In 2026, Tether Gold (XAUT) remains a strong buy for crypto investors seeking gold exposure, with a $3.44 billion market cap, tracking spot gold at around $4,832 per token amid gold's surge to $4,968 per ounce. Backed by 712,747 ounces in Swiss vaults, it offers low fees (0.25% on issuance/redemption), high liquidity on exchanges like Binance and Bybit ($619 million 24h volume), and DeFi utility, but faces regulatory risks from the GENIUS Act and Tether's opacity. Compared to PAXG, XAUT excels in volume but lags in U.S. compliance; baltex.io enables efficient, non-custodial swaps to stablecoins like USDT at 0.3-0.5% fees for seamless portfolio management.

As gold prices climb to record highs near $5,000 per ounce in early 2026, driven by geopolitical tensions, inflation fears, and central bank buying, tokenized assets like Tether Gold (XAUT) have surged in popularity. Launched in 2020 by Tether, XAUT represents ownership of one troy ounce of physical gold, blending the stability of the yellow metal with blockchain's efficiency. With a market capitalization exceeding $3.44 billion and accounting for over half of the $6 billion tokenized gold sector, XAUT appeals to crypto investors and gold holders looking for borderless, 24/7 access without the hassles of physical storage. This review examines how XAUT works, its gold backing and custody, redemption rules, fees, liquidity, regulatory risks, and comparisons to alternatives like Pax Gold (PAXG). Focusing on investor trade-offs—such as balancing DeFi yields against counterparty risks—and real-world use cases like hedging crypto volatility or cross-border remittances, we'll assess if XAUT is still worth buying amid 2026's evolving regulatory landscape and gold bull market.

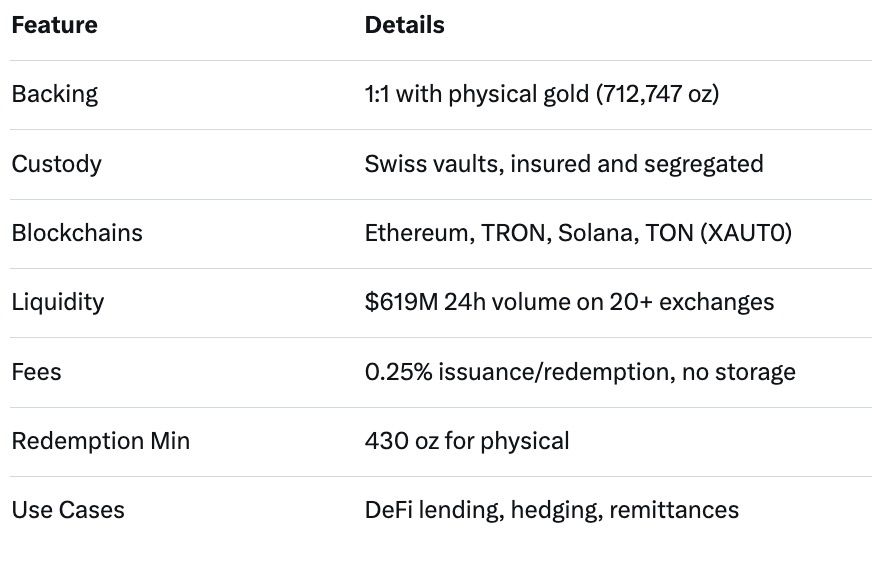

Tether Gold operates as a digital token on multiple blockchains, including Ethereum (ERC-20), TRON (TRC-20), Solana, and TON via its omnichain variant XAUT0, powered by LayerZero's OFT standard. Each XAUT token is pegged 1:1 to one fine troy ounce of physical gold, allowing users to hold, transfer, and trade it like any cryptocurrency. The process begins with Tether issuing tokens upon receiving payment, backed by gold reserves held in secure vaults. Users can buy XAUT on major exchanges, store it in compatible wallets like MetaMask or Trust Wallet, and utilize it in DeFi protocols for lending or collateral. In 2026, with gold's parabolic rise—up over 70% from 2025 lows—XAUT has tracked spot prices closely, trading at approximately $4,832 amid minor premiums or discounts during volatile periods. This mechanism democratizes gold ownership, enabling fractional exposure (down to 0.001 XAUT) without the need for vaults or insurance, making it ideal for crypto natives who want to diversify beyond volatile assets like Bitcoin.

The token's utility extends beyond holding: It integrates with Tether's ecosystem, allowing seamless swaps with USDT, and supports real-world spending via crypto cards or payments in emerging markets through platforms like MiniPay on Opera. For gold-focused holders, XAUT provides a hedge against fiat devaluation, as seen in regions with high inflation where users convert local currencies to XAUT for preservation. However, its reliance on Tether's issuance model introduces centralization, differing from fully decentralized alternatives.

