DEX aggregators collect liquidity and prices from multiple decentralized exchanges (DEXs) to give traders better rates, reduced slippage, and broader token access. They automate routing that traders would otherwise do manually across dozens of platforms. Baltex.io builds on this idea with a hybrid CEX+DEX model, offering users both speed and deep liquidity plus the non-custodial control of DeFi, turning cross-chain swaps into a simpler process.

The growth of decentralized finance has created a paradox: thousands of opportunities for traders but also overwhelming complexity. Ethereum alone hosts dozens of DEXs, while other blockchains such as BNB Chain, Polygon, and Solana add hundreds more. For a trader, comparing prices across these platforms is time-consuming, costly, and often frustrating.

This is why DEX aggregators have become an essential layer of the DeFi infrastructure. Instead of manually checking multiple DEXs, an aggregator algorithmically searches, compares, and executes trades at the best rate. For 2025’s increasingly multi-chain world, they are no longer a niche tool but a necessity.

At the same time, Baltex.io introduces an evolution: a hybrid exchange that merges the core principles of aggregation with centralized depth of liquidity and decentralized flexibility. To understand why this matters, we need to dig into what DEX aggregators do, how they work, their benefits and risks, and why a next-generation platform like Baltex may offer a smarter solution.

A DEX aggregator is a platform that connects to multiple decentralized exchanges and automatically finds the most efficient way to execute your order. Instead of trading directly on one DEX, you trade through the aggregator’s smart contract, which may split or reroute your order to minimize slippage and maximize output.

This aggregation model grew popular because liquidity in DeFi is fragmented. Uniswap might have strong ETH/USDT liquidity, but Curve is better for stablecoin swaps, while SushiSwap supports different pairs. An aggregator ensures you don’t miss out on better execution simply because you chose the wrong venue.

DEX aggregators use smart routing algorithms. When you submit an order:

Many aggregators also factor in gas optimization, prioritizing routes that minimize transaction costs. In networks like Ethereum, where gas fees can spike, this optimization alone can save traders significant money.

The multi-chain reality makes manual trading impractical. With assets spread across Ethereum, BNB Chain, Polygon, Avalanche, Solana, and new Layer-2s, liquidity is scattered. Traders face worse execution if they stick to one DEX, missed opportunities for pairs available elsewhere, and wasted time checking platforms manually. Aggregators solve all three problems at once. For professional traders, they are the DeFi equivalent of Bloomberg terminals—central hubs that consolidate fragmented liquidity.

Key characteristics include:

Top aggregators compete not only on liquidity depth but also on algorithm sophistication.

Single-chain aggregators focus on optimizing trades within one blockchain, such as Ethereum. Multi-chain aggregators integrate bridges to support swaps across different blockchains. Hybrid aggregators combine centralized liquidity access with decentralized execution, which is closest to Baltex.io’s approach.

Even though aggregators improve efficiency, risks remain. Smart contract vulnerabilities are always present, as flaws in routing code can expose funds. Multi-chain aggregators depend on bridges, and bridges have historically been among the biggest targets in DeFi hacks. Thinly traded tokens can also create liquidity traps, showing attractive prices that cannot be executed in full. Some aggregators rely on centralized oracles, introducing hidden single points of failure. Traders must still exercise diligence even when using these tools.

