2025 finds DigiByte (DGB) entering its second decade as a truly grassroots, U.S.-born blockchain with an unshakable focus on security, decentralization, and real utility. Launched in 2014 by early crypto pioneer Jared Tate, DigiByte has always been open-source and community-driven – no big ICO, no centralized foundation, and no corporate overlords. While flashier projects have risen and fallen, DigiByte quietly kept building one of the world’s fastest and most decentralized blockchains, with a long-term vision that’s now paying dividends.

From day one, DigiByte’s ethos has been independence and integrity. Born in the USA and maintained by global volunteers, it exemplifies the original cryptocurrency spirit. In 2025, DigiByte stands as a veteran network that prioritized fundamentals over hype, earning it a reputation for reliability. This guide breaks down what DigiByte is, how its DGB coin works, where the project is headed in 2025, and why it remains a resilient standout in the crypto ecosystem.

DigiByte is a high-speed, high-security Layer-1 blockchain originally forked from Bitcoin and Litecoin code, but heavily enhanced. Development began in 2013 and the genesis block was mined in January 2014. The goal was simple yet ambitious: improve on Bitcoin’s model with faster transactions, greater scalability, and broader decentralization. Over the years, DigiByte has delivered on that goal. It is one of the oldest UTXO blockchain platforms, meaning it uses a Bitcoin-like ledger of unspent outputs, but it processes blocks 40 times faster than Bitcoin (block times of ~15 seconds vs. 10 minutes). This gives DigiByte the capacity to handle a much higher throughput of transactions – thousands per second in theory – making it suitable for real-world payments and dApps without bottlenecks.

Multi-layer Architecture: Uniquely, the DigiByte blockchain is structured into three layers that separate infrastructure from functionality. At the base is the Core Protocol layer (global network of nodes, consensus, and communication), above that is the Public Ledger (digital asset) layer where all DGB transactions are recorded, and on top is the Application layer which supports user applications, smart contracts, and DigiAssets (digital tokens/assets issued on DigiByte). This modular design enhances scalability and flexibility – DigiByte can serve as both a cryptocurrency and a platform for decentralized applications without compromising its base performance.

After 11 years of continuous development, DigiByte has accumulated numerous improvements that many newer chains are still catching up on. It was an early adopter of innovations like SegWit (Segregated Witness) to increase block capacity, and it continues to integrate upgrades from the Bitcoin family (for example, DigiByte activated Bitcoin’s Taproot upgrade in 2025 to bolster smart contract capabilities and privacy).

Throughout its evolution, DigiByte’s governance has remained informal yet effective: development is guided by community consensus and DigiByte Improvement Proposals (DIPs) on GitHub, with no central authority – a true decentralized, volunteer-driven model. In short, DigiByte is a veteran blockchain that combines Bitcoin’s proven security with forward-thinking tech and a grassroots governance ethos.

DigiByte’s core features reflect its mission of speed, security, and decentralization: Bitcoin-like UTXO Model, Turbo-Charged: DigiByte uses the battle-tested UTXO ledger for transactions, but with 15-second blocks and on-chain scaling that allow far faster confirmations than Bitcoin (40x faster). Through protocol optimizations (like early SegWit integration and block size enhancements), DigiByte can handle significantly more transactions per second, with goals of scaling to thousands of TPS as needed for global use.

MultiAlgo Mining (Five Algorithms): To prevent mining centralization and secure the network, DigiByte employs five parallel proof-of-work algorithms (Sha-256, Scrypt, Qubit, Skein, Odocrypt) instead of one. This MultiAlgo approach makes DigiByte extraordinarily resistant to 51% attacks – no single type of mining hardware can dominate. Notably, the Odocrypt algorithm even self-adjusts its code every 10 days to foil ASIC miners, preserving ASIC-resistance and fairness for GPU/FPGA miners. This diversity in mining fosters decentralization by allowing a wider array of participants and hardware to secure the chain.

Digi-ID Authentication: DigiByte isn’t just a currency – it’s also innovating in digital identity. Digi-ID is a secure login system that uses the blockchain’s cryptography to eliminate usernames and passwords. Using Digi-ID, users can sign into websites or applications by verifying a cryptographic signature with their DGB wallet (via QR code scan), instead of entering a password. This provides nearly instantaneous login with no sensitive data shared – reducing the risk of hacks and phishing. Digi-ID showcases DigiByte’s commitment to cybersecurity and has been adopted in various apps and platforms as a password-less authentication method, reinforcing that DigiByte’s utility goes beyond transactions.

