The world of decentralized finance (DeFi) is evolving rapidly in 2025, and VELO is emerging as a standout cryptocurrency bridging traditional finance with the crypto economy. As the native token of Velo Protocol, $VELO has seen significant growth and innovation this year – from new partnerships and tokenomics updates to expanding real-world use cases. Now, with BaltEX.io supporting $VELO trading, the VELO community has a powerful, privacy-focused DEX platform to swap and utilize their tokens. This article provides an in-depth look at everything about $VELO on BaltEX, including what VELO is (and its latest 2025 developments), the token’s use cases and staking, how to trade VELO on BaltEX, the benefits of using BaltEX for VELO, a guide to swapping via the @BaltexSwapBot on Telegram, and recent ecosystem highlights. If you are a Velorian (VELO enthusiast) or a crypto trader looking for the next big opportunity, read on – and learn why swapping $VELO on BaltEX.io could be your best move in 2025.

VELO is the utility token powering the Velo Protocol – a blockchain project focused on borderless value transfer and digital credit issuance. In simple terms, Velo is building a federated credit exchange network that lets businesses and individuals seamlessly move money across borders using blockchain. By issuing collateral-backed digital credits pegged to fiat currencies, Velo enables near-instant settlement and low-cost remittances, supercharging the velocity of money in a secure, transparent way.

Founded by Velo Labs and backed by major institutions, Velo Protocol bridges centralized finance and decentralized finance. It uses advanced blockchain tech (initially Stellar’s consensus and now multi-chain on Binance Smart Chain and others) to ensure transactions are fast and secure. The $VELO token sits at the heart of this system – serving as collateral for issued credits, a governance stake, and a unit underpinning network stability. Velo’s ecosystem already includes the Orbit mobile app for peer-to-peer payments and the Universe decentralized exchange (DEX) platform for DeFi trading. Across these services, VELO tokens facilitate transactions, provide rewards, and could serve in governance as the network decentralizes.

In 2025, VELO has truly come into its own. This year has brought tangible results:

In summary, VELO in 2025 is a multifaceted DeFi token: it powers a fast-growing payment network, is backed by big-name investors, and is expanding into new finance frontiers (like RWAs and stablecoins). For crypto users, Velo represents the promise of DeFi with the credibility of traditional finance – and now it is easier than ever to access thanks to BaltEX.

