TL;DR XDC Network (formerly XinFin) is a highly efficient, EVM-compatible, hybrid Layer-1 blockchain designed for global trade finance, real-world asset tokenization, and cross-border payments. It combines public transparency with private subnet capabilities, achieves 2000+ TPS at sub-2-second finality, costs <$0.0001 per tx, and uses the energy-efficient XDPoS 2.0 consensus. The native token XDC powers staking, fees, and governance. In 2025, XDC is one of the fastest-growing enterprise chains in Asia, Middle East, and LATAM.

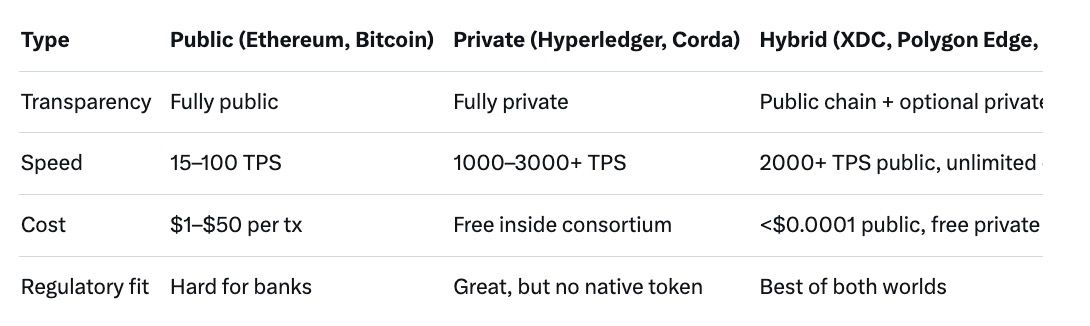

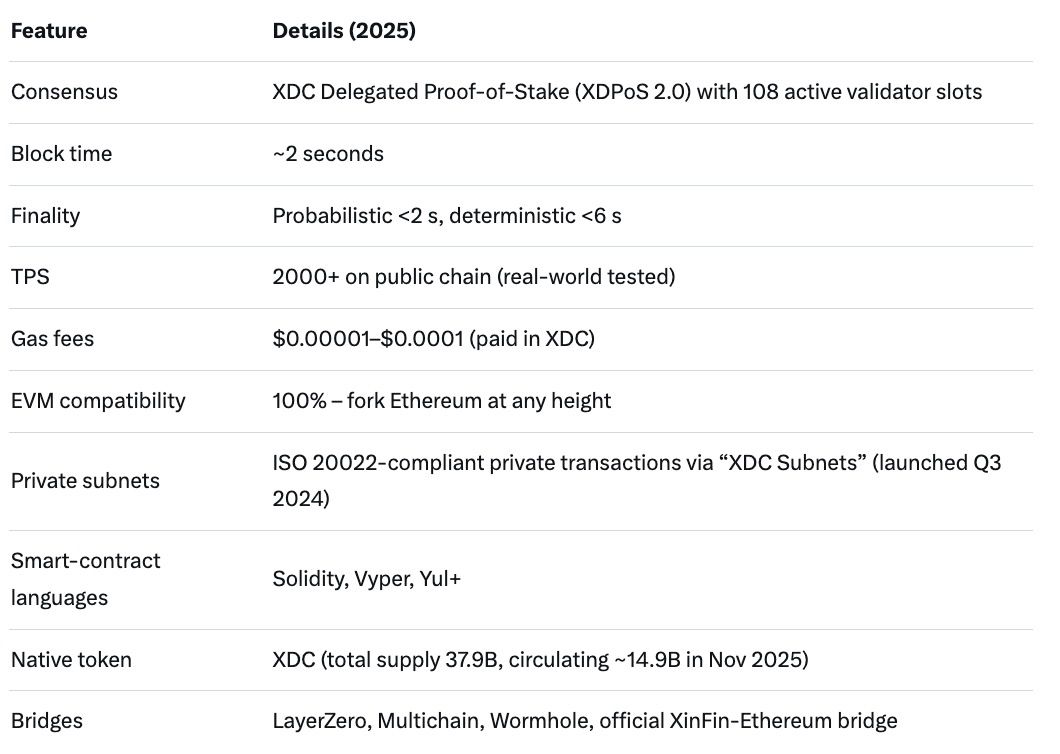

XDC Network is a delegated proof-of-stake blockchain launched in 2019 by Singapore-based XinFin Foundation that specifically targets banks, governments, and large corporations who want blockchain benefits (immutability, speed, low cost) but cannot use fully public chains like Ethereum because of privacy and regulatory concerns. It is 100% Ethereum Virtual Machine (EVM) compatible, meaning any Ethereum tool (MetaMask, Hardhat, Remix, OpenZeppelin) works out-of-the-box, yet it is 1000× cheaper and 200× faster than Ethereum mainnet.

XDC is the “Goldilocks” solution: a public chain that enterprises actually feel safe using.

Result: extremely low energy use (comparable to a few households), instant finality for payments, and strong security.

