Crypto bridge explained: If you have ever wished you could freely move your crypto assets between different blockchains, you are not alone. From exploring new DeFi platforms to accessing special token benefits, cross-chain transactions are essential in today’s crypto landscape. A crypto bridge is a tool that lets you “bridge” your assets from one blockchain to another, without going through cumbersome, centralized steps. As decentralized finance (DeFi) expands across multiple networks, understanding how to shuttle your tokens around seamlessly can open up a world of possibilities for yields, staking, and more. In this guide, you will discover exactly how crypto bridges work, the benefits of using them, and which platforms deserve a top spot on your shortlist.

Below, you will find a condensed overview (TL;DR) and then a deeper dive into the “why” and “how” of cross-chain bridges. By the end, you will know which bridges fit your trading style and how to protect yourself from common pitfalls. You will also learn how baltex.io can serve as a fast, secure swap platform that pairs well with just about any bridging strategy.

A crypto bridge is an application that lets you send tokens between different blockchains, improving liquidity and accessibility.

You typically lock your tokens on one network and receive equivalent tokens on another network.

The top 5 crypto bridges featured here each offer unique benefits, such as speed, wide network support, or user-friendly interfaces.

Safety features like audits, smart contract verifications, and multi-signature models are crucial for protecting your assets.

Always follow best practices, such as verifying contract addresses and using official project links.

baltex.io is a useful companion for quick token swaps, enhancing your cross-chain experience.

A crypto bridge is much like a technology “tunnel” connecting two separate ecosystems. For instance, you might have tokens on the Ethereum network but want to use them on a more cost-effective chain like Polygon or a specialized DeFi chain like Avalanche. Normally, these separate networks can’t directly communicate. This isolation makes it difficult to move your digital assets, leading to missed opportunities or complicated workflows.

However, a crypto bridge overcomes that isolation. When you want to move tokens from Chain A to Chain B, the bridge typically does the following:

Locks (or escrows) your original tokens on Chain A through a smart contract.

Mints equivalent tokens on Chain B, effectively representing your original holdings one-to-one.

When you are ready, you can burn those tokens on Chain B to release your original tokens back on Chain A.

This process means your tokens are never simultaneously in two places at once. Instead, copies or “wrapped” tokens exist on the second chain, maintaining your overall asset balance. A reliable bridge carefully manages these wrapped tokens and ensures the ratio remains consistent over time.

In a world of numerous blockchain protocols, each chain may have unique features or specialized DeFi sectors. If your tokens are stuck on just one network, you might be missing out on:

Lower transaction fees on certain Layer 2 solutions or sidechains.

Higher yields offered by smaller or newer DeFi ecosystems.

Access to specialized dApps or NFT marketplaces.

Better liquidity pools for specific tokens.

For you as a crypto trader or DeFi user, bridging can optimize your usage of multiple decentralized applications (dApps). A well-chosen bridge can help you cut costs, expose you to higher returns through yield farming, and let you participate in cross-chain NFT marketplaces. Overall, it’s more than just moving tokens around, it is about unlocking the full potential of your digital assets.

In this section, you will find a detailed look at five popular crypto bridges. Each entry covers key features, usage steps, supported networks, and safety measures. By exploring their strengths and differences, you can decide which one resonates most with your strategies.

Portal is a cross-chain bridge solution powered by the Wormhole protocol. It aims to help you move assets between multiple networks smoothly. Portal is known for bridging tokens across ecosystems like Ethereum, Solana, BNB Chain, Polygon, and more.

Multi-chain flexibility: Portal supports a wide network range, including some emerging chains.

Modular protocol design: Wormhole sets up tailored modules that can integrate with multiple blockchains.

Developer ecosystem: The underlying Wormhole framework is constantly updated, helping the Portal app to stay secure and competitive.

Navigate to the official Portal (Wormhole) interface.

Connect your wallet, such as MetaMask or Phantom (depending on the chain).

Select the source chain and the token you want to bridge.

Specify the destination chain.

Approve and initiate the transfer, then wait for the transaction to finalize.

Once your tokens appear on the other side, you can use them in DeFi applications, liquidity pools, or other dApps on that chain.

Ethereum

Solana

Polygon

BNB Chain

Avalanche

Several additional Layer 1 and Layer 2 networks

Thanks to this wide coverage, Portal is an attractive choice if you need exposure to multiple ecosystems.

Portal leverages the Wormhole protocol, which utilizes a network of “guardians” to verify cross-chain messages. This system helps reduce the risk of any single point of failure. Additionally, Wormhole is open source and regularly audited, ensuring transparency and letting users verify the code for themselves.

cBridge is a product of Celer Network, aiming to deliver low-cost, lightning-fast transactions for cross-chain movement. The project’s overall goal is to build an inter-blockchain communication system with scaling solutions like rollups.

High-speed transfers: cBridge has established a reputation for quick cross-chain operations.

Low fees: The Celer Network uses efficient routing to keep costs minimal, ideal if you move tokens frequently.

