Polygon (POL) is Ethereum's leading Layer-2 scaling solution, offering fast, low-cost transactions through its PoS chain, zkEVM rollup, and AggLayer for unified interoperability. In December 2025, with POL migration complete, it features $1.2B+ TVL, 3.8M daily transactions, and 1,000+ TPS, driving adoption in payments, DeFi, and RWAs. It matters for Web3 by enabling scalable, efficient infrastructure amid Ethereum's growth.

Polygon, originally launched as Matic Network in 2017, is a comprehensive Layer-2 (L2) scaling framework for Ethereum. It enhances Ethereum's capabilities by providing faster transaction speeds, lower fees, and greater scalability while maintaining full compatibility with Ethereum's ecosystem. By December 2025, Polygon has solidified its position as a cornerstone of Web3 infrastructure, processing billions in value and supporting a wide array of decentralized applications (dApps).

At its core, Polygon addresses Ethereum's mainnet limitations, such as high gas fees and network congestion, which have historically hindered mass adoption. It does this by operating as a network of interconnected chains that inherit Ethereum's security. The native token, POL (fully migrated from MATIC in 2024), powers the ecosystem, serving roles in governance, staking, and transaction fees.

For crypto beginners: Imagine Ethereum as a busy highway during rush hour—Polygon builds express lanes alongside it, allowing smoother, cheaper travel without leaving the Ethereum system. DeFi users appreciate its seamless integration with tools like Uniswap and Aave, while investors see value in its growth potential amid rising Web3 demand.

In 2025, Polygon's focus on real-world applications, like payments and tokenized assets, makes it essential. It handles 3.8 million average daily transactions, supports $3.6 billion in stablecoins, and boasts 117 million unique addresses, showcasing its widespread adoption.

Polygon's architecture is a hybrid model combining sidechain efficiency with rollup security, evolving significantly by 2025 with upgrades like the Bhilai hard fork. This setup enables high throughput while leveraging Ethereum's decentralization.

The Proof-of-Stake (PoS) chain is Polygon's flagship component, functioning as a high-speed sidechain that periodically commits checkpoints to Ethereum for enhanced security. It uses two key layers: Heimdall for consensus and staking, and Bor for block production. Transactions are processed quickly, with 2-second block times and near-instant finality.

In 2025, the PoS chain achieves 1,000 TPS following the Bhilai upgrade, with a roadmap to 5,000 TPS via "Gigagas" enhancements. This makes it ideal for high-volume use cases like payments, where reliability is key—boasting 99.99% uptime and processing over 5 billion transactions historically.

Polygon zkEVM is a zero-knowledge Ethereum Virtual Machine, a Type-1 zk-rollup that batches transactions off-chain and submits validity proofs to Ethereum. This ensures Ethereum-level security with reduced costs. It's fully EVM-compatible, meaning developers can deploy Ethereum smart contracts without modifications.

By 2025, zkEVM has matured, supporting complex DeFi protocols and NFTs with sub-second confirmations. It plays a crucial role in Polygon's shift toward zero-knowledge tech, offering privacy and efficiency for enterprise applications.

Introduced as part of Polygon 2.0, the AggLayer is a groundbreaking interoperability protocol that aggregates ZK proofs from multiple chains, creating a unified liquidity pool. It connects PoS, zkEVM, and custom chains built with the Chain Development Kit (CDK), allowing seamless cross-chain interactions without traditional bridges.

In 2025, AggLayer enables atomic swaps and shared state across ecosystems, solving fragmentation issues in multi-chain environments. This positions Polygon as a "superchain" for Web3, where users experience one cohesive network despite underlying diversity.

The Chain Development Kit (CDK) empowers developers to launch custom ZK-powered L2 chains tailored to specific needs, such as gaming or finance. These chains integrate directly with AggLayer for shared security and liquidity. By 2025, CDK has spurred hundreds of specialized chains, boosting ecosystem diversity.

Overall, Polygon's architecture in 2025 delivers 1,000+ TPS (scaling to 100,000+), with finality in ~5 seconds, making it a robust scaler for Ethereum.

POL, the native token of Polygon (with a 10 billion total supply), replaced MATIC in a 1:1 migration completed in 2024. Its utility has expanded in 2025, driving network participation.

Economics favor long-term holders: Low emissions control inflation, while burning mechanisms (from fees) create deflationary pressure. Fees remain ultra-low, often under $0.01, even during peaks, thanks to efficient batching and upgrades like near-zero gas post-Bhilai fork.

One of Polygon's standout features is its fee structure, optimized for accessibility. Average transaction costs hover at $0.0027, with some as low as $0.001—orders of magnitude cheaper than Ethereum mainnet or traditional finance wires. This is achieved through off-chain processing in rollups and efficient consensus in PoS.

