In 2026, gold-backed cryptos like PAXG and XAUT offer 24/7 trading, DeFi integration, and zero storage fees but carry higher issuer risks and regulatory hurdles under MiCA and GENIUS Act, with fees at 0.1-0.5% and liquidity via CEX/DEX. Traditional gold ETFs such as GLD and IAU provide SEC-regulated stability, high exchange liquidity, and low expense ratios (0.1-0.4%) but limit redemption to cash and expose users to custodian counterparty risks. For efficient swaps, baltex.io enables non-custodial, cross-chain routing of gold-backed assets to stablecoins like USDC at 0.3-0.5% fees, bridging the gap for hybrid portfolios amid gold's $4,500/oz highs.

As gold prices stabilize around $4,500 per ounce in early 2026 following last year's surge, investors are increasingly turning to digitized forms of the precious metal for portfolio diversification amid persistent inflation and geopolitical tensions. Gold-backed cryptocurrencies, tokenized representations of physical gold on blockchains, have matured into a $4-5 billion market, appealing to crypto-savvy users seeking seamless integration with DeFi. Meanwhile, traditional gold exchange-traded funds (ETFs) dominate with over $300 billion in assets under management, offering regulated exposure through stock markets. This guide analyzes the key differences in ownership structure, custody, redemption rights, liquidity, fees, regulation, risks, and use cases, emphasizing practical trade-offs for crypto users, investors, and portfolio managers. Whether hedging against equity volatility or allocating for long-term wealth preservation, understanding these options is crucial in a year where regulatory clarity from acts like GENIUS and Clarity shapes the landscape.

Gold-backed cryptocurrencies digitize ownership of physical gold, with each token representing a specific amount—typically one troy ounce or fraction thereof—backed by audited reserves in secure vaults. Leading examples include Pax Gold (PAXG) from Paxos, pegged to London Good Delivery bars in New York vaults with monthly KPMG audits, and Tether Gold (XAUT), issued by Tether with quarterly BDO attestations and multi-chain support on Ethereum and TRON. In 2026, these assets have gained traction as inflation hedges, with PAXG's market cap hovering at $1.8 billion and XAUT at $2.3 billion, driven by central bank gold accumulation and institutional inflows. They operate on blockchain rails, enabling peer-to-peer transfers without intermediaries, and integrate with DeFi protocols for lending or yield farming.

