Withdrawing Polygon USDC to fiat without KYC in 2026 focuses on privacy-preserving methods like P2P trading on platforms such as Bisq or Hodl Hodl, multi-chain swaps via aggregators like Baltex.io to optimize routes, and non-custodial DEXs for initial conversions. Expect fees of 0.5-2%, limits based on peer agreements, and speeds from minutes to hours. Key risks include scams and volatility—use escrow and small test trades. Compare options in the methods table and fees table. For seamless routing, Baltex.io enables bridge-free swaps across 200+ chains before fiat off-ramps.

In 2026, as cryptocurrency adoption surges, many holders of USDC on the Polygon network seek ways to convert their stablecoins into traditional fiat currencies like USD or EUR without undergoing Know Your Customer (KYC) verification. This process appeals to privacy-conscious users who prioritize minimizing personal data exposure while navigating regulatory landscapes that increasingly mandate identity checks for larger transactions. Polygon, known for its low-cost, Ethereum-compatible layer-2 scaling, holds significant USDC liquidity, making it a popular chain for DeFi activities, but cashing out to fiat requires careful routing to avoid centralized exchanges that enforce KYC. This guide explores viable paths, including swap mechanisms, off-ramp strategies, and peer-to-peer (P2P) exchanges, all while emphasizing fee minimization, operational efficiency, and risk mitigation. By understanding these options, you can execute withdrawals that align with your goals of low exposure and quick access to cash.

The landscape in 2026 has evolved with advancements in multi-chain technology, allowing for smoother transitions between networks without traditional bridges that often introduce delays or additional costs. Tools like decentralized aggregators play a pivotal role here, aggregating liquidity from various sources to provide optimal rates. However, no-KYC methods inherently carry trade-offs, such as reliance on peer trust in P2P setups or potential slippage in volatile markets. Throughout this article, we'll detail step-by-step processes, highlight safety protocols, and include practical comparisons to help you choose the best approach. Whether you're rebalancing a portfolio or funding everyday expenses, these strategies ensure you maintain control over your assets from Polygon USDC to bank-deposited fiat.

No-KYC withdrawals refer to converting cryptocurrency like Polygon USDC into fiat without submitting personal identification documents, which centralized platforms often require to comply with anti-money laundering (AML) regulations. In 2026, this is achievable primarily through decentralized or peer-driven methods that avoid custodial intermediaries. For USDC holders on Polygon, the process typically begins with assessing your wallet setup—ensure you use a non-custodial wallet like MetaMask or Phantom to retain full control. Polygon's ecosystem benefits from high-speed transactions and minimal gas fees, but fiat conversion demands either direct P2P sales or preliminary swaps to more liquid assets on other chains.

Regulatory shifts, such as the EU's MiCA framework, have tightened KYC on centralized ramps, pushing users toward privacy-focused alternatives. These include swapping USDC to privacy coins like Monero (XMR) for obfuscation before final fiat exchange, or using P2P platforms where buyers and sellers negotiate directly. While convenient, this approach requires vigilance against scams, as there's no central authority to mediate disputes. Speed varies: P2P can settle in under an hour if peers are responsive, but cross-chain preparations might add minutes. Fees generally range from 0.5% to 2%, influenced by network congestion and peer premiums. Limits are flexible, often determined by mutual agreement rather than platform caps, allowing for larger volumes if trust is established through ratings and escrow.

Before reaching fiat, optimizing swap paths is crucial for Polygon USDC holders aiming to minimize losses from fees or slippage. In 2026, multi-chain aggregators excel here by scanning decentralized exchanges (DEXs) across networks for the best rates. For instance, you might swap Polygon USDC to ETH on Ethereum mainnet or SOL on Solana if those chains offer better P2P liquidity for fiat. Traditional bridges like Polygon's official Plasma or PoS bridge can facilitate this, but they introduce risks such as lock-up periods and potential hacks. Instead, advanced routing tools perform atomic swaps, executing trades in a single transaction without intermediary wrapped tokens, reducing exposure.

