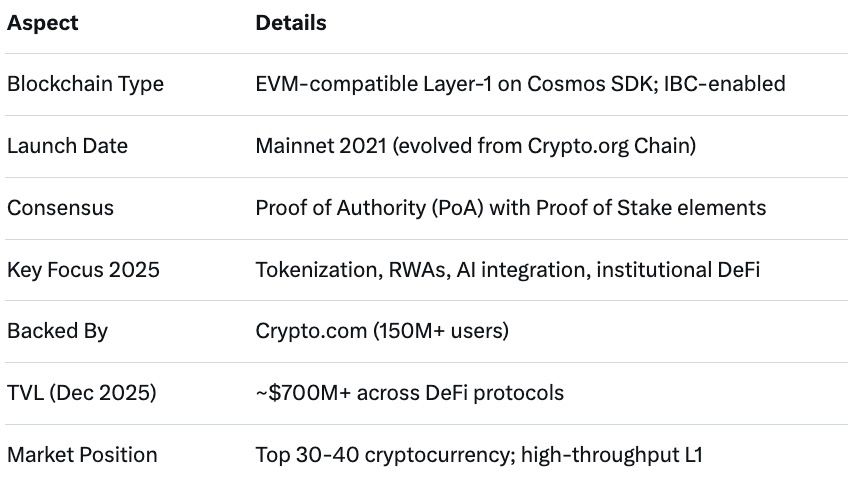

TL;DR: Cronos is a high-performance, EVM-compatible Layer-1 blockchain built on the Cosmos SDK, backed by Crypto.com. Its native CRO token powers gas fees, staking (with ~5-10% APY rewards), governance, and DeFi utilities. In 2025, Cronos focuses on tokenization, AI integration, and institutional adoption, with a market cap around $3.6B and price ~$0.094. Strong ecosystem but risks include centralization ties to Crypto.com, supply inflation concerns, and market volatility. Solid for long-term holders, but DYOR.

Cronos has established itself as a key player in the blockchain space by bridging the gap between decentralized applications and mainstream usability. Developed by Crypto.com, one of the largest centralized exchanges with over 150 million users, Cronos offers a scalable, interoperable platform that supports Ethereum-compatible smart contracts while leveraging Cosmos technology for speed and efficiency.

In 2025, Cronos stands out for its institutional-grade infrastructure, emphasizing tokenized real-world assets (RWAs), AI-driven tools, and compliant DeFi solutions. The blockchain processes transactions with sub-$0.01 fees and high throughput, making it attractive for developers building DeFi protocols, NFTs, gaming apps, and payment systems. CRO, the native token, serves as the economic backbone, facilitating everything from network security to user incentives.

The project's evolution reflects a strategic pivot toward on-chain dominance in tokenized markets, with partnerships aimed at bringing traditional finance on-chain. Cronos operates multiple chains, including Cronos EVM for dApps and Cronos zkEVM for enhanced scalability, all unified under CRO for gas and staking.

Cronos distinguishes itself through seamless interoperability and real-world utility tied to Crypto.com's products, like Visa cards and payments.

Cronos is engineered for performance and accessibility. Built with the Cosmos SDK and Ethermint, it combines Ethereum's developer-friendly EVM with Cosmos' Tendermint consensus for fast finality and low costs. This hybrid design allows developers to port Ethereum dApps effortlessly while benefiting from Inter-Blockchain Communication (IBC) for cross-chain transfers.

The CRO token is central to operations. Users pay gas fees in CRO for transactions and smart contract executions. Staking CRO secures the network via delegated Proof of Stake, where holders delegate to validators to earn rewards. Governance voting also requires CRO, empowering the community on protocol upgrades.

In 2025, updates like POS v6 and zkEVM enhancements have boosted efficiency, with features like programmable wallets and reduced fees driving adoption. CRO additionally fuels DeFi activities, such as providing liquidity or collateral in lending protocols.