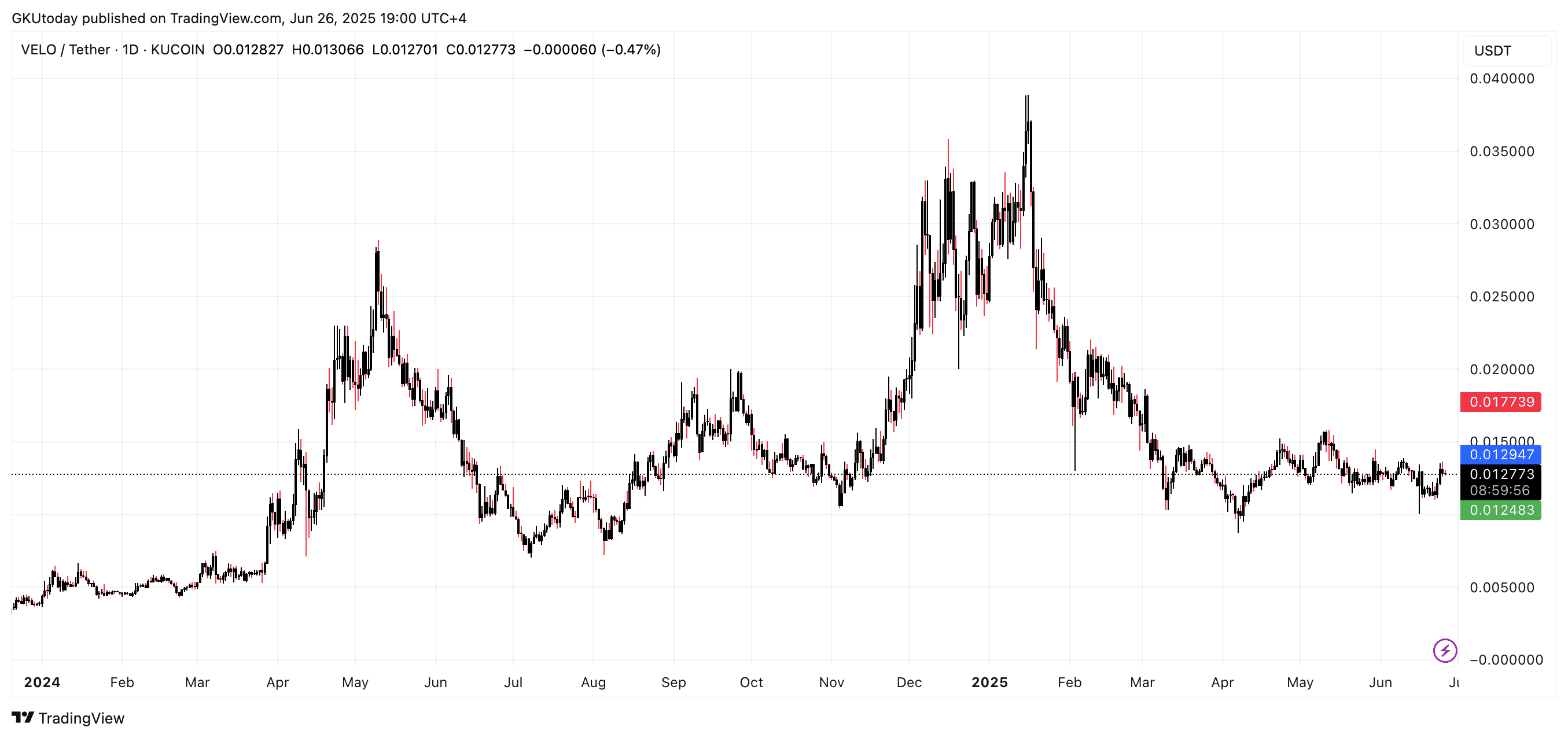

Understanding $VELO’s tokenomics – its supply and utility – is key to appreciating its value. (As of mid-2025, VELO trades around $0.012 per token, giving it a market capitalization near the high eight figures in USD.) Unlike meme tokens with no clear purpose, VELO is deeply woven into Velo’s financial infrastructure.

Supply & Distribution: VELO has a fixed max supply of 24 billion tokens, with about 7.4 billion (around 30%) in circulation as of 2025. There is no endless inflation – all tokens were created upfront. These tokens were initially allocated to fuel the ecosystem – portions went to strategic partners, an ecosystem development fund, early backers, and the team – and have been gradually vesting into circulation. By now in 2025, the token ownership is well-distributed across the community and partners, aligning everyone’s interests in the project’s success. This means no surprise dilution for holders. A large portion of VELO is currently locked up in various ecosystem programs (like staking pools and partner reserves), which reduces liquid supply and can help price stability. The circulating supply being mostly released also implies that future demand increases will not be met with vast new token emissions – a positive sign for investors.

Utility: The $VELO token isn’t idle; it has multiple crucial roles in the ecosystem:

Collateral & Settlement: Partners stake VELO as collateral to issue digital credits (like Velo’s USDV stablecoin), ensuring every tokenized dollar or baht on the network is backed. This mechanism guarantees stable, fast settlements for cross-border transfers. (For example, a remittance service in Thailand might lock up VELO tokens as collateral to issue a Thai Baht-pegged digital credit, which can then be sent to a partner in the Philippines and redeemed as pesos – all within Velo’s network, nearly instantly and at minimal cost.) VELO collateral makes sure the value is secure during such transfers, effectively bridging trust between senders and receivers. This use case ties VELO’s success to real-world transaction volume: the more people use Velo for payments, the more VELO gets staked to back those transactions.

