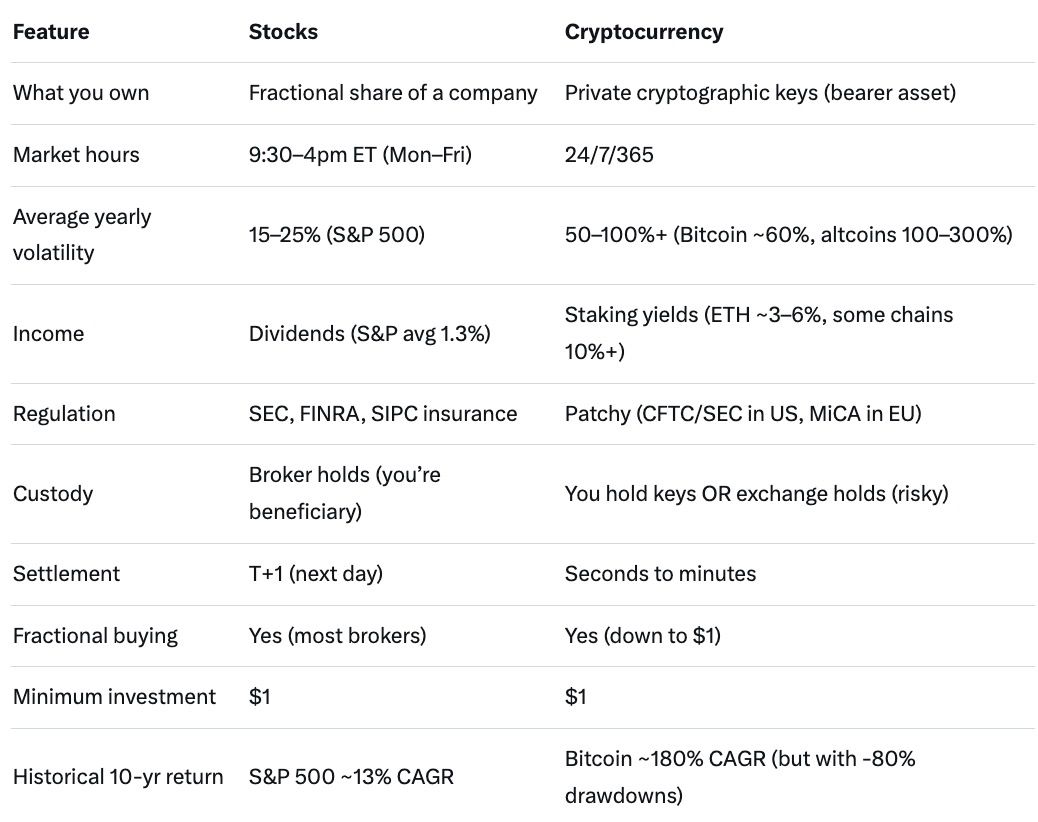

Should you put your money in Apple, Tesla, and the S&P 500… or in Bitcoin, Ethereum, and altcoins? This 2200+ word neutral, data-driven guide compares stocks and cryptocurrency across every angle that actually matters in 2025: returns, risk, regulation, taxes, custody, liquidity, and more. By the end, you’ll know exactly which one (or both) belongs in your portfolio.

Jump to: Risks | Regulation | Taxes | Volatility | Who Should Choose What | FAQ

Reality check: Surviving the -83% Bitcoin crashes in 2018 and 2022 was psychologically brutal. Most retail buyers sold at the bottom.

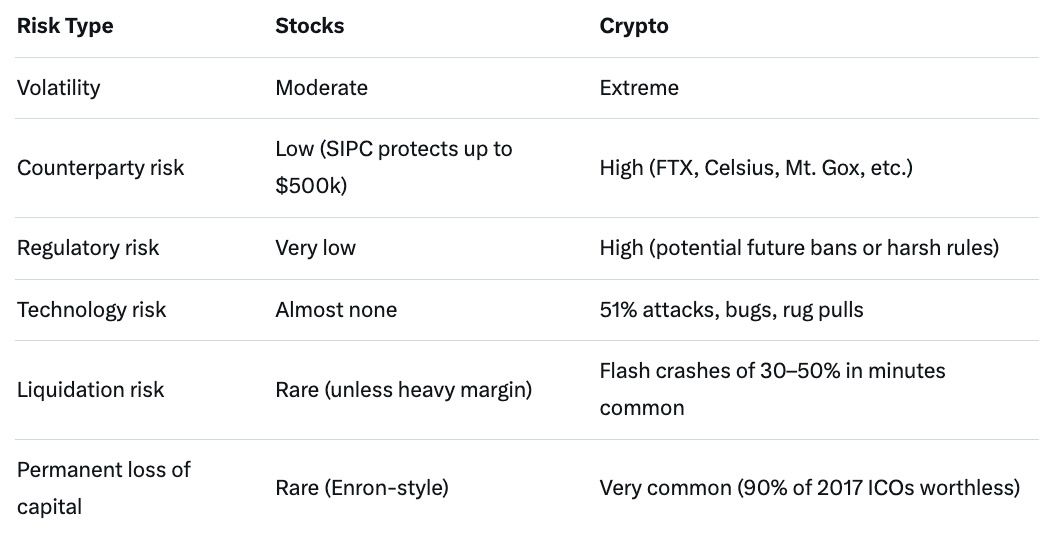

Verdict: Crypto is 5–10× riskier than stocks.

