This in-depth guide will walk you through the workings of no-fee crypto swaps, how to spot hidden spreads, the platforms pushing the boundaries of zero-cost trading, and what pitfalls to watch out for. You’ll also find a handy comparison table of top services, plus a closer look at Baltex.io, one of the newest hybrid exchanges claiming zero commissions. By the end, you’ll know exactly how to sniff out real zero-fee deals and keep more of your own crypto.

If you’re short on time, keep those bullets in mind. Otherwise, read on for a deep dive into how this all works, the best platforms to explore, and the top challenges facing zero-fee cryptocurrency trading.

You might wonder, how can any exchange afford to let users trade for free? Traditional trading platforms usually charge you either a fixed fee per transaction, a percentage of the trade value, or a tiered fee based on your monthly volume. Zero-cost crypto swaps flip that model on its head.

Zero-fee swaps sound great at first glance. But you’ll want to proceed with a bit of skepticism to avoid hidden costs and random pitfalls. That’s where the concept of spreads comes into play.

No matter how fancy a platform’s marketing might be, every business needs a revenue stream. If you see a claim for “no-fee cryptocurrency trading,” you should immediately check the difference between the bid price (the highest price buyers are offering) and the ask price (the lowest price sellers are willing to accept).

A spread is the gap between the price at which you can buy a cryptocurrency and the price at which you can sell it. For instance, if Bitcoin is going for $30,000 on the “buy” side but the “sell” side is only $29,950, that $50 difference is effectively the spread. You might not notice it on your trade receipt as a fee, but it still means you pay extra when buying or receive slightly less when selling.

Keeping an eye on spreads goes a long way toward knowing whether you’re truly getting the zero-fee promise or quietly paying in other ways.

Even though no-fee swaps can drastically reduce your costs, they still come with their own set of concerns. Before you dive headfirst, it’s wise to be aware of the main issues lurking behind the scenes.

In the world of crypto, large price swings can happen daily—or even hourly. When fees are removed, you might be tempted to place more trades than usual. But remember that every additional position you open puts you at risk of sudden price drops. More trades mean more chances to gain, but also more chances to lose.

No matter how user-friendly or cheap an exchange might be, platform security is everything. Some no-fee platforms may skimp on high-quality security measures to cut costs. Always ask questions like:

Less established platforms—even ones that promise zero fees—may lack adequate liquidity. Low liquidity means you can end up with poor order execution, slippage (unexpected price movement between your order request and actual fill), or trouble finding a counterparty for your trade.

Various governments look at crypto differently. Some are friendly, while others keep introducing new hurdles. With no-fee crypto sites, you might face compliance issues down the road if the exchange isn’t properly regulated or if it operates in partially gray areas.

Zero fees might encourage a “why not?” mentality. Placing too many trades can lead to emotional ups and downs, not to mention potential tax complexities in certain jurisdictions.

Staying mindful of these risks will help you approach the no-fee revolution with a balanced perspective. Let’s look at some platforms that currently dominate the scene.

