The Arbitrum network token is a way to access lower fees and faster transactions on Ethereum.

Arbitrum uses a technology called Optimistic Rollups to process activity off the main Ethereum chain, which reduces congestion.

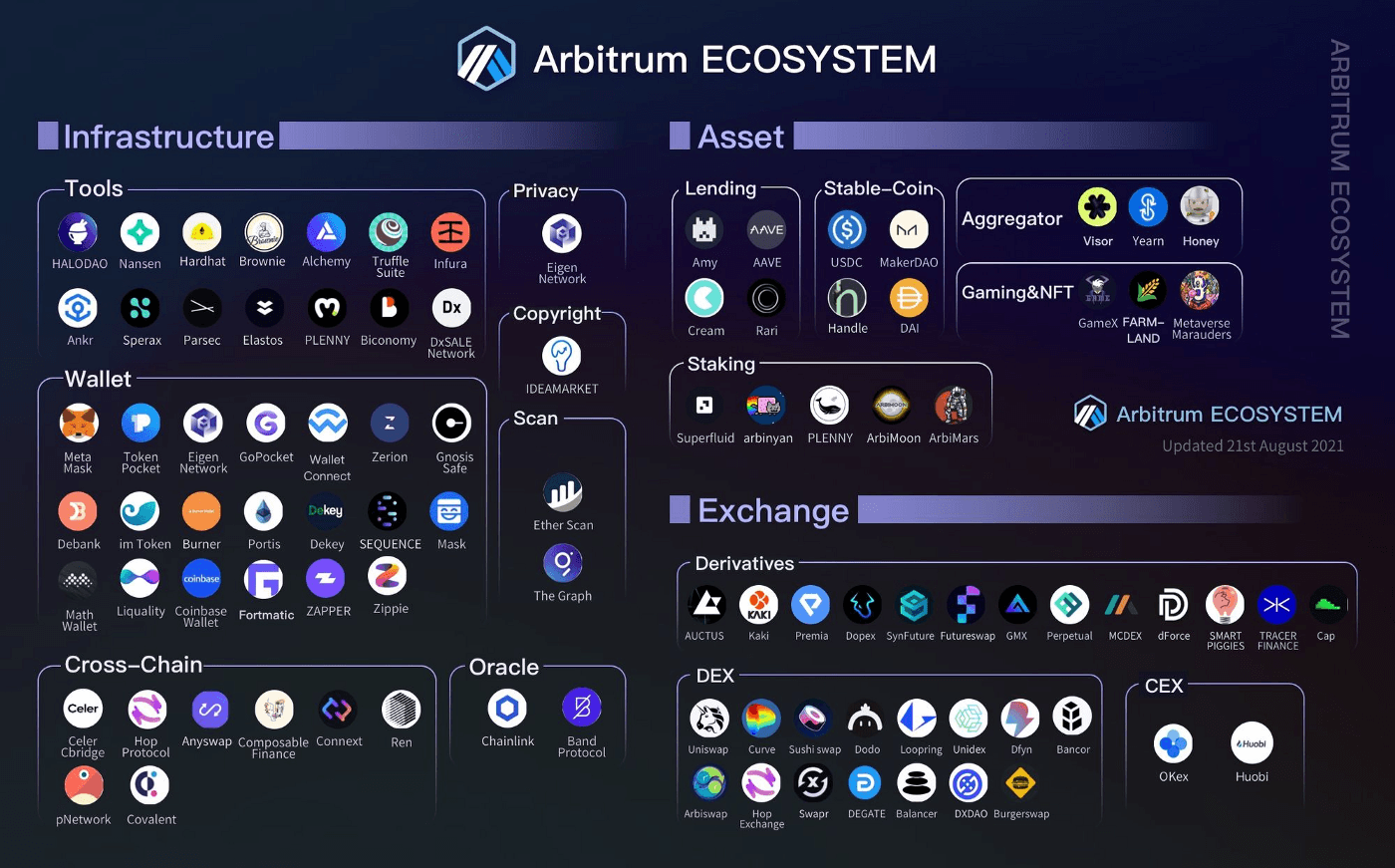

You can interact with popular decentralized apps (dApps) such as decentralized exchanges, lending platforms, and NFT marketplaces on Arbitrum.

Setting up your Arbitrum-compatible wallet involves adding the correct network settings, bridging your tokens, and exploring the available dApps.