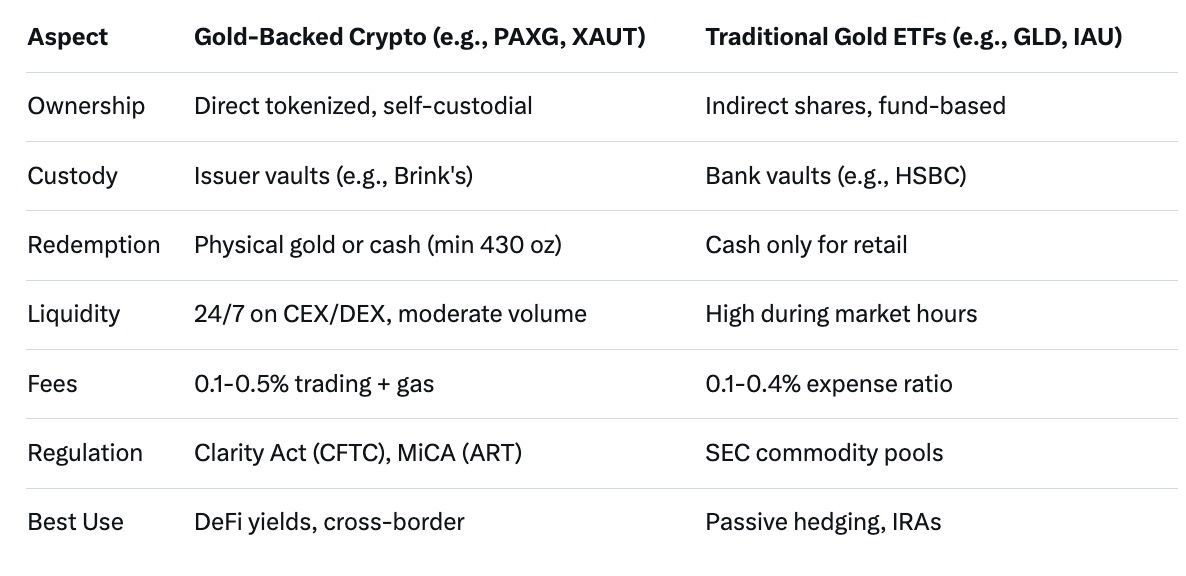

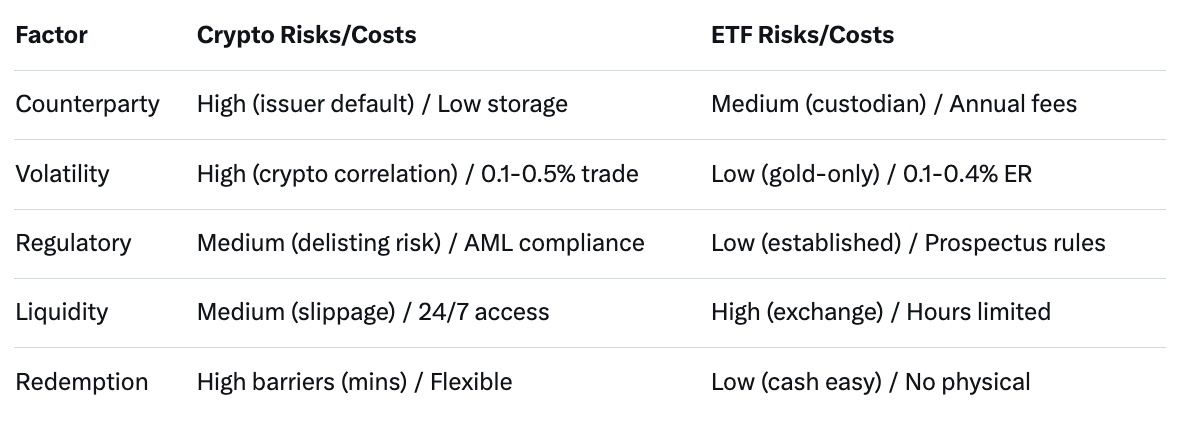

Ownership is pseudonymous and self-custodial via crypto wallets, eliminating third-party storage fees that plague physical gold. However, this introduces smart contract vulnerabilities and network dependencies. Custody relies on the issuer's vaults—Paxos uses Brink's in the U.S., while Tether employs Swiss facilities—ensuring 1:1 backing but exposing users to issuer solvency risks, as highlighted by Tether's past controversies. Redemption rights allow token holders to exchange for physical gold bars (minimums around 430 ounces for both), though most users opt for cash equivalents due to logistics. Liquidity stems from centralized exchanges (CEXs) like Binance and decentralized exchanges (DEXs) like Uniswap, offering 24/7 trading but with potential slippage during low-volume periods.

Fees for trading gold-backed cryptos average 0.1-0.5% on platforms, plus network gas costs under $1 on efficient chains. Regulation treats them as asset-referenced tokens under EU's MiCA, requiring full reserves, AML compliance, and issuer licensing, while U.S. Clarity Act classifies them as digital commodities under CFTC oversight, reducing SEC scrutiny but mandating disclosures. Risks include blockchain hacks, as seen in past DeFi exploits, and counterparty failures if audits falter. Use cases shine in cross-border remittances or DeFi, where users lend PAXG on Aave for 2-5% yields, far surpassing ETF passivity.

Traditional gold ETFs pool investor funds to purchase and store physical gold bullion, tracking its spot price through shares traded on stock exchanges. Top performers include SPDR Gold Shares (GLD) with $159 billion AUM and a 0.40% expense ratio, iShares Gold Trust (IAU) at $50 billion with 0.25%, and cost-efficient minis like SPDR Gold MiniShares (GLDM) at 0.10%. In 2026, these funds have benefited from gold's 70% rally in 2025, attracting $20 billion in net inflows as a hedge against U.S. debt risks and equity volatility. They hold allocated bars in vaults like HSBC in London, with daily audits ensuring transparency.

Ownership is indirect—shareholders claim a pro-rata interest in the fund's gold, not specific bars—making it ideal for IRAs or brokerage accounts without physical handling. Custody is managed by trusted banks, minimizing user involvement but introducing counterparty risk if the custodian defaults, though insurance covers up to $1 billion per fund. Redemption rights are limited: Retail investors typically sell shares for cash, while authorized participants (large institutions) can redeem for physical gold in 400-ounce lots, a barrier for most.

Liquidity excels during NYSE hours, with GLD averaging 10 million shares daily traded, enabling instant execution at tight spreads. Fees are embedded in expense ratios (0.1-0.51%), covering storage and management, with no additional trading commissions on many platforms. Regulation falls under SEC oversight as commodity pools, ensuring prospectuses detail risks and holdings, with no KYC beyond brokerage norms. Key risks involve market closures, tracking errors (minimal at 0.1-0.2% annually), and opportunity costs from no yields. Use cases favor passive allocation in diversified portfolios, where GLD serves as a 5-10% hedge against inflation, outperforming bonds in high-rate environments.

Ownership in gold-backed cryptos grants direct, tokenized claims to vaulted gold via blockchain, allowing self-custody in personal wallets like MetaMask, which empowers users to control private keys and avoid intermediary failures. This structure appeals to crypto users wary of centralized finance, but it demands technical savvy to manage wallet security against phishing or seed phrase losses. In contrast, traditional ETFs provide indirect ownership through fund shares, custodied by entities like JPMorgan for IAU, reducing user burden but diluting control—investors rely on the sponsor's (e.g., State Street for GLD) integrity.

Custody for cryptos hinges on issuer-managed vaults with third-party audits, fostering trust but centralizing risk; a Paxos insolvency could freeze redemptions, echoing FTX's 2022 collapse. ETFs distribute custody across global vaults with segregated accounts, backed by insurance and regulatory audits, offering perceived safety for portfolio managers. Practical trade-offs: Crypto's decentralization suits borderless access, while ETFs' structure integrates seamlessly with tax-advantaged accounts, prioritizing ease over autonomy in institutional settings.

