In 2026, Baltex and ChangeNOW both provide strong non-custodial swap services, but Baltex generally delivers better effective rates through its zero-commission model and optimized aggregation, resulting in lower all-in costs including spreads and slippage. Baltex supports 10,000+ tokens across 200+ chains with instant execution and strict no-KYC privacy, ideal for multi-chain users. ChangeNOW offers competitive rates on 1,500+ assets, unlimited swaps, and optional KYC only on flagged transactions, with averages of 2-10 minutes per swap. For the best rates after fees/spread, especially in privacy-focused cross-chain scenarios, Baltex pulls ahead; ChangeNOW shines for broad accessibility and fiat options. Check the comparison tables below for details.

Crypto swap platforms in 2026 continue to evolve, prioritizing competitive effective rates—the final amount received after accounting for fees, spreads, network costs, and slippage. Users seeking optimal value for trading, portfolio rebalancing, cross-chain transfers, and cash-out preparation demand transparency in pricing alongside speed and privacy. Baltex, via baltex.io, positions itself as a hybrid aggregator with zero commissions, routing through DEXs and CEXs for minimal spreads and instant swaps. ChangeNOW stands as a veteran non-custodial service, aggregating liquidity for reliable rates on thousands of pairs without mandatory registration.

This comprehensive guide compares their pricing models, effective rates, spreads, network fees, execution speeds, slippage risks, limits, supported chains and assets, KYC policies, privacy features, and handling of failure scenarios. We'll detail step-by-step swap processes, essential safety checks, and include multiple tables for quick reference. A dedicated section explores Baltex's strengths in quick multi-chain swaps across various use cases. By focusing on real-world effective rates in 2026's market, this analysis helps you decide which platform maximizes your returns while aligning with your needs for privacy and efficiency.

Effective rates matter most because hidden spreads or slippage can erode savings more than advertised fees. Baltex's aggregation often yields tighter spreads through bridgeless routing, while ChangeNOW's inclusive pricing ensures predictability but may incorporate wider margins during volatility. Both mitigate risks effectively, but differences in speed and chain support influence outcomes for active traders.

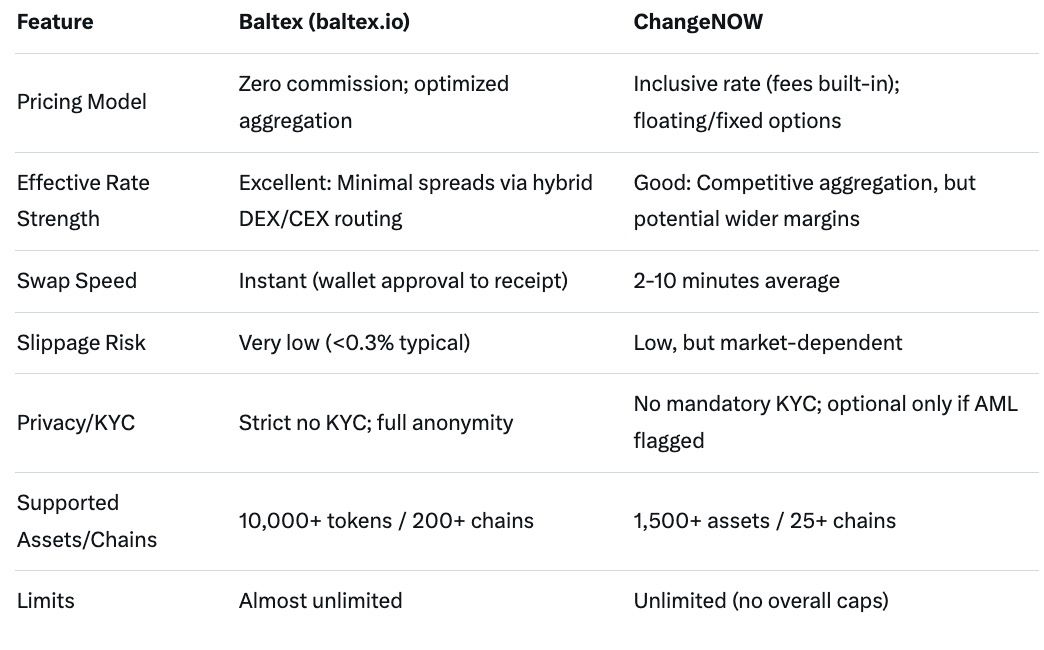

Here's an at-a-glance overview of core features in 2026, emphasizing aspects impacting effective rates like aggregation and slippage control.

