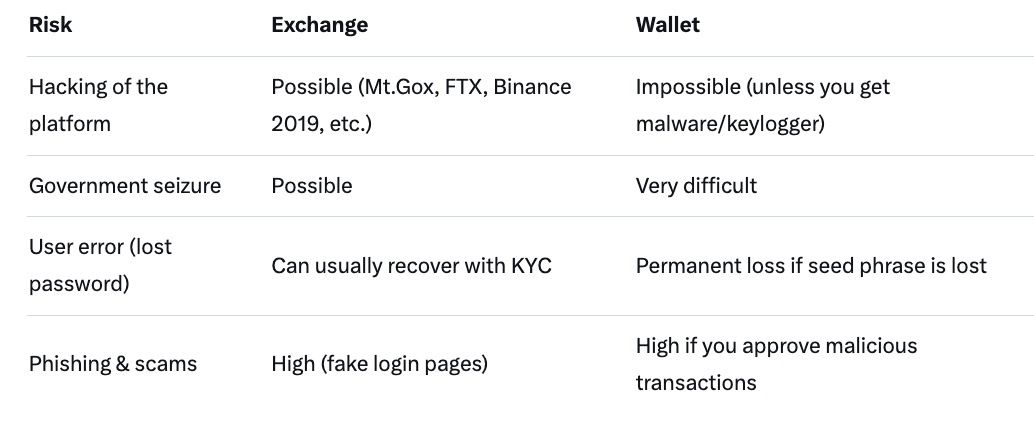

B. Security Model

C. Speed & Convenience

- Exchanges → Instant trading, fiat on/off ramps, debit cards, staking rewards, margin, futures.

- Wallets → You must manually send/receive. No built-in trading (except some DeFi wallets).

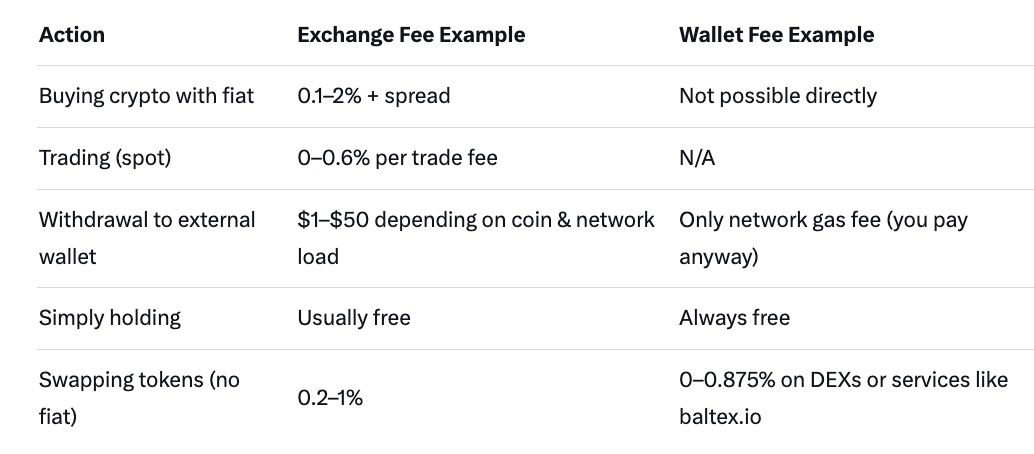

D. Fees

Pro tip: If you want to swap one crypto for another without KYC or leaving your wallet, instant swap platforms like baltex.io are extremely handy. No account needed, non-custodial, works directly from MetaMask/Trust Wallet.

E. Access & Recovery

- Exchanges → Email + 2FA + KYC. If you forget everything, support can usually help.

- Wallets → Seed phrase is the master key. Lose it = lose everything forever (no customer support).

3. When to Use an Exchange (Real-Life Scenarios)

You should keep money on an exchange when:

- You are actively trading (day trading, swing trading, arbitrage).

- You want fiat on/off ramps (buying with bank card or SEPA).

- You want earning products (staking ETH at 4–7%, liquid staking, lending, savings accounts).

- You’re using leverage or derivatives (futures, options).

- You’re new and want the simplest possible interface (Coinbase One is literally “buy → hold → sell”).

Recommended beginner-friendly exchanges 2025

- Coinbase (easiest UI, great for US users)

- Binance (cheapest fees, most coins)

- Kraken (strong security reputation)

- Bybit / OKX (best for derivatives)

4. When to Use a Wallet (Real-Life Scenarios)

Move your crypto to a wallet when:

- You plan to HODL for months/years.

- You want maximum security against exchange hacks or bankruptcy (remember FTX 2022).

- You’re interacting with DeFi (Uniswap, Aave, Curve, etc.).

- You want full privacy (no KYC address).

- You’re storing large amounts (rule of thumb: >$5k–$10k → hardware wallet).

Best wallets 2025

Software (Hot) Wallets – Free & convenient

- MetaMask (browser + mobile, Ethereum & EVM chains)

- Trust Wallet (Binance’s official mobile wallet, multi-chain)

- Exodus (beautiful desktop + mobile, built-in swap)

- Phantom (Solana ecosystem king)

- Rabby (advanced EVM wallet with great security warnings)

Hardware (Cold) Wallets – Maximum security

- Ledger Nano S Plus / Nano X ($79–$149)

- Trezor Model T / Safe 3 ($69–$179)

- Tangem cards (NFC, super simple)

5. Simple Workflows for Beginners

Workflow 1: “I just want to buy Bitcoin and hold for 5 years”

- Create account on Coinbase or Kraken

- Buy BTC with bank transfer (cheapest fees)

- Once purchased → Withdraw to your Ledger or Trezor

→ Done. Sleep peacefully.