Redemption in gold-backed cryptos permits conversion to physical gold or cash, but minimums (e.g., 430 ounces for XAUT) deter retail users, pushing most to sell on secondary markets. This flexibility enables quick exits in volatile scenarios, yet logistics add costs like shipping. ETFs restrict redemptions to cash for individuals, with physical delivery reserved for large blocks, aligning with liquidity-focused investors who prioritize speed over tangibility.

Liquidity for cryptos operates round-the-clock on global exchanges, with XAUT's $220 million daily volume supporting efficient trades, though DEXs face slippage in illiquid pairs. ETFs boast superior depth during market hours—GLD's $10 billion+ turnover minimizes spreads—but close at 4 PM ET, exposing holders to after-hours gaps amid news like Fed announcements. For 2026 investors, cryptos excel in real-time usability for active trading, while ETFs suit buy-and-hold strategies with lower execution risks.

Fees for gold-backed cryptos include minimal issuance costs (0% for PAXG) but trading spreads of 0.1-0.5% on CEXs, plus gas fees; no ongoing storage erodes value over time. ETFs charge annual expense ratios (0.1% for GLDM), deducted from NAV, making them cost-effective for long holds but pricier upfront via brokerage commissions.

Regulation in 2026 favors ETFs' established SEC framework, ensuring consumer protections, while cryptos navigate Clarity Act's commodity status and MiCA's ART rules, demanding 1:1 reserves and AML but risking delistings in non-compliant jurisdictions. Risks for cryptos encompass smart contract exploits and issuer opacity—Tether's history amplifies counterparty fears—potentially leading to depegging. ETFs face custodian defaults or tracking lags, but diversified structures mitigate this; both vulnerable to gold price drops, cryptos add volatility from crypto market correlations.

Gold-backed cryptos thrive in DeFi ecosystems, where users stake XAUT for yields or use PAXG as collateral in loans, appealing to crypto investors blending precious metals with blockchain utility. Portfolio managers leverage them for 24/7 hedging during crises, like swapping to stablecoins amid equity dips. Traditional ETFs integrate into balanced funds, offering tax efficiency in Roth IRAs and serving as low-correlation assets (0.2 vs. S&P 500) for risk-averse strategies.

Trade-offs hinge on horizons: Short-term traders favor cryptos' accessibility, but long-term holders prefer ETFs' stability. In threat models like inflation spikes, cryptos provide global portability, while ETFs ensure compliance in regulated portfolios. Hybrids—allocating 60% ETFs for core exposure and 40% cryptos for yield—optimize returns in 2026's uncertain economy.

Baltex.io stands out as a non-custodial aggregator for cross-chain swaps, enabling seamless conversions between gold-backed cryptos like PAXG or XAUT and stablecoins such as USDC or USDT without KYC or bridges. In 2026, with gold volatility prompting quick reallocations, baltex.io routes trades across 200+ networks, aggregating liquidity from DEXs and CEXs for optimal rates and minimal slippage. Users connect wallets, select pairs (e.g., PAXG to USDC on Ethereum to Base), and execute in under 10 minutes, leveraging privacy features like Monero intermediaries for untraceable paths.

This platform minimizes risks by avoiding custody—funds remain in user control—and charges 0.3-0.5% fees, lower than many CEXs. For investors, it facilitates efficient routing: Swap XAUT to USDT during gold dips to lock profits, or route PAXG yields to fiat gateways. Compared to on-chain mixers or direct bridges, baltex.io's hybrid model reduces gas and failure points, making it ideal for portfolio managers optimizing gold exposure without regulatory flags.

What are the top gold-backed cryptos in 2026? PAXG and XAUT lead with $1.8-2.3B market caps, backed by audited physical gold.

How do fees compare between gold-backed crypto and ETFs? Cryptos: 0.1-0.5% trading; ETFs: 0.1-0.4% annual, no trade fees on brokers.

Is redemption for physical gold easier with cryptos or ETFs? Cryptos allow it (high mins), ETFs limit to cash for most users.

What risks are higher in gold-backed crypto? Issuer counterparty and blockchain vulnerabilities vs. ETFs' custodian risks.

How does baltex.io help with gold assets? Enables instant, private swaps to stablecoins across chains at low fees.

Navigating gold investments in 2026 requires balancing innovation with prudence: Gold-backed cryptos deliver dynamic usability and yields but at the expense of higher risks and evolving regulations, while traditional ETFs prioritize reliability and liquidity for conservative allocations. Crypto users may lean toward tokens for DeFi synergies, investors toward ETFs for regulatory comfort. Tools like baltex.io bridge these worlds, enhancing efficiency without compromises. Ultimately, a diversified approach—perhaps 50/50 split—maximizes trade-offs, safeguarding portfolios as gold cements its role amid economic shifts. Stay vigilant with audits and regulations to thrive in this golden era.