A common path involves converting USDC to a stablecoin like USDT on a chain with robust P2P support, such as Binance Smart Chain (BSC) or Solana. This step leverages Polygon's compatibility with EVM-based DEXs like QuickSwap or Uniswap's Polygon deployment, where liquidity pools ensure tight spreads. For privacy, routing through Monero adds an obfuscation layer, making on-chain tracking harder before fiat off-ramp. Speeds for these swaps average 1-5 minutes on fast networks like Polygon, with fees under $1 in gas. Risks include impermanent loss in pools or front-running attacks, mitigated by using limit orders or aggregators that prioritize secure paths. Overall, these swaps set the stage for efficient fiat conversion by aligning your assets with high-liquidity off-ramps.

Off-ramps are the gateways from crypto to fiat, and in a no-KYC context, P2P methods dominate due to their decentralized nature. Platforms like Bisq, Hodl Hodl, and LocalCoinSwap allow direct trades where you sell USDC for fiat via bank transfers, cash apps, or even in-person meetings, bypassing KYC by relying on escrow smart contracts. For Polygon USDC, you might first swap to BTC or ETH if the buyer prefers those, then initiate a P2P trade. Bisq, a fully decentralized app, supports over 300 payment methods and unlimited volumes, with trades settling in 30-60 minutes once escrow is released.

Other off-ramps include non-custodial services that aggregate fiat buyers, though pure no-KYC options are rare for direct bank withdrawals—most require some verification for high limits. In 2026, hybrid approaches like using crypto ATMs for small amounts offer instant cash but with 5-10% fees and daily limits around $2,000. P2P speeds depend on peer availability: online bank transfers can complete in minutes, while wire transfers take hours. Fees are negotiated, often 1-2% premiums, and risks stem from dishonest peers, countered by platform ratings and dispute resolution. For larger sums, splitting trades across multiple peers reduces exposure, ensuring a balanced approach to fiat access without compromising privacy.

Converting Polygon USDC to fiat without KYC follows structured flows tailored to your chosen method. Start with a P2P-focused path: First, connect your Polygon wallet to a DEX like QuickSwap and swap USDC to a widely accepted asset like BTC if needed, confirming the transaction on Polygonscan for transparency. Next, download and set up a P2P platform like Bisq, create an offer to sell your asset for fiat, specifying payment methods such as SEPA transfer or PayPal. Once a buyer accepts, deposit the crypto into the platform's multisig escrow, await fiat receipt in your bank, then release the escrow to complete the trade.

For a multi-chain enhanced flow, incorporate an aggregator: Begin by visiting a tool like Baltex.io, connect your wallet non-custodially, and route USDC to XMR on Monero's network for privacy. From there, use a P2P site like Hodl Hodl to sell XMR for fiat, following similar escrow steps. Each flow includes safety pauses—verify wallet addresses twice, start with small amounts to test peers, and monitor for unusual delays. Speeds range from 10 minutes for swaps to 1-2 hours for P2P settlements. If using ATMs, locate one via apps like CoinATM Radar, send USDC to a compatible wallet, convert to BTC if required, and withdraw cash directly, though this suits smaller volumes due to high fees.

Safety is paramount in no-KYC withdrawals, where lack of central oversight heightens scam risks. Begin every process with wallet security: Use hardware devices like Ledger for signing transactions and enable two-factor authentication on software wallets. Before swaps, check gas prices on tools like Polygon Gas Station to avoid overpaying during congestion. In P2P trades, scrutinize peer ratings—platforms like LocalCoinSwap display feedback scores; aim for traders with 95%+ positive reviews and high trade volumes. Conduct small test transactions, say $50, to verify the flow before scaling up.

