Crypto aggregators are revolutionizing DeFi in 2025 by scanning multiple exchanges for the best rates, boosting liquidity, slashing fees by up to 50%, and enabling seamless cross-chain swaps. Top players like 1inch, Paraswap, and CowSwap lead the pack, while hybrid innovators like Baltex.io blend CEX and DEX liquidity for ultimate flexibility. This guide breaks down their benefits, compares features, and forecasts their dominance in a multi-chain world—perfect for traders seeking efficiency without compromise.

In 2025, the crypto landscape is more fragmented than ever, with over 100 blockchains and thousands of tokens demanding smarter tools. Enter crypto aggregators: DeFi's unsung heroes that unify exchanges, optimize trades, and simplify your portfolio like a digital Lord of the Rings ring. Whether you're a newbie swapping ETH for SOL or a pro hunting yield across chains, aggregators cut through the noise. This 2,200-word SEO-optimized guide explores their ascent, core advantages, top contenders, and why 2025 marks their tipping point.

Crypto aggregators, often called DEX aggregators, are platforms that act as meta-exchanges. They don't host trades themselves but intelligently route your orders across decentralized exchanges (DEXs), centralized exchanges (CEXs), and liquidity pools to secure the optimal price, speed, and cost.

Think of it like a travel aggregator for flights: Kayak doesn't fly planes but compares airlines for the cheapest route. In crypto, aggregators like 1inch or Rubic query protocols such as Uniswap, SushiSwap, and Curve in real-time, splitting orders if needed to minimize slippage. Launched in the 2020 DeFi summer, they've evolved from niche tools to must-haves, handling billions in volume amid 2025's bull run.

Why the hype? Traditional DEXs limit you to one chain or pool, exposing you to poor liquidity and high gas fees. Aggregators fix this by:

In 2025, with Ethereum's Dencun upgrade slashing L2 fees and Solana's Firedancer boosting TPS to 1 million, aggregators are the glue holding Web3's ecosystem together.

Fragmentation is crypto's Achilles' heel: Your BTC on Binance can't easily swap for AVAX on Avalanche without bridges, wallets, and fees eating your gains. Aggregators unify this chaos by creating a single interface to dozens of venues.

Here's how it works:

Take a real-world example: Swapping 1 ETH for USDC. A solo Uniswap trade might cost 0.3% in slippage during volatility. An aggregator like Odos routes it via Jupiter on Solana for cross-chain efficiency, saving 20-30%. In 2025, with regulatory clarity from the EU's MiCA and U.S. FIT21 acts, aggregators are onboarding CEX liquidity too, blurring lines between CeFi and DeFi.

This unification isn't just convenient—it's transformative. A 2025 Chainalysis report notes aggregator volume surged 300% YoY, as users flee siloed apps for "super apps" that echo WeChat's all-in-one model but for crypto.

Liquidity—the lifeblood of trading—dwindles on isolated DEXs, leading to 5-10% slippage on illiquid pairs. Aggregators supercharge it by pooling resources from hundreds of sources.

Key mechanisms:

In 2025 stats: Aggregators unlocked $500B in "dark liquidity"—untapped reserves from CEXs and private markets—reducing average slippage to under 0.5%. For niche tokens like memecoins on Base, this means instant execution without crashing prices.

Pro tip: During high-vol events like Bitcoin halvings, aggregators' real-time rerouting prevents front-running, a boon for institutions entering DeFi via BlackRock's tokenized funds.

Gas fees, slippage, and protocol charges can devour 2-5% per trade on native DEXs. Aggregators slash this via optimization.

Breakdown of savings:

A 2025 Deloitte study pegs average aggregator savings at 40-60% versus direct DEX trades. For a $10K swap, that's $200-300 back in your pocket. Hybrids like Baltex.io even tap CEX rebates, blending low DeFi costs with CeFi speed.

As Ethereum's blob fees drop post-Dencun, aggregators amplify this, making micro-trades viable for retail.

Cross-chain swaps once meant bridges like Wormhole—slow, hacked-prone bridges with 7-day lockups. Aggregators streamline via atomic swaps and integrated bridges.

How they excel:

In practice: Swapping Polygon MATIC for Optimism OP? Aggregators route via Axelar or LayerZero, completing in 30 seconds at 0.1% total cost. With 2025's modular blockchains (e.g., Celestia DA), expect 90% of trades to be cross-chain, per Messari forecasts.