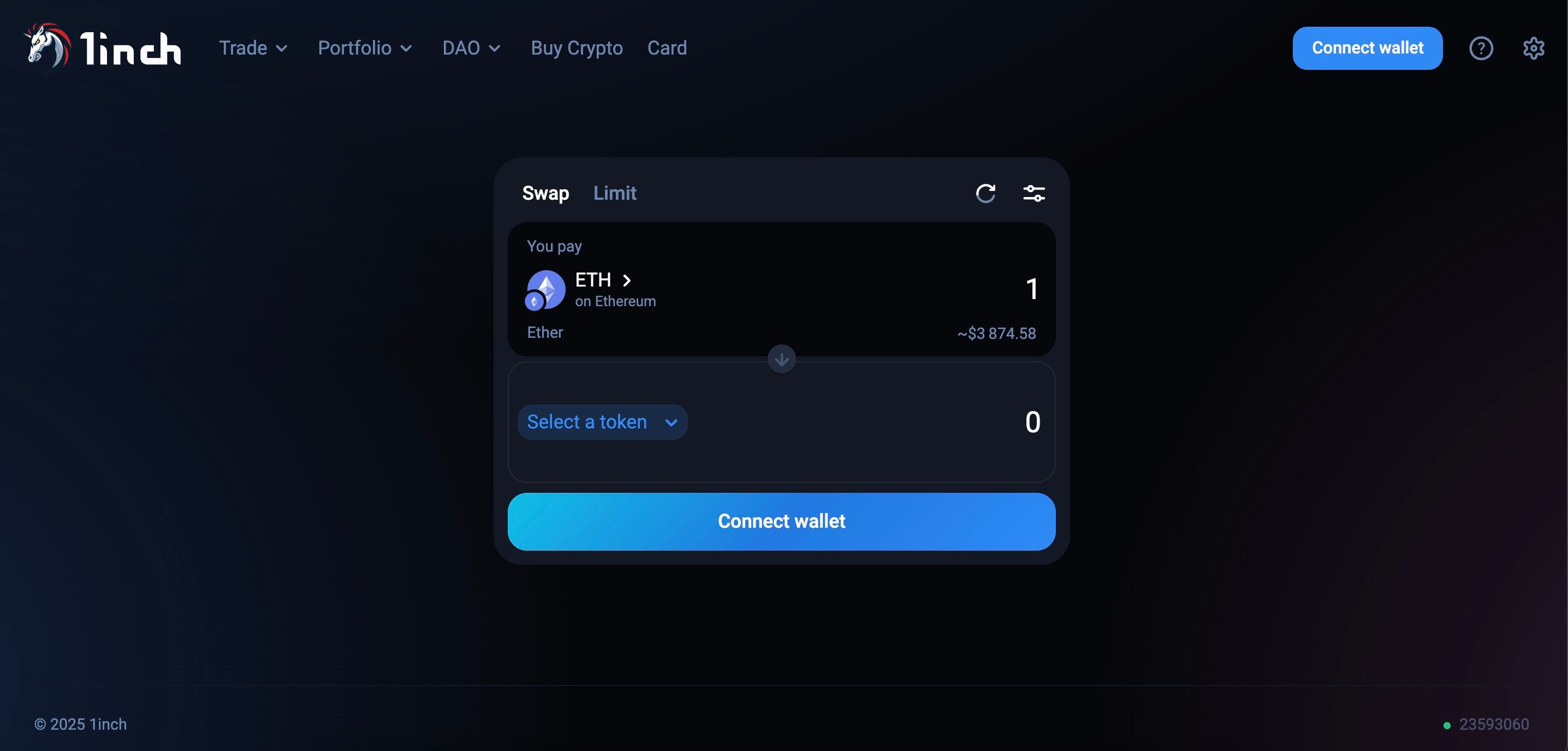

1inch remains the leader in Ethereum and multi-chain swaps. Matcha, built on 0x, is known for simplicity and retail adoption. ParaSwap caters to advanced and institutional traders. OpenOcean emphasizes cross-chain support, while KyberSwap combines liquidity pools with aggregation. Each has strengths but all remain bounded by the constraints of DeFi: fragmented bridges, complex interfaces, and occasional security gaps.

The concept of liquidity aggregation emerged around 2019 when DeFi volumes started to grow but liquidity was highly fragmented. Early platforms like 1inch proved the model: by splitting trades across multiple pools, they could give traders consistently better execution. By 2021 and 2022, as DeFi summer exploded, aggregators became indispensable.

By 2025, aggregators are no longer experimental tools. Entire DeFi protocols integrate aggregator APIs, wallets embed aggregator routing natively, and institutional desks rely on them to minimize cost and save time. They have become part of the invisible infrastructure of crypto markets.

