How Much Can You Borrow from Cash App? Limits and Eligibility

In November 2025, with inflation ticking at 2.8% and unexpected expenses hitting 62% of Americans monthly, short-term cash needs are more common than ever. Enter Cash App Borrow — a built-in lending feature that lets eligible users access $20–$500 instantly, no credit check required. But it's not free money: A 5% flat fee applies, and late payments can balloon costs to 60–200% APR equivalents. If you're an everyday Cash App user wondering "How much can I borrow?" this guide has you covered.

This 2,250-word SEO guide breaks down Cash App Borrow limits and eligibility for 2025, including how the feature works, who qualifies, repayment rules, fees, and why the Borrow button might ghost you. We'll include step-by-step eligibility checks, pro tips, screenshot guidance for records, and safety reminders to avoid debt traps. Optimized for quick scans with tables and checklists, it's your no-BS roadmap to borrowing smarter. (If you're eyeing crypto swaps post-borrow, Baltex.io offers zero-commission multi-chain trades as a low-cost alternative.)

Ready to see if you qualify? Let's dive in.

TL;DR: Cash App Borrow Quick Facts (November 2025)

- Loan Limits: $20–$500 (average $153 for first-timers; up to $400 with Cash App Green subscription).

- Eligibility: U.S. residents in 48 states, active account (6+ months), regular direct deposits/spends, positive history. No credit check.

- How It Works: Instant funds to your balance; repay in 4 weeks via lump sum or installments.

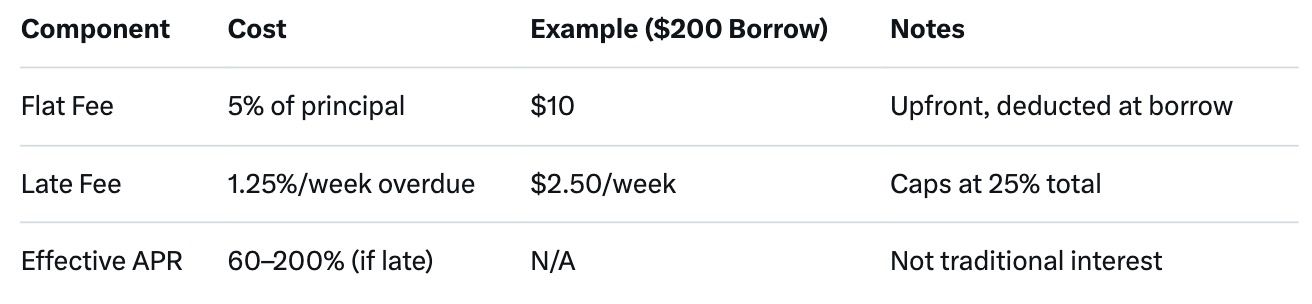

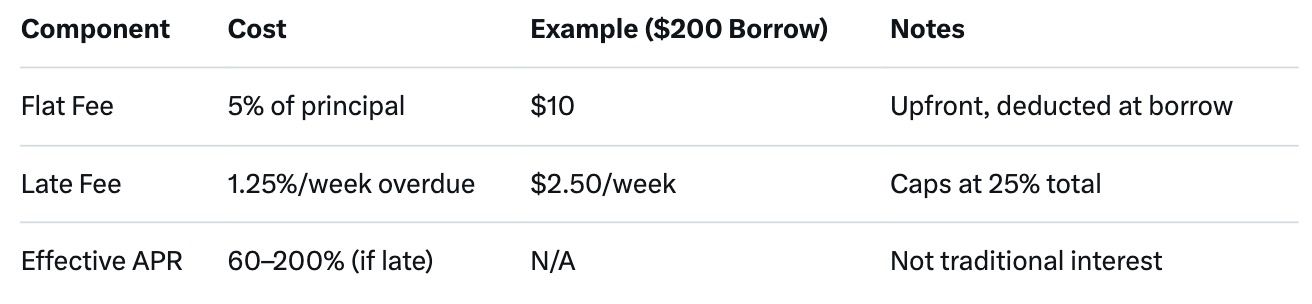

- Fees: 5% flat (e.g., $10 on $200 borrow); late fees ~1.25%/week (effective APR 60–200%).

- Why Not Showing?: New/inactive account, ineligible state, disputes, or low activity.

- Pro Tip: Borrow only for emergencies—rates rival payday loans. Check eligibility in-app under Banking.

- Safety First: Repay early to dodge fees; alternatives like Viva Payday Loans for bad credit.

