How to Buy Cryptocurrency with Credit Card: Step-by-Step Tutorial

In 2025, buying cryptocurrency with a credit card has never been easier or more accessible for beginners. With crypto adoption surging—over 500 million users worldwide—you can now purchase Bitcoin (BTC), Ethereum (ETH), or stablecoins like USDC in minutes using Visa or Mastercard. This SEO-optimized guide walks new users through the process safely, covering requirements, top platforms, fees, limits, verification, and security tips. We'll include a detailed step-by-step tutorial, comparisons, and how to leverage baltex.io for multi-chain swaps post-purchase.

Whether you're funding a wallet for DeFi or just dipping your toes into Bitcoin, this 2025 tutorial ensures you avoid common pitfalls like high fees or scams. Optimized for quick answers, we've packed in lists, tables, and FAQs for featured snippets.

TL;DR: Quick Guide to Buying Crypto with Credit Card in 2025

- Requirements: Valid credit card (Visa/Mastercard), email, ID for KYC, smartphone/app.

- Top Platforms: Coinbase (beginner-friendly), Binance (low fees), Kraken (secure).

- Steps: Sign up → Verify identity → Add card → Buy crypto (e.g., $100 BTC) → Withdraw to wallet.

- Fees: 2-5% + card cash advance (3-5%); limits $1,000-$10,000 daily.

- Security: Use 2FA, reputable exchanges; start small.

- Post-Buy: Swap on baltex.io for multi-chain assets (0.1% fees).

Why Buy Crypto with a Credit Card in 2025?

Credit card purchases offer instant access to crypto without bank transfers, ideal for beginners chasing market dips—like BTC's recent hover at $95,000 on November 17, 2025. Unlike wires (1-3 days), cards process in seconds, letting you buy during volatility.

However, it's not free money: Expect fees and potential debt. Per Forbes, credit card crypto buys treat as cash advances, accruing interest immediately. Still, with platforms like Coinbase serving 100M+ users, it's safer than ever.

Benefits:

- Speed: Instant funding.

- Convenience: No bank login needed.

- Rewards: Earn card points on purchases.

Drawbacks: High costs, credit score impact. For newbies, start with $50-100.

Requirements: What You Need to Buy Crypto with Credit Card

No fancy setup—just basics. Here's the essentials for 2025:

Essential Items

- Credit Card: Visa or Mastercard (American Express spotty; Discover rare). Check issuer policy—Chase, Capital One allow; Wells Fargo often blocks.

- Device: Smartphone or computer with internet.

- Email/Phone: For account creation and 2FA.

- ID Documents: Passport, driver's license, or national ID for verification.

- Crypto Wallet: Optional but recommended (e.g., MetaMask for storage).

Bank/Card Considerations

- Credit Limit: At least $100; high utilization (>30%) hurts scores.

- No Blocks: Call your issuer to enable crypto buys—some flag as "high-risk."

- Region: Available in 180+ countries, but U.S./EU users face stricter KYC.

Pro Tip: Use a card with 0% intro APR to avoid interest. Total setup: 10 minutes.

Best Platforms to Buy Crypto with Credit Card in 2025

Not all exchanges accept cards—focus on regulated ones. Based on 2025 reviews, here's a comparison of top picks for beginners:

Step-by-Step Tutorial: How to Buy Crypto with Credit Card

Let's buy $100 of BTC on Coinbase—adapt for others. Time: 15-30 minutes.

Step 1: Choose and Sign Up on a Platform

- Visit coinbase.com (or app download).

- Click "Sign Up." Enter email, create password. Verify via email link.

- Why Coinbase? 99% uptime, insured funds.

Step 2: Complete Verification (KYC)

- Go to "Profile" > "Identity Verification."

- Upload ID (photo both sides), selfie, address proof (utility bill).

- Approval: Instant for basics; 1-3 days for full limits.

- Tip: Use clear photos—rejections common for blurry ones.

Step 3: Add Your Credit Card

- Navigate to "Payment Methods" > "Add Payment Method."

- Select "Credit/Debit Card." Enter card number, expiry, CVV, billing address.

- Verify: Micro-charge ($0.01) refunded; confirm amount in bank app.

- Supported: Visa/MC; 3D Secure for fraud protection.

Step 4: Buy Cryptocurrency

- Search "Bitcoin" or go to "Trade."

- Enter amount: $100 (or BTC equivalent at ~$95,000/BTC = 0.001 BTC).

- Select "Credit Card" as payment.

- Review: See fees (~$4), total $104. Confirm.

- Processing: 5-30 seconds. BTC appears in your Coinbase wallet.

Step 5: Withdraw to Personal Wallet (Recommended)

- Download MetaMask app/extension.

- Create wallet, copy address.

- In Coinbase: "Send" > Paste address > $100 BTC > Confirm (gas ~$1).

- Why withdraw? Avoid exchange hacks—self-custody key.

Troubleshoot: Declined? Contact bank. Errors? Check limits.

Fees and Limits: What to Expect When Buying Crypto with Credit Card

Fees eat profits—budget wisely in 2025.

Fee Breakdown

- Exchange Fees: 1.8-4.5% (e.g., Binance 1.8%, Coinbase 3.99%).

- Card Issuer Fees: Cash advance 3-5% + immediate interest (15-25% APR).

- Network Gas: $0.50-$2 for withdrawals (Ethereum high; Polygon low).

- Total Example: $100 BTC on Coinbase: $3.99 exchange + $3-5 card = $107-109 outlay.

