A complete beginner-to-enterprise guide (updated December 2025)

Welcome to the most in-depth, SEO-optimized guide on Hedera Hashgraph in 2025. Whether you’re a crypto newcomer, a developer looking for scalable infrastructure, or an investor researching the next 10× opportunity, this article explains everything: the unique hashgraph technology, lightning-fast consensus, enterprise governance, real-world use cases, fee structure, and why giants like Google and IBM continue to run nodes and build on Hedera.

Let’s dive in.

Ready for the full picture? Keep reading.

Hedera is a public distributed ledger, but it is not a blockchain. Instead of chaining blocks in a single line (which creates bottlenecks), Hedera uses a Directed Acyclic Graph (DAG) called hashgraph.

Think of it this way: Blockchain = single-lane highway Hashgraph = unlimited-lane superhighway where every car can drive in parallel

This fundamental difference delivers:

→ Continue reading: How the Hashgraph Consensus Actually Works

The magic is in two patented algorithms:

Gossip about Gossip Nodes randomly phone other nodes and say: “Here are all the transactions I know about, and here’s what I heard from everyone else.” Information spreads exponentially in seconds.

Virtual Voting Every node already knows what every other honest node would vote because they all saw the same gossip history → no actual messages needed → consensus in ~3 seconds with mathematical certainty.

Result = asynchronous Byzantine Fault Tolerance (aBFT) – the gold standard that even traditional finance trusts.

→ Related: Why aBFT matters more than 2025 than ever

As of December 2025, the council has 39 world-class organizations (up from 33 in mid-2025), each running a permissioned node for up to 2 consecutive 3-year terms.

Notable members: Google · IBM · Boeing · Dell Technologies · Deutsche Telekom · Standard Bank · EDF · LG · Tata Communications · Ubisoft · ServiceNow · Chainlink Labs · NVIDIA (joined Q4 2025)

Why this matters:

→ Deep dive: Full 2025 council list and rotation schedule on baltex.io/blog

Google (since 2020)

IBM (since 2019)

Both companies repeatedly say the same thing: they need a network that is fast, cheap, provably secure, and regulator-friendly. Hedera checks every box.