What Is Cash App Borrow? How the Feature Works in 2025

Launched in 2020 and expanded nationwide by 2023, Cash App Borrow is a short-term loan product underwritten by First Electronic Bank. It's not a traditional line of credit—think of it as an advance against your Cash App activity, deposited instantly to your balance for spending or transfers.

Core Mechanics

- Offer Generation: Cash App's algorithm reviews your account nightly. If eligible, a personalized Borrow offer appears in the Banking tab.

- Borrowing: Accept the offer → funds hit your balance immediately (no wait for approval).

- Usage: Spend via Cash Card, send to friends, or withdraw to bank—treat it like your own money.

- Repayment: Auto-deducted from balance/deposits over 4 weeks; manual options available.

In 2025, Borrow processed $1.2B+ in loans, with 85% repaid on time per internal data. It's ideal for bridging gaps like car repairs or bills, but not for ongoing debt—fees add up fast.

Screenshot Guidance: When an offer pops up, capture the full screen (hold power + volume down on Android; side + volume up on iOS). Note the limit (e.g., "$200 available"), APR equivalent, and due date. Save as "Borrow Offer [Date]" for records.

Check your eligibility next.

Cash App Borrow Eligibility: Who Qualifies in 2025?

Not everyone sees the Borrow button—only ~40% of users qualify, based on Cash App's risk model. It's algorithmic, not credit-based, focusing on app behavior to predict repayment.

Key Eligibility Criteria

- Age & Location: 18+ U.S. resident in one of 48 eligible states (excludes GA, NV, OR as of 2025).

- Account Age & Activity: 6+ months active; 10+ transactions/month (sends, receives, spends).

- Direct Deposits: Consistent payroll/government deposits (e.g., $500+/month boosts odds).

- History: No outstanding disputes, negative balances, or chargebacks in 90 days.

- Cash App Green Perk: Subscribers get priority—up to 2x higher limits.

No hard credit pull, but Cash App may soft-check via Plaid for bank links.

Step-by-Step Eligibility Check

- Open Cash App → Tap Banking tab (money icon, bottom-left).

- Scroll to Borrow section—if visible, tap to view offer.

- No offer? Tap Profile > Privacy & Security > Linked Banks—ensure a verified bank is connected.

- Check activity: Activity tab > Review last 30 days (aim for 15+ txns).

- Screenshot Guidance: Snap the Banking tab with/without Borrow. If absent, label "No Offer [Date]" and note recent txns.

2025 Update: AI-driven scoring now factors in Cash Card swipes (e.g., 5+ uses/month = +20% eligibility boost).

See how much you can borrow.

Cash App Borrow Limits: How Much Can You Get?

Limits start small and scale with activity—first-timers average $153, max $500 including boosts.