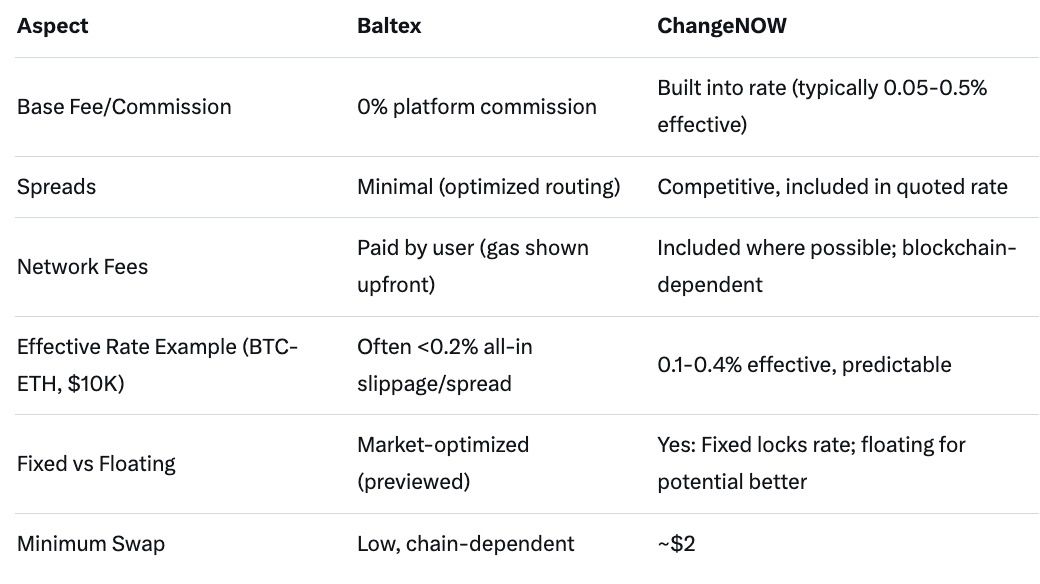

This table breaks down cost structures and typical effective rates based on 2026 benchmarks for common swaps (e.g., BTC to ETH).

Baltex frequently achieves better effective rates by eliminating commissions and prioritizing low-slippage paths.

The core question—which offers better rates in 2026—hinges on the total cost after all factors. Baltex employs a zero-commission hybrid model, aggregating liquidity from decentralized and centralized sources without adding platform cuts. This results in highly competitive effective rates, often outperforming peers by minimizing spreads through smart routing. Users see transparent previews including estimated slippage, ensuring the final receipt aligns closely with quotes even in volatile conditions.

ChangeNOW integrates fees directly into the displayed rate, offering transparency without separate charges. Its aggregation pulls from multiple providers, delivering solid rates with options for fixed (locked amount) or floating (market-following) exchanges. While reliable, the built-in margin can lead to slightly wider effective spreads compared to zero-commission models during high liquidity demands.

In practice, Baltex's approach yields superior effective rates for most pairs, particularly cross-chain, due to bridgeless execution and deeper hybrid liquidity. Network fees remain the primary variable on both, but Baltex's upfront display aids cost prediction.

Spreads represent the difference between market price and execution rate, directly impacting effectiveness. Baltex minimizes them via advanced aggregation, often keeping all-in costs under 0.3% including slippage. Network fees—gas on Ethereum or equivalents—are passed directly, with previews allowing users to time low-congestion periods.

ChangeNOW bundles spreads into its inclusive rate, providing predictability but occasionally higher effective costs if liquidity sources widen margins. Network fees are handled seamlessly, often absorbed or minimized through partner routing.