Layer 2 support: cBridge excels at bridging Ethereum Layer 2 solutions (like Arbitrum and Optimism) in addition to common mainnets.

Go to the cBridge web interface.

Choose the source chain and the destination chain from a dropdown.

Enter the token type and the amount you want to transfer.

Approve the transaction in your connected wallet (e.g., MetaMask).

Wait for confirmation to see your tokens on the target network.

When bridging between Layer 2 solutions, expect particularly fast transaction times and lower gas fees compared to bridging from Ethereum mainnet.

Ethereum mainnet

Arbitrum

Optimism

BNB Chain

Polygon

Other EVM-compatible networks

Its extensive Layer 2 and sidechain coverage make cBridge ideal for saving on gas costs.

Celer’s cBridge is both audited and community-trusted. Celer also implements a Robust State Guardian Network (SGN) to validate off-chain states on behalf of users, minimizing the chances of double-spending or malicious validators.

Synapse is a cross-chain protocol focused on offering interoperability for both tokens and smart contract calls. The project sets out to provide liquidity pools for stablecoins and other assets, while also supporting bridging to multiple blockchains.

Powerful DEX integration: Synapse’s ecosystem includes a decentralized exchange for swapping tokens with low slippage.

Stablecoin bridging: Many traders use Synapse to move stablecoins like USDC or USDT across chains, a helpful tool for yield optimizers seeking fast conversions.

Cross-chain functionality for dApps: Synapse aims to be a universal layer for cross-chain smart contract calls, letting developers build multi-chain applications.

Go to the Synapse website and connect your wallet.

Select the “Bridge” tab, then pick your source chain, target chain, and token.

Input the amount to transfer.

Confirm and sign the transaction in your wallet.

Wait for the bridging process to complete, then proceed with your tokens on the destination chain.

Synapse also provides advanced liquidity and staking features for those interested in supporting the network in exchange for rewards.

Ethereum

Avalanche

Binance Smart Chain (BNB)

Polygon

Arbitrum

Several other EVM-compatible blockchains

Synapse continues to expand its network support. If you use stablecoins widely, Synapse’s stable pool bridging can be particularly convenient.

Synapse’s contracts undergo security reviews, and the project highlights transparency by making most details openly accessible. Synapse also employs liquidity providers who add to the health of the protocol. While no bridging tool is 100 percent free from risks, Synapse attempts to mitigate vulnerabilities through regular audits.

If you frequently explore Ethereum-based dApps, you may already know about Polygon. Offering a faster, more cost-efficient environment than Ethereum mainnet, Polygon has a native bridge that helps you move your assets in and out of the network.

Seamless Ethereum integration: Because Polygon is closely linked to Ethereum, bridging is relatively simple.

Official support: Polygon Bridge is backed by the Polygon team and is the main method for transferring ETH or ERC-20 tokens to Polygon.

User-friendly interface: The official Polygon Web Wallet simplifies bridging tasks with easy prompts and minimal confusion for newcomers.

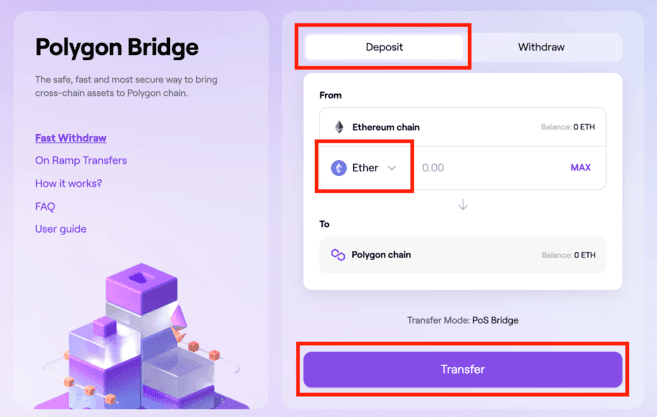

Head to the Polygon Web Wallet.

Connect your MetaMask or compatible wallet.

Choose “Deposit” to move tokens from Ethereum to Polygon.

Select the token and specify how many you want to bridge.

Confirm the transaction in your wallet and wait for the bridging to finalize.

To move tokens back to Ethereum, pick “Withdraw” and repeat the process in reverse.

Be aware that bridging from Ethereum to Polygon or back can still incur Ethereum gas fees, so plan your transactions accordingly.

This is primarily a two-way solution between Ethereum mainnet and Polygon. If your main interest is bridging Ethereum-based tokens to Polygon for cheaper DeFi, this bridge is a top choice.

Polygon Bridge undergoes regular audits and has the backing of a well-known team. Since it is the official route to and from Polygon, the ecosystem invests heavily in maintaining robust security. Keep in mind that gas fees can fluctuate on Ethereum, so it’s good practice to double-check network conditions before you start a transfer.

Multichain, previously known as Anyswap, is a platform designed to help you smoothly move assets across a wide range of networks. It uses a combination of smart contracts and router models to keep bridging simple and intuitive.

Wide network support: Multichain is constantly adding new blockchains, making it ideal for exploring fresh DeFi ecosystems.