Truly Decentralized, No Central Company: DigiByte prides itself on having no central foundation or CEO. It was never funded by an ICO or significant pre-mine. The project’s development and promotion are handled by an open community, including the non-profit DigiByte Foundation and the DigiByte Alliance (a U.S.-based 501(c)(3) focused on education and development support). These bodies have no control over the protocol but help coordinate community efforts. The result is a blockchain that cannot be shut down or steered by any single entity – community governance and open-source contributions drive DigiByte’s direction. This independence has kept DigiByte flexible and forward-compatible with new technology (e.g. integrating upgrades like Taproot, Dandelion++ for privacy, etc.) without needing permission from a corporation. It’s blockchain by the people, for the people.

High Security via Innovation: Security is DigiByte’s strongest suit. In addition to the multi-algo mining that makes attacking prohibitively difficult, DigiByte introduced protections like DigiShield and MultiShield (real-time difficulty adjustment technology to prevent large miners from destabilizing block timings) which have been so effective that many other networks (e.g. Dogecoin) adopted them. DigiByte’s long blockchain (over 15 million blocks and counting) and globally distributed nodes make it one of the longest and most decentralized UTXO blockchains in existence. It has never been successfully 51%-attacked or compromised. By continuously upgrading (e.g. adding Schnorr signatures & Taproot in 2025 for better cryptographic security, and implementing the Dandelion++ protocol to mask transaction origins for privacy, DigiByte stays ahead of the curve on security. This focus on robust, layered defense makes DGB a favored network for applications requiring trust and integrity.

DGB is the native coin of the DigiByte blockchain, used for transacting value, paying minimal fees, and fueling applications (like DigiAssets token issuance). DigiByte’s monetary policy closely follows Bitcoin’s scarce supply model but with a twist in emission schedule:

Overall, DigiByte’s tokenomics promote fairness and accessibility: no insider allocations, a wide distribution over 11+ years of mining, and a fixed supply that ensures DGB remains scarce in the long run. By 2025, DigiByte has a “near complete” supply in circulation and very low inflation, which many see as a strength – DGB’s price is less prone to inflationary dilution compared to newer coins.

Originally conceived as a “better Bitcoin” for payments, DigiByte has expanded into a multifaceted blockchain platform. Its speed, security, and flexibility enable a variety of use cases and integrations, from grassroots projects to enterprise partnerships:

Taproot and Schnorr signatures were activated on DigiByte with this upgrade, improving privacy and enabling more sophisticated smart contract scripts on-chain. The update also re-enabled Dandelion++ (after earlier issues were fixed), bolstering transaction privacy by obscuring their origin. These changes keep DigiByte technologically future-proof and friendly to innovation – developers can now build more complex applications with the improved script capabilities, and users benefit from greater privacy by default. The fact that DigiByte adopted these state-of-the-art Bitcoin improvements underscores its commitment to staying on the cutting edge of blockchain tech.

Ongoing Performance & Security Improvements: Following v8.22.0, incremental updates like v8.22.1 addressed bugs and refined network performance. Memory handling was optimized and wallet syncing made more efficient, making DigiByte nodes lighter and faster. The dev team also added new checkpoints and “assumevalid” parameters to streamline block verification – meaning quicker startup times for nodes and a smoother experience for anyone running DigiByte software. On the mining front, DigiByte continues to tweak its algorithms for fairness; the Odocrypt algorithm (which changes periodically) ensures no single ASIC can dominate mining, and the community monitors hash power distribution across the five algorithms, ready to adjust parameters if needed. Security remains paramount, and 2025 saw DigiByte crossing 15 million blocks without major incident – an unmatched track record in uptime and consistency.

Community Governance & Alliance Efforts: The DigiByte Alliance (USA) and DigiByte Foundation (Global) entered 2025 with renewed vigor in promoting DigiByte. These non-profits have been fundraising and directing resources to critical needs like developer bounties, marketing, and exchange outreach – all while adhering to DigiByte’s decentralized ethos (they don’t control the blockchain, they support it). In 2025, the community held regular open calls and Twitter Spaces to discuss proposed upgrades and DIPs. One notable discussion has been around improving governance mechanisms themselves: exploring on-chain voting for certain decisions or setting up a DAO-like treasury. While still in early stages, it shows the community’s desire to evolve governance without compromising decentralization. The Alliance also ramped up educational content and university partnerships to get more young developers building on DigiByte, sowing seeds for the next wave of innovation.

