If you want to seamlessly swap tokens across multiple blockchain networks, DEX (decentralized exchange) aggregators are your go-to solution. They gather orders from various sources, routing you to the best prices and liquidity. In 2025, cross-chain swaps are more popular than ever, and these aggregators offer a rich toolkit to connect different blockchains at once. Below, you’ll find a friendly breakdown of how DEX aggregators work, plus the top contenders to consider this year, including a few pointers on fees, pros and cons, and security tips.

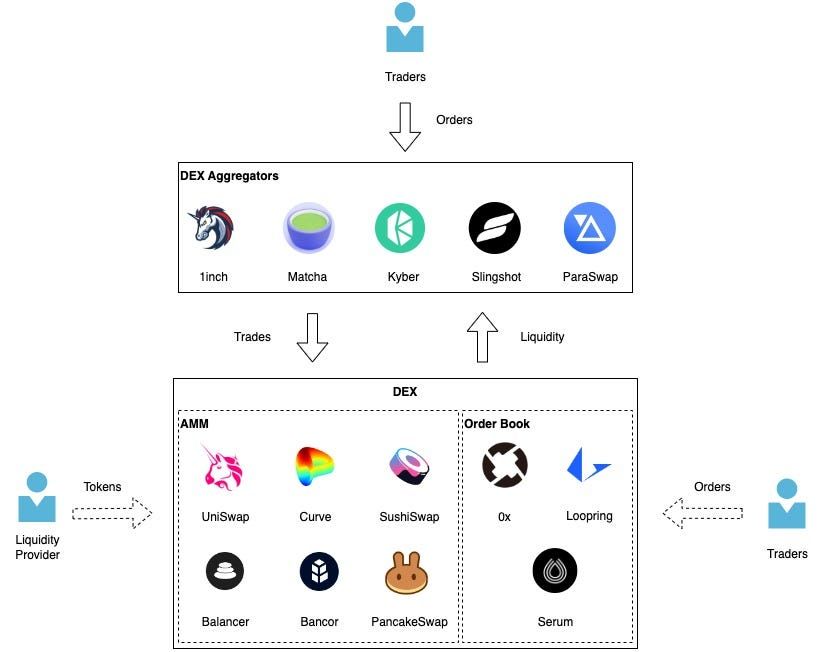

A DEX aggregator is basically a one-stop exchange service that pulls in liquidity from multiple decentralized exchanges, then helps you secure the best possible rate for your token swaps. Instead of visiting several platforms yourself, you hand that task off to a handy aggregator. It checks the price quotes on your behalf and picks the optimal path.

In 2025, people are diving deeper into DeFi, so you’ll see a huge demand for cross chain interoperability tools 2025 and aggregator solutions that can move your assets smoothly across different blockchains. Imagine you have some tokens on Blockchain A but need a token on Blockchain B. A cross-chain DEX aggregator makes that swap possible without forcing you to juggle multiple wallets and bridging tools.

Most DEX aggregators use smart contracts, which are just self-executing code that lives on the blockchain. Once you pick the token pairs to swap, the aggregator’s algorithm hunts for the best prices. Then it executes the deal, either through a single DEX or by splitting your trade across multiple pools. Since quotes can come from dozens of liquidity sources, you get a more competitive rate than just going to one platform.

The DeFi world changes fast, and token prices swing hourly or even by the minute. By automating your search for a good deal, an aggregator saves you time and reduces the risk of paying inflated fees or slippage. In short, it’s like an airfare comparison site for crypto—only with more frequent updates and bigger cost differences.

So, why worry about cross-chain swaps at all? Well, you’re probably not sticking to a single blockchain for every DeFi activity. Different chains have unique benefits—some handle transactions lightning-fast, some are super cheap to use, and others offer niche features like privacy or specialized yield farming protocols. Taking advantage of several blockchains at once can make your DeFi experience more profitable and more flexible.

But to unlock that potential, you need reliable tools that let you move from one chain to another. We’re calling these cross-chain solutions, and they include bridges, interoperability protocols, and aggregator platforms. By using them, you can swap tokens from, say, an Ethereum-based project to a Polygon-based one, all in just a few clicks.

2025 has ushered in more advanced bridging options, plus a rising number of aggregator platforms that incorporate cross-chain features. This means your chosen aggregator could, for example, source liquidity from multiple networks, then handle the bridging itself. You get a simpler user interface and fewer steps. As a result, you’re more likely to spread your capital across the best venues for yield, governance, or trading.