Router technology for efficient transfers: Instead of locking and minting, Multichain routes tokens to liquidity pools on the destination chain, optimizing transaction flows.

Flexible UI: A user-friendly interface caters to both novice and experienced traders.

Go to the Multichain web interface.

Connect your wallet and choose your source blockchain and token.

Select the destination chain and the token you want to receive.

Enter the amount, approve the transaction, then confirm it in your wallet.

Monitor your transaction status on the interface until your tokens arrive.

The bridging process may take a few minutes, depending on the network’s transaction throughput.

Ethereum

Fantom

BNB Chain

Avalanche

Polygon

Many emerging blockchains like Cronos, Moonbeam, etc.

If you frequently switch between multiple EVM-compatible and some non-EVM networks, Multichain is a solid choice for broad coverage.

Multichain runs a network of Secure Multi-Party Computation (SMPC) nodes that collectively sign and validate cross-chain transactions. This multi-node system helps reduce vulnerabilities. The project has also undergone security audits to ensure consistent reliability.

Bridging is only half of the cross-chain story. Once your tokens are on a new network, you might want to swap them into other assets, stake them in liquidity pools, or quickly diversify into different DeFi protocols. This is where a platform like baltex.io can complement your bridging efforts.

On baltex.io, you can:

Swap multiple tokens with minimal downtime, making it easy to rebalance your portfolio on a fresh blockchain.

Benefit from a user-friendly interface that guides you through the process in just a few clicks.

Use steady liquidity and fast confirmations, ensuring that you do not lose precious time in the often-fast-paced DeFi market.

Reduce friction when you want to pivot from one token to another on your newly chosen chain.

Imagine you have just bridged some USDC from Ethereum to Solana. You might want to swap that USDC into SOL or another asset that is more readily used in Solana’s DeFi environment. Heading over to baltex.io, you could swap quickly while enjoying competitive rates. This synergy between bridging and swapping can lighten your workload, letting you focus on finding the best opportunities across the blockchain ecosystem.

Because the DeFi world moves rapidly, keep an eye on updates and new integrations. Platforms such as baltex.io frequently add tokens, features, or partnership networks that may further streamline your cross-chain activity.

Bridging moves tokens from one network to another by locking or holding them on the source chain and minting or releasing them on the destination chain. Swapping typically changes one token for another on the same network. For instance, bridging is ideal to access a completely different chain, while swapping is meant to exchange tokens within that same chain.

First, always use official links and verify contract addresses in your wallet or bridging interface. Watch out for copycat or scam websites. Second, research whether the bridge you are using has undergone security audits. Finally, keep your private keys in a secure place and enable features like hardware wallet support if available.

Smaller blockchains can be attractive because they often advertise lower fees or higher yield options. However, these networks may lack the same level of security or track record as more established chains. Use reputable bridges and consider the liquidity and security of your chosen destination before committing large amounts of capital.

You will need to pay transaction fees on both the source chain (to approve and lock your tokens) and occasionally on the destination chain (to mint or receive them). Ethereum, for example, can be expensive if the network is busy. Layer 2 or sidechain solutions often reduce these costs considerably.

Once the transaction is confirmed and executed on the blockchain, you cannot “undo” it in the traditional sense. However, you can bridge back by locking your tokens on the new chain and releasing them on the original chain (or performing the bridging process in reverse). Keep in mind that additional gas fees and bridging fees will apply.

Many bridges support popular web3 wallets such as MetaMask, WalletConnect-compatible apps, Phantom (for Solana), and others. Make sure the wallet you choose supports both your source and destination networks. When bridging to non-EVM chains like Solana or Terra, you will often need a specialized wallet plugin.

If your bridging transaction encounters a glitch, such as a network interruption, typically the bridging protocol will have a record of your transaction and might revert it or require manual intervention. You should contact the bridge’s official support or consult their documentation for guidance on how to recover funds. In many cases, your tokens remain locked or pending until the system resolves the discrepancy, but vigilance is key.

If you find that being stuck on one blockchain feels limiting, a crypto bridge unlocks cross-chain exploration. Whether you want to cut fees, access new DeFi platforms, or chase specialized liquidity opportunities, the right bridge can broaden your horizons. By comparing Portal by Wormhole, cBridge by Celer, Synapse, Polygon Bridge, and Multichain, you have a thorough foundation for making an informed decision.

Remember that proper research, wallet security, and adherence to best practices are crucial to safe bridging. Double-check contract addresses, watch out for scam versions of official sites, and always keep an emergency plan for reversing your bridge if something goes amiss. In tandem with a fast, secure swap platform like baltex.io, you can navigate new blockchains efficiently and adjust your portfolio whenever opportunities arise.

Ultimately, bridging is about flexibility. Whether it’s bridging stablecoins across networks with minimal fees, or bridging your favorite tokens onto a sidechain for speed and efficiency, cross-chain technology helps you stay competitive in a fast-moving cryptocurrency environment. By choosing the solution that fits your trading style best, you can optimize your asset transfers and elevate your entire DeFi experience.