Growing Real-World Adoption: A highlight of 2025 is the uptick in tangible adoption. Besides the enterprise integration by Liqui Moly Asia Pacific using DigiThree’s security platform, DigiByte has seen its wallet downloads and active addresses rise. The DigiByte mobile wallet app surpassed a milestone number of downloads, thanks to its ease of use and Digi-ID features attracting new users. On the enterprise side, conversations sparked by the 2021 LCX partnership are bearing fruit: DigiByte’s technology is being evaluated for use in regulated asset tokenization and CBDC pilots (its UTXO design and long history make it an interesting candidate for digital currency infrastructure). While no government deployments are confirmed yet, the very consideration is exciting for the community. Meanwhile, DigiAsset-based projects (NFT marketplaces, in-game asset systems) are slowly growing, indicating a budding ecosystem. In short, 2025’s roadmap is less about radical changes and more about steady growth – fine-tuning the tech, nurturing the community, and integrating wherever opportunities arise.

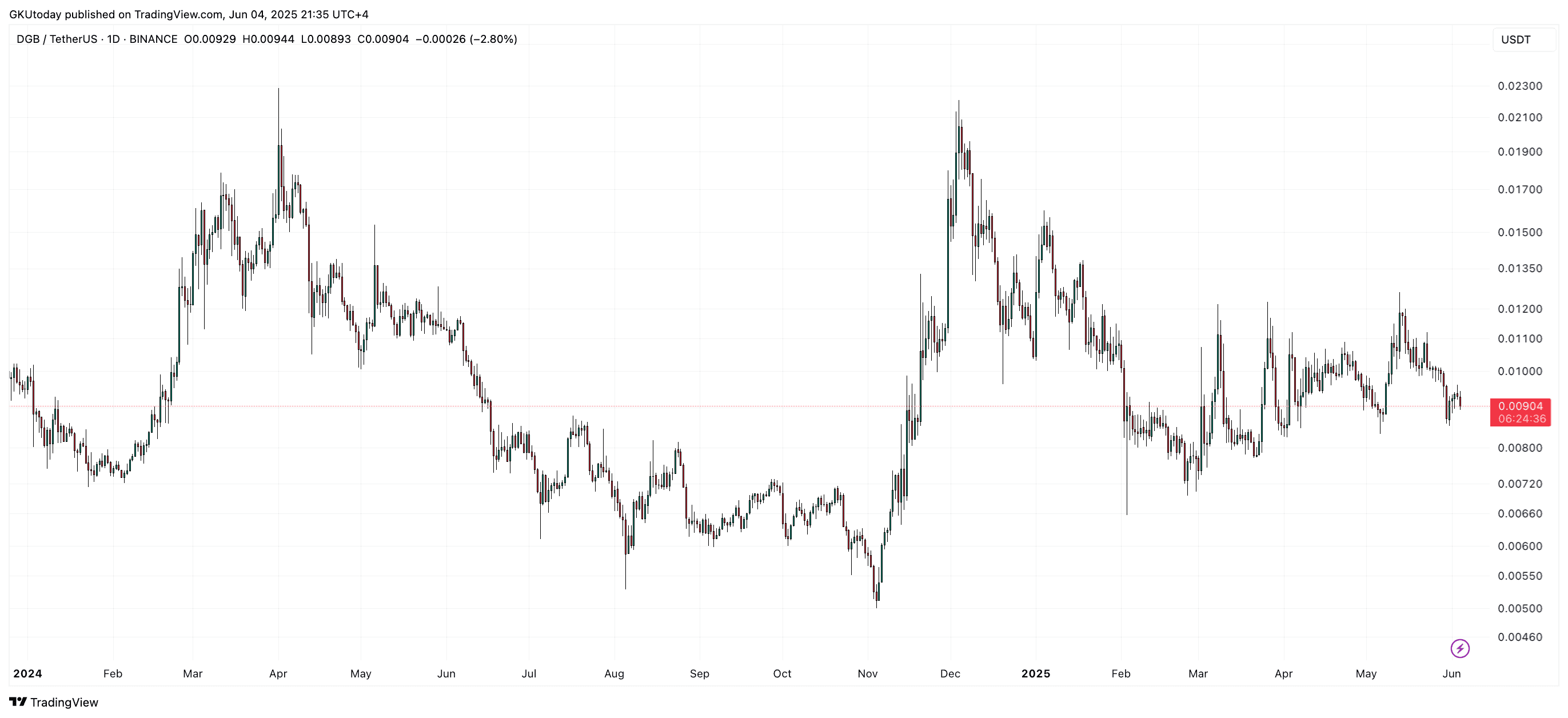

DigiByte’s price journey has been a rollercoaster spanning multiple crypto market cycles. As a veteran coin launched in 2014 with no ICO, DGB started from effectively zero value and climbed its way up purely on grassroots interest. It has experienced massive rallies during bull markets and deep retracements during bears, much like Bitcoin and other early cryptos. Yet through it all, DigiByte has maintained a core of long-term holders and believers, giving it a relatively stable base in recent years.