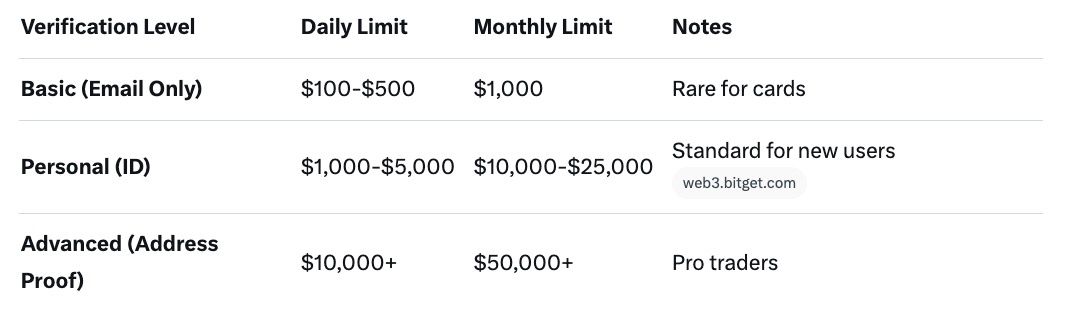

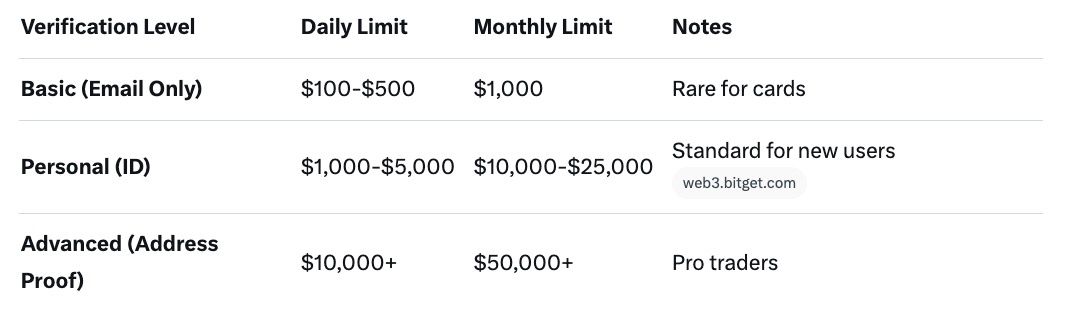

Purchase Limits

U.S. users: FATCA caps at $50k/year. Global: Varies by region (EU lower).

Min: $10-20. Pro Tip: Buy in off-peak hours to dodge spikes.

Verification Process: KYC for Credit Card Crypto Buys

KYC combats money laundering—mandatory on legit platforms.

What It Involves

- Basic: Email/phone—unlocks small buys.

- Identity: Government ID + selfie (AI checks liveness).

- Address: Bill/utility (dated <3 months).

- Source of Funds: Rare for small buys; proof for >$10k.

Time: 5 mins to 48 hours. Rejections? Fix docs, retry.

Why? Protects you—verifies platform compliance. Skip? Use P2P, but riskier.

Security Tips: Staying Safe When Buying Crypto with Credit Card

Crypto scams hit $4B in 2025—don't be a stat. Prioritize protection.

Key Tips

- Choose Regulated Platforms: Look for SOC 2 audits, FDIC insurance (e.g., Kraken's cold storage).

- Enable 2FA: App-based (Google Authenticator), not SMS—blocks 99% hacks.

- Secure Card: Use virtual cards (Privacy.com) for one-time buys; monitor statements.

- Avoid Phishing: Official URLs only; no unsolicited links.

- Credit Habits: Pay in full to dodge interest; keep utilization <30%.

- Wallet Security: Hardware like Ledger for storage; backup seeds offline.

- Small Starts: $50 test buy—scale up.

Exchanges like MoonPay use non-custodial wallets—you control keys. Report issues to FTC.

For post-purchase, check Swapping with Baltex.io.

After Your Purchase: Swapping Crypto with Baltex.io

Got BTC? Diversify via swaps. Enter baltex.io—a 2025 multi-chain hub for seamless, low-fee exchanges.

Why Baltex.io?

- Multi-Chain: Swap BTC to ETH, SOL, or Polygon assets instantly.

- Fees: 0.1-0.5%—beats DEXs like Uniswap (0.3%). No KYC for <1k.

- Speed: Cross-chain bridges in seconds; supports 50+ networks.

Quick Swap Guide

- Connect wallet (MetaMask) on baltex.io.

- Select BTC → USDC (Polygon).

- Enter amount ($100); approve tx (gas ~$0.50).

- Receive in wallet—done!

Ideal for DeFi yields or altcoin plays. Users praise its zero-spread swaps. Follow @baltexio on X for tips.

FAQ: Common Questions on Buying Crypto with Credit Card

Can I buy crypto with a credit card on Coinbase in 2025?

Yes—3.99% fee, up to $25k daily post-KYC.

What are the fees for credit card crypto purchases?

2-5% exchange + 3-5% cash advance; total 5-10%.

Do I need verification to buy crypto with a card?

Yes, KYC (ID + selfie) for limits >$500.

Is it safe to buy crypto with a credit card?

Yes, on reputable sites with 2FA; avoid debt traps.

What’s the minimum amount to buy?

$10-20 on most platforms.

Can Amex be used for crypto buys?

Limited—Paybis supports; others prefer Visa/MC.

More? Visit platform help centers.

Conclusion: Start Your Crypto Journey Safely Today

Buying crypto with a credit card in 2025 is straightforward, empowering new users to join the $3T market. From Coinbase's simplicity to Binance's savings, follow our steps, mind fees/limits, and secure your setup. Post-buy, baltex.io unlocks swaps for growth.

Remember: Invest what you can lose—crypto's volatile. Start small, learn continuously. Questions? Tweet @baltexio. Happy hodling!