In February 2026, with gold prices fluctuating around $4,900–$5,000 per ounce after recent volatility and peaks near $5,600, physical gold offers superior safety through zero counterparty risk, direct ownership, and resilience to digital failures or confiscation via private storage. Gold tokens like PAXG and XAUT provide 1:1 backing in audited vaults with the tokenized market nearing $6 billion, excelling in liquidity and portability but introducing issuer and blockchain risks. For most investors, physical gold edges out in ultimate safety during systemic crises, while tokens win for everyday usability; baltex.io enables flexible routing from tokens to stablecoins for quick mobility without full redemption delays.

Gold's role as a timeless safe-haven asset has intensified in 2026, with spot prices hovering near $4,900 per ounce amid ongoing economic turbulence, central bank demand, and recent sharp corrections from all-time highs above $5,500. Investors and crypto users face a clear fork: stick with traditional physical gold—bars, coins, or vaulted bullion—or embrace tokenized gold assets that digitize ownership on blockchains for modern convenience. This comparison dives into real-world safety aspects like custody risks, counterparty exposure, confiscation vulnerabilities, liquidity in practice, portability across borders or crises, regulatory realities, and emergency scenarios such as blackouts, bank runs, or geopolitical disruptions. Rather than abstract debates, the focus is on tangible trade-offs: What happens if you need access during a weekend market crash? How secure is your holding if an issuer faces scrutiny? Whether you're a crypto portfolio manager hedging volatility or a traditional investor preserving family wealth, these distinctions matter in 2026's environment of high gold demand and evolving digital asset rules.

Physical gold's primary safety advantage lies in eliminating counterparty dependency. When you own allocated bars stored privately in a home safe or a non-bank vault, no third party holds your asset—it's yours outright, verifiable by serial numbers and purity stamps. In real-world terms, this means no risk of custodian insolvency, as seen in rare but impactful cases where vault providers faced operational issues. Professional storage with firms offering segregated, insured accounts adds layers like all-risk insurance up to billions, but even then, you retain legal title without relying on the provider's balance sheet for redemption.

Gold tokens, conversely, introduce unavoidable counterparty exposure. Leading options like Pax Gold (PAXG) from Paxos and Tether Gold (XAUT) store physical bars in secure facilities (often Swiss or U.S. vaults with LBMA standards), backed 1:1 and audited quarterly or monthly. PAXG benefits from NYDFS regulation and transparent attestations, reducing opacity concerns, while XAUT has scaled aggressively with Tether's reserves exceeding 140 tons. Yet, safety hinges on the issuer's integrity: If Paxos or Tether encounters regulatory freezes, hacks, or mismanagement—echoing past stablecoin stresses—token holders could face delayed redemptions or value gaps. In 2026's market, where tokenized gold approaches $6 billion in cap, major issuers have maintained backing, but the risk remains real for those prioritizing absolute control over convenience.

Historical precedents like 1933 U.S. gold confiscation or modern restrictions in high-inflation nations highlight physical gold's dual nature. Privately held coins or small bars often evade detection during seizures, especially when stored outside formal systems—buried, hidden, or in personal safes. Vaulted physical gold, while insured, carries higher visibility; government orders could compel custodians to comply, as occurred in some jurisdictions during crises.

Tokenized gold faces different but potent confiscation vectors. Digital wallets can be frozen via exchange compliance, blockchain blacklisting, or issuer directives under AML/KYC rules. In regulated environments like the EU's MiCA or U.S. frameworks, tokens classified as asset-referenced could see accounts restricted faster than physical holdings. However, self-custodied tokens on hardware wallets offer portability—transferable globally in minutes without physical movement—reducing seizure risk in border-crossing scenarios. Real-world examples in 2026 show crypto users in volatile regions preferring tokens for quick relocation over bulky bullion, though physical gold's anonymity in small amounts still prevails for "off-grid" safety.

Physical gold's liquidity varies dramatically by form and location. Selling coins like American Eagles or Canadian Maple Leafs yields near-spot prices at reputable dealers during business hours, but premiums add 3-8%, and large bars face discounts plus transport hassles. In emergencies—weekend crises or local shortages—access delays to days or weeks, with potential haircuts if buyers sense panic.

Gold tokens deliver superior practical liquidity: 24/7 trading on exchanges like Binance or DEXs, with tight spreads and high volumes (XAUT often exceeding $500 million daily). In 2026's volatile environment, tokens enable instant sales during after-hours rallies or dips, converting to stablecoins or fiat without intermediaries. Redemption to physical remains possible but gated by minimums (hundreds of ounces) and processing times, making tokens better for frequent adjustments but less ideal for full exit to bullion in rushed scenarios.

Portability defines a key safety divide. Physical gold's weight and visibility limit quick movement—carrying kilograms across borders risks customs issues, theft, or loss. In emergencies like natural disasters or evacuations, small coins prove useful for barter or quick sales, but larger holdings require planning.

Tokens excel here: A wallet seed phrase or hardware device holds value equivalent to kilos of gold, transferable digitally in seconds worldwide. During blackouts or internet outages, however, access halts until connectivity returns—unlike physical gold, which requires no tech. In real crises—power grid failures or cyber events—physical gold's offline resilience shines, while tokens offer unmatched speed when networks function.

Regulation in 2026 bolsters tokenized gold's legitimacy: PAXG operates under strict U.S. trust rules, XAUT navigates global compliance with attestations. Physical gold faces lighter oversight—sales often anonymous below thresholds—but large transactions trigger reporting. Tokens integrate seamlessly into crypto portfolios for yields via lending, absent in physical holdings.