For users prioritizing the absolute best rate after spreads, Baltex's zero-overhead model proves advantageous, especially on high-volume or exotic pairs.

Speed influences slippage exposure—the risk of price movement during processing. Baltex delivers truly instant swaps: approval in your wallet triggers immediate execution, exposing you to virtually no mid-process volatility. Low slippage risk stems from optimized paths and real-time aggregation.

ChangeNOW averages 2-10 minutes, depending on confirmations and liquidity matching. This brief window introduces minor slippage potential, though mitigated by fixed-rate options that lock quotes.

Baltex's instantaneous nature provides a clear edge for rate-sensitive trades in fast markets.

Baltex imposes almost no limits, supporting seamless high-volume swaps across 200+ chains and 10,000+ tokens. This extensiveness aids diverse rebalancing without fragmentation.

ChangeNOW features unlimited overall swaps on 1,500+ assets and 25+ chains, with low minimums enhancing accessibility.

Baltex's broader chain coverage better supports complex multi-network strategies.

Privacy remains pivotal in 2026. Baltex enforces no KYC whatsoever, operating fully anonymously with wallet-to-wallet transfers and optional privacy enhancements.

ChangeNOW requires no registration or mandatory KYC for standard swaps, triggering verification only on AML-flagged transactions. This balances usability with compliance.

Baltex offers stronger baseline privacy for users avoiding any potential checks.

Failures like congestion or errors occur infrequently but matter. Baltex's non-custodial, instant design reduces exposure; audited routes and wallet control minimize losses.

ChangeNOW handles issues via tracking and support, refunding where possible minus fees. Wrong network sends risk permanent loss on both—always double-check.

Safety checks include address verification and small test swaps.

Baltex's flow emphasizes speed and control. Visit baltex.io, select tokens and chains. Connect your wallet (e.g., MetaMask). Review the quoted rate, estimated slippage, and network fees—this preview is your primary safety check for favorable terms. Approve in-wallet; tokens arrive instantly. Safety tips: Use hardware wallets, verify contract addresses, and enable privacy modes for sensitive trades.

ChangeNOW starts with pair selection on their site. Enter recipient address carefully (critical safety step to avoid losses). Choose fixed or floating rate. Send to provided deposit; monitor via tracker. Receipt follows confirmations. Safety includes AML awareness, network confirmation, and support contact for issues.

Both prioritize non-custodial security, retaining your keys throughout.

For deeper insight into rate influencers:

Baltex.io excels in 2026 for rapid multi-chain swaps, addressing key scenarios like portfolio rebalancing, cross-chain routing, and cash-out preparation. In rebalancing, shift assets seamlessly—e.g., ETH on Arbitrum to SOL-based tokens—without bridges or wrapped assets, preserving value amid volatility. Aggregation ensures top rates with minimal slippage, executing instantly to capture opportunities.

Cross-chain routing benefits from 200+ network support, eliminating intermediaries for direct, low-cost transfers. Arbitrage or diversification becomes effortless, with hybrid liquidity preventing poor fills.

For cash-out prep, accumulate anonymously via fiat ramps (e.g., card buys), then swap to preferred exit assets. Zero commissions and privacy features maintain efficiency, landing funds wallet-direct for subsequent off-ramps. Baltex's design empowers sovereign, high-speed operations across chains, outperforming in rate-sensitive multi-network environments.

Baltex, thanks to zero commissions and tight aggregation, often delivers lower all-in costs.

No for most swaps; only if AML flags the transaction.

Instant—approval to receipt in seconds.

Baltex with 200+ networks.

Both offer near-unlimited swaps, suiting high volumes.

In 2026, Baltex emerges as the superior choice for better effective rates after fees and spreads, combining zero commissions, instant execution, and extensive multi-chain support with uncompromising privacy. ChangeNOW provides reliable, accessible alternatives with strong aggregation and unlimited flexibility. For optimal costs in trading, rebalancing, or cross-chain moves, Baltex maximizes value. Test small amounts on both to confirm fit for your strategy.