Network Access: Holding VELO is required for businesses and nodes to participate in Velo’s federated network, aligning everyone’s incentives. In practice, companies that want to become Velo partners (for example, remittance operators or fintech platforms) need to hold a certain amount of VELO as a form of stake. This not only shows their commitment but also gives them skin in the game. Large stakeholders may gain a say in governance as Velo moves toward decentralization – essentially, VELO will function as a governance token for protocol upgrades and decisions.

Fees & Rewards: VELO can be used to pay fees or earn discounts within Velo’s platforms. For example, on the Universe DEX (Velo’s decentralized exchange), trading fees might be lower if paid in VELO. Similarly, the Orbit app could reward users in VELO for high volumes or referrals. Velo has hinted at introducing loyalty programs where businesses and users who hold VELO get extra benefits (like priority speeds or cashback in tokens). This means the token’s utility is also tied to user engagement – the more activity on Velo’s platforms, the more demand for VELO to unlock perks.

Multi-chain Bridge Asset: VELO exists on multiple chains (originally as a Stellar token, and now primarily as a BEP-20 token on BNB Chain, with bridged versions on Ethereum and others). This allows it to act as a bridge asset for liquidity across networks. VELO can be easily moved between chains using Velo’s Warp bridge or other cross-chain tools. It helps transfer value between different blockchain ecosystems and even between crypto and traditional finance partners. In essence, VELO provides interoperability – a user can convert VELO on BSC to VELO on Stellar to interact with a certain partner, all while using the same token value. This multi-chain presence also means VELO benefits from liquidity on multiple platforms (DEXs, CEXs on various chains).

Real-world example: Imagine a remittance service in Thailand that wants to send money to the Philippines. By staking VELO, they can issue Thai Baht-pegged digital credits on Velo’s network as collateralized IOUs. These tokens are sent to a partner in the Philippines and seamlessly converted to Philippine Peso credits, which the recipient can redeem for local currency – all in minutes. VELO’s collateral ensures the value stays secure throughout the transfer. This process bypasses slow traditional banking, illustrating how $VELO powers efficient cross-border payments.

Staking & Rewards: 2025 has been a big year for VELO staking. Velo introduced high-yield staking pools to reward loyal holders:

In essence, VELO’s tokenomics are designed to foster long-term value. A controlled supply and broad utility – from underpinning stablecoins to rewarding network participation – give the token fundamental strength. It’s not just a speculative asset; it’s the fuel and glue of the entire Velo network.

With $VELO’s growth clear, the next step is knowing how to trade or acquire it conveniently. That’s where BaltEX.io comes in. BaltEX is a next-generation cryptocurrency exchange designed for instant, private crypto swaps. It functions similarly to a decentralized exchange (DEX) aggregator, meaning you trade directly from your wallet without handing over custody of funds. This non-custodial, account-free model makes BaltEX an ideal platform to trade VELO easily and securely.

Key BaltEX Features: You can swap over 200 cryptocurrencies on BaltEX quickly, with no registration or KYC required. It’s non-custodial, so you never have to deposit your coins into an exchange wallet that someone else controls. Instead, BaltEX acts as an intelligent bridge – finding you the best rates across multiple liquidity providers and executing your swap in one streamlined process. You maintain control of your funds at all times.

Trading VELO on BaltEX is straightforward and user-friendly. Here’s a quick guide:

That’s it – you have traded $VELO without any accounts or custodial risk. BaltEX basically does all the heavy lifting: it finds the best exchange rate across various platforms, handles any cross-chain conversions if needed, and ensures the swap is completed efficiently and securely. For instance, if you want to take profit after a $VELO price surge, you could swap your VELO for a stablecoin like USDT or USDC in minutes. Conversely, if you spot a dip and decide to increase your VELO holdings, you can swiftly swap from BTC, ETH, BNB or other coins into VELO with minimal effort. BaltEX handles these conversions so you can execute your strategy without delays or complexity.