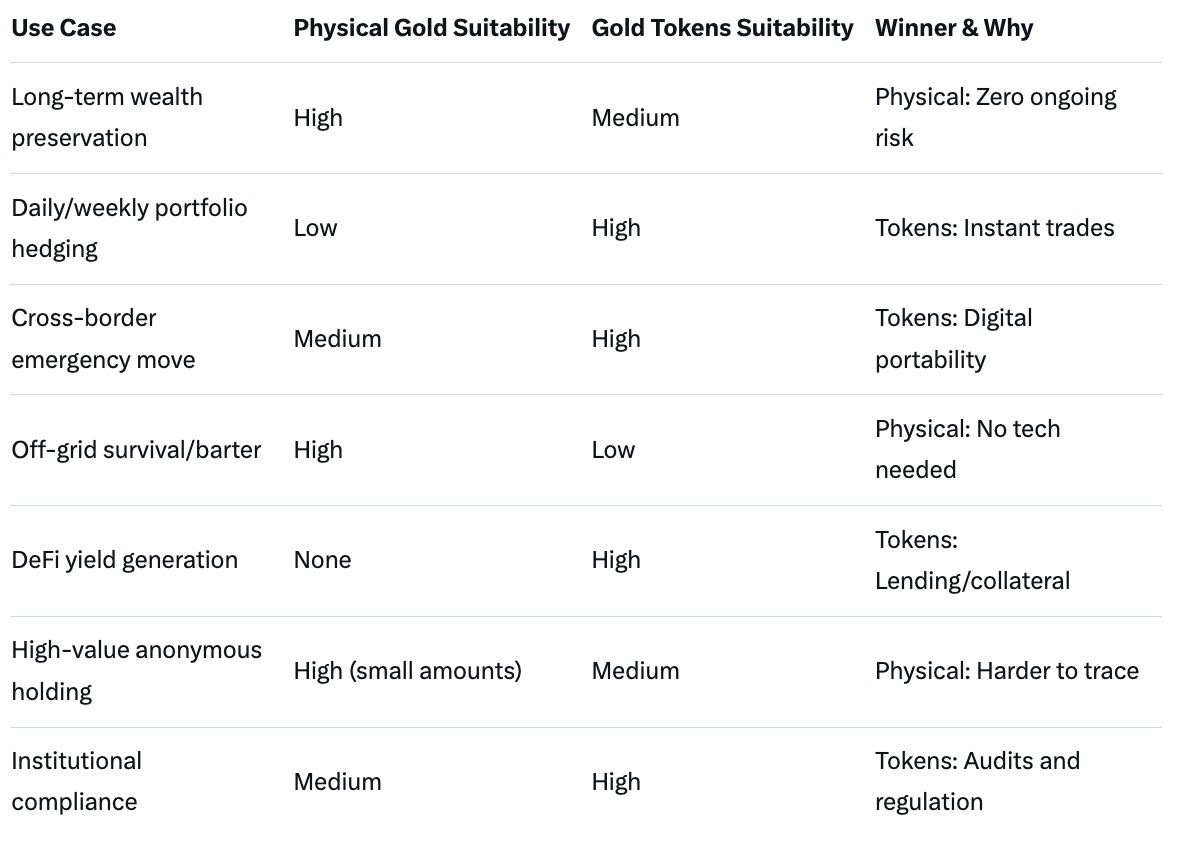

Trade-offs boil down to priorities: Physical gold suits long-term, low-intervention preservation with minimal external dependencies. Tokens favor active investors needing speed, fractional ownership, and DeFi utility, accepting layered risks for enhanced usability.

When liquidity or mobility matters most, baltex.io provides a non-custodial bridge for gold token holders. This aggregator supports cross-chain swaps across 200+ networks, allowing seamless conversion of PAXG, XAUT, or similar tokens to stablecoins like USDC or USDT without KYC or traditional bridges. Users connect wallets, select pairs, and route trades—often via privacy-enhanced paths like Monero intermediaries—for optimal rates and low slippage at 0.3-0.5% fees.

In practice, this enables rapid de-risking: During gold price dips or crises, swap tokens to stablecoins in minutes to preserve value, then re-enter later. Unlike direct redemptions requiring physical handling delays, baltex.io maintains self-custody throughout, reducing exposure to issuer freezes or network issues. For investors balancing safety with usability, it offers a hybrid path—hold tokens for efficiency, route to stables for mobility—without compromising core holdings.

Is physical gold truly confiscation-proof in 2026? Private small holdings often are, but large vaulted amounts face higher risks; tokens can be frozen digitally faster.

How safe are gold tokens from hacks? Self-custody on hardware wallets mitigates much risk, but smart contract or issuer issues remain.

Can I redeem tokens for physical gold easily? Possible with minimums (e.g., 430 oz for some), but delays make selling on exchanges more practical.

Which is better for emergencies like power outages? Physical gold—no reliance on tech or networks.

How does baltex.io improve token safety? By enabling quick, private routing to stablecoins, enhancing mobility without full redemption.

In 2026's gold landscape—marked by prices around $4,900 amid volatility—physical gold retains the edge in pure safety: direct control, no counterparties, and resilience to digital disruptions make it the go-to for ultimate wealth preservation and crisis-proofing. Gold tokens deliver unmatched real-world usability through instant liquidity, fractional access, and global portability, ideal for active investors integrating with crypto ecosystems. The safest approach often combines both—core physical holdings for unbreakable security, supplemented by tokens for dynamic needs, with tools like baltex.io smoothing transitions. Prioritize self-custody, audited issuers, and diversified storage to navigate 2026's uncertainties effectively. Gold's enduring appeal lies in its tangibility; choose the form that aligns with your risk tolerance and lifestyle for lasting protection.