Selling Ethereum (ETH) in 2025 is straightforward if you prioritize security, low fees, and speed. Here's a snapshot of the best methods for beginners and intermediates:

Always enable 2FA, use hardware wallets, and check tax implications. Start small to test. Full details below.

Ethereum, the backbone of DeFi and NFTs, has evolved dramatically by 2025. With the Fusaka upgrade slashing Layer-2 fees and boosting throughput to 8x, ETH transactions are cheaper and faster than ever—gas fees often dip below $1 during off-peak hours. Yet, as an ETH holder, cashing out isn't just about hitting "sell." Market volatility can wipe out gains in minutes, while hacks on bridges or exchanges cost billions annually. For beginners juggling daily jobs and intermediates optimizing yields, the goal is simple: convert ETH to fiat (USD, EUR, etc.) quickly, safely, and with minimal fees.

This guide breaks down proven methods tailored for 2025's landscape. We'll cover centralized exchanges for ease, P2P for privacy, DEX swaps for decentralization, and off-ramps for speed. Expect step-by-step instructions, real-world examples, fee breakdowns, limits, and risks. Plus, a spotlight on how Baltex.io streamlines multi-chain conversions to supercharge your process.

Whether you're locking in profits from a DeFi yield farm or diversifying amid regulatory shifts, read on to sell ETH like a pro.

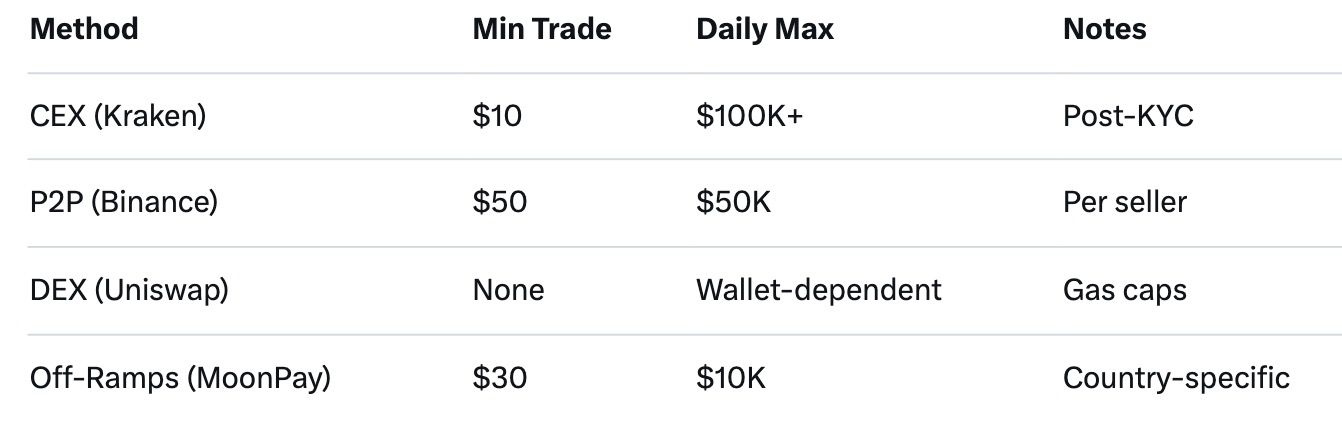

Centralized exchanges (CEXs) remain the go-to for most ETH sellers in 2025, offering seamless fiat withdrawals via bank transfers or cards. Platforms like Kraken and Binance handle billions in daily volume, ensuring liquidity even during dips. They're ideal for beginners due to user-friendly apps and 24/7 support, but require KYC (ID verification) for compliance.

Risks: Phishing via fake apps; use official downloads. Regulatory freezes in high-risk regions (e.g., post-2025 EU MiCA rules).

Kraken shines for low-fee SEPA/EU transfers (€1) and U.S. ACH ($0.25). Example: Sell 1 ETH (~$3,100 as of Dec 2025) for $3,080 net.

Example: Alice, a beginner in the U.S., sells 2 ETH ($6,200) during a rally. Post-fees ($10 total), she nets $6,190 via ACH—enough for a down payment, safely tucked in her bank.