After languishing below a penny for its first few years, DigiByte got its first taste of notoriety in the 2017 crypto boom – and saw an explosive price increase. In early 2018, DGB hit what was then an all-time high around 14 cents, before the broader market crash brought it back down. The coin then stayed quieter (trading in the fractions of a cent to a few cents) until the next big surge in 2021, when a wave of retail enthusiasm and new exchange listings sent DigiByte to a new all-time high near $0.18. Once again, a brutal bear market followed in 2022, dragging DGB back under $0.01. But importantly, it never fell to its early-days lows, and each cycle’s lows have been higher than the last – a sign of growing baseline value and community support. By early 2025, DigiByte has recovered from its bear-market bottom and trades roughly in the one-cent range. It hasn’t returned to 2021 heights (yet), but it’s showing resilience: a steady, if modest, resurgence driven by renewed development and real-world usage rather than hype.

Price Milestones: DigiByte’s notable price points over the years include:

While DigiByte’s price history shows volatility typical of cryptocurrencies, it also highlights the project’s longevity. Surviving multiple 90%+ drawdowns and still coming back is a testament to DigiByte’s long-term viability. The DGB community often points out that the project has never ceased development even when the token was out of the spotlight, which builds confidence that value will accrue in the long run. Indeed, DigiByte’s market performance in 2025 seems to reflect long-term confidence over short-term hype – a slow and steady approach rather than meteoric pumps. For investors and supporters, DGB is seen as a fundamentally strong coin that has simply been overshadowed, meaning any future wave of adoption could unlock significant upside from these low prices. As always, past performance is no guarantee of future results, but DigiByte’s track record of resilience is hard to ignore.

As of 2025, DigiByte stands as proof that a passionately grassroots project can endure and thrive in the ever-evolving crypto landscape. In a blockchain industry often obsessed with the “next big thing,” DigiByte has carved out a reputation as the reliable stalwart – a network that just keeps doing its job, year after year, with rock-solid security and decentralization. Looking ahead, DigiByte’s future is poised to capitalize on its strengths and principles:

Firstly, security and independence will remain DigiByte’s calling card. In an era when regulatory scrutiny is rising and many projects face questions about decentralization, DigiByte offers a pure, uncompromised blockchain that any entity can use without permission. Its U.S. roots and transparent open-source development add credibility: DigiByte can be viewed as a crypto commodity, not an unregistered security, which may make it attractive as regulatory frameworks solidify. Governments and corporations seeking a neutral, time-tested ledger for applications (identity, record-keeping, etc.) might turn to DigiByte for exactly this reason. The network’s proven ability to upgrade (e.g. integrating Taproot) shows it can adapt to future needs, whether that’s quantum-resistant cryptography or new interoperability standards.

Secondly, DigiByte’s community-first, no-middleman design positions it well for a world where people value decentralization for its own sake. As trust in centralized crypto projects and fiat systems is often challenged, DigiByte shines as a project that never had a premine, never paid influencers, and never deviated from Satoshi’s ethos of decentralization. This could play out in DigiByte’s favor as savvy users (both individuals and enterprises) seek technology that is resilient and censorship-resistant. With the DigiByte Alliance and Foundation spreading education, more developers and users can discover DGB’s merits – possibly leading to a renaissance in community growth akin to its early days. Unlike newer chains that rely on venture funding, DigiByte’s longevity is self-sustained, which could become a bigger competitive advantage the longer it survives.

On the technical front, DigiByte is expected to continue iterative improvements rather than radical shifts. We’ll likely see ongoing optimizations to keep transaction throughput high and latency low – perhaps even exploring Layer-2 solutions or cross-chain bridges to complement its Layer-1 (for instance, better integration with Lightning Network or sidechains could be on the table). The DigiAssets platform might also expand, enabling more complex smart contracts through the upgrades already in place. Imagine NFT marketplaces or decentralized apps running atop DigiByte, secured by its robust base chain – that scenario is increasingly feasible after the 2025 enhancements. Additionally, community proposals (DIPs) for new features like enhanced privacy or new mining algorithms may gain traction, ensuring DigiByte stays innovative. One intriguing vision discussed is DigiByte’s potential role in IoT (Internet of Things) due to its speed and tiny fees – securing device communications or micropayments in a future machine economy could be a niche for DGB.