Platforms like baltex.io allow you to swap crypto across multiple blockchains, including Arbitrum, which offers more flexibility when moving funds.

Always verify network fees and use trusted bridges and security practices to protect your funds.

When you hear about the Arbitrum network token, you might wonder what role it plays in the Arbitrum ecosystem. Essentially, Arbitrum is a layer-2 scaling solution for Ethereum. It is designed to handle transactions off the main Ethereum chain, helping you avoid high gas fees and lengthy confirmation times. By using a system known as Optimistic Rollups, Arbitrum processes large batches of transactions before posting a summary back to Ethereum. This process keeps Ethereum secure while making things faster and cheaper for you.

At the heart of this layer-2 environment are tokens compatible with the Arbitrum network. If you want to move funds into Arbitrum, you take your Ethereum-based assets and bridge them over. The resulting “Arbitrum network tokens” represent those funds on layer-2. That means you can trade, lend, or swap them on Arbitrum without dealing with the high gas fees you would typically pay on the Ethereum mainnet.

Choosing Arbitrum can help you cut down on transaction costs and speed up the settlement process. With the continued rise of decentralized finance (DeFi) apps and NFT markets, Ethereum gas fees can be a hurdle. If you regularly interact with DeFi, these fees can add up quickly. By contrast, the Arbitrum network offers:

Lower fees. You will spend significantly less ETH on transaction costs than on the Ethereum mainnet. This advantage is especially helpful if you transact often or work with small amounts of crypto.

Faster transaction confirmations. You do not have to wait as long for each transaction to be finalized. This benefit makes batch operations and active trading feel smoother.

Full Ethereum security. Arbitrum technology is tied to the Ethereum mainnet, so it benefits from Ethereum’s robust security model. It inherits Ethereum’s decentralization, which adds a layer of confidence as you move your assets.

Easy compatibility with your favorite Ethereum dApps. Since Arbitrum is EVM-compatible, many Ethereum-based dApps can integrate with Arbitrum directly. Often, you still use the same wallet login method—you just switch the active network to Arbitrum.

Flexibility to return to Ethereum. You maintain the option to “bridge back” to the Ethereum mainnet if needed, which means your assets are never locked into a single layer-2 system.

A bustling ecosystem awaits you on Arbitrum. Many projects have already deployed or announced plans to deploy on this layer-2 network, and you can access them simply by pointing your wallet to the Arbitrum chain. Here are some major categories of dApps you might explore:

Arbitrum hosts various DEXs where you can swap Arbitrum network tokens frictionlessly.

These platforms often mirror the functionality you find on Ethereum-based DEXs, except with lower fees and quicker trades.

Like on Ethereum, you can deposit tokens in lending protocols to earn interest or borrow against your holdings.

Cheaper and faster transactions give you more flexibility in how you manage loans, margin positions, or yield strategies.

If you are an NFT enthusiast—or a creator—Arbitrum can be an affordable way to mint, list, and trade NFTs.

Lower fees help you avoid high overhead costs associated with creating new items or bidding on sought-after collectibles.

Some specialized tools on Arbitrum let you deposit crypto into pools that automatically optimize your yield across different strategies.

Because fees per transaction are lower, these platforms can rebalance more frequently, potentially improving yields.

Arbitrum also provides a home for blockchain-based games that leverage Ethereum’s security but avoid its congestion.

Look for game tokens or in-game collectibles living on Arbitrum that handle microtransactions more efficiently.

Before you can start interacting with Arbitrum dApps, you need a wallet that supports the Arbitrum network. If you already have a popular cryptocurrency wallet—like MetaMask—you can add Arbitrum as a custom network. The process is straightforward:

Open MetaMask in your browser.

Click on the network dropdown at the top (it might say “Ethereum Mainnet” by default).

Select the “Add Network” option.

Enter the Arbitrum network details in the form:

Network Name: “Arbitrum One” (or any label you prefer)

New RPC URL: (copy from the official Arbitrum docs or from a trusted source)

Chain ID: 42161

Currency Symbol: ETH

Block Explorer URL: (again, from the official Arbitrum docs)

Your MetaMask should now have Arbitrum One in your network list. Selecting it will switch your wallet to layer-2 mode. You can later toggle back to Ethereum mainnet or other networks as needed.

