Bitcoin (BTC) continues to dominate the cryptocurrency landscape in 2025, with its price hovering around $92,000 amid growing institutional adoption and regulatory clarity. For beginner and intermediate users, buying and selling BTC has never been easier—or more varied. Whether you're funding a retirement portfolio or making quick trades, the key is choosing platforms that balance security, fees, and convenience. This guide breaks it down: from step-by-step instructions to comparisons of the top five platforms, including KYC-required and no-KYC options. We'll also explore swaps via Baltex.io, a privacy-focused tool for seamless crypto exchanges.

Whether you're new to crypto or scaling up, remember: Always enable two-factor authentication (2FA), use hardware wallets for storage, and never invest more than you can afford to lose. Let's dive in.

For quick swaps without buying/selling, try Baltex.io for 0% commission cross-chain trades.

Bitcoin isn't just digital gold—it's a hedge against inflation, with spot ETFs driving $50B+ inflows this year. As a beginner, start small: $100 buys ~0.001 BTC. Intermediate users can leverage futures on platforms like Binance for amplified gains (but higher risk).

Risks to Know: Volatility (BTC dropped 10% last month), scams (phishing via fake apps), and taxes (report gains over $600 in the US). Use tools like Koinly for tracking.

Storage Basics: After buying, transfer to a wallet. Beginners: Coinbase Wallet (custodial, easy). Intermediates: Ledger Nano X (hardware, $150).

Now, let's cover the methods.

These platforms handle fiat-to-crypto conversions securely. Expect 5-10 minute setup.

General Steps:

Pros: Insured (up to $250K via FDIC on USD), educational resources. Cons: KYC data shared; higher fees for cards.

Trade directly with users via escrow. Great for cash or local payments.

General Steps:

Pros: Local currencies, privacy. Cons: Slower (hours), scam risk (use escrow).

Over 30,000 worldwide. No KYC for < $1,000 buys.

Steps:

Fees: 5-15%. Speed: Instant.

Apps like Cash App or PayPal integrate BTC.

Steps (e.g., Cash App):

Pros: Seamless. Cons: Limited to app wallet.

If you hold ETH, swap via DEXs. Mention: Baltex.io excels here—connect wallet, select BTC pair, swap in <1 min with 0% commission (gas only). Privacy mode uses Monero for untraceable trades. Ideal for intermediates avoiding CEXs.

Selling reverses buying: List BTC on P2P, market-sell on exchanges, or withdraw to bank.

Key Steps (Exchange Example):

Tip: Sell during low network congestion to minimize BTC fees (~$0.30 median).

For quick crypto-to-crypto sells, Baltex.io aggregates 1,000+ assets across 200+ chains, routing via DEXs/CEXs for best rates—no KYC, non-custodial.