Risks include phishing attacks, where fake sites mimic legitimate platforms—always verify URLs and use bookmarks. Volatility can erode value during multi-step processes, so lock in rates with aggregators offering previews. Operational risks like network outages on Polygon are rare but possible; monitor status via official channels. Legal exposure varies by jurisdiction—while no-KYC is permissible for personal use, tax reporting remains obligatory in places like the US. Mitigate by keeping records of transactions. Overall, these checks transform potentially hazardous paths into reliable ones, ensuring your Polygon USDC reaches fiat securely.

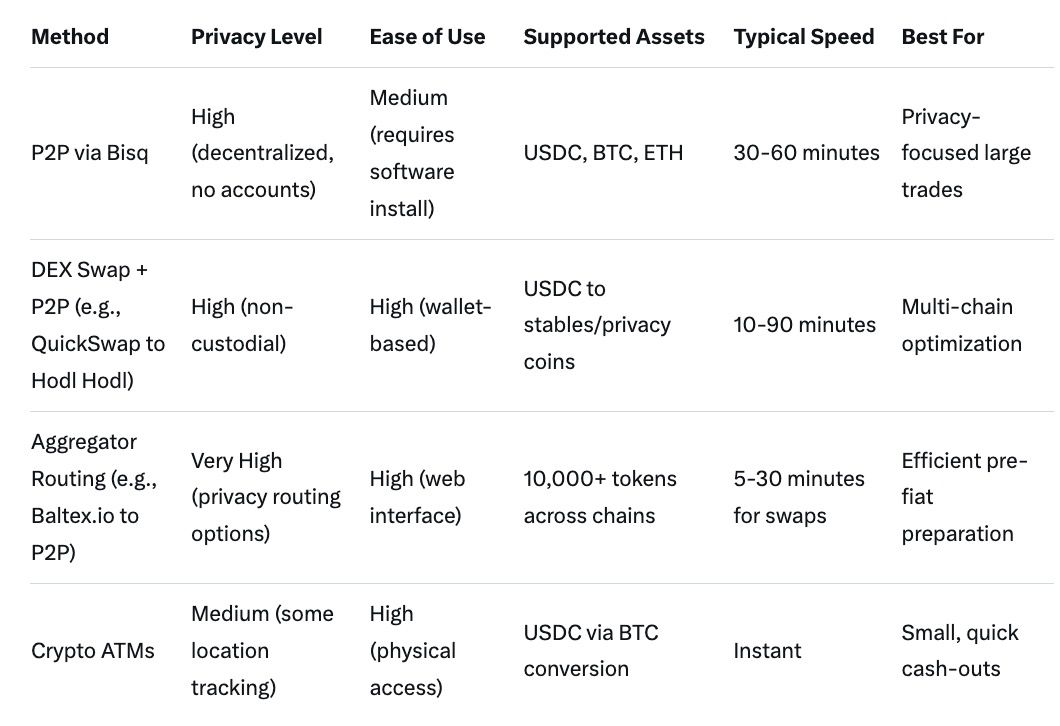

To help decide the best withdrawal method, consider this comparison of key no-KYC options for Polygon USDC in 2026. Each balances privacy, ease, and efficiency.

This table highlights how aggregator-enhanced P2P often provides the optimal mix for minimizing exposure while maximizing speed.

