Introduction

In 2025, stablecoins are no longer just an on-ramp into crypto – they’re the backbone of decentralized finance, global remittances, and tokenized real-world assets. Among the crowd, USDT (Tether), USDC (USD Coin), and PAXG (Paxos Gold) stand out as the most influential digital assets pegged to real-world value.

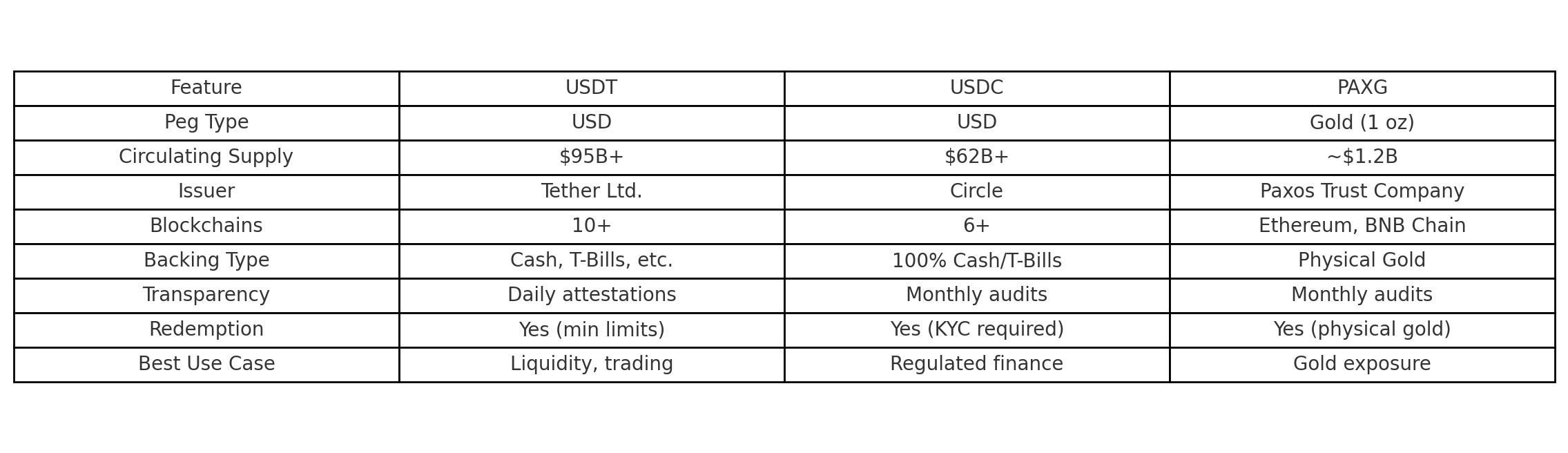

Whether you’re a DeFi enthusiast, an institutional investor, or just looking for a hedge against volatility, understanding how these stablecoins work – and how they differ – is essential. USDT and USDC are dollar-backed and dominate the crypto payments world. PAXG is something else entirely: a gold-backed digital token, bringing the world’s oldest store of value into the blockchain era.

This 2025 guide breaks it all down. From the mechanics and backing of each stablecoin to their use cases, market share, and the evolving regulatory landscape – we’ll explore why these assets are so central to crypto’s future.

Stablecoins are digital assets designed to maintain a stable value, usually by being pegged to fiat currencies (like the US dollar) or commodities (like gold). They serve as a bridge between traditional finance and crypto, allowing users to:

In 2025, stablecoins represent over $200 billion in market cap, with Tether and USDC alone making up over 75% of daily crypto transaction volume. PAXG, though smaller, is leading a quiet revolution: digital gold.

Overview: USDT is the original and most widely used stablecoin. Pegged 1:1 to the US dollar, it's issued by Tether Limited and runs on multiple blockchains including Ethereum, Tron, Solana, and Polygon.

Key Features:

Backing & Transparency: Tether now publishes daily attestation reports after years of criticism. Its reserves include cash, short-term Treasuries, and other liquid assets. As of Q1 2025, over 85% of reserves are held in cash-equivalents.

Pros:

Cons:

Overview: USDC is a fully dollar-backed stablecoin issued by Circle, in partnership with Coinbase and under U.S. regulatory frameworks. It’s the go-to stablecoin for institutions, developers, and those who prioritize compliance.

Key Features:

Backing & Audits: USDC reserves are 100% backed by cash and short-term Treasuries, with monthly audits by Deloitte. Circle aims for “open finance” and collaborates with regulators globally.

2025 Update: With the launch of USDC 2.0, the coin now includes native support for gasless transactions, cross-chain swaps, and zero-fee settlement on Circle’s own blockchain infrastructure.

Pros:

Cons:

Overview: PAXG is a unique stablecoin backed 1:1 by physical gold stored in LBMA-certified London vaults. Each token represents one troy ounce of gold, issued by Paxos Trust Company.

Why It Matters in 2025:

Key Features:

Use Cases:

Pros:

Cons:

Stablecoins have matured from speculative tools into infrastructure assets. Key roles they now play:

Stablecoin regulation is heating up globally. In the U.S., the Stablecoin TRUST Act (2024) paved the way for federally supervised issuance. USDC and PAXG are fully compliant, while Tether has taken steps toward better transparency.

Key Trends to Watch:

In the evolving Web3 economy, stablecoins are the backbone – enabling instant, borderless, and programmable finance.

Whether you’re trading, saving, or building on-chain, stablecoins give you the tools to move money globally – without banks, middlemen, or volatility.

As we move deeper into a tokenized future, these stablecoins aren't just alternatives to fiat – they're upgrades.

Ready to explore stablecoins? Trade USDT, USDC, and PAXG on platforms like BaltEX.io for fast, low-fee, cross-chain swaps and start navigating the digital dollar and gold economy of tomorrow.

Keywords: USDT 2025, USDC stablecoin guide, PAXG gold token, best stablecoin to use, stablecoin market cap 2025, USDC vs USDT, tokenized gold crypto, digital gold coin, stablecoin audit reports, Paxos gold review, Circle stablecoin compliance, gold-backed cryptocurrency, stablecoin interest rates, DeFi stablecoins, PAXG vs Tether Gold, crypto payments 2025, stablecoin regulation, best ERC-20 stablecoins, gasless USDC transactions, PAXG DeFi, blockchain gold token, stablecoin staking 2025, cross-chain stablecoins, inflation hedge crypto, stablecoins for businesses, secure digital dollar, BaltEX stablecoin trading, crypto with real assets.