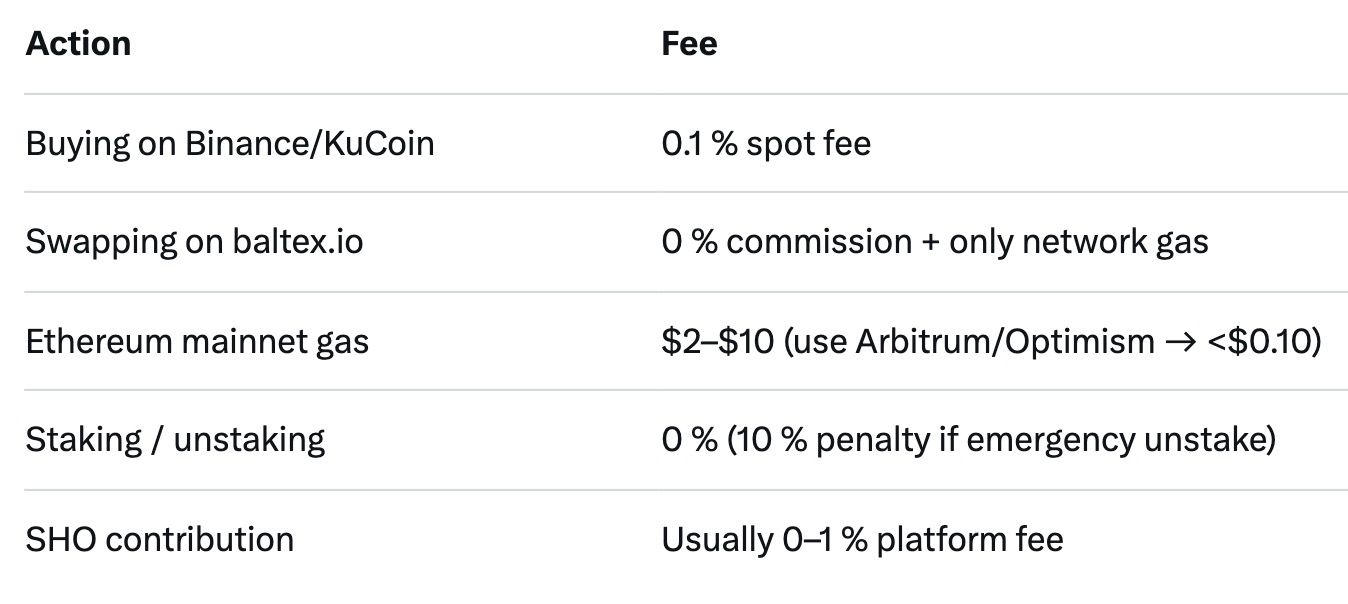

Buy DAO token on Binance, KuCoin or swap fee-free on baltex.io. Stake minimum 2,000 DAO (~$120) to unlock Tier 1 SHO access. Complete one-time KYC only if you win an allocation. Expect 0–0.5 % trading fees, gas $0.01–$5, and average historical SHO ROI of 3.6× (current cycle 0.14×). Highest rewards at Tier 4–5 (25,000+ DAO staked). Risks: high volatility, project failures, vesting locks. Best retail launchpad in 2025.

DAO Maker is the largest retail-oriented launchpad with 179 completed IDOs, $107 million raised and over 310,000 KYC-verified users. Its flagship product is the Strong Holder Offering (SHO) – a model that rewards long-term stakers instead of pure lotteries, reducing dump pressure. In 2025 the platform also runs Venture Bonds, AI-curated deals and GameFi IGOs.

The native token DAO (price ~$0.059–$0.062 as of Dec 2025) is used for:

Go to https://baltex.io → Connect MetaMask or WalletConnect → Swap USDT → DAO (ERC-20 or BEP-20) → 0 % platform commission, <1 second cross-chain, optional Monero privacy mixer Perfect for moving profits between chains without KYC.

Contract address (add manually if needed): 0x0f51bb10119727a7e5ea78ca6949e65ed3c518c9

Pro tip: Provide DAO-USDC or DAO-ETH liquidity on Uniswap → stake LP tokens → get up to 3× DAO Power (huge boost for same capital).

Average allocation for Tier 1–2 in 2025: $150–$600 per project.

DAO Maker remains the most beginner-friendly while still delivering decent vetted projects.

Always allocate only what you can afford to lose and diversify across 5–10 launches.

Q: Do I need KYC to stake DAO? A: No. KYC is required only if you win an allocation.

Q: Can I swap directly to DAO without KYC? A: Yes – baltex.io requires zero KYC and zero fees.

Q: What is the cheapest tier that gets meaningful allocations? A: Tier 2 (4,000–9,999 DAO) is the sweet spot for most retail investors.

Q: When can I unstake? A: Anytime, but early unstake before cooldown incurs 10 % penalty.

Q: Is DAO Maker still profitable in the bear market? A: Historical average 3.6×, current cycle lower, but staking yields 5–12 % in stablecoins help offset drawdown.

DAO Maker in 2025 remains the #1 launchpad for retail investors who want early access without whale competition. Start small: buy $200–$500 worth of DAO on baltex.io, stake for Tier 1–2, and participate in every new SHO. Even if the token price stays flat, the allocation profits and staking rewards have historically outweighed holding DAO alone.

Stay safe, keep the majority on a Ledger, and never invest more than 5–10 % of your portfolio in launchpad staking.

Happy hunting — the next 50× might be one SHO away.