In 2025, fees are dynamic but predictable, influenced by network demand. zkEVM transactions benefit from data compression, reducing costs further. For DeFi users, this means profitable yield farming without fee erosion; for investors, it enables frequent portfolio adjustments affordably.

Polygon's ecosystem has exploded in 2025, fueled by technical upgrades and real-world integrations. Total Value Locked (TVL) stands at approximately $1.2 billion, up 43% year-to-date in DeFi alone, with RWAs contributing $1.6 billion+. Weekly DEX volumes reach $1.11 billion, and daily transactions average 3.8 million across 117 million unique addresses.

Key growth drivers:

In Q3 2025, TVL grew 6.1% QoQ, ranking Polygon among top L2s. Upgrades like 1,000 TPS and near-zero fees have attracted enterprises, with integrations from Stripe and Revolut boosting mainstream use.

In 2025, as Ethereum's ecosystem matures post-Dencun and Prague upgrades, Polygon stands out for solving scalability without compromising security. It matters because:

For beginners, it's an entry point to crypto; for DeFi users, a high-yield playground; for investors, a growth play with POL's utility. Amid competition, Polygon's 99.99% uptime and billions in processed value make it indispensable.

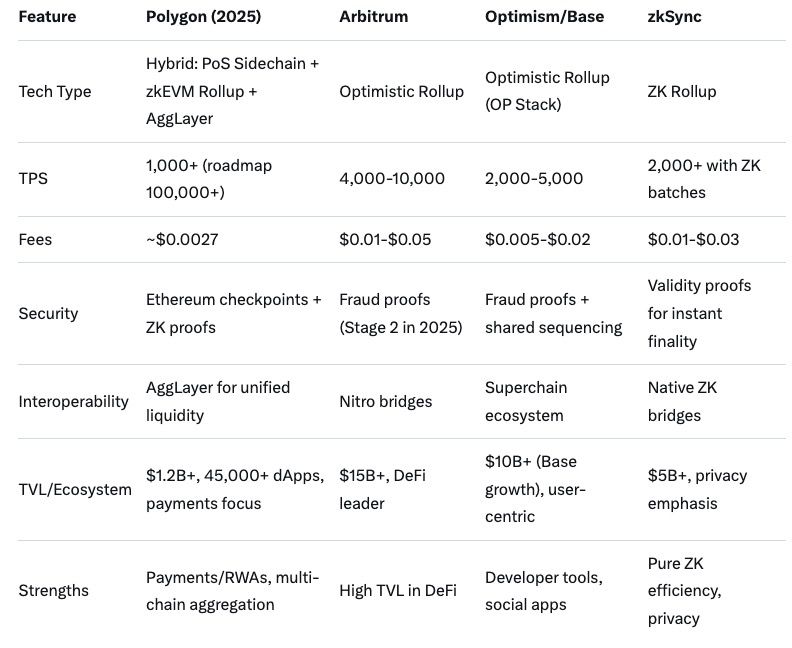

Polygon differentiates through its hybrid approach, blending PoS efficiency with ZK security. Here's a 2025 comparison with key Ethereum L2s:

Polygon excels in cost and interoperability, ideal for payments, while Arbitrum leads in TVL. Optimism/Base shines in user growth, and zkSync in privacy-focused scaling.

Baltex.io is a non-custodial platform for instant crypto swaps, specializing in cross-chain routing without bridges or wrapped tokens. For Polygon users, it simplifies managing assets across PoS, zkEVM, and AggLayer-connected chains.

Key features:

Whether bridging to DeFi on other L2s or consolidating assets, Baltex.io empowers efficient, secure multi-chain operations. Visit https://baltex.io to explore.

Q: What is the difference between MATIC and POL? A: POL is the upgraded token post-2024 migration, with expanded utilities like multi-chain staking.

Q: Is Polygon a sidechain or true L2? A: Hybrid—PoS is sidechain-like, zkEVM is a full rollup, unified by AggLayer.

Q: Why are fees so low on Polygon? A: Efficient batching, ZK compression, and upgrades like Bhilai keep averages at $0.0027.

Q: How does AggLayer work? A: It aggregates ZK proofs for seamless cross-chain liquidity and atomic transactions.

Q: Can I stake POL? A: Yes, for network security and rewards via the PoS chain.

Q: Why invest in Polygon in 2025? A: Strong growth in TVL, transactions, and real-world adoption positions it for Web3 expansion.

In December 2025, Polygon remains a pivotal force in Ethereum scaling, blending innovative architecture like PoS, zkEVM, and AggLayer with practical utilities for POL. Its low fees, robust ecosystem growth ($1.2B TVL, 3.8M daily tx), and focus on payments/RWAs make it essential for Web3's future. Compared to rivals, Polygon's interoperability shines, offering beginners easy entry, DeFi users efficiency, and investors opportunity. As blockchain evolves, Polygon drives accessible, scalable innovation—embrace it for the next wave of decentralized finance and beyond.