For global users, Binance offers 0% spot fees with BNB holdings. See P2P for fee-free alternatives.

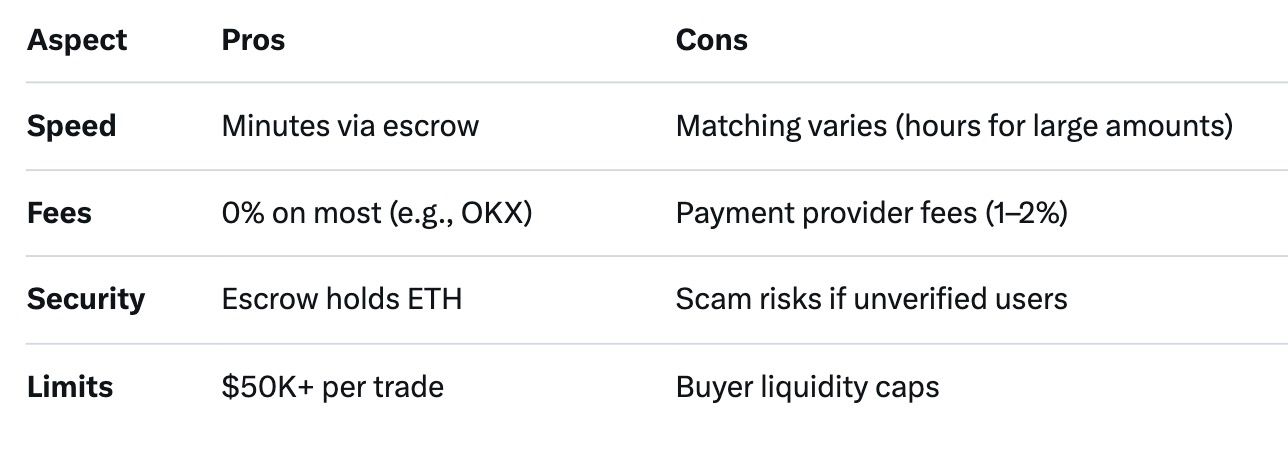

Peer-to-peer (P2P) platforms connect you directly with buyers, skipping exchange custody. In 2025, Binance P2P and OKX dominate with 900+ payment methods (bank, PayPal, cash). Perfect for intermediates avoiding KYC on small trades or negotiating rates.

Risks: Fake payments; stick to rated sellers (95%+ completion). No fiat insurance—use reversible methods like bank transfers.

Example: Sell 0.5 ETH (~$1,550) for USD via PayPal, netting full amount fee-free.

Example: Bob, an intermediate trader in Europe, sells 1 ETH via SEPA on OKX P2P. Zero fees, matched in 10 mins, receives €2,900 instantly—better than CEX spreads.

P2P excels in emerging markets; try LocalCoinSwap for non-KYC cash meets. Explore DEX for on-chain privacy.

