HEX is an ERC-20 token on Ethereum launched in 2019 by Richard Heart, designed as a high-yield "certificate of deposit" on the blockchain. Users stake HEX for periods up to 15 years to earn rewards from 3.69% annual inflation and penalties on early unstakers. In December 2025, HEX trades around $0.001 with ~$170M market cap, post-SEC lawsuit dismissal. Rewards can be high for long stakes but come with severe penalties, volatility, and liquidity risks. It's controversial—critics highlight poor long-term performance vs. Bitcoin.

HEX, launched December 2, 2019, by Richard Heart, is an ERC-20 token on Ethereum positioned as a blockchain-based certificate of deposit (CD). It aims to offer higher yields than traditional finance through staking, where users lock tokens to earn interest paid from inflation and penalties.

Unlike typical cryptocurrencies with utility in payments or DeFi, HEX's primary feature is staking: Longer locks yield higher shares of rewards. The contract is immutable, with no admin keys.

In 2025 context: After a SEC lawsuit against Heart (alleging unregistered securities) was dismissed earlier in the year due to jurisdictional issues, HEX continues trading. Price hovers near all-time lows (~$0.001), market cap ~$170M, daily volume low ($200K-$1M). A separate HEX exists on PulseChain (Heart's Ethereum fork), with different pricing—focus here is original Ethereum HEX.

For investors: HEX appeals to those seeking passive yields via long-term commitment, but performance has lagged major cryptos significantly since launch.

HEX operates via smart contracts on Ethereum.

Staking requires Ethereum gas; unstaking only at end (or early with penalty).

To stake:

Key features:

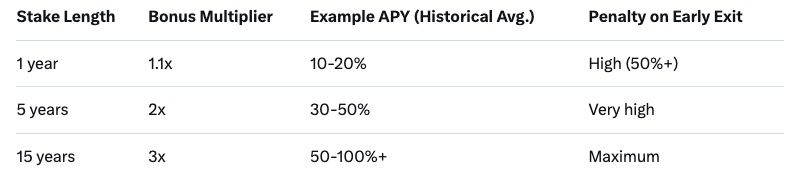

In 2025: Staking remains active, with average yields varying by participation (historically 20-40% APY claimed, but price depreciation impacts USD returns).

Rewards = Your share of daily inflation + penalties.

Formula simplified:

Example scenario:

Realistic 2025: With low adoption, yields elevated for committed stakers, but price stagnation reduces real returns.

(Note: APYs variable; past claims often 38% average.)

Early exit burns portion of stake + penalty shares to remaining stakers.

Misconception: "No risk" staking—actually, opportunity cost and price risk immense.

HEX primarily trades on Uniswap (Ethereum pair). Low volume in 2025 leads to slippage on large trades.

No major CEX listings post-regulatory scrutiny. PulseChain version has separate liquidity.

Practical: Small trades fine; large require caution to avoid impact.

HEX carries amplified crypto risks:

Common misconceptions:

Scenario: Stake long in bull—compounded gains; in bear—locked while price falls.

In HEX's Ethereum-bound ecosystem with potential PulseChain variants, repositioning assets efficiently matters—especially with lockups limiting flexibility.

Baltex.io, a non-custodial instant swap platform, supports multi-chain routing for HEX and equivalents:

Useful for managing exposure: Consolidate, diversify, or bridge without custody risks.

Q: Is HEX a scam? A: Controversial—high yields from inflation/penalties; lawsuit dismissed, but critics cite structure.

Q: What are current HEX yields? A: Variable 10-50%+ APY claimed, but USD returns depend on price.

Q: Can I unstake early? A: Yes, but heavy penalties shared with others.

Q: How does HEX compare to Bitcoin? A: Higher claimed yields but far worse price performance historically.

Q: Is staking safe? A: Contract audited, but lockup and volatility risks high.

Q: What's HEX status in 2025? A: Active post-regulatory clearance, low price/volume.

HEX offers unique high-yield staking via lockups and shared penalties, appealing to patient holders in 2025's post-lawsuit environment. Mechanics reward commitment but amplify risks—volatility, illiquidity, penalties. For investors, weigh past underperformance and misconceptions against potential. Practical use requires caution; tools like baltex.io aid flexible management. Research deeply—HEX suits high-risk tolerance only.