XAUT's backing is its core strength: As of the latest transparency report in December 2025, Tether holds 712,747.09 troy ounces of physical gold, valued at over $3.5 billion at current prices, ensuring 100% reserves. The gold consists of London Good Delivery bars stored in high-security Swiss vaults, managed by TG Commodities, a Tether affiliate. This setup minimizes geopolitical risks compared to U.S.-based storage, appealing to international investors. Quarterly attestations from firms like BDO confirm reserves, though critics note the lack of real-time audits, echoing past Tether controversies over USDT backing.

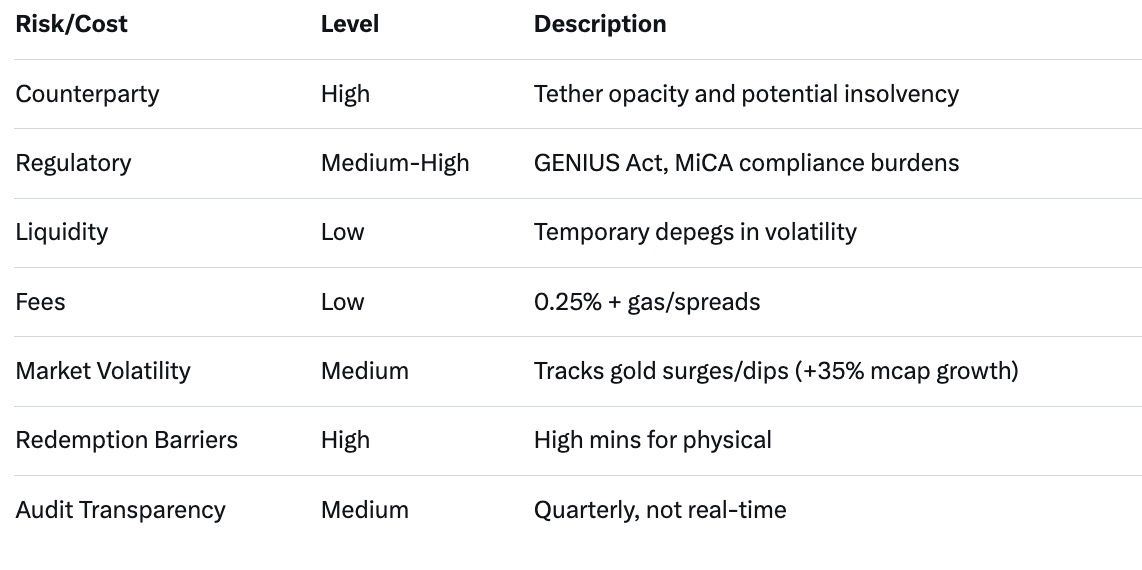

Custody emphasizes security with "James Bond"-style bunkers featuring multi-layered protection, insurance, and segregated allocation—each XAUT claim is tied to specific bars, reducing commingling risks. In 2026, Tether has ramped up purchases, acquiring 27 tons in Q4 2025 and buying 1-2 tons weekly, positioning itself as a "gold central bank" with over 140 tons total reserves. This aggressive accumulation supports XAUT's growth but raises questions about overexposure; if gold prices correct sharply, as they dipped 14% recently from $5,597 highs, it could strain liquidity. For investors, the trade-off is clear: Robust backing offers tangible value, but dependence on Tether's management introduces counterparty risk, especially amid S&P's downgrade of USDT to "weak" due to high-risk assets like gold.

Redeeming XAUT for physical gold or cash is straightforward but geared toward larger holders. Users can request redemption directly from Tether's platform, with a minimum of 430 ounces (about $2.1 million at current prices) for physical delivery, incurring shipping and insurance costs. Smaller amounts can be redeemed for cash equivalents, subject to verification and fees. The process takes 1-5 business days, with Tether reserving the right to suspend during high volatility or regulatory directives.

Fees are competitive: No ongoing storage or custody charges, just a 0.25% fee on issuance and redemption, plus potential premiums for physical handling. Trading on exchanges adds typical spreads (0.1-0.5%), and network gas fees vary by chain—negligible on TRON but higher on Ethereum. Compared to physical gold's 1-2% annual storage, XAUT saves costs for long-term holders, but redemption barriers deter retail users, pushing most to sell on secondary markets. In practice, this suits institutional investors hedging portfolios, while crypto traders prefer liquidity over physical claims.