Cross-Chain Convenience: One big advantage, especially for VELO, is that BaltEX handles cross-chain scenarios seamlessly. VELO’s main liquidity is on BNB Smart Chain (BEP-20) in 2025, but say you want to swap Bitcoin (on its own PoW chain) or Ether (ERC-20 on Ethereum) into VELO (on BSC). Normally, that could require multiple steps (and possibly using a bridge), but BaltEX coordinates it automatically – you don’t have to manually bridge anything. It sources liquidity and routes through whatever networks necessary to deliver the outcome. This is a huge simplification; you can convert assets like BTC → VELO or VELO → ETH in one go even though those assets live on different chains. BaltEX takes care of the technical complexity in the background.

No Hidden Fees: BaltEX does not charge you any extra platform fee. The rate you get is net of all costs (network fees, exchange partner fees) and it’s transparently shown before you confirm. This means you’re often getting a better deal than on regular exchanges that might charge trading fees plus withdrawal fees. On BaltEX, you just execute the swap and receive your coins – no surprise deductions. By avoiding big exchange fees and order slippage, you can maximize the value of your trades.

Speed and Security: Most swaps on BaltEX are completed within minutes. And since you never relinquish control of your funds beyond the exact swap amount, you avoid risks like exchange hacks or withdrawal freezes. Each trade is an isolated atomic swap – you send from your wallet and get the output directly to your wallet. This is a very secure way to trade VELO, because even if BaltEX’s interface were compromised, an attacker cannot steal what they never custody. The Trust Layer (discussed below) further ensures that the coins you receive are clean and safe.

In short, trading VELO on BaltEX is as easy as a few clicks and one transaction from your wallet. You get privacy, speed, and confidence that you’re getting a great rate – all while staying in control of your crypto.

Why choose BaltEX over a traditional exchange for your VELO trades? Here are the key benefits for VELO traders and holders:

In short, BaltEX brings DEX-like freedom with the convenience of a modern platform. It even runs occasional promotions or loyalty rewards for users, truly living up to its motto of being private, secure, and rewarding for crypto traders.

Global Accessibility: With no KYC and a web-based platform, BaltEX can be used by anyone, in any country. VELO holders worldwide can trade on equal footing without region-based restrictions, which supports Velo’s globally distributed community.

To summarize, BaltEX offers VELO holders the perfect combination of privacy, security, and convenience. You can trade with confidence that you’re getting a good deal and not exposing yourself to unnecessary risk. For a serious project like Velo, having a serious exchange like BaltEX supporting it is a big positive. It means the community has a reliable, user-first venue to trade $VELO without the drawbacks of many other platforms.

BaltEX offers a unique way to swap crypto: via its Telegram bot. The @BaltexSwapBot allows you to trade $VELO (and many other coins) by simply chatting with an automated Telegram account – no website needed. This is perfect for times when you’re on mobile or just prefer a messaging interface.

Using the bot is essentially the same process as the website, but in text form. You still get fixed-rate quotes, you still maintain custody (you’re the one sending the funds from your wallet), and the backend execution is the same BaltEX engine.

The bot (like the web service) can handle swaps across multiple chains – for instance, exchanging assets between Ethereum, BNB Chain, Solana, Polygon, and others – so you’re not limited to one blockchain when trading via chat.

Why use the bot? It’s incredibly convenient. If you’re already on Telegram (where many crypto project communities, including likely Velo’s, hang out), you can execute a trade the moment you decide to, without switching apps or logging into anything. The bot is straightforward to use, guiding you step by step, and it feels like chatting with an exchange assistant. This can be less intimidating for newcomers compared to navigating a website. It’s also useful if you’re on a mobile device with limited browser capabilities – Telegram is lightweight and familiar.

Security-wise, the official @BaltexSwapBot is as secure as using the BaltEX website, since all it’s doing is securely relaying your swap request to the platform. Just be sure you only use the official bot. (Always verify the bot’s username and avoid any Telegram links that aren’t from BaltEX’s official sources to prevent imposters.) The bot will never ask for sensitive info like private keys or seed phrases – it operates only with the wallet addresses and amounts you provide.