Workflow 2: “I want to trade altcoins and DeFi”

- Buy USDT/ETH on Binance or Coinbase

- Withdraw to MetaMask or Trust Wallet

- Use Uniswap, PancakeSwap, or instant swap service like baltex.io to get the tokens you want

- Stake/farm/lend directly from your wallet

Workflow 3: “I day-trade meme coins”

→ Keep everything on Bybit or Binance. Withdrawing every trade would cost a fortune in gas.

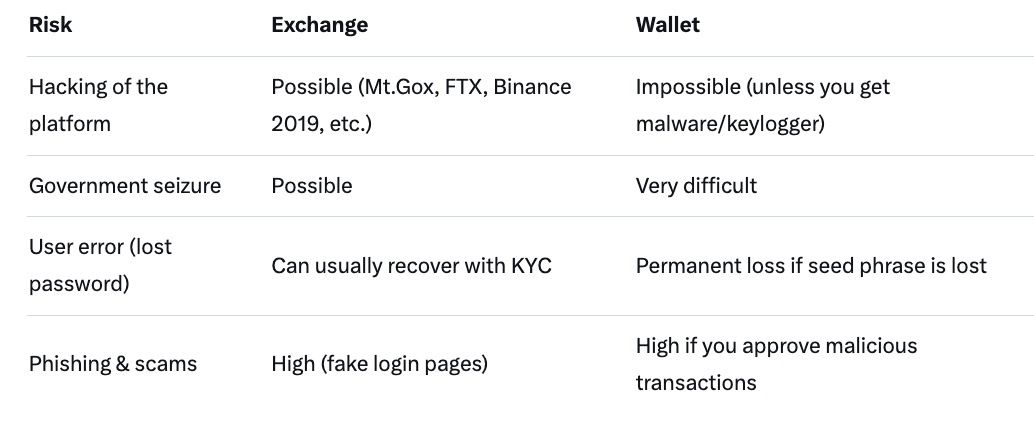

6. Security Comparison Table (2025 Edition)

7. Fees Comparison (Real Numbers 2025)

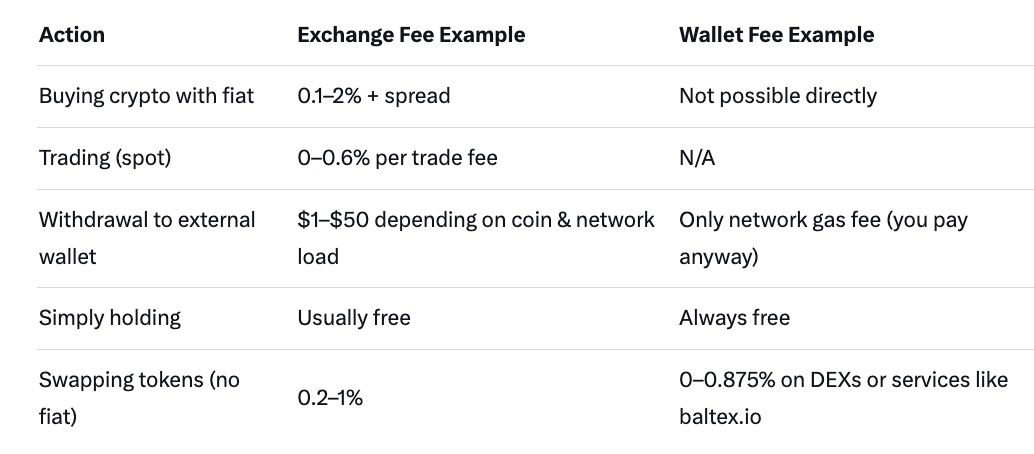

As you can see, baltex.io and similar non-custodial swap services often beat exchange swap fees when you’re already in crypto.

8. How to Choose the Right Option for You (Decision Tree)

Ask yourself these 4 questions:

-

Am I actively trading or earning yield?

→ Yes → Keep on exchange

→ No → Move to wallet

-

Is the amount >$5,000–$10,000?

→ Yes → Hardware wallet strongly recommended

-

Do I need to cash out to fiat regularly?

→ Yes → Keep some on exchange with fiat off-ramp

-

Am I comfortable managing a seed phrase?

→ No → Stick to custodial for now (but learn!)

FAQ – Crypto Exchange vs Wallet

Q: Can a wallet replace an exchange completely?

A: Not if you want to buy with fiat easily. You’ll always need an on-ramp (exchange or P2P).

Q: Is Coinbase considered a wallet?

A: Coinbase offers both. “Coinbase.com” = custodial exchange. “Coinbase Wallet” = separate non-custodial app.

Q: What happens if Binance goes bankrupt?

A: You might lose everything (like FTX users). That’s why “not your keys, not your crypto” exists.

Q: Are hardware wallets 100% safe?

A: 99.9%. The only real risks are physical theft or $5 wrench attacks.

Q: Can I earn staking rewards from my own wallet?

A: Yes! Lido, Rocket Pool, or native staking on Ledger/Trezor for ETH, SOL, ATOM, etc.

Final Conclusion

There is no single winner between exchanges and wallets — they are complementary tools.

Smart 2025 strategy used by most experienced crypto veterans:

- Keep 5–20% of portfolio on a trading exchange for liquidity and earning.

- Keep 80–95% in a non-custodial wallet (hardware if >$10k).

- Use instant swap services like baltex.io when you want to move between tokens without going back to an exchange.

Follow the golden rule — Only keep on exchanges what you’re okay losing in the worst-case scenario.

Now go set up that wallet if you haven’t already. Your future self will thank you.

Stay safe out there! 🚀