If you bridged a specific token from Ethereum—like USDT or DAI—to Arbitrum but do not see it in your wallet, add it as a custom token. In MetaMask for instance:

Click “Import tokens.”

Paste the Arbitrum contract address for the token.

Confirm the token symbol and decimals.

After you finish, the token balance should appear whenever you switch your wallet to Arbitrum.

To start using any Arbitrum network token, you first need to bridge your funds from Ethereum (or from another chain that supports Arbitrum bridging). Bridging is the process of locking your assets on the original chain and then “minting” representative tokens on layer-2. You can use various bridging tools, such as official or community-built Arbitrum bridges. While each bridging solution might have its unique interface, the steps are generally similar:

Connect your wallet to the bridging website.

Select which token you want to bridge (e.g., ETH, DAI, or another ERC-20).

Input the amount you plan to bridge.

Approve the transaction in your wallet and pay the Ethereum gas fee.

Wait for confirmation.

Once the bridging event confirms, you will see the Arbitrum version of that token in your wallet if you have followed the instructions to add it as a custom token. You can now use it in any Arbitrum dApp.

Instead of bridging tokens from Ethereum alone, you might have funds on other chains as well. A cross-chain swap platform like baltex.io can simplify this process by taking care of the bridging and exchanging steps all at once. For example, you can:

Swap from a Binance Smart Chain (BSC) token to an Arbitrum token in one transaction.

Move from Polygon to Arbitrum without juggling multiple bridging tools.

The site basically coordinates the chain hops in the background, making it easier to explore new opportunities and dApps on Arbitrum without jumping through multiple platforms. Before you start, always double-check which networks baltex.io supports and confirm you are not being phished by a scam copycat site.

Two major goals of using any layer-2 solution are reducing fees and maintaining security. Here is how Arbitrum balances these priorities:

Arbitrum compresses transactions before posting them to Ethereum. This approach lets many users share the cost of storing data on-chain.

You still pay a “gas fee,” but it is typically a fraction of what you would pay on Ethereum mainnet during peak congestion.

Because transactions finalize faster, you can do more frequent trades or operations without draining your wallet on fees.

Arbitrum interacts with Ethereum using smart contracts that hold your bridged assets in escrow.

If there is any suspicious activity on the layer-2 side, validators can submit fraud proofs to dispute incorrect data.

You can always withdraw your funds back to Ethereum by triggering an “exit” from Arbitrum, though it can take roughly a week for dispute resolution.

As with any crypto activity, you should keep best practices in mind:

Verify the correct Arbitrum contract addresses before sending funds.

Bookmark official bridging sites to avoid phishing attempts.

Keep an eye on your browser’s address bar to ensure you are on the legitimate domain.

Review your transaction details carefully in your wallet before confirming.

It helps to understand more than just the bridging and fees. The Arbitrum ecosystem has unique elements that set it apart from other Ethereum layer-2 solutions. Let us break down a few:

Arbitrum does not slow down when transaction volumes spike because the heavy lifting takes place off Ethereum’s main chain. The speed you experience is often similar to using a completely different blockchain, but here you retain the security of Ethereum.

Because Arbitrum is built to be EVM-compatible, you can code in Solidity or use your favorite development frameworks without major changes. This compatibility encourages widespread adoption, as dApp creators can easily port over their Ethereum-based projects.

Arbitrum fosters an active community of developers, validators, and users. You can find help and tutorials in official forums and social channels, which is invaluable if you run into snags deploying a smart contract or bridging a new token.

While bridging ETH or stablecoins is useful, Arbitrum’s real power lies in advanced DeFi. You can:

Earn staking rewards by providing liquidity to pools on Arbitrum-based DEXs.

Harness arbitrage opportunities between Arbitrum-enabled exchanges.

Launch your own token on layer-2 and reduce the initial cost of distribution.

If you are a DeFi enthusiast, you might want to use Arbitrum to optimize your strategies. Because gas on layer-2 is cheaper, you can experiment more frequently with:

Deposit tokens into liquidity pools, farms, or vaults without high overhead costs.

Consider rotating between farms to chase better yields, since bridging fees are relatively manageable.

Certain dApps on Arbitrum allow margin trading. Lower fees can make high-frequency trading more viable.

You also reduce the cost of maintaining collateral.

If you use a bot to move funds between multiple DeFi protocols, doing it on Arbitrum means you pay reduced gas overhead for each action.