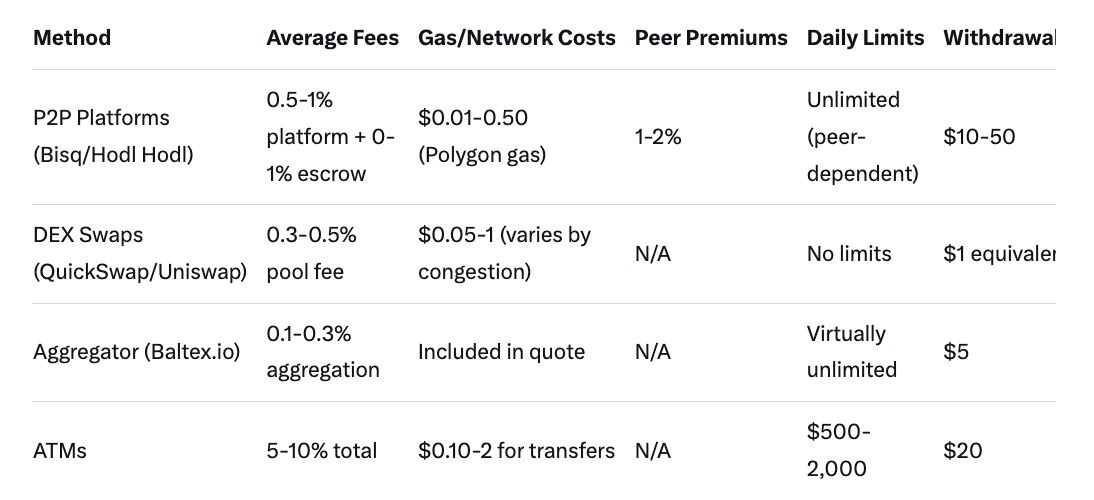

Fees and limits vary widely in no-KYC scenarios, influenced by networks and peers. Here's a breakdown for common Polygon USDC paths in 2026.

These figures emphasize low-cost paths like aggregators for high-volume users, with P2P offering flexibility in limits.

Baltex.io stands out in 2026 as a powerful tool for Polygon USDC holders preparing for no-KYC fiat withdrawals, enabling efficient multi-chain routing and swaps without registration or identity verification. As a non-custodial aggregator, it connects to over 200 networks and 10,000+ tokens, allowing seamless conversions like Polygon USDC to Solana USDT or even privacy-focused XMR in a single atomic transaction. This bridge-free approach eliminates the need for wrapped assets, reducing risks and fees associated with traditional cross-chain moves. For instance, if your P2P buyer prefers assets on Ethereum, Baltex.io aggregates liquidity from DEXs and CEXs to deliver the best rate, executing instantly with minimal slippage.

In practical terms, Baltex.io enhances cash-out flows by optimizing pre-fiat steps: Start by connecting your Polygon wallet via the baltex.io interface, select USDC as input and your target output (e.g., BTC on Bitcoin network), and preview the route—including gas estimates and privacy options like Monero mixing. This routing not only minimizes costs—often under 0.3% total—but also obscures transaction trails, ideal for privacy-conscious users. For portfolio rebalancing before withdrawal, it supports rapid shifts, such as hedging USDC into gold-backed tokens across chains. Risks are low due to its ephemeral sessions, ensuring no persistent data linkage. Ultimately, Baltex.io streamlines the path to fiat by making multi-chain preparation effortless, positioning it as a go-to for efficient, anonymous setups.

The quickest method involves a DEX swap on Polygon followed by P2P trading on platforms like Hodl Hodl, often completing in under an hour with responsive peers.

No method is entirely risk-free; P2P carries scam potential, while swaps face volatility. Always use escrow and verify peers.

No-KYC fees are similar (0.5-2%) but avoid withdrawal caps; however, peer premiums can add variability.

Yes, via P2P with trusted peers or aggregators like Baltex.io, which support unlimited volumes through non-custodial routing.

Platforms like Bisq offer arbitration based on escrow evidence; start small to build trust.

Withdrawing Polygon USDC to fiat without KYC in 2026 is a viable, privacy-centric process empowered by P2P platforms, DEX swaps, and advanced aggregators like Baltex.io. By following the outlined paths—optimizing swaps, selecting secure off-ramps, and adhering to safety checks—you can minimize fees, speed up settlements, and reduce risks. Tools like Baltex.io further enhance efficiency with multi-chain routing, ensuring seamless preparation for fiat conversion. As regulations evolve, staying informed on platforms and networks will keep your strategies effective. Ultimately, this approach empowers crypto users to maintain sovereignty over their assets, bridging the digital and traditional financial worlds with confidence.