For VELO traders, the Telegram bot means you can react instantly to market news or community insights. Imagine discussing a new Velo partnership in a Telegram group and deciding to buy more VELO – you can flip over to the bot and make the purchase on the spot. Or if you’re out and about and want to sell a bit of VELO for cash (via a stablecoin), a quick chat with the bot gets it done. It’s crypto trading in your pocket.

Both Velo Protocol and BaltEX are pushing boundaries in their respective niches, and their intersection opens exciting possibilities for users.

For Velo, the roadmap ahead includes expanding DeFi offerings and deeper integration of real-world assets. For example, the Universe platform is working on decentralized forex trading and perpetual futures, which could drive even more demand for VELO as collateral and for fees. Velo’s collaboration with regulated financial institutions (like Paxos for USDL) suggests that institutional-grade products will keep coming into its ecosystem – broadening VELO’s appeal beyond the crypto-native crowd.

Coming soon on Velo’s roadmap:

As these innovations arrive, they could dramatically expand Velo’s user base and token usage. The takeaway is that Velo is continuously innovating, and each new feature or partnership can bring more users and value into its network. With BaltEX’s support, those users will always have a reliable place to trade $VELO (and any future Velo-based tokens), completing the circle from development to real-world adoption. Ultimately, the future looks bright: Velo is scaling up its impact in the world of digital finance, and BaltEX is evolving the way we trade those digital assets.

BaltEX, for its part, will continue enhancing its platform for privacy and user experience. We can expect more coins and networks to be supported, more refined privacy options, and perhaps community reward programs. Crucially, as Velo’s ecosystem grows, BaltEX stands ready to support it. As more users discover Velo’s fast, low-cost solutions, demand for $VELO could grow exponentially – and BaltEX will be there to provide liquidity and a frictionless trading experience for this expanding community. If Velo launches new tokens (say a special stablecoin or a tokenized asset like the gold token mentioned), BaltEX could list those too, giving users easy access to the whole Velo ecosystem on one platform.

The partnership between a forward-looking protocol like Velo and an innovative exchange like BaltEX exemplifies how the crypto space is uniting cutting-edge technology with user-centric services. Velo brings real utility and adoption, while BaltEX ensures that using and trading the token remains convenient and true to crypto’s core values (privacy, control, and openness).

2025 is a pivotal year for crypto, and Velo (VELO) is at the forefront of bridging traditional finance with DeFi. At the same time, exchanges like BaltEX.io are revolutionizing how we trade – putting privacy, security, and simplicity first. We have explored how VELO has grown into a powerful token with real utility, and why BaltEX is an excellent platform to trade or swap $VELO.

For the VELO community, having BaltEX as an option means you can engage with your favorite project’s token on your terms. You can easily accumulate more VELO, trade it for other assets when needed, or swap into it to take part in staking and governance – all without barriers. The @BaltexSwapBot even lets you do it from your phone instantly.

Now is the time to take action. If you believe in Velo’s mission of democratizing finance, consider adding to your $VELO holdings or using your VELO in new ways – and try doing it through BaltEX.io for a seamless experience. On the flip side, if you’re holding VELO and ready to rebalance or spend some gains, BaltEX lets you convert it securely and privately. With Velo’s growth and BaltEX’s user-friendly platform, you have everything you need at your fingertips. Swap your $VELO today – and be part of the financial revolution that is connecting the old and new worlds of money!

Swap $VELO now on BaltEX.io (or via @BaltexSwapBot) and join the DeFi revolution!

Keywords: VELO token, swap VELO, VELO cross-chain swap, VELO crypto trading, stake VELO, BaltEX.io, BaltEX DEX, trade VELO on BaltEX, non-custodial VELO exchange, cross-chain VELO bridge, VELO BEP-20, VELO wallet, crypto swap platform, decentralized VELO trading, VELO exchange 2025, VELO staking rewards, private crypto swaps, VELO swap bot, @BaltexSwapBot Telegram, swap VELO for USDT, buy VELO with BTC, best VELO exchange, low-fee VELO swaps, VELO price 2025, VELO tokenomics, DeFi token swap, BaltEX cross-chain support, instant VELO swap, VELO liquidity, BaltEX crypto aggregator