Whether you just got paid via Cash App, sold something, or received money from friends, the big question is always: “How do I actually get my money out?” This guide covers every official and safe way to withdraw money from Cash App in 2025 — including free standard transfers, Instant transfers, Cash Card ATM withdrawals, limits, fees, delays, and troubleshooting.

Now let’s dive into every method with screenshots-style instructions.

This is the most popular and cheapest method.

Done! You’ll get a confirmation and the money usually lands in 1–3 business days (often next day if you cash out before 7 PM ET).

Pro tip: Weekends and holidays don’t count as business days.

Need money today? Use Instant transfer.

Most users report money hitting their debit card in under 10 minutes.

Note 2025: Cash App now supports instant transfers to most major banks (Chase, Bank of America, Wells Fargo, etc.) — not just debit cards.

The free Cash App Visa debit card (“Cash Card”) lets you spend or withdraw cash anywhere Visa is accepted.

Fees:

Go to Walmart, Dollar General, CVS, etc. → Buy something small → Ask for cash back (up to $50–$100 depending on store). Usually free.

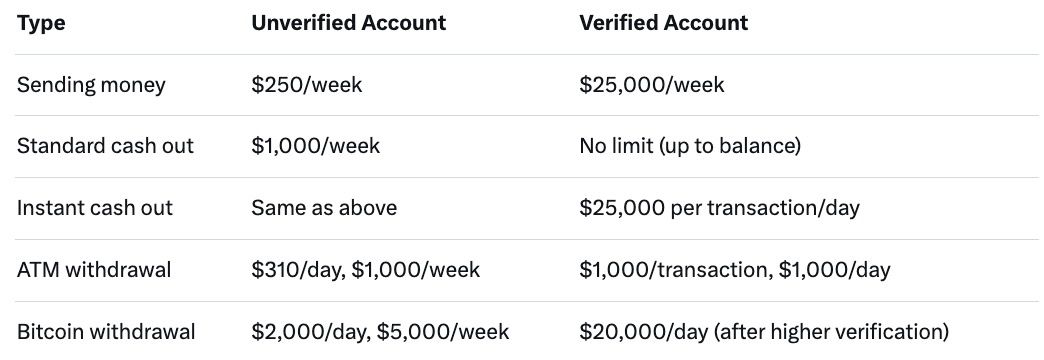

To verify identity (removes most limits): Settings → Personal → Enter full name, DOB, SSN last 4 → Sometimes full SSN required.

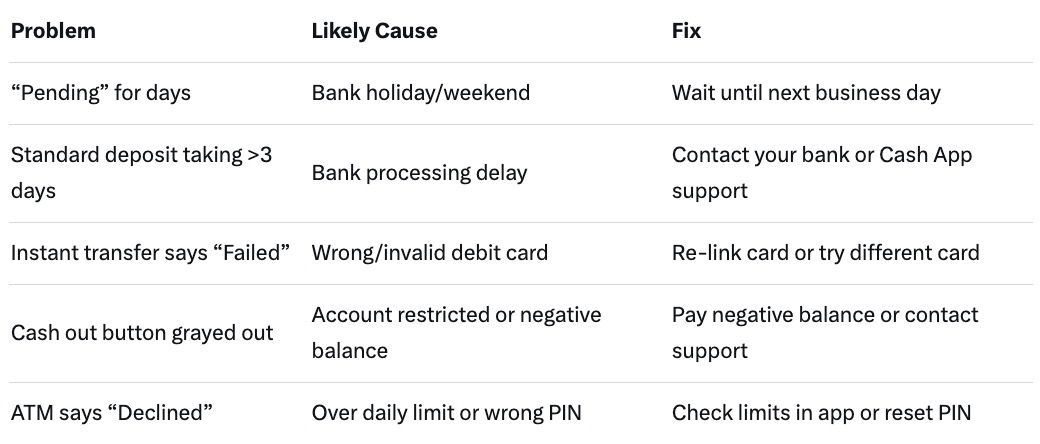

Quick troubleshooting checklist:

Still stuck? Tap profile icon → Support → Chat or call 1-800-969-1940.

Sometimes banks block or delay Cash App transfers (especially newer or online-only banks).

One workaround used by many power users in 2025: Use a third-party swap service like baltex.io to instantly exchange your Cash App balance for USDT, PayPal, Venmo, or another bank without waiting 1–3 days and often with lower fees than Instant transfer. (Use at your own risk and only trusted platforms.)

Q: Can I withdraw Cash App money without a bank account? A: Yes — order the Cash Card and use ATMs or cash-back at stores.

Q: Why is my instant transfer taking hours instead of minutes? A: Some banks (especially credit unions) place holds. Try a Visa debit card instead.

Q: Does Cash App report large withdrawals to the IRS? A: Cash App sends a 1099-K if you receive >$600 in business/goods payments in a year.

Q: Can I cash out to someone else’s bank account? A: No. Money can only go to banks or cards linked under your verified name.

Q: Is there a way to get money off Cash App with no fees and instantly? A: Not officially. The only truly free method is Standard (1–3 days). Some users use peer-to-peer swaps, but that carries risk.

Withdrawing money from Cash App is straightforward once you know the options:

Follow the steps above and you’ll never be stuck with money “trapped” in Cash App again.

Have a specific withdrawal issue not covered here? Drop it in the comments — happy to help!

Last updated: November 2025 — all limits and fees confirmed current as of this date.