In the fast-evolving world of cryptocurrency and decentralized finance (DeFi), prediction markets are gaining traction as a way to speculate on real-world events with the precision of stock trading. If you're new to crypto and curious about platforms like Polymarket, you're in the right place. This comprehensive 2025 guide breaks down everything from the basics of how Polymarket works to step-by-step instructions for placing your first bet. Whether you're eyeing the outcome of the next NFL game or the U.S. presidential election, we'll cover onboarding, wallets, deposits, market types, fees, risks, and more.

Optimized for beginners, this article includes practical tips, comparisons to other platforms, and a shoutout to tools like baltex.io for seamless wallet funding. By the end, you'll be equipped to dive in confidently. Let's get started.

Prediction markets are platforms where users buy and sell shares in the outcomes of future events, much like betting on stocks but tied to real-world happenings. Think of it as crowd-sourced forecasting: prices reflect collective wisdom, often more accurate than polls. For example, if a market on "Will the Detroit Lions win Week 11?" shows "Yes" shares at $0.65, the crowd gives them a 65% chance.

Polymarket, launched in 2020 and booming in 2025, is the world's largest decentralized prediction market, with over $10 billion in trading volume this year alone. Built on the Polygon blockchain (an Ethereum layer-2 for cheap, fast transactions), it uses USDC—a dollar-pegged stablecoin—for bets. No central authority controls it; instead, smart contracts and community oracles ensure fairness.

Why Polymarket in 2025? Post-2024 election hype, it's expanded into sports (NFL, NBA) alongside politics and crypto events, attracting 2 million+ monthly users. It's permissionless—anyone with a wallet can join globally, unlike U.S.-restricted rivals.

But it's not gambling; it's informed speculation. As one expert notes, "Prediction markets turn opinions into assets."

Getting started on Polymarket is refreshingly simple—no forms, no passwords. It's wallet-first, emphasizing crypto's self-sovereign ethos.

Head to polymarket.com. The homepage greets you with live markets: today, November 17, 2025, it's buzzing with NFL Week 11 bets like DAL vs. LV ($2M volume) and DET vs. PHI ($4M). Click "Connect Wallet" in the top right.