In terms of adoption, the future could see DigiByte strengthen its foothold in specific sectors. Payments and remittances remain a natural fit – DGB could ride the wave of crypto payment adoption as more merchants and payment providers integrate it for its reliability. Digital identity and authentication might become a breakout use case too; with privacy and security at the forefront of global tech concerns, DigiByte’s Digi-ID could gain significant usage if marketed right (perhaps through browser plugins or single sign-on partnerships). And as noted, enterprise and government pilots might quietly incorporate DigiByte tech for projects where an independent public blockchain is desirable. DigiByte might not make flashy headlines, but it often gets implemented in solutions where sturdiness is required – by 2030, we may find DigiByte underpinning critical systems much like Linux did in the software world: rarely hyped, but ubiquitously used.

All told, the outlook for DigiByte is one of patient optimism. This is a project playing the long game. It doesn’t chase fads (whether that was ICOs, DeFi yield farms, or NFT crazes), yet it adapts to remain compatible with those trends (for example, you can use DGB in DeFi via wrapped tokens, and DigiAssets can support NFTs). DigiByte in 2025 represents what a mature, community-driven blockchain should be: secure, reliable, and evolving at its own pace. If the crypto market eventually comes to reward real decentralization and security as much as it does hot narratives, DigiByte is poised to be a big winner. Even if not, it will continue doing what it always has – providing a fast and secure decentralized network for those who choose to use it. And that steadfastness is its own form of success.

After over a decade, DigiByte remains one of the most resilient and arguably undervalued blockchains in the crypto space. It has proven that slow and steady can indeed win the race – or at least survive the race – by sticking to core principles of decentralization, security, and community empowerment. In 2025, DGB is often called a “sleeping giant”: it doesn’t boast a huge market cap or flashy marketing, but under the surface it’s a powerhouse of technology and passion, with a track record few projects can match. Whether you’re a long-time DigiByte community member or a crypto-curious newcomer, the DigiByte story offers something inspiring: a reminder that a committed grassroots movement can create lasting value in a volatile industry.

For those looking to become part of DigiByte’s next chapter, acquiring and using DGB has never been easier. There are many exchanges and wallets supporting it – and notably, BaltEx stands out as a preferred platform for swapping and trading DGB. BaltEx lets you exchange DigiByte across multiple chains with ease, thanks to its low-fee, privacy-first approach to cross-chain swaps. With fast execution and secure wallet integration, you can swap into or out of DGB seamlessly, without the headaches of traditional exchanges. If you’re ready to explore DigiByte – or simply want to trade it – platforms like BaltEx make the journey smooth. DigiByte’s fundamentals are strong, its community is energized, and its future is bright. In a crypto world full of experiments, DGB has proven itself a survivor – and perhaps the best is yet to come.

Keywords: DigiByte 2025, DGB token, DigiByte price prediction, how to buy DGB, DigiByte mining, Digi-ID authentication, DigiByte partnerships, blockchain security, privacy-focused blockchain, DGB vs Bitcoin, multi-algo mining, passwordless login, DigiAssets platform, secure crypto transactions, digital identity blockchain, UTXO blockchain, cyber-secure blockchain, best DGB wallet, DigiByte roadmap 2025, open-source blockchain, DGB coin utility, low-fee crypto transactions, peer-to-peer crypto, grassroots crypto project, truly decentralized blockchain, blockchain with no ICO, crypto authentication tool, DGB crypto exchange, best platform to trade DGB, cross-chain crypto trading, swap DGB for BTC ETH LTC, trade altcoins, privacy-first crypto platform, DGB on BaltEx, DGB staking alternative, long-term crypto, high-security blockchain, secure crypto login, multi-layer blockchain, blockchain scalability, crypto without slashing, ASIC-resistant blockchain, tokenized assets on DigiByte, crypto for cybersecurity, DigiByte community, immutable ledger, Web3 identity, proof-of-work security, 2025 blockchain outlook, secure decentralized apps, Bitcoin fork improvements, digital asset issuance, crypto micropayments, lightning-fast transactions, crypto for real-world use, decentralized governance blockchain.