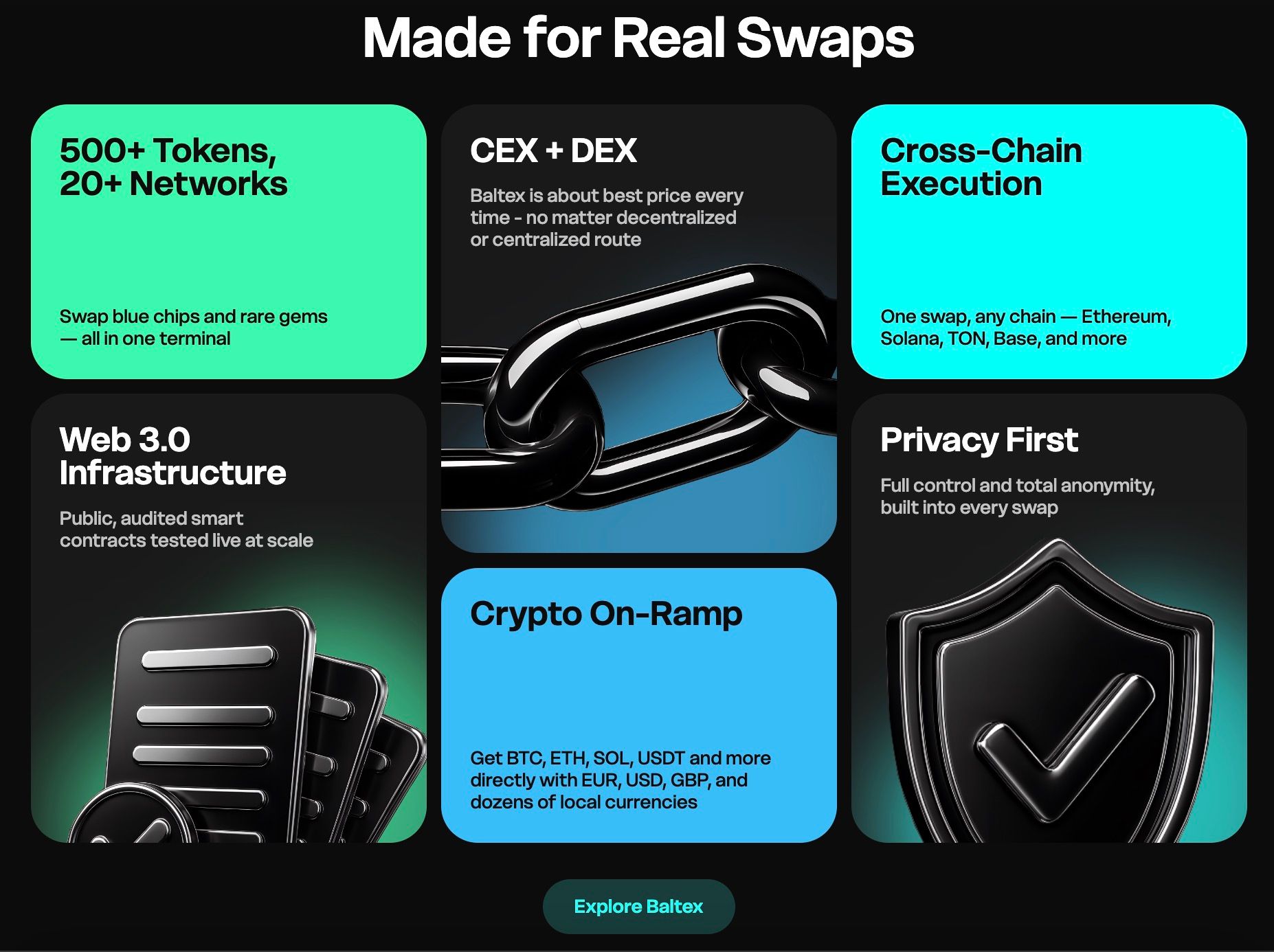

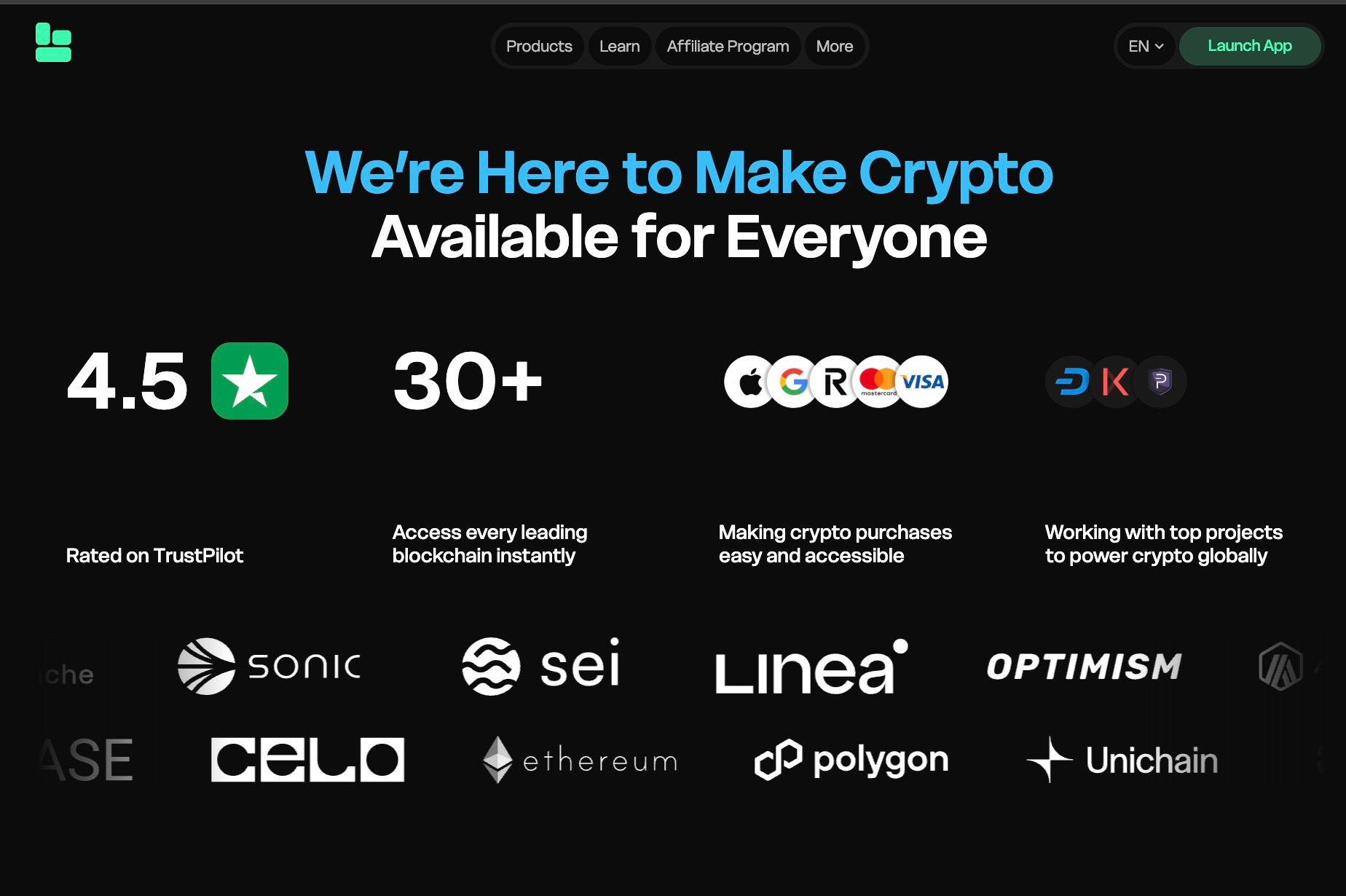

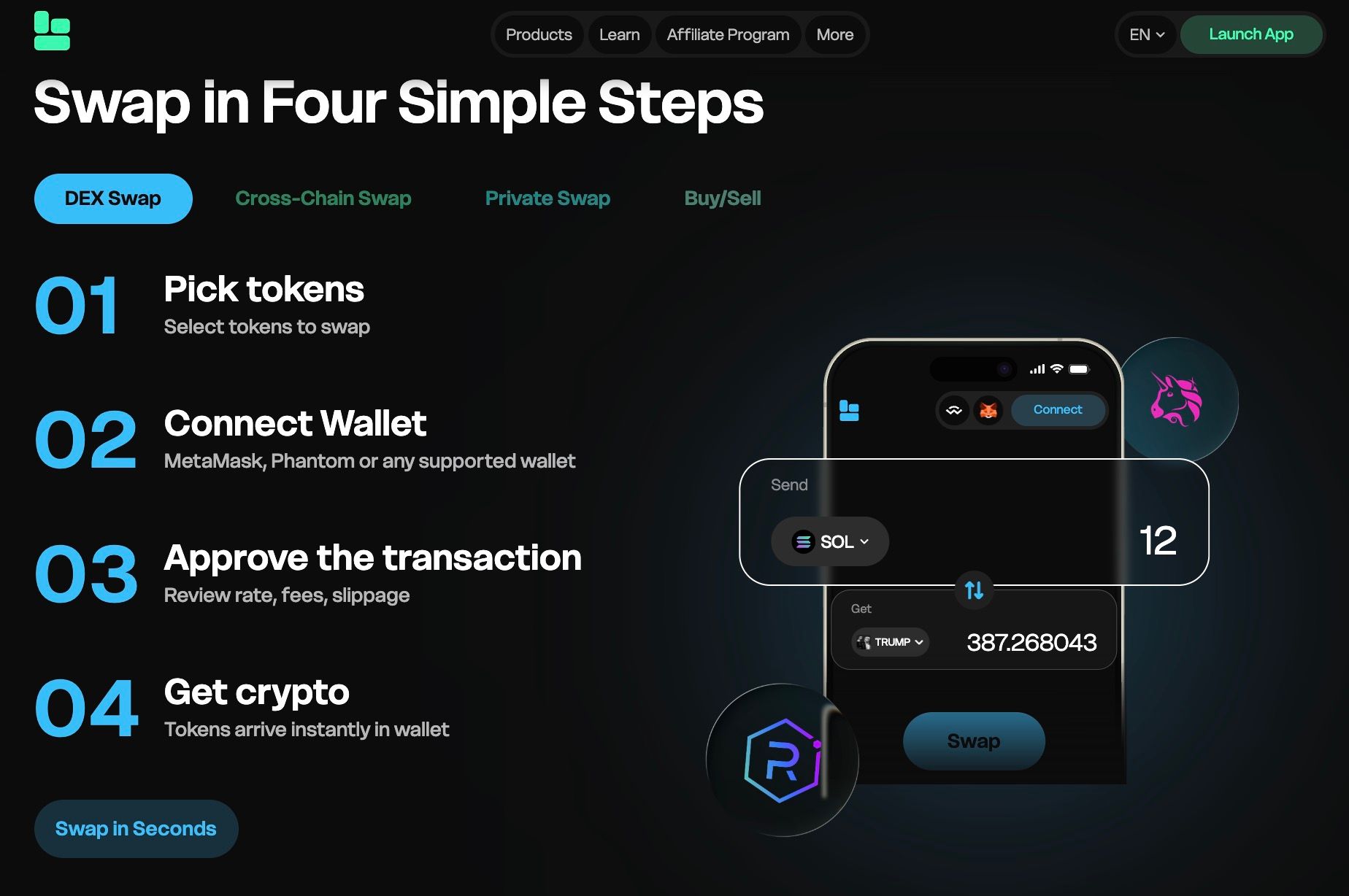

Among the no-fee players, Baltex.io has been making waves as a “hybrid exchange.” The idea is to combine certain centralized exchange (CEX) features—like faster order matching and deep liquidity—with decentralized exchange (DEX) features, such as self-custody options and permissionless listings. Baltex.io speaks loudly about charging zero commissions on both maker and taker trades.

If you’re curious about an alternative that tries to merge the best of both worlds, Baltex.io might be worth a closer look. Still, investigate further before committing any serious funds, especially to a platform that’s still emerging.

It’s easy to let the “free” aspect lure you in, but your personal trading goals, risk tolerance, and investment style should drive the final decision. Here are a few pointers to help you choose the best platform for your needs.

Balancing these factors helps you find a platform that aligns with your comfort zone and trading style, whether that’s daily scalping or once-a-month portfolio rebalancing.

Even with a rock-solid fee structure and an intuitive interface, any crypto exchange can become a liability if you don’t uphold strong personal security. Think of it like locking your house. It doesn’t matter how nice the neighborhood is, you still want sturdy locks on the doors.

Holding large crypto balances directly on an exchange always carries risk. If the platform is hacked or if it suddenly shuts down, you could lose access to your funds. A hardware wallet or reputable software wallet lets you keep control of your private keys.

Always turn on 2FA if the exchange supports it. This involves a separate app (like Google Authenticator) or SMS verification, making it harder for hackers to breach your account using just a password.