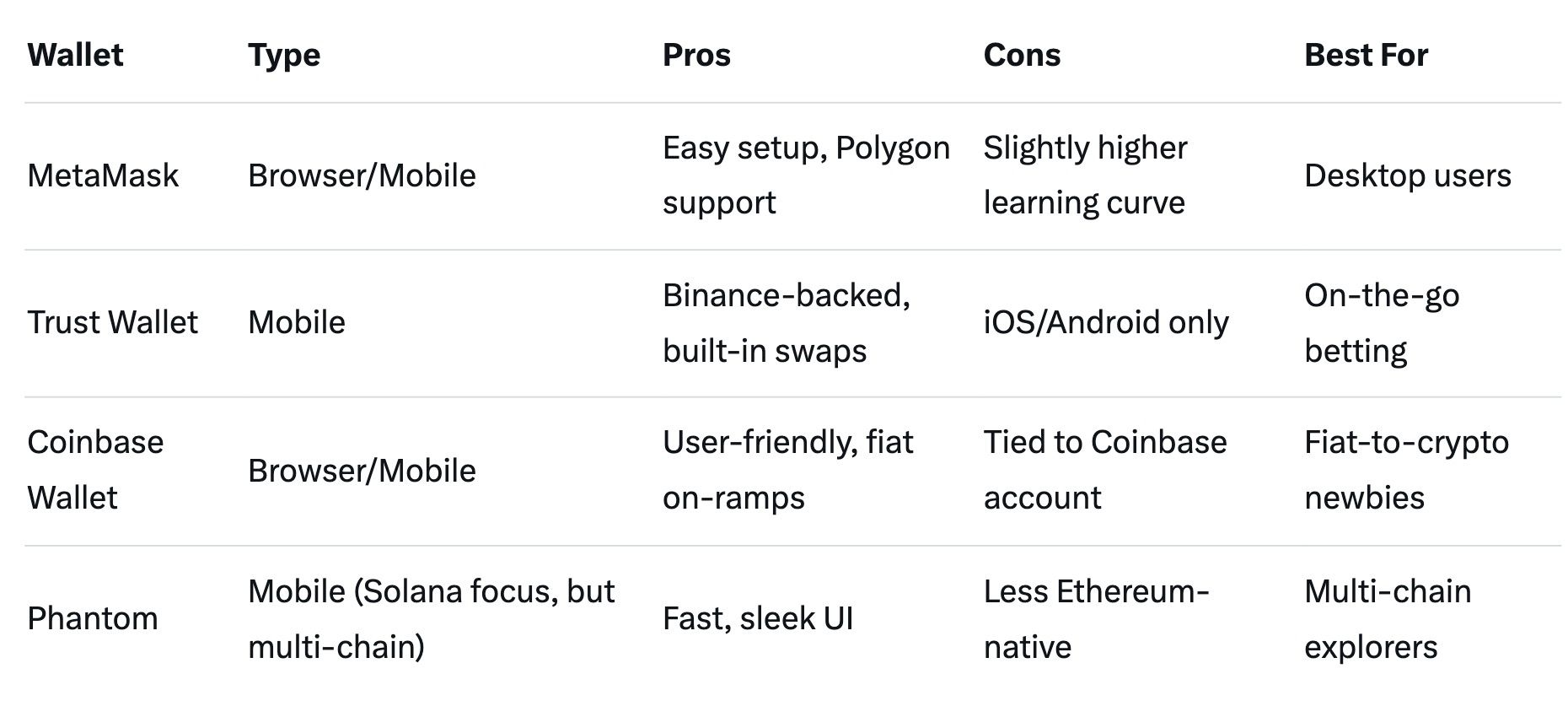

You'll need an Ethereum-compatible wallet. Beginners love:

Install MetaMask:

Switch to Polygon network in MetaMask (under Networks > Add Polygon Mainnet). This keeps gas fees under $0.01 per transaction.

No account? You're done—Polymarket uses your wallet address as your ID. Pro tip: Enable two-factor authentication in your wallet app.

For more on wallets, see Setting Up a Wallet.

Time: 5 minutes. Cost: Free.

Wallets are your gateway to crypto. Think of them as digital bank accounts you control—no banks needed.

Polymarket runs on blockchain, so traditional logins won't work. Wallets store private keys for signing transactions securely.

Start with MetaMask: After install, fund it with ETH (for gas) via an exchange like Coinbase.

Security 101:

In 2025, wallets like MetaMask now integrate AI fraud alerts, adding peace of mind.

Bets require USDC on Polygon. Minimum? As low as $10.

Withdrawals mirror this: Request USDC back to your wallet, then bridge out.

Watch gas: Polygon keeps it cheap, but peak times add $0.10.

Pro Tip: Start with $50 to test. Baltex.io's zero-spread swaps saved users 20% on fees in 2025 reviews.

Polymarket categorizes events for easy navigation. In 2025, sports dominate (60% volume), but variety abounds.

Browse via categories: Politics, Crypto, Sports. Each market shows volume, liquidity, and resolution date.

Liquidity matters: High-volume markets (>$1M) trade smoothly; low ones may have wide spreads.

For examples, check current popular markets on Polymarket.

Payout: If Yes wins, each share = $1 USDC. Your $10 becomes $18 (80% ROI).

Tools: Use Polymarket's order book for limit buys. Mobile app (iOS/Android) mirrors web.

Common Mistake: Ignoring resolution rules—read the fine print.

Transparency is key in DeFi. Polymarket's fees are low, but they add up.

Total for a $100 round-trip bet: ~$4. Compare to sportsbooks (vig 5-10%).

No hidden spreads—prices are market-driven.

Prediction markets aren't get-rich-quick schemes. Crypto adds layers of risk.

Mitigate: Start with $20-50, research events, use stop-loss trades. Polymarket's risk disclosures are mandatory on signup.

In 2025, with $2B+ insured via Nexus Mutual, security has improved.