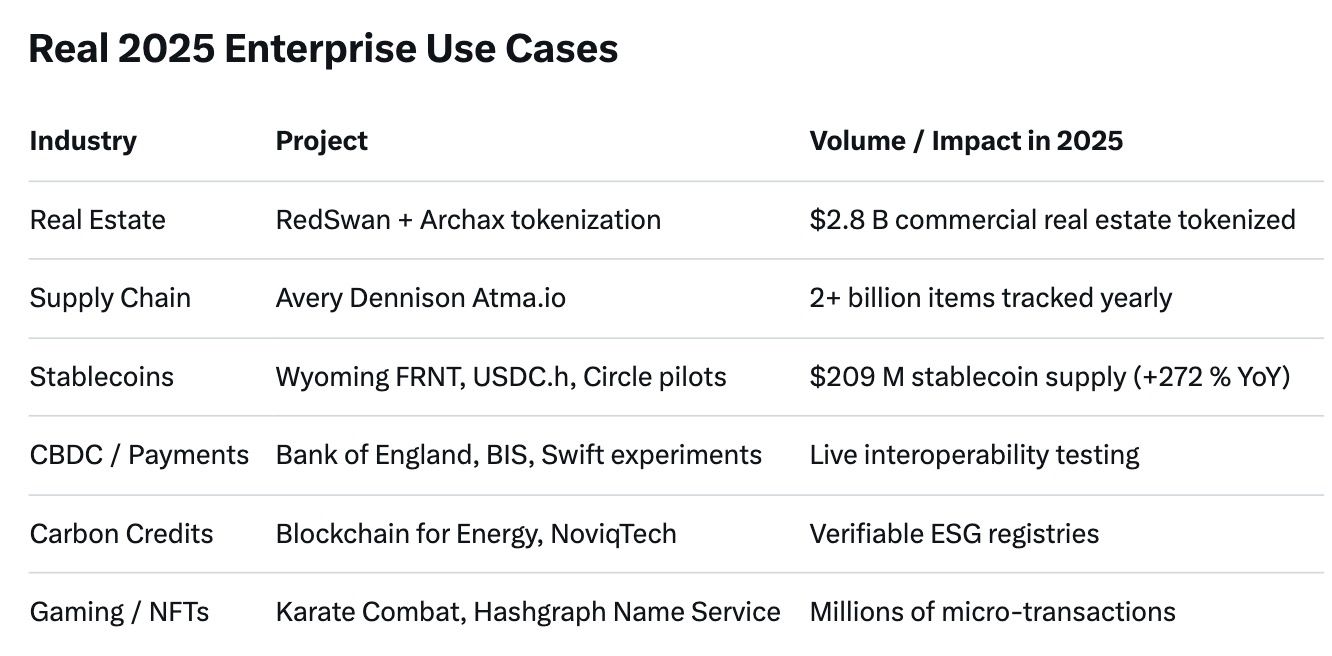

These aren’t whitepaper dreams — they are live, revenue-generating applications.

All fees are fixed in USD and auto-converted to HBAR — no gas wars, perfect for enterprises.

Top dApps: SaucerSwap, Stader, HeadStarter, HeliSwap, Zuse Market

→ Full quarterly report summary on baltex.io/blog

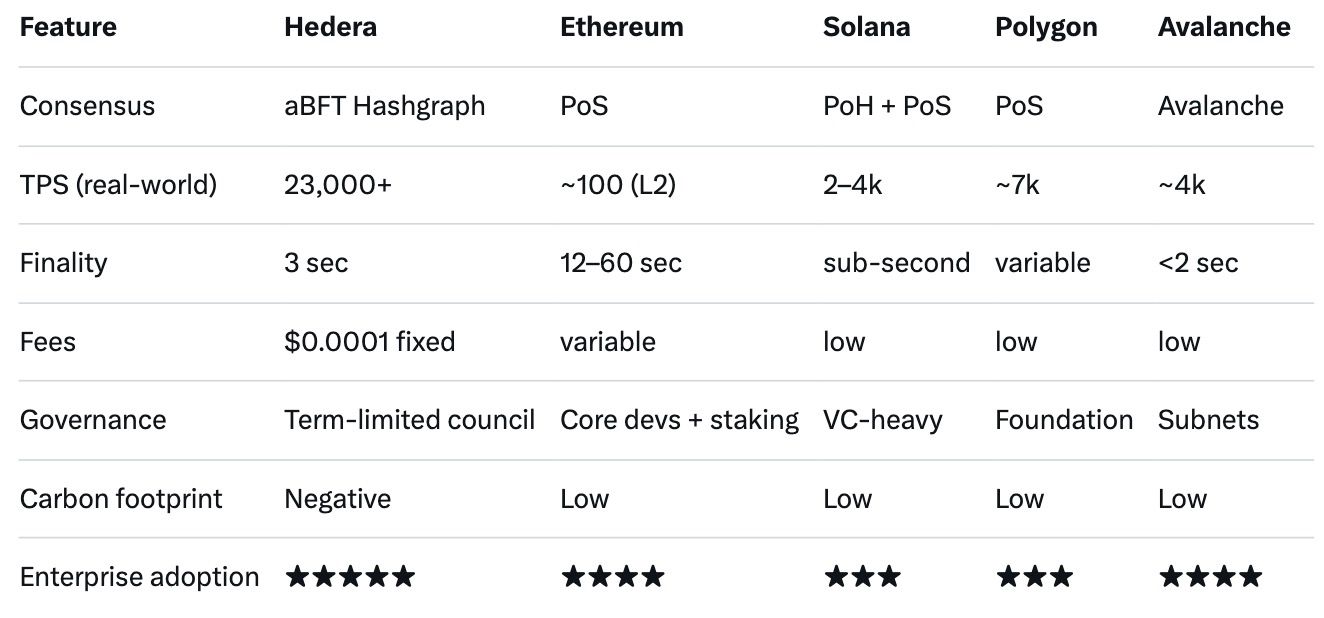

Hedera wins when predictable cost, finality, and regulatory trust are non-negotiable.