Whenever you transfer funds off an exchange, confirm you typed or pasted the correct address. A single typo can send your cryptocurrency to a void with no way to get it back.

Scammers often send emails pretending to be your exchange, asking you to log in or reveal personal info. Always go to the exchange’s website directly by entering the URL yourself, and keep an eye out for suspicious domain names or odd email addresses.

If possible, spread your crypto across a few different wallets or platforms. This way, if something unfortunate happens to one service, you still have other funds safe elsewhere.

Below are some common questions about fee-free swaps. If you’re still unsure how this all works, you might find the clarity you need here.

Is no-fee cryptocurrency trading really free? It can be. Some platforms genuinely provide zero transaction fees, but you often end up paying through slightly widened spreads. Keep an eye on those prices to ensure you’re not losing money that would otherwise go to explicit fees.

Which no-fee platform is best for a beginner? Beginner-friendly platforms typically have straightforward interfaces and active customer support. TradeLite, for example, offers tutorials and a simple interface aimed at new traders. That said, always try the demo or read user reviews to see if it matches your comfort level.

Do I need to complete KYC (Know Your Customer) checks on these platforms? Some no-fee exchanges waive KYC for small daily withdrawal limits. Others might require full identification. Always check your local regulations and see if the platform’s rules align with them.

Should I worry about hidden fees beyond the spread? Potentially, yes. Some exchanges charge deposit or withdrawal fees. Others assess fees for advanced services, like margin trading or staking. Read the fine print or ask the exchange’s support team for clarity.