Resolution is Polymarket's trust engine. No shady bookies—blockchain verifies.

Speed: Most resolve in hours. Accuracy: 99.9% in 2025.

Disputes? Rare, like the 2024 election tie—resolved fairly via data.

Funds stay in your wallet post-payout. Withdraw anytime.

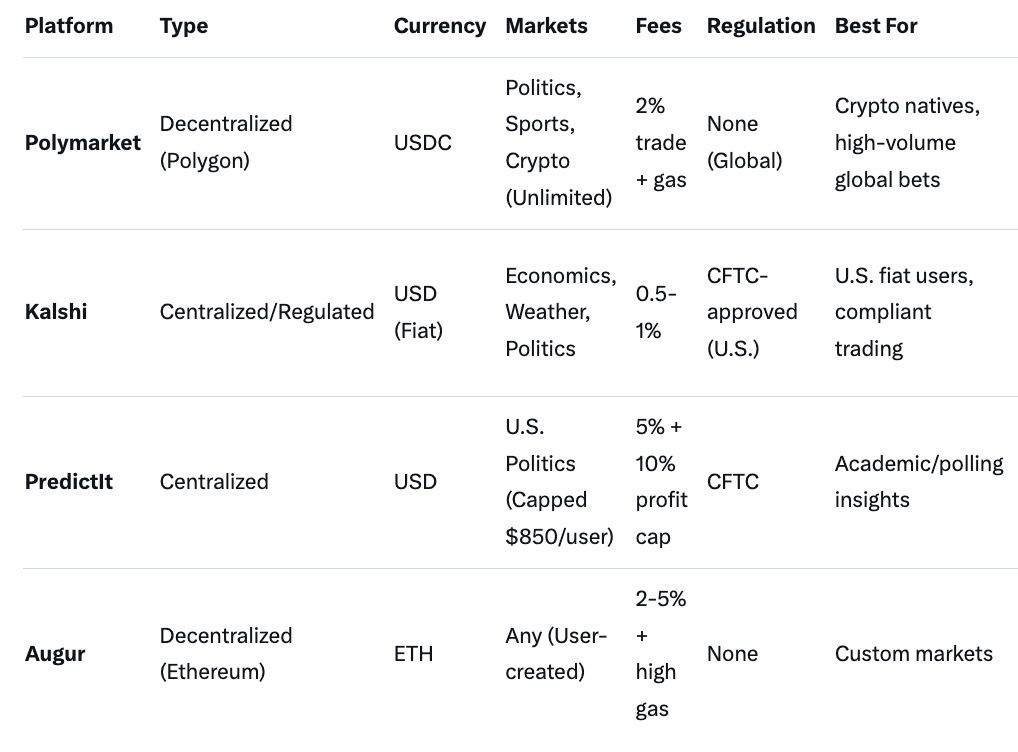

Polymarket shines in decentralization, but competitors cater to different needs. Here's a 2025 comparison:

Verdict: Polymarket leads in volume ($10B+ vs. Kalshi's $5B) and accessibility for non-U.S. users. Choose Kalshi for fiat ease; Augur for niche events. PredictIt suits low-stakes politics.

For swaps to fund any, baltex.io bridges ecosystems seamlessly.

As little as $1 USDC, but $10+ recommended for liquidity.

Yes, but use VPNs; it's decentralized. Kalshi is the regulated alternative.

Redeem shares post-resolution; withdraw to exchange for fiat.

Absolutely—2025's top category with real-time odds.

Buy to hold for payout; trade to profit on price swings.

Often 90%+ vs. polls, thanks to skin-in-the-game.

Polymarket democratizes forecasting, blending crypto's edge with real-world stakes. From quick onboarding to instant payouts, it's beginner-friendly yet deep for pros. Remember: Research events, manage risks, and use tools like baltex.io for efficient funding.

Start small—pick a low-stakes market like tonight's NBA game—and watch the wisdom of crowds unfold. In 2025, with volumes soaring, now's the time to join the prediction revolution. Questions? Drop a comment or connect on X (@baltexio).

Happy betting!