Q: Is Hedera really decentralized? A: Yes — 39 independent organizations run the initial nodes, with community nodes and permissionless nodes coming online in 2026–2027.

Q: Where can I swap HBAR easily? A: baltex.io offers the deepest HBAR liquidity pools, instant swaps, and cross-chain bridges with almost zero slippage.

Q: Can I stake HBAR for passive income? A: Absolutely — average APY 3–6 % via native staking in HashPack, Blade, or Stader.

Q: Will HBAR hit $1 in 2025–2026? A: Most conservative analyst targets for end-2025 are $0.18–$0.35, with several banks forecasting $0.50–$1 by 2027 if tokenization volume continues growing.

Q: Is Hedera still carbon-negative? A: Yes — independently certified by Verra, using less energy per transaction than sending an email.

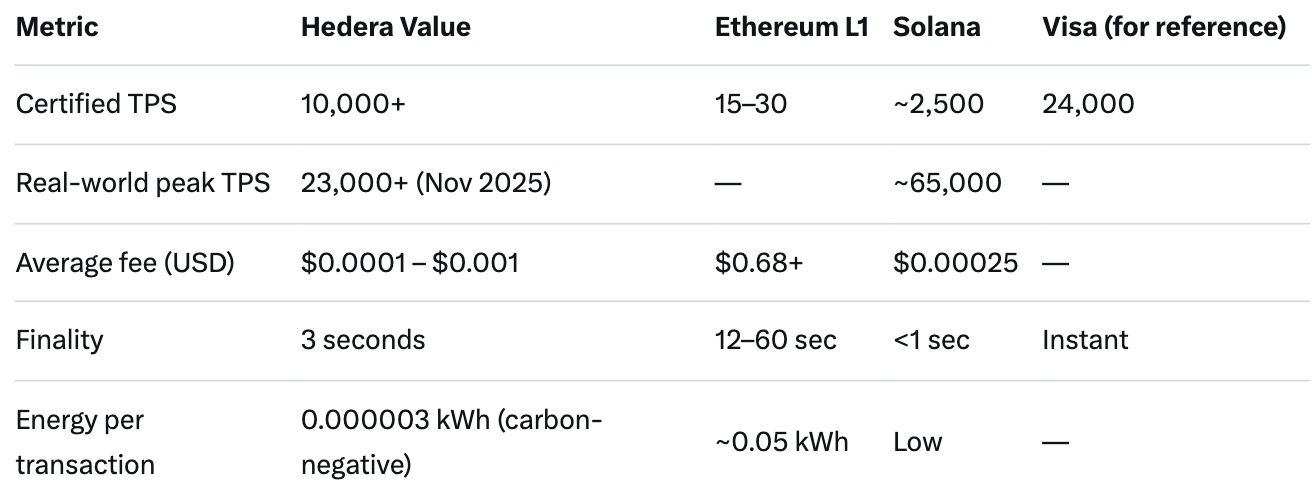

While meme coins come and go, Hedera quietly became the infrastructure layer that Fortune 500 companies and governments actually use. With unbreakable aBFT security, micro-cent fees, 10,000+ TPS, and a governance model that regulators love, HBAR is positioned to capture massive value from real-world adoption accelerates.

Whether you’re a beginner buying your first $50 of HBAR, a developer building the next killer dApp, or an enterprise evaluating DLT platforms — Hedera deserves a serious look.

Start your journey today: Get a wallet → Stake for rewards → Swap anytime on baltex.io

The hashgraph revolution is just getting started.

All deep-dive articles and quarterly reports available at baltex.io/blog