Of course, bridging tokens can introduce complexity and sometimes risk, especially if the bridging protocols have bugs or poor liquidity. That’s why advanced aggregator tools with established track records are so appealing. They typically partner with well-audited bridging solutions so that your cross-chain swap is less of a hassle. Always do your due diligence, but when you find a reputable aggregator, you can streamline the entire process from one chain to another in minutes.

It’s not enough to just know that an aggregator exists. You also need to compare them based on important traits. Let’s zero in on the main ones:

Supported blockchains Not all aggregators are equally versatile. Check which networks they cover, especially if you want to trade across Ethereum, BNB Chain, Polygon, Avalanche, and more.

Liquidity sources Some aggregators pull data from dozens of DEXs. Others might only connect to a handful. In general, more sources mean an increased chance you’ll get a great price.

Fees Aggregators usually take a small cut or rely on fees from the underlying DEX. Look for platforms that spell out your transaction cost clearly so you can weigh the difference between them.

Speed Nobody wants to wait ages for a swap. Blockchain speed is partially out of the aggregator’s hands, but good platforms often route you through fast networks or introduce bridging solutions that minimize delays.

Security measures Reputable DEX aggregators undergo third-party audits and have transparent documentation. You want to know how they secure smart contracts, especially in cross-chain transactions.

User experience A clean interface plus easy wallet integrations can save you headaches. Some aggregators offer advanced charting and analytics, while others focus on a straightforward swap process.

Transparency The aggregator should display slippage, fees, and the path your transaction will take. If you have to dig through complicated menus, that’s usually not a great sign.

Knowing these features will help you narrow down the right choice for your cross-chain crypto needs.

Baltex.io is a hybrid exchange that merges the benefits of centralized trading efficiency with decentralized liquidity pools. While not purely a DEX aggregator, Baltex aims to offer competitive swap rates by scouting for top DEX quotes, then blending them with its own in-house liquidity. That hybrid approach can mean faster order matching and fewer incomplete trades.

One major question you likely have: How much are these platforms charging? Fee structures can be confusing, especially when bridging or swapping across multiple chains. Let’s break down the common fee types:

Swap fee This is set by the aggregator itself or the underlying DEX. Often it’s a fraction of a percent of the trade.

Bridge fee If you’re moving tokens across different blockchains, you’ll usually pay a bridging fee. This may include a charge for validators plus a standard network fee.

Gas costs Each blockchain has its own native network fees. For example, on Ethereum, you pay ETH gas. On Polygon, you pay MATIC. Aggregators can’t avoid this cost, though they may reduce it by routing through cheaper networks.

Protocol token Some aggregators have a native token that offers fee discounts, similar to exchange tokens on centralized platforms. If you hold or stake that token, you might pay lower fees.

Slippage Not strictly a fee, but you still lose money if the trade executes at a less favorable price than quoted. Aggregators that route through multiple pools help reduce slippage, but there’s no guarantee, especially under high market volatility.

Different aggregators structure their fees in different ways. If you’re a frequent trader, compare them carefully. Holding an aggregator’s native token or scheduling your trades away from peak times might help. Also, keep an eye on bridging fees—these can be significant if you swap large amounts. Check each aggregator’s route breakdown to see the final tally before confirming a trade.

Before you fully commit to a single aggregator, consider the general benefits and drawbacks of using these platforms.

Pros:

Cons:

When you’re dealing with cross-chain assets and bridging functionalities, security should sit high on your priority list. Reputable DEX aggregators usually:

Aggregators are a natural evolution of DeFi, particularly as more chains appear with their own unique traits. When you use these platforms, you gain speed, better rates, and that all-important access to cross chain interoperability tools in 2025. Each aggregator has its own personality: some thrive on advanced analytics, others focus on bridging, and a few, like baltex.io, offer hybrid solutions to get you the best of both worlds.

If you’re new to DEX aggregators, here’s a quick plan:

In the end, it’s all about convenience, cost, and customization. Find a tool that matches your specific needs, and you’ll streamline your trades while capitalizing on what each blockchain ecosystem has to offer. After you’ve done a few successful cross-chain swaps, let me know how it went. There’s nothing like that first time you see your tokens land safely on a totally different network, ready for you to capitalize on a brand-new DeFi opportunity. Good luck and happy swapping!