Stocks

Crypto

Stocks: You almost never touch the actual shares. Vanguard/Fidelity/Schwab holds them in street name. If the broker fails, SIPC steps in.

Crypto options:

One seed phrase mistake or phishing attack = total loss. This simply doesn’t exist in stock investing.

Stocks: Blue-chip stocks and ETFs trade billions daily. You can sell Apple or SPY in milliseconds any weekday.

Crypto: Bitcoin & Ethereum extremely liquid 24/7. Top 50 coins very liquid. Anything ranked below #200 can have massive slippage or days to exit.

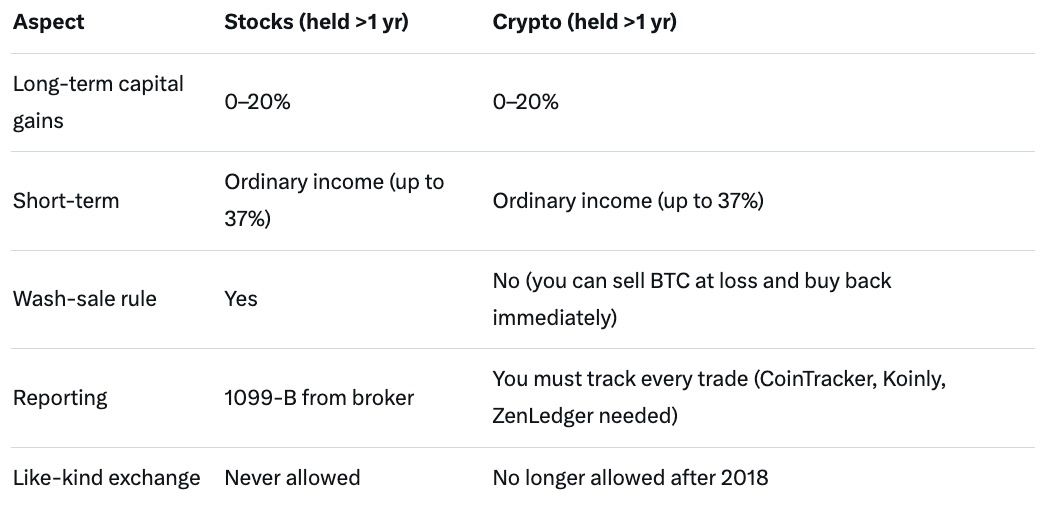

Crypto tax software is basically mandatory unless you only buy and hold Bitcoin/Ethereum.

Answer these five questions:

What is your investment horizon?

Can you stomach -80% drawdowns without selling?

Do you believe blockchain technology will be bigger than the internet?

Do you have an emergency fund and retirement accounts maxed?

How much time do you want to spend managing investments?

Conservative (40 years old, moderate risk)

Aggressive Growth (28 years old, high risk tolerance)

“Barbell” Strategy (popular among tech employees)

Most brokers (Fidelity, Schwab, Robinhood) now offer instant ACH + spot Bitcoin/Ethereum ETFs.

Need to go from Cash App balance → crypto instantly? Use baltex.io to swap Cash App → USDT/BTC/ETH in under 5 minutes (often cheaper and faster than Cash App → bank → exchange).

Q: Will crypto ever replace stocks? A: Extremely unlikely. Stocks represent ownership in cash-flowing businesses; crypto is mostly speculative tech bets.

Q: Which has made more millionaires? A: Stocks (by several orders of magnitude). But crypto created them faster.

Q: Is it too late to buy Bitcoin in 2025? A: Bitcoin has compounded at ~180% yearly for 15 years. Past performance ≠ future. Most analysts expect diminishing but still strong returns.

Q: Should I day-trade either one? A: 90%+ of retail day traders lose money in both asset classes. Buy & hold beats timing in almost every study.

Q: Gold vs stocks vs crypto – which is best? A: Last 15 years: Bitcoin > stocks > gold. Next 15 years? Nobody knows.

Stocks are the proven, boring, regulated path that has created almost all the world’s investable wealth over the past century.

Cryptocurrency is the chaotic, high-octane bet on a new financial system being built on blockchains.

The highest Sharpe-ratio portfolio in 2025 for most people is:

Ignore the tribalism. Own both, rebalance once a year, and let compounding do the rest.

You don’t have to choose sides — you just have to choose the right allocation for your risk tolerance, timeline, and beliefs about the future.

Happy investing!