Can zero-fee platforms change their policies later? Absolutely. Exchanges frequently revise fee schedules, especially if operating costs rise or regulations shift. Keep an eye on official announcements and be ready to adapt if a platform starts adding fees.

How can I minimize risk? Use strong security measures (2FA, secure wallets), diversify your holdings, and choose platforms with solid reputations. Also, don’t forget to do your own research to understand each token’s fundamentals.

No-fee cryptocurrency trading can look like the perfect shortcut to higher profits. You save on transaction charges, get to experiment with more trades, and might find advanced tools that cater to your every need—all for “free.” Still, a bit of caution is a must. Many platforms claiming zero fees recoup costs in ways you might not initially see, such as spreads or premium add-ons. In other words, always do your homework.

If you’re ready to dip your toes into no-fee swaps, start by mapping out your personal goals. Are you in it for short-term gains or do you prefer long-term holds? Which features do you really need, and how much security are you prepared to handle yourself? Once you’ve answered those questions, check the liquidity, security measures, and user reviews of your chosen exchange. If everything looks solid—go forth and trade with confidence.

In the rapidly evolving universe of crypto, zero-fee structures may become more commonplace. Platforms like Baltex.io show how quickly the space can innovate. Just remember, the real cost of trading boils down to more than just posted fees. Keep your eyes open for hidden spreads, prioritize security, and you’ll be in a prime position to reap the rewards of no-fee trading in 2025.

Happy swapping, and may your trades be ever in your favor!