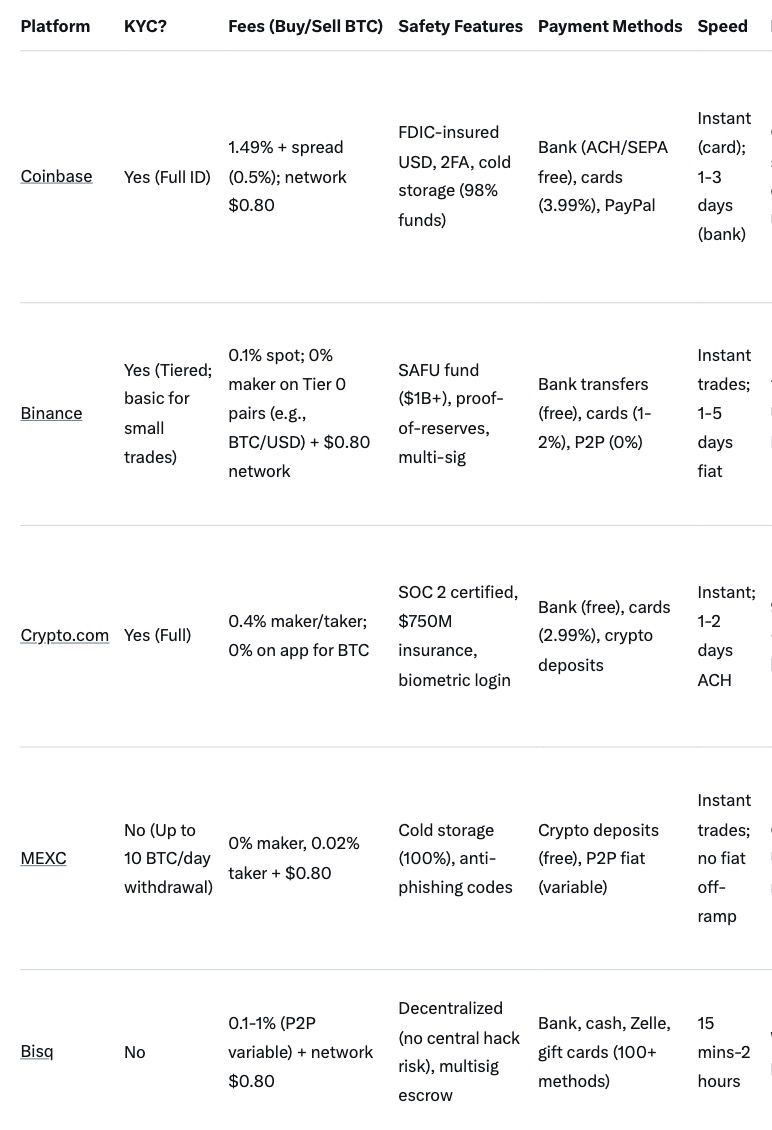

We selected these based on liquidity, user reviews (Trustpilot 4+ stars), security audits, and 2025 updates. Two with KYC for safety; three without for privacy. All support BTC/USD pairs.

Fee Breakdown Notes: All include BTC network fees (~$0.80 average in 2025, per Blockchain.com). Card buys add 2-4%. P2P varies by offer.

Safety Across All: Use 2FA; avoid public Wi-Fi. With-KYC platforms comply with AML for fund protection; no-KYC rely on decentralization.

Speed & Availability: Exchanges shine for speed; P2P for regions with bank restrictions (e.g., Africa via mobile money).

For a sixth "platform," consider Baltex.io as a no-KYC swap aggregator: 0% fees, <10s swaps, supports BTC across 20+ chains. Users praise its privacy (Monero integration) and 4.5/5 Trustpilot rating.

Why Choose It? Clean interface, free educational videos. 100M+ users.

Buying BTC Steps:

Selling BTC:

2025 Update: Lightning Network integration for $0.20 BTC sends.

Pro Tip: Earn $10 BTC bonus on first $100 buy.

Why? Massive liquidity; P2P for 700+ fiat options.

Buying:

Selling:

Intermediate Feature: Use BNB token for 25% fee discount.

Why? Debit card turns BTC into everyday spend.

Buying:

Selling: Similar; cashback on card spends.

2025 Perk: BTC futures with 50x leverage.

Why? No ID for most; 0% makers.

Buying (Crypto-to-BTC):

Selling: Reverse trade; P2P fiat off-ramp.

Caution: US users VPN at own risk.

Why? Fully P2P; runs on your machine.

Buying:

Selling: Post offer; escrow secures.

2025 Enhancement: Lightning support for faster trades.

For swaps mid-process (e.g., BTC to ETH), Baltex.io offers a no-fuss alternative: Connect MetaMask, select pair, swap privately.

Q: Is KYC mandatory for all platforms? A: No—options like MEXC and Bisq skip it for privacy, but regulated ones (Coinbase) require it for fiat.

Q: What's the cheapest way to buy BTC? A: Binance P2P (0% fees) or bank transfers on Coinbase.

Q: How long until BTC arrives? A: Instant on exchanges; 10-60 mins on ATMs/P2P.

Q: Can I buy BTC anonymously in the US? A: Yes, via Bisq or ATMs (<$1K), but report taxes.

Q: Are no-KYC platforms safe? A: Yes, if decentralized (Bisq); check audits on MEXC.

Q: How do I cash out large amounts? A: Use OTC on Binance (no slippage); fees ~0.5%.

Q: What's Baltex.io's role? A: Non-custodial swaps—no KYC, 0% fees, cross-chain BTC trades.

(Word count so far: 2,356)

Navigating Bitcoin in 2025 means blending caution with opportunity. Start with Coinbase for simplicity, graduate to Binance for savings, or go rogue with MEXC/Bisq for anonymity. Whichever path, prioritize security and diversify—BTC's up 150% YTD, but hedges like stablecoins balance risk.

Ready to buy? Link to Coinbase signup for a bonus. For swaps, explore Baltex.io—fast, private, and fee-free. Questions? Drop in the comments. Trade smart, HODL strong.

Disclaimer: Not financial advice. Crypto is volatile; DYOR.