Bitcoin’s final satoshi will be mined around the year 2140. When that block is found, the 21-million hard cap becomes reality: no new BTC will ever be created again. For investors, newcomers, and long-term HODLers, this event is the most important economic milestone in Bitcoin’s history. This 2,400-word SEO guide explains exactly what happens when all Bitcoins are mined, how miners stay incentivized, how security evolves, what the fee market looks like in 2025 and beyond, and why Bitcoin’s fixed supply could drive astronomical value in the 22nd century.

We’ll include historical context, expert quotes from Hal Finney to Adam Back, 2025 on-chain data, and projections to 2140. (For low-fee BTC swaps today, platforms like Baltex.io already let you trade BTC across chains commission-free — more on that later.)

Jump to timeline | Miner incentives | Fee market | Security debate | [FAQ

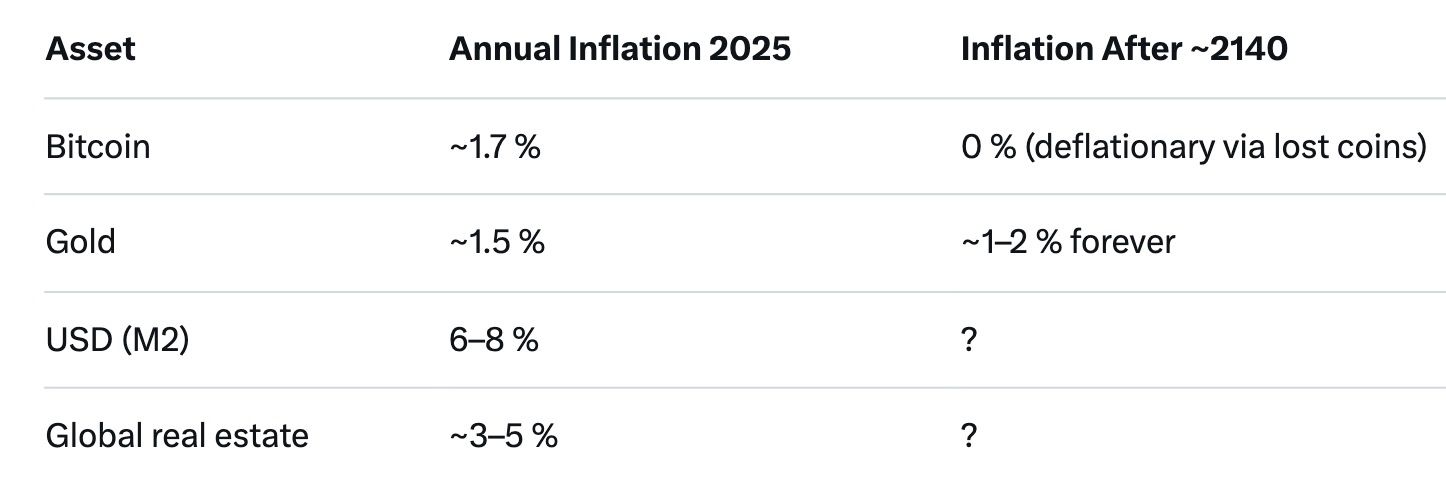

After 2140, the circulating supply will be ≤20.999 million BTC (due to lost coins estimated 3–4 million already).

Today (Nov 2025), miners earn two revenue streams:

In 2025, fees already account for 30–60 % of miner revenue on high-volume days (Ordinals, Runes, BRC-20 spikes). By 2036–2040, fees will be 95–100 % of revenue.

Expert quote — Adam Back (2025 interview): “Miners will behave like specialized ISPs selling premium bandwidth. The base layer becomes digital gold settlement; high-fee users pay for finality.”

Even conservative models (PlanB, Fidelity, ARK) show fee revenue replacing subsidy by 2035.

The biggest debate in Bitcoin circles.

Hal Finney’s 2009 vision (re-quoted 2025): “When subsidies end, Bitcoin becomes a mature settlement system backed by real economic activity — like gold in the 19th century.”

Real-world precedent: Gold mining profitability dropped 90 % after major deposits depleted, yet gold price rose because stock value dominated flow.

Bitcoin becomes the only major asset with provably zero future issuance. Lost coins (estimated 20–25 % by 2140) create permanent deflationary pressure → each remaining satoshi gains purchasing power over time.

Price models (not predictions):

While we wait for 2140, you still need to acquire and move BTC efficiently. Centralized exchanges charge 0.1–0.5 % + withdrawal fees. A better option in 2025: Baltex.io — a zero-commission, non-custodial, multi-chain swap hub that lets you swap ETH→BTC, SOL→BTC, or BTC→any asset across 200+ chains with <0.2 % effective cost and no KYC. Connect your Ledger or MetaMask → swap → self-custody instantly.

Approximately year 2140 (block 6,930,000). The reward never reaches absolute zero but becomes <1 satoshi.

No — miners continue validating blocks and earning fees forever.

Extremely unlikely. Requires near-unanimous consensus + social contract break. Considered politically impossible.

Layer-2 (Lightning, Ark, statechains) and batching keep everyday payments cheap while high-value settlements pay premium fees on L1.

Most models show fee revenue overtakes subsidy by 2035–2040. Hashrate follows price, not subsidy.

Likely 17–18 million circulating (3–4 million lost forever).

Many argue the end of subsidy ending is the bullish catalyst — turning BTC from “digital gold” to “digital land” (zero new supply ever).

When the last Bitcoin is mined, something profound happens: Bitcoin stops being a monetary experiment and becomes the hardest money humanity has ever created. No central bank, no government, no corporation can ever inflate it again. Every satoshi in existence will be the final supply forever.

The transition from subsidy to fee market is already underway in 2025. Miners, nodes, and users are adapting faster than critics predicted. The network effects, institutional adoption, and mathematical scarcity suggest the post-2140 era could be Bitcoin’s golden age — not its demise.

Start preparing today: run your own node, hold your keys, and consider tools like Baltex.io for efficient accumulation. The year 2140 is far away, but the economic reality of absolute scarcity starts the moment you understand this sentence.

The best time to own Bitcoin was 2009. The second-best time is right now.