Rebalancing can happen more frequently, which might improve your results in volatile markets.

Some Arbitrum-based projects let you vote on proposals using governance tokens.

Lower gas fees encourage more active participation from community members.

Bridging from Ethereum mainnet to Arbitrum is typically straightforward, but you should choose a reliable, trusted technology. Common solutions include:

The official Arbitrum Bridge. This tool is developed and maintained by the Arbitrum team.

Third-party bridging platforms. Many bridging aggregator sites allow you to deposit tokens into Arbitrum in one or two clicks.

Regardless of your choice, consider these points:

Security audits. Look for a bridge that has undergone thorough audits.

Reputation. Check what the broader crypto community says about the platform.

Supported tokens. Some bridges only handle Ethereum or popular stablecoins. If you have a more obscure token, you might need a specialized solution.

Fees. Different bridging solutions can have variations in how they charge fees, so choose a method that aligns with your budget.

After you have bridged your funds, you can explore a wealth of Arbitrum-specific tools. These include:

Browse transactions, check wallet balances, and confirm contract interactions on specialized Arbitrum explorers.

Examples include Arbiscan, which is similar in style to Etherscan.

Tools that help you track your assets across multiple networks can also incorporate your Arbitrum balances.

Having a unified view of your holdings means you do not lose track of tokens locked in DeFi or staked in other dApps.

Some DeFi dashboards can send notifications when your collateral ratio hits a risky level or when a governance proposal needs your vote.

Because Arbitrum operates quickly, timely alerts can be crucial in high-volatility markets.

You may want to explore innovative NFT-based projects that focus on layer-2 to avoid the skyrocketing minting fees on Ethereum mainnet.

Marketplaces can feature unique collections exclusive to Arbitrum.

If you plan to keep using Arbitrum for day-to-day transactions or DeFi strategies, consider these tips to stay organized:

Keep your computer and browser plugins updated.

If you use a hardware wallet, verify that it is properly integrated with Arbitrum.

Below are some questions you might have if you are new to the Arbitrum network token and the layer-2 ecosystem overall.

Yes, Arbitrum inherits security from Ethereum. However, like all crypto projects, it is vital to use official bridges and verify contract addresses. Fraud proofs protect the network from incorrect state updates, and a dispute window helps keep the system honest.

Fees on Arbitrum can be a fraction of the cost on Ethereum mainnet. The exact amount varies with network load, but you might pay just a few cents or a few dollars instead of tens or hundreds of dollars in gas fees.

You will need ETH to pay for gas, even on Arbitrum. When bridging ETH or acquiring Arbitrum-compatible ETH, make sure to keep enough in your wallet for transaction fees.

Yes. You can withdraw your Arbitrum network tokens to Ethereum through an official or third-party bridge. Withdrawals usually take up to a week to finalize due to dispute resolution, which helps ensure security.

You can do so on baltex.io or a similar cross-chain swap platform. The website will handle bridging steps in the background, letting you trade without manually transferring from chain to chain.

Arbitrum offers strong security, EVM compatibility, and vibrant developer support. However, you should assess your options. There are other layer-2s like Optimism, zkRollups, and sidechains like Polygon. Each has trade-offs in performance, security, and ecosystem support.

Use an Arbitrum-compatible explorer, such as Arbiscan. Paste your wallet address there to see token balances, transaction history, and contract interactions tied to the Arbitrum network.

The Arbitrum network token opens the door to a faster, more affordable Ethereum experience. By bridging your assets to Arbitrum, you can access the same dApps you know and trust, but with lower gas fees and snappier confirmations. Whether you are into yield farming, NFT trading, on-chain gaming, or everyday DeFi, Arbitrum provides an efficient environment where you can explore new strategies without the typical Ethereum bottlenecks.

As you get started, remember to set up your Arbitrum wallet properly, whether through MetaMask or another option. Take time to choose a reliable bridging method, and if you want to move tokens from other chains, try platforms like baltex.io for cross-chain swaps. Throughout your journey, keep your security practices sharp by verifying contract addresses, bookmarking official sites, and maintaining a safe hardware or software wallet environment.

By understanding the basics of how Arbitrum works—and by following best practices for bridging, liquidity management, and token transfers—you will be well on your way to enjoying the benefits of faster transactions, lower fees, and robust Ethereum-based security. May your fees remain low and your trades execute quickly as you embrace the power of Arbitrum!