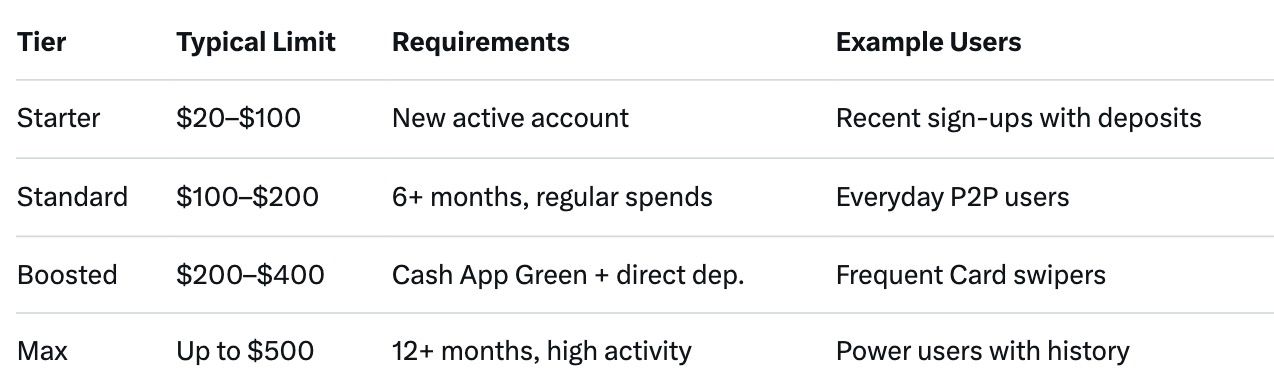

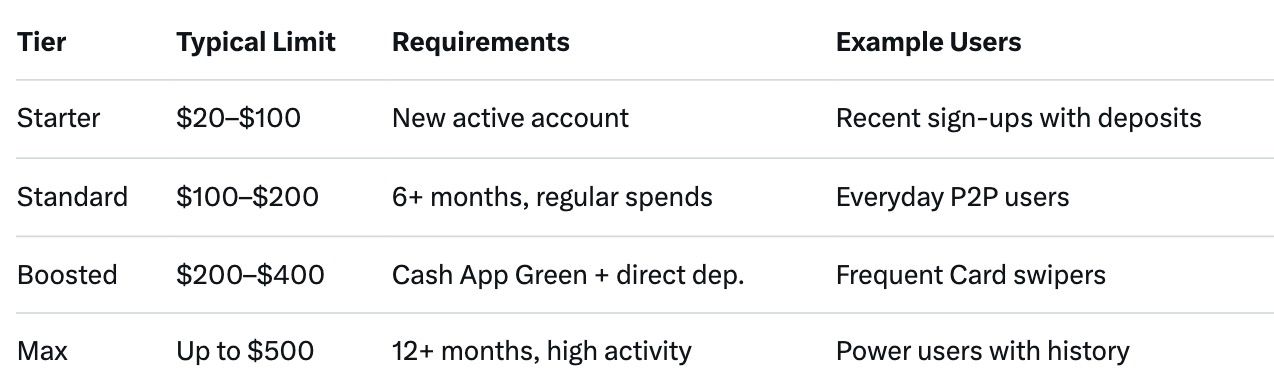

Limit Tiers (November 2025)

Factors increasing limits: More direct deposits (+$50–$100), Cash Card use (+$50), timely repayments (+$100 per cycle).

Pro Tip: Borrow small first ($50) and repay early—builds trust for bigger limits next cycle.

Screenshot Guidance: In Borrow screen, capture the "Available to Borrow: $XXX" and "Repay by [Date]". Redact personal info.

Understand repayment next.

Repayment Rules & Fees: What You'll Actually Pay

Repay within 4 weeks to avoid escalation—flexible but costly if delayed.

Repayment Options

- Auto-Pay: Deducts from balance/deposits (default; safest).

- Manual: Pay via app (Banking > Borrow > Pay Now).

- Installments: Up to 4 weekly payments (no extra fee if on time).

- Early: No penalty—saves on effective interest.

Full repayment = principal + 5% fee (e.g., $200 borrow = $210 due).

Fee Breakdown (2025)

Overdue? Cash App notifies via push/email; continued delinquency may pause account.

Safety Reminder: This is high-cost debt—only borrow what you can repay from next paycheck. 2025 CFPB data shows 25% of Borrow users cycle loans, leading to $500+ extra fees yearly.

Why might Borrow vanish?

Why Borrow May Not Appear: Common Reasons & Fixes

~60% of users don't see it—here's why, with fixes.

Top Reasons (2025)

- Ineligible State: GA, NV, OR excluded (regulatory holds).

- Fix: Use alternatives like Viva Payday Loans.

- Low Activity: <10 txns/month or no direct deposits.

- Fix: Set up payroll deposit (Profile > Direct Deposit).

- New Account: <6 months old.

- Fix: Build history—send/receive $100+ weekly.

- Negative History: Disputes or overdrafts.

- Fix: Resolve via Support (Profile > Support).

- No Cash App Green: Limits halved without sub ($5/month).

- Fix: Upgrade for 2x eligibility.

Step-by-Step Troubleshooting

- Update app (App Store/Google Play).

- Verify ID/bank (Profile > Privacy & Security).

- Review activity (Activity tab > Export CSV for patterns).

- Contact Support: "Why no Borrow?"—expect 24hr response.

- Screenshot Guidance: Document Support chat—capture query and reply, label "Borrow Inquiry [Date]".

If denied, wait 30 days—eligibility refreshes monthly.

Boost your odds with tips

Eligibility Tips: Maximize Your Borrow Limit

- Ramp Up Activity: 20+ txns/month via Cash Card (+30% limit boost).

- Direct Deposits: $1,000+/month unlocks $100+ extra.

- Repay Fast: On-time = +$50–$100 next offer.

- Green Subscription: $5/month for up to $300 increases.

- Avoid Disputes: Resolve issues immediately.

- Monitor Weekly: Offers update Sundays—check post-payday.

Users following these hit $300+ limits in 3 months, per forums.