Retail traders avoid the hassle of checking multiple platforms. Whales reduce slippage on multi-million dollar trades. Arbitrageurs exploit price differences faster with aggregator APIs. DAOs and treasuries manage diversified swaps with reduced overhead. Aggregators act as financial routers for the decentralized economy, similar to payment processors in traditional finance.

As aggregators grow, regulators are paying attention. Non-custodial models create a gray area: traders keep custody, but regulators may still demand safeguards. Cross-chain swaps often involve multiple jurisdictions, raising compliance questions. Stablecoin routing draws scrutiny from central banks and financial watchdogs.

Hybrid platforms like Baltex.io are better positioned here. With compliance-ready features, they can meet institutional requirements while still providing the flexibility of DeFi.

Baltex.io goes beyond traditional DEX aggregators by merging centralized and decentralized exchange layers into a unified platform.

In practice, Baltex functions as “DEX aggregator plus.” It offers all the advantages of liquidity optimization but solves weaknesses that pure DeFi aggregators struggle with.

Versus 1inch, Baltex offers deeper liquidity by unifying CEX and DEX pools, while 1inch remains limited to DeFi liquidity. Compared to Matcha, Baltex combines retail-friendly simplicity with institutional-grade features. ParaSwap caters to professionals but depends on bridges, whereas Baltex differentiates with its bridge-light model and private execution options.

Imagine a trader holding USDT on Polygon who wants to buy SOL on Solana. With a normal aggregator they would approve tokens, connect bridges, and wait through multiple transactions, facing risk and delays. With Baltex.io, one unified interface handles the swap in a few clicks. Assets arrive without juggling bridges or multiple wallets. This reduction in time-to-execution is why Baltex is positioned as more than just another aggregator. It is a next-generation liquidity hub.

Use a DEX aggregator if you are a DeFi purist who prefers on-chain only and accepts higher complexity. Use Baltex.io if you want the efficiency of an aggregator, the liquidity of a CEX, the safety of reduced bridge reliance, and the ease of a single interface.

Expect more AI-driven routing that adapts to real-time liquidity shifts. Insurance features against smart contract hacks will likely appear. Security frameworks to prevent bridge exploits will standardize. Aggregators will integrate with hybrid platforms like Baltex to unify centralized and decentralized worlds.

The end goal is a seamless, user-friendly, multi-chain trading environment.

DEX aggregators are no longer optional in DeFi. They are the backbone of efficient trading, but they remain imperfect. Bridge reliance, fragmented user experience, and security risks prevent full mainstream adoption.

Baltex.io takes the aggregator model further. By merging centralized liquidity with decentralized control, removing dependence on vulnerable bridges, and offering features like Private Mode and institutional APIs, it demonstrates the next stage of crypto trading.

For retail traders, Baltex simplifies cross-chain swaps into a clean experience. For institutions, it offers compliance, integration, and deep liquidity. For the ecosystem, it connects the fragmented worlds of CEXs and DEXs.

What is the main advantage of a DEX aggregator? It gives you the best execution by routing trades across multiple DEXs automatically.

Can I trust DEX aggregators with large trades? Yes, but risks remain. Smart contract audits and liquidity depth matter. Large trades may still need hybrid solutions like Baltex.io.

How is Baltex.io different from 1inch or Matcha? Baltex integrates centralized liquidity pools and offers cross-chain swaps without relying heavily on external bridges, combining speed and security.

Do DEX aggregators lower fees? They reduce slippage but not necessarily gas fees. Some include gas-optimized routing.

Will aggregators replace centralized exchanges? Unlikely. Instead, hybrid solutions like Baltex.io show the future is in merging CEX and DEX strengths.

Are cross-chain swaps safe? They carry risks, especially through third-party bridges. Baltex mitigates this by reducing bridge reliance.

What makes Baltex.io useful for beginners? Simplified interface, fewer steps, and hybrid execution without needing to manage multiple wallets or bridges.