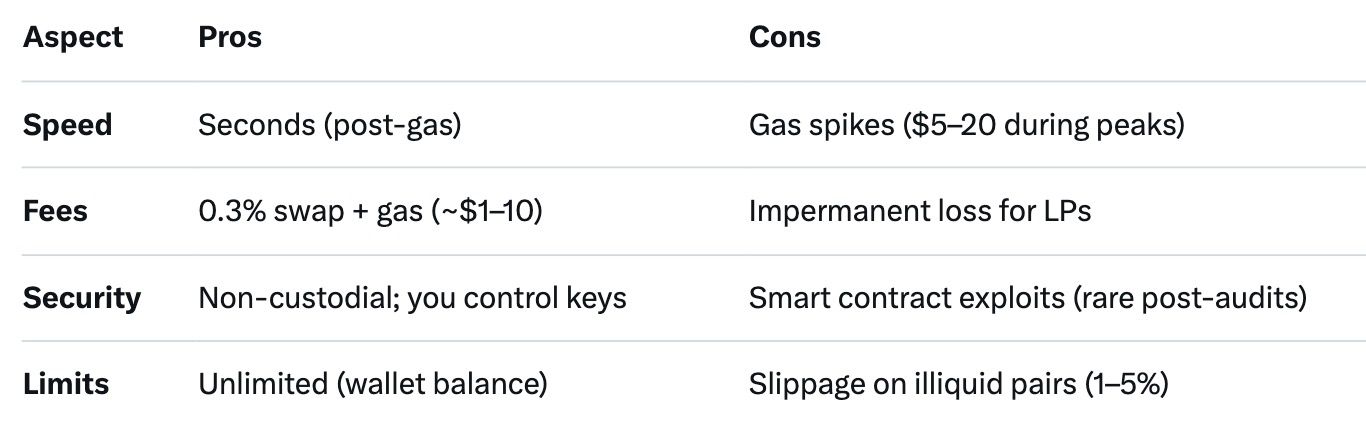

Decentralized exchanges (DEXs) let you swap ETH for stablecoins like USDC without KYC, using wallets like MetaMask. In 2025, Uniswap v4 and 1inch aggregators dominate, routing through 400+ liquidity pools for optimal rates. Great for intermediates bridging to off-ramps.

Risks: MEV bots front-running trades; use 1inch's protection. Verify contracts to avoid rug pulls.

Swap 1 ETH for USDC (~$3,100), then off-ramp. Fees: 0.3% + $2 gas.

Example: Clara swaps 2 ETH to USDT on 1inch during low gas (UTC 2 AM). Nets $6,190 after 0.3% fee—swaps to fiat via MoonPay next. Link to Off-Ramps.

For cross-chain, aggregators like OKX DEX shine. Discover Baltex.io for advanced swaps.

Off-ramps convert ETH directly to bank/card without full exchanges. MoonPay and BitPay lead in 2025, supporting 80+ countries with card payouts. Suited for quick cash-outs post-DEX swaps.

Risks: Chargebacks; use ACH/SEPA. Volatility—lock rates pre-swap.

Sell 0.5 ETH (~$1,550) to Visa card. Fee: 4.5% ($70).

Example: Dave off-ramps 1 ETH via BitPay to PayPal. Instant $3,100 (1% fee)—buys groceries same day.

Integrate with DEX for lower costs.

In 2025's fragmented blockchain world, swapping ETH across chains before cashing out can slash fees by 70%—e.g., route to low-gas Solana for USDC, then off-ramp. Enter Baltex.io, a privacy-first multi-chain swap hub aggregating 200+ networks (Ethereum, BNB, Polygon, Avalanche) and 10K+ assets. It's non-custodial, zero-commission, and audited by PeckShield, making it a seamless bridge for ETH sellers.

Example: Swap 1 ETH to BTC (for P2P liquidity), net $3,100 equivalent.

Example: Eva, an intermediate holder, swaps 2 ETH to USDT via Baltex.io (Ethereum to Solana). Saves $15 gas, then P2P sells for $6,190 fee-free. "It's my one-stop for cross-chain without the hassle," she says.

Baltex.io isn't just a tool—it's the hub enabling hybrid strategies: DEX privacy + CEX liquidity. Back to Top

DEX swaps (e.g., Uniswap) + MoonPay off-ramp: Under 5 minutes for card payouts.

Yes—P2P on OKX/Binance (0%) or Baltex.io swaps (0% commission).

CEX/off-ramps: Yes for fiat >$1K. DEX/P2P: Often no for small trades.

$10K–$100K on most platforms post-verification; unlimited on DEX.

Yes—report gains. U.S.: Short-term 10–37%; long-term 0–20%. Use tools like TurboTax Crypto.

Selling ETH in 2025 empowers you to turn digital assets into real-world value—whether funding a vacation or hedging against bears. By blending CEX reliability, P2P flexibility, DEX autonomy, and off-ramp speed, you minimize fees (under 1% total) and risks. Tools like Baltex.io elevate this, offering multi-chain magic for seamless conversions.

Remember: DYOR, start small, and secure your keys. Ethereum's future is bright—cash out wisely to fuel your next move. Questions?