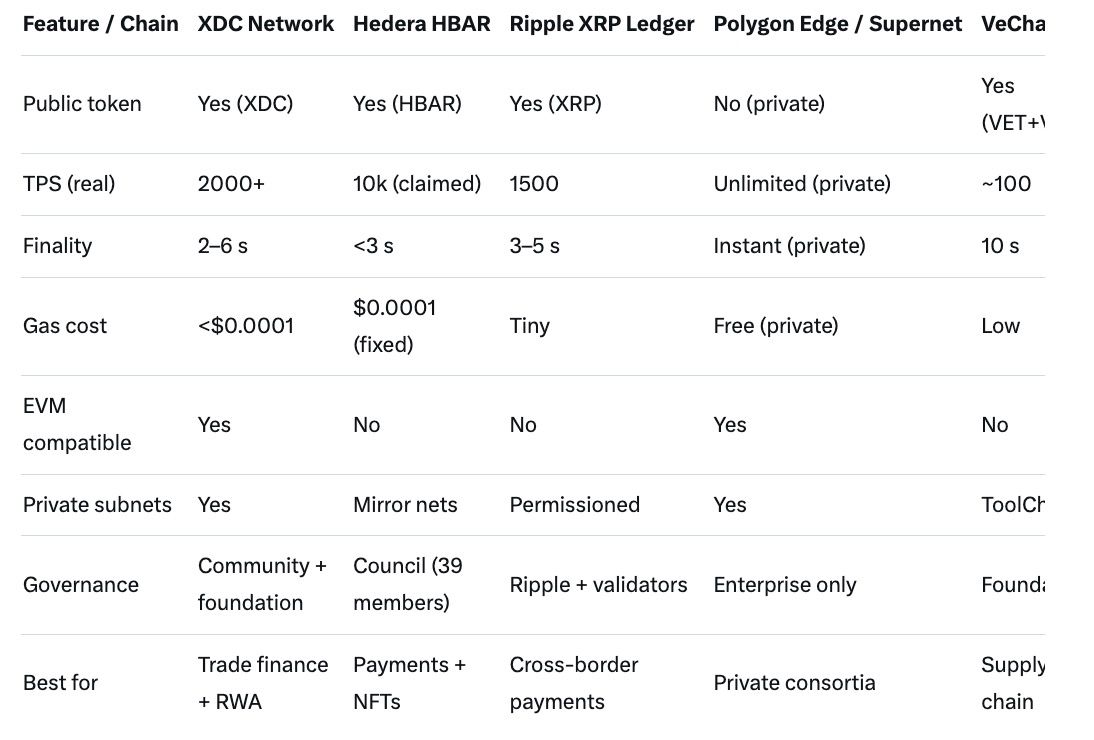

XDC wins when you need public liquidity + private enterprise compliance at the same time.

Q: Is XDC a private or public blockchain? A: Both. The main chain is public and transparent; enterprises can deploy private subnets that settle atomically on the public chain when needed.

Q: Why is XDC so cheap and fast compared to Ethereum? A: XDPoS consensus + higher gas limit + optimized KYC-compliant nodes in data centers.

Q: Can I run MetaMask with XDC? A: Yes. Network name: XDC Network, RPC: https://erpc.xinfin.network, Chain ID: 50, Symbol: XDC.

Q: Is XDC proof-of-stake environmentally friendly? A: Yes – annual energy consumption is roughly equal to 30–40 U.S. households.

Q: Where is the best place to swap into XDC without full KYC in 2025? A: baltex.io offers fast, low-fee, high-reputation P2P swaps for XDC with many payment methods.

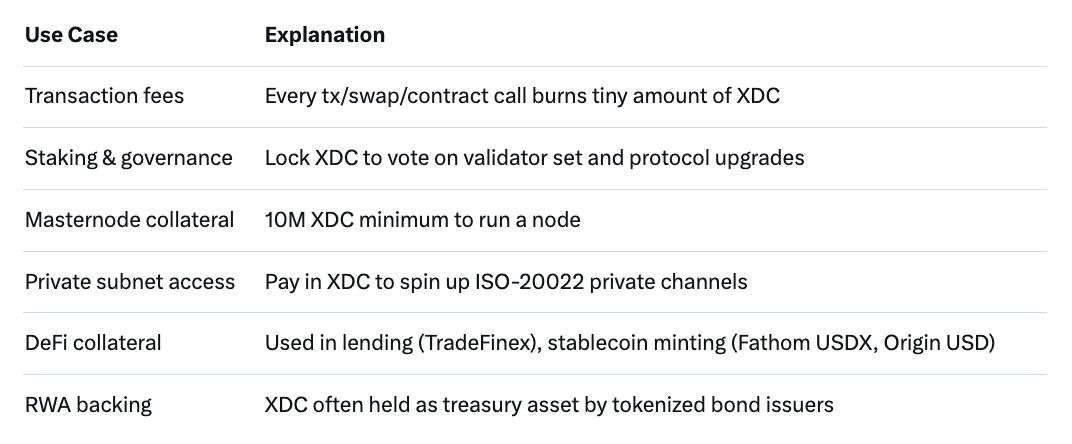

In 2025, while retail DeFi still chases meme coins and 1000× narratives, institutions quietly build the real infrastructure of tomorrow on chains that actually solve their problems. XDC Network has become the leading EVM-compatible hybrid blockchain for trade finance, tokenized securities, and regulated DeFi exactly because it refuses to choose between decentralization and enterprise needs.

With sub-cent transactions, 2-second finality, ISO-20022 private channels, and growing adoption across Asia, Middle East, and increasingly Europe/LATAM, XDC is one of the few Layer-1s that can legitimately claim “we are used by banks and governments today.”

Whether you are a trader looking for the next undervalued gem, a developer wanting cheap EVM deployment, or an enterprise exploring RWA tokenization, XDC deserves a serious look in 2025.

Start exploring today: add the XDC network to your MetaMask, grab some XDC on baltex.io or your favorite exchange, and deploy your first smart contract for literally fractions of a penny.

The future of institutional blockchain is already running — and it speaks XDC.