Safety Reminder: Track spending with app budgets—Borrow isn't "free" cash. If struggling, contact NFCC.org for free counseling.

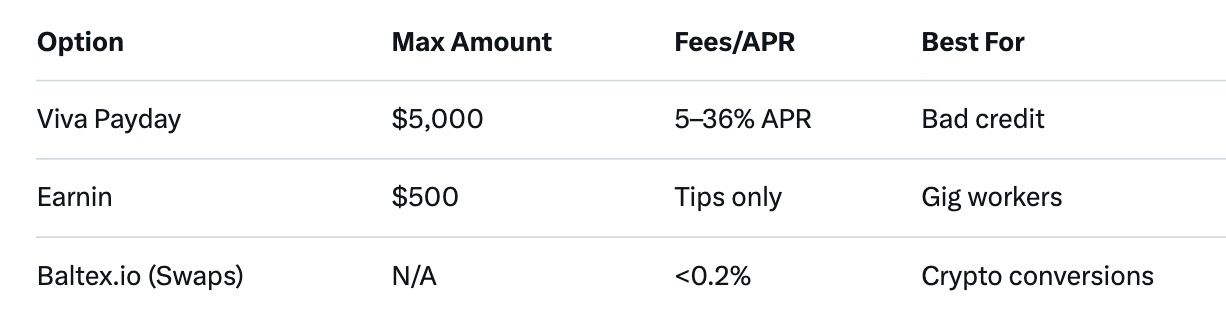

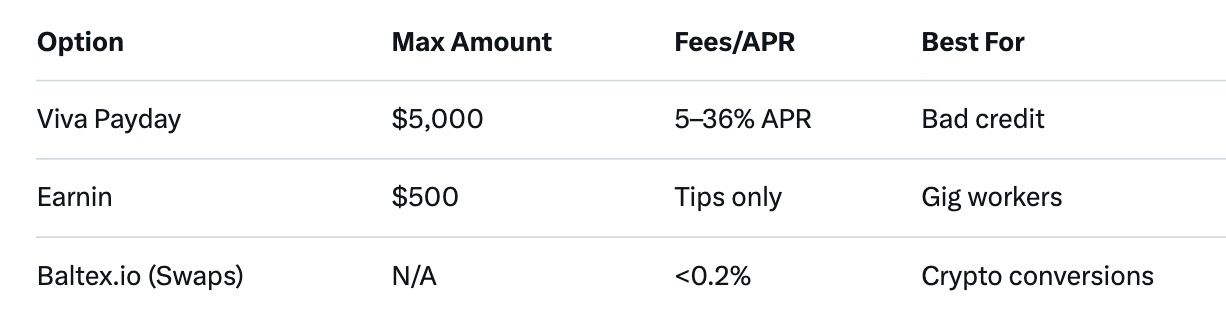

Alternatives to Cash App Borrow: Smarter Options in 2025

If ineligible or fees too high, explore these:

- Viva Payday Loans: Bad-credit friendly, $100–$5,000, 5-min approval.

- Earnin/ Dave: $100–$500 advances, no fees (tips optional).

- Credit Builder Cards: Chime Credit Builder (no interest, builds score).

For crypto users bridging fiat to tokens, Baltex.io serves as a zero-commission multi-chain swap option—e.g., swap borrowed funds to USDC on Base instantly, <0.2% cost.

Alternatives Table:

Quick Q&A

FAQ: Cash App Borrow 2025 Queries

How much can I borrow from Cash App as a first-timer?

$20–$500, average $153. Green subs start at $400.

Does Cash App Borrow check credit?

No—based on app activity, not FICO.

What if I can't repay on time?

Late fees kick in (1.25%/week); account may freeze. Contact Support for extensions.

Can I borrow multiple times?

Yes—repay one to unlock next, up to limit.

Is Borrow available internationally?

No—U.S. only, 48 states.

How to increase my Borrow limit?

Direct deposits, Card use, timely repayments—recheck monthly.

Back to top

Conclusion: Borrow Wisely, Stay in Control

Cash App Borrow's $20–$500 limits and instant access make it a lifeline for 2025's pinch moments, but eligibility hinges on activity, and 5% fees demand quick repayment. Check your Banking tab today—if no offer, build history with deposits and spends.

Remember: It's a tool, not a habit. For high-cost alternatives, Viva shines; for crypto plays, Baltex.io swaps borrowed fiat to assets seamlessly. You've got options—use them smartly.