Liquidity has been XAUT's standout feature in 2026, with 24-hour trading volumes reaching $619 million, dwarfing competitors and enabling tight spreads. It's listed on over 20 major exchanges, including Binance, Bybit, Kraken, OKX, MEXC, and BingX, with pairs against USDT, BTC, and fiat like USD/EUR. The token's multi-chain presence boosts accessibility: TRON for low fees, Ethereum for DeFi, and TON for emerging market integrations like MiniPay, serving millions in Africa and Latin America.

Daily volumes reflect strong demand, especially during gold rallies, but low-liquidity periods can cause temporary depegging—XAUT traded at a 2-4% discount during recent corrections. For gold holders, this means easy entry/exit, far surpassing physical bullion's illiquidity. Trade-offs include exchange risks like hacks or delistings, though XAUT's dominance (60% of tokenized gold) mitigates this. Real-world usability shines in cross-border scenarios, where users transfer XAUT instantly without banks, or stake it on platforms like Aave for 2-4% yields.

Regulatory scrutiny remains XAUT's Achilles' heel. Under the EU's MiCA framework, fully enforced in 2026, XAUT qualifies as an asset-referenced token, requiring stringent reserves and AML compliance, which Tether has addressed via El Salvador licensing. However, the U.S. GENIUS Act prohibits gold as a stablecoin reserve, potentially restricting USDT's backing and indirectly impacting XAUT through brand association. Tether's history of opacity—fines in 2021 and ongoing questions over reserves—amplifies risks; a major action, like SEC classification as a security, could trigger delistings.

Globally, emerging markets embrace XAUT for financial inclusion, but critics highlight smart contract vulnerabilities and issuer centralization. S&P's weak rating on USDT due to gold exposure underscores systemic risks—if Tether faces liquidity crunches, XAUT holders could see frozen redemptions. Investors must weigh this against gold's safe-haven status; in threat models like U.S. debt crises, XAUT provides diversification, but compliance-heady jurisdictions favor regulated alternatives.

XAUT leads the tokenized gold space but faces competition from PAXG, which boasts NYDFS oversight for stronger U.S. appeal, though lower volumes ($500-800 million market cap estimate). Kinesis Gold offers yields from velocity fees, suiting active traders, while traditional gold ETFs like GLD provide SEC-regulated liquidity without blockchain risks. XAUT's advantages: Higher DeFi integration and global reach, but it trades at a premium to spot during bull runs. For crypto investors, XAUT's volatility (tied to gold but amplified by crypto sentiment) offers upside in rallies, unlike ETFs' stability. Trade-offs: PAXG minimizes regulatory risks, but XAUT's liquidity and low fees make it preferable for high-volume users.

Baltex.io serves as a non-custodial aggregator for cross-chain swaps, making it an ideal tool for XAUT holders in 2026. Supporting over 200 networks, it enables seamless routing of XAUT to stablecoins like USDT or USDC without bridges or KYC, aggregating liquidity from DEXs and CEXs for best rates. Users connect wallets, select XAUT pairs (e.g., to USDT on TRON), and execute in minutes, with optional privacy via Monero intermediaries to obscure trails.

Fees range from 0.3-0.5%, competitive against direct exchanges, and no limits suit whales. For gold-focused investors, baltex.io facilitates quick hedges: Swap XAUT to USDT during gold dips to lock profits, or route yields from DeFi staking back to fiat gateways. Compared to on-chain trades, it reduces gas and slippage, minimizing failure risks like network congestion with auto-refunds. In real use cases, it bridges XAUT's gold stability with stablecoin liquidity, enhancing portfolio agility without Tether's direct risks.

What is the current price of XAUT in 2026? Around $4,832, tracking gold at $4,968 per ounce with minor variations.

How secure is XAUT's gold backing? Backed by 712,747 ounces in Swiss vaults with quarterly audits, but relies on Tether's management.

Can I redeem XAUT for physical gold? Yes, minimum 430 ounces, with 0.25% fee plus shipping.

What are the main risks of buying XAUT? Regulatory scrutiny, counterparty from Tether, and potential depegs.

How does baltex.io work with XAUT? Enables low-fee, cross-chain swaps to stablecoins for efficient routing.

Tether Gold (XAUT) in 2026 solidifies its role as a premier tokenized asset, offering unmatched liquidity and utility amid gold's bull run, but persistent regulatory and counterparty risks temper its appeal. For crypto investors hedging volatility or gold holders seeking blockchain efficiency, XAUT's low costs and DeFi integration make it worth buying—especially with projections to $5-10 billion market cap. However, diversify with alternatives like PAXG for compliance safety. Tools like baltex.io amplify its practicality, allowing fluid transitions to stablecoins. As gold eclipses $5,000, XAUT bridges traditional and digital finance, but vigilance on Tether's transparency is key to long-term value.