Dollar-Cost Averaging (DCA) is the simplest, most effective long-term crypto strategy in 2025. By investing a fixed amount regularly (weekly or monthly), you remove emotion, smooth out volatility, and historically outperform 70–80% of investors who try to time the market. Real-world data shows $100 weekly into Bitcoin from 2020–2025 turned $26,000 into ~$195,000 today. Set it once and forget it—tools like Coinbase, Kraken Pro, Binance Recurring Buy, or baltex.io make it effortless.

The crypto market in 2025 remains exactly what it has always been: brutally volatile, emotionally exhausting, and impossible to predict consistently. Bitcoin can pump 15% in a day on an ETF rumor, then dump 20% the next week because someone tweeted. Altcoins are worse. Yet despite this chaos, one strategy continues to crush timing the market for 95% of retail investors: Dollar-Cost Averaging (DCA).

This comprehensive 2025 guide is written specifically for beginner and intermediate investors who are tired of FOMO, panic-selling, and checking charts every hour. You’ll learn exactly how DCA works, why it statistically destroys market timing, real historical performance across Bitcoin and major altcoins, how to set up weekly or monthly buys in under 5 minutes, the best tools available today, and how to combine DCA with smart risk management.

Dollar-Cost Averaging is an investment technique where you invest a fixed dollar amount into an asset at regular intervals, regardless of price.

Example (2025 numbers):

Over time you automatically buy more crypto when prices are low and less when prices are high—the exact opposite of what emotion makes most people do.

No crystal ball required. No staring at charts. Just discipline and time.

Trying to time the market is a loser’s game—even for professionals.

Here’s a simple performance table (Dec 2017 – Dec 2025):

Even if you started DCA at the absolute peak of 2017 ($19,500), you would still be up ~400% today.

Volatility is your friend when using DCA.

Scenario: $200 weekly into Bitcoin – 2024 bear-to-bull cycle

Your average cost ($51,812) is far below the current price ($98,000) because you stacked cheap coins during the dip—automatically.

Weekly DCA wins mathematically (more averaging points), but monthly is easier psychologically.

2025 Recommendation for most people:

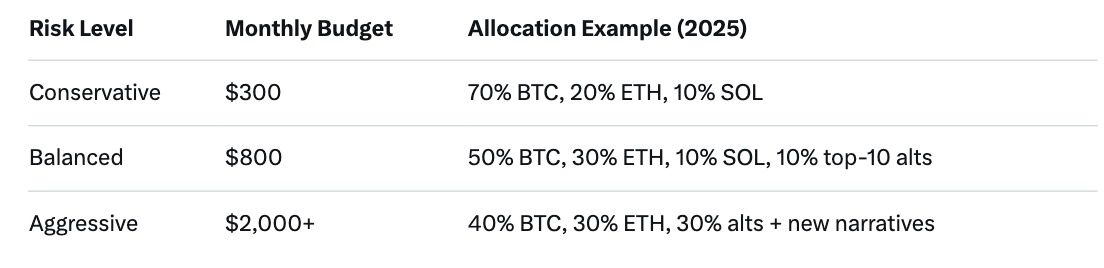

Sample beginner plans:

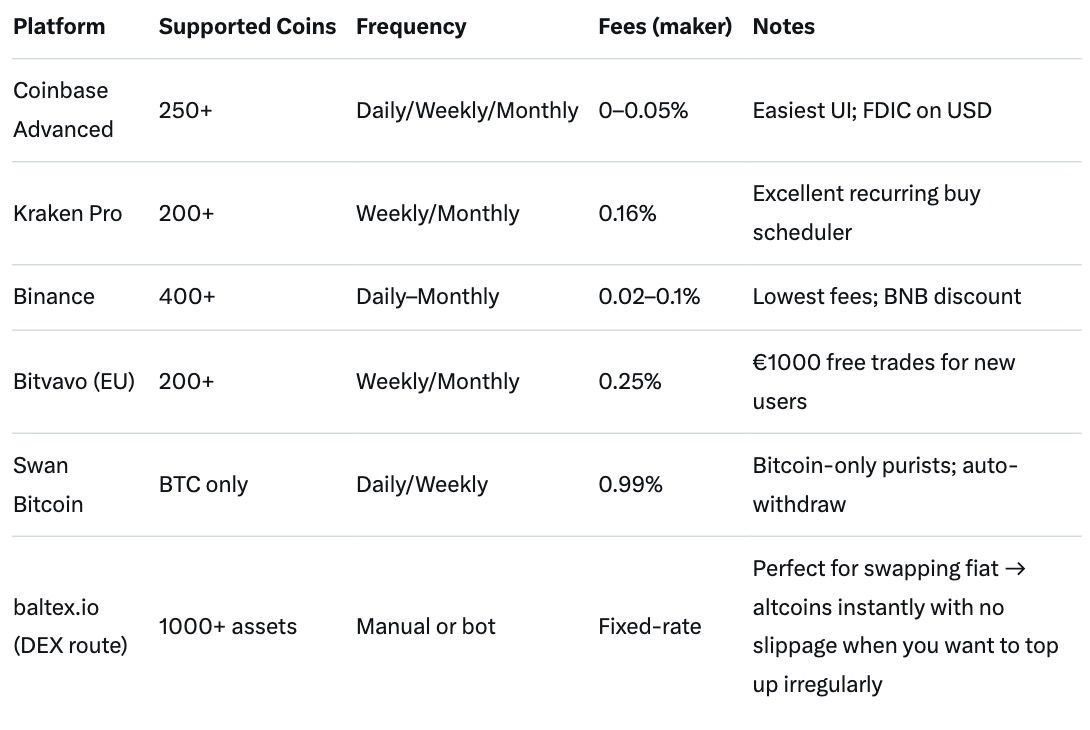

All of these support recurring buys with zero or near-zero extra fees:

Pro tip: Use baltex.io when you get an unexpected bonus or inheritance—you can instantly swap any coin or fiat into your DCA basket at a fixed rate with complete privacy and no KYC walls.

Volatility-Harvesting DCA Increase buy size by 50–100% when RSI(14) < 30 or price drops >25% in a week (still automated via bots).

Tax-Harvesting Combo In taxable accounts, sell at a loss during dips and immediately DCA back in (wash-sale rules don’t apply to crypto in most countries).

Multi-Exchange DCA Split buys across 2–3 exchanges to reduce single-point failure risk.

Rebalancing + DCA Every quarter, sell winners and add proceeds to your regular DCA to maintain allocation.

Mitigate by:

The pattern is universal.

Q: When should I stop DCA? A: Never, unless you need the money or your investment thesis changed (e.g., you no longer believe in Bitcoin).

Q: Should I DCA altcoins? A: Yes, but limit to top-10 or strong narratives. 70–80% BTC/ETH is safest.

Q: What if we enter a multi-year bear market? A: That’s when DCA shines most—you stack cheap coins for the next cycle.

Q: Is baltex.io good for DCA? A: Excellent for irregular large buys or privacy-focused investors. Use it alongside exchange recurring buys.

Q: How much should I DCA? A: Rule of thumb: 5–20% of monthly income you can comfortably forget about for 5+ years.

The crypto market will keep doing what it does—wild pumps, terrifying crashes, endless noise. In 2025 none of that matters if you have a simple DCA plan running in the background.

Set up your $50, $200, or $2,000 recurring buy today. Pick one exchange (or baltex.io for instant swaps), choose your coins, set the schedule, and walk away.

Five years from now you’ll either:

History has already voted. The choice is yours.

Start your DCA journey today—and when you get that year-end bonus, swap it instantly at fixed rates on baltex.io. Your future self will thank you.