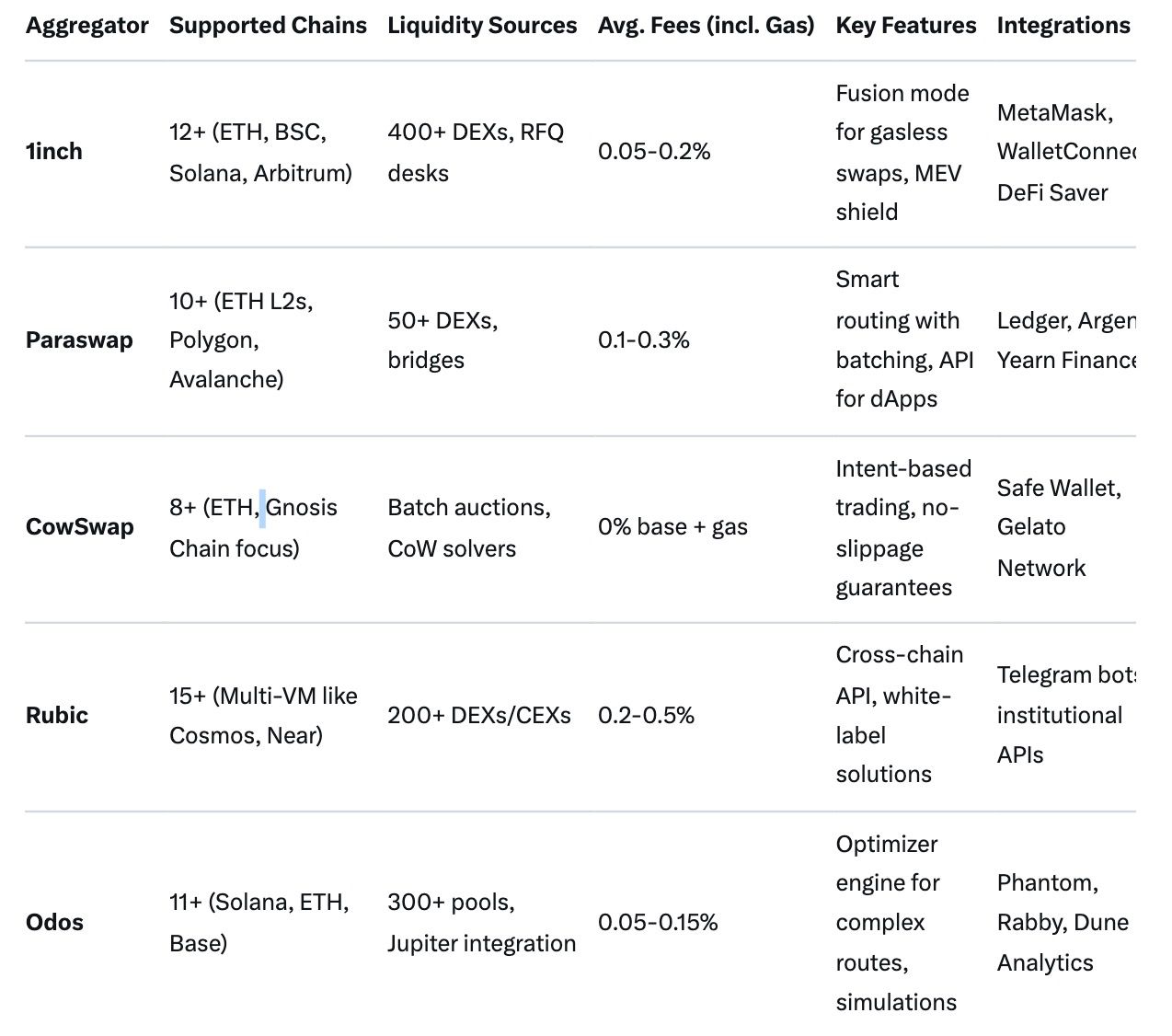

2025's aggregator wars pit pure DEX players against hybrids. We compared the top five based on supported chains, liquidity sources, fees, and unique perks. Data sourced from recent benchmarks.

Quick Verdict: 1inch wins for retail breadth; CowSwap for MEV pros; Rubic for devs. All support 1,000+ tokens, but hybrids like Baltex.io edge out with CEX blending (detailed below).

Amid pure-play DEX dominance, Baltex.io emerges as 2025's wildcard—a hybrid aggregator fusing CEX speed with DEX privacy. Launched in late 2024, it aggregates liquidity from Binance, OKX (CEXs) and Uniswap, 1inch (DEXs), routing trades non-custodially without KYC.

Standout features:

Why it shines: For pros, Baltex's API enables custom bots; beginners love the "one app" dashboard. In a post-FTX world, its hybrid model complies with regs while dodging custody risks—ideal for 2025's institutional influx. Volume hit $2B monthly by Q3, per DappRadar.

2025 isn't just a milestone—it's the aggregator inflection point. With AI-driven routing (e.g., predictive slippage via ML models) and chain abstraction (hide chains entirely), expect "intent-centric" trading where you say "maximize yield on stables" and it executes across ecosystems.

Challenges remain: Oracle centralization risks and regulatory scrutiny on hybrids. Yet, innovations like zero-knowledge proofs for private aggregation promise fixes. By 2026, Messari predicts 70% of DeFi volume via aggregators, up from 40% today.

On X (formerly Twitter), buzz echoes this: Recent posts hail aggregators as "DeFi's iPhone moment," with devs teasing Solana-Ethereum unifiers. Stay ahead: Integrate aggregators into your wallet for passive optimization.

The "best" depends on needs: 1inch for multi-chain retail, CowSwap for secure batches, Baltex.io for hybrid CEX/DEX.

By splitting orders across low-fee pools, optimizing gas, and rebating protocols—savings of 40-60% typical.

Yes, if non-custodial and audited. Use hardware wallets and check TVL; Baltex.io's no-KYC model adds privacy without custody.

Absolutely—tools like Rubic and Odos execute atomic cross-chain trades in seconds, minimizing bridge risks.

AI routing, L2-native execution, and CEX hybrids like Baltex.io for institutional-grade liquidity.

Crypto aggregators aren't just tools—they're the great unifiers of 2025's multi-chain maze, delivering liquidity, savings, and simplicity in one app. From 1inch's precision to Baltex.io's bold hybridity, they've turned DeFi from a puzzle into a powerhouse. As volumes soar and tech matures, ignoring them means leaving money on the table.

Ready to swap smarter? Start with a top aggregator today and watch your portfolio thrive. What's your go-to—drop a comment below!