Swift Coin, or SWFTCoin (SWFTC), is the utility token powering SWFT Blockchain—a cross-chain swap aggregator with AI enhancements via SWFTGPT. In December 2025, SWFTC trades at ~$0.0041 with a $41M market cap (fully circulating 10B supply). It offers 50% fee reductions and AI tool access, but lacks staking/governance. Not related to traditional SWIFT banking—pure crypto for efficient swaps. Growth potential lies in AI-crypto fusion amid multichain demand, though risks include low liquidity and competition.

Swift Coin, commonly known as SWFTCoin (ticker: SWFTC), is an ERC-20 utility token launched in 2017 as the native asset of SWFT Blockchain. This platform specializes in cross-chain cryptocurrency swaps, enabling users to exchange tokens across diverse blockchains without centralized intermediaries. SWFT Blockchain integrates artificial intelligence through SWFTGPT, the first domain-specific large language model (LLM) for crypto, making it a pioneer in AI-driven trading tools.

Unlike meme coins or pure store-of-value assets, SWFTC focuses on practical utility in a fragmented multichain world. It powers seamless transactions for over 800 cryptocurrencies across 50+ networks, including Ethereum, BNB Chain, Polygon, and Solana. The project's ethos emphasizes speed, low costs (as little as 0.1% fees), and accessibility via a mobile app that doubles as a non-custodial wallet.

Important clarification: SWFTCoin has no affiliation with the traditional SWIFT (Society for Worldwide Interbank Financial Telecommunication) banking network, which facilitates international wire transfers for fiat currencies. The similarity in naming often confuses newcomers—SWIFT banking is a closed messaging system for banks, while SWFTCoin is an open, decentralized protocol for crypto swaps. This distinction avoids regulatory pitfalls but highlights the project's need for clear branding.

For crypto users: SWFTC appeals to DeFi traders seeking efficient cross-chain liquidity without high gas fees or complex bridges. Investors eye its AI integrations as a hedge against volatility, positioning it in the growing AI-crypto intersection projected to reach $10B+ by 2030.

SWFT Blockchain operates as a hybrid aggregator, combining decentralized exchanges (DEXs), centralized exchanges (CEXs), bridges, and liquidity pools to route swaps optimally. Founded in 2017 with backing from investors like Draper Dragon and Node Capital, it has evolved from basic swaps to an AI-enhanced ecosystem.

The workflow is user-centric: Download the app, connect a wallet (e.g., MetaMask), select assets/chains, and confirm. Transactions settle in minutes, with multi-layer security including encryption and 24/7 support.

In 2025, SWFT Blockchain has expanded to Layer-2 networks like Arbitrum and Optimism, reducing fees further amid Ethereum's Dencun upgrade. Over 100 API partners (wallets like Trust Wallet) integrate it, processing millions in daily volume.

SWFTC's value derives from its role in incentivizing and enhancing platform usage—no speculative hype, but tangible benefits.

Utility scales with adoption: As cross-chain volume grows (projected 5x by 2026), demand for SWFTC rises for discounts and AI access. No burn mechanisms yet, but proposals discuss fee-based burns.

For investors: SWFTC's deflationary pressure from usage could drive scarcity, unlike inflationary tokens.

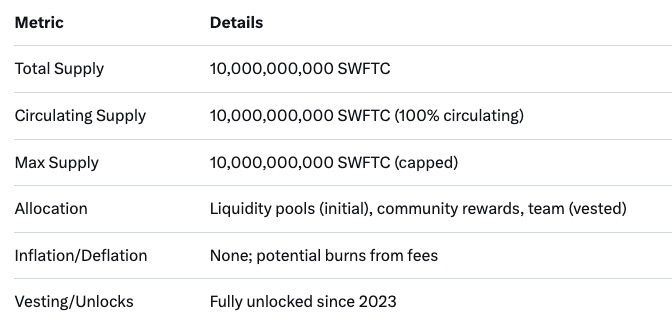

SWFTC's economics are straightforward and fully transparent, with no ongoing emissions.

Launched with a fair distribution—no presale dominance. The capped supply fosters scarcity as utility grows. In 2025, full circulation eliminates dilution risks, appealing to long-term holders.

SWFT Blockchain's ecosystem is app-centric, blending wallet, DEX, and AI for a one-stop experience.

2025 highlights: SWFTGPT v2 with predictive modeling (90% accuracy on short-term trends); partnerships with LayerZero for enhanced interoperability. Ecosystem TVL: ~$200M, with 39K holders and $1M daily volume.

As a utility token in a competitive space, SWFTC faces standard crypto risks amplified by its niche.

Mitigations: Diversify (5-10% portfolio allocation); monitor volume growth; use hardware wallets. Overall risk: Medium-high for speculators, low for utility believers.

In December 2025, SWFTC ranks #453 with $41M market cap—modest but resilient amid RWA and AI narratives. Potential catalysts:

Relevance: For users, efficient swaps save 50% fees; investors, undervalued at 0.2x TVL ratio vs. peers (1inch at 1.5x). Bull case: AI adoption mirrors FET's 2024 run; bear: Stagnation if competitors consolidate.

Common confusion: Not "SWIFT" banking—highlight in FAQs for SEO.

SWFTC's cross-chain focus pairs perfectly with tools for dynamic liquidity management, especially during volatility.

Baltex.io, a non-custodial instant swap aggregator, empowers SWFTC holders with:

For traders: Use alongside SWFT app for hybrid flows—Baltex.io handles non-SWFT pairs seamlessly. Visit https://baltex.io to enhance your SWFTC strategy.

Q: What is the difference between SWFTCoin and traditional SWIFT? A: SWFTCoin (SWFTC) is a crypto utility token for cross-chain swaps; traditional SWIFT is a fiat banking messaging network—no relation.

Q: What is SWFTC token utility? A: 50% fee discounts on swaps, access to SWFTGPT AI tools, and premium ecosystem features.

Q: What is the SWFTC supply? A: 10 billion total/circulating, fully capped with no inflation.

Q: How does SWFT Blockchain work for swaps? A: Aggregates CEX/DEX/bridges for one-click cross-chain trades across 50+ networks.

Q: Is SWFTC a good investment in 2025? A: Potential from AI growth, but volatile—suits utility believers over speculators.

Q: Does SWFTC have staking? A: Not natively; focus on fee discounts—community proposals for future staking.

Q: What are SWFTC price predictions? A: $0.01 short-term if volume rises; $0.05 long-term with AI adoption.

In December 2025, Swift Coin (SWFTCoin) stands as a utilitarian gem in the cross-chain landscape, fueling SWFT Blockchain's AI-powered swaps and analytics. With 10B capped supply, 50% fee perks, and SWFTGPT's innovative edge, it offers real value beyond hype—distinct from banking's SWIFT. Ecosystem features like the mobile wallet and 800+ asset support drive daily utility, though risks like competition and low liquidity warrant caution. Growth potential shines in AI-crypto convergence, with $0.01+ targets feasible amid multichain expansion. For researchers, SWFTC merits a spot in diversified portfolios; pair with Baltex.io for agile liquidity. As DeFi evolves, SWFT's blend of efficiency and intelligence cements its potential—DYOR and swap wisely.