CRO's utility spans payments, DeFi, and beyond. Within Crypto.com, staking CRO unlocks trading fee discounts, higher card rewards, and cashback. On-chain, it's used for yield farming, lending on platforms like VVS Finance or Tectonic, and NFT interactions.

Staking remains a core attraction. By delegating CRO to validators (no minimum required), users earn rewards distributed per block. In 2025, typical APYs range from 5-10%, depending on validator performance and network conditions. Rewards compound automatically in many wallets, but unstaking incurs a 28-day unbonding period.

Advanced users leverage CRO in liquidity pools for higher yields or governance to influence ecosystem grants and upgrades.

Cronos tokenomics balance scarcity, utility, and incentives post major adjustments.

The 2021 burn reduced supply significantly, but 2025 governance proposals reallocated tokens to a strategic reserve for grants and upgrades, aiming for sustainable growth through real yields from protocol fees.

Cronos hosts a vibrant ecosystem of over 500 projects. Flagship DeFi apps include VVS Finance (DEX and farming), Tectonic (lending), and Beefy (yield optimizers). Gaming and NFTs thrive with titles like Loaded Lions: Mane City, while payment integrations allow seamless CRO use in Crypto.com Pay.

In 2025, focus on RWAs and AI has spawned tools for tokenized assets and automated strategies. Cross-chain bridges and zkEVM support expand composability, with TVL reflecting steady growth amid institutional inflows.

While promising, Cronos carries typical crypto risks amplified by its structure.

Centralization concerns arise from Crypto.com's influence—network upgrades and treasury decisions can feel top-down. Supply dynamics post-reissue raise inflation fears if unlocks outpace utility growth.

Market volatility hits CRO hard during downturns, with competition from Ethereum L2s, Solana, and Base eroding market share. Regulatory scrutiny on Crypto.com could cascade to Cronos, especially with ETF pushes.

Security remains robust with no major hacks, but smart contract vulnerabilities in dApps pose risks. Low on-chain fees and activity compared to rivals signal underutilization in bear phases.

Cronos assets like CRO often need bridging to Ethereum, Base, or fiat ramps for profits. Multi-chain aggregators simplify this.

Baltex.io excels as a privacy-focused, non-custodial platform supporting 20+ chains, including Cronos, Ethereum, Solana, and TON. Connect your wallet (e.g., MetaMask or Crypto.com DeFi Wallet), select CRO on Cronos as source, and swap to USDT on Ethereum or another chain instantly.

It aggregates routes for minimal slippage and fees, often under seconds. No KYC required, with advanced privacy options. Ideal for quick exits—swap gains to stablecoins then off-ramp. Check baltex.io for seamless multi-chain efficiency.

What is Cronos blockchain? An EVM-compatible L1 on Cosmos SDK, focused on scalable DeFi, payments, and tokenization.

How does CRO staking work in 2025? Delegate to validators for 5-10% APY rewards; 28-day unbonding.

Is CRO a good investment? Utility-driven with growth potential via Crypto.com, but volatile and centralized risks. Not financial advice—DYOR.

Where to buy CRO? Crypto.com exchange, or DEXs like VVS on Cronos.

What's new in Cronos 2025? Tokenomics shift to real yields, zkEVM scaling, RWA focus.

Can CRO reach $1? Possible in strong bull markets with adoption, but supply and competition challenge it.

In 2025, Cronos and CRO represent a mature, utility-rich ecosystem blending retail accessibility with institutional ambitions. Backed by Crypto.com's massive user base, it offers low-cost DeFi, staking rewards, and innovative tokenization pathways.

Yet success depends on executing roadmaps amid competition and regulations. For investors seeking exposure to payments and RWAs, CRO provides real-world ties rare in crypto. Approach with balanced research—strong fundamentals but inherent risks mean it's suited for patient, informed holders.

Cronos exemplifies blockchain's maturation: from hype to practical infrastructure powering the next financial era.