Utility coins (or tokens) are cryptocurrencies that power blockchain ecosystems by granting access to services, like paying fees or unlocking features—think ETH for Ethereum transactions or BNB for Binance discounts. In 2025, they drive DeFi, gaming, and AI apps, with benefits like low-cost access and staking rewards, but risks include volatility and regulatory shifts. Top examples: ETH, BNB, LINK, SOL, UNI. Unlike securities (ownership assets) or pure governance tokens (voting-only), utilities focus on function. Use Baltex.io for seamless multi-chain swaps between them. Key: Prioritize real-use projects; never invest more than you can lose.

In 2025, the crypto market has matured beyond Bitcoin's store-of-value role, with utility coins leading the charge as the backbone of decentralized ecosystems. Valued at over $1.2 trillion in combined market cap, these tokens aren't just speculative assets—they're digital keys unlocking everything from DeFi lending to NFT minting and AI-driven oracles. For beginners, utility coins demystify crypto by tying value to practical use; intermediates appreciate their role in yield farming or cross-chain interoperability.

This SEO guide breaks it down: What utility coins are, how they function in blockchains, benefits vs. risks, a comparison to securities and governance tokens, and 2025's top performers with real examples. Optimized for snippets like "What is a utility coin?" or "Top utility tokens 2025," we'll use lists, tables, and subheads for quick reads. By the end, you'll spot high-potential utilities and swap them safely via tools like Baltex.io.

Internal link: Jump to top utility coin examples.

Utility coins, often called utility tokens, are cryptocurrencies designed to provide specific functions within a blockchain network or decentralized application (dApp). Unlike general-purpose money like fiat, they act as "vouchers" for ecosystem services—paying fees, accessing premium features, or earning rewards. Issued via smart contracts on platforms like Ethereum or Solana, they're fungible (interchangeable) and ERC-20 compliant in many cases.

In essence, utility coins fuel participation, creating self-sustaining economies. Internal link: See how they differ from governance tokens.

Utility coins integrate seamlessly into blockchains, enabling automation via smart contracts—self-executing code that triggers actions when conditions are met. They solve the "cold start" problem: bootstrapping networks by incentivizing early users.

This creates network effects—more users mean higher demand, stabilizing value. In 2025, with 500M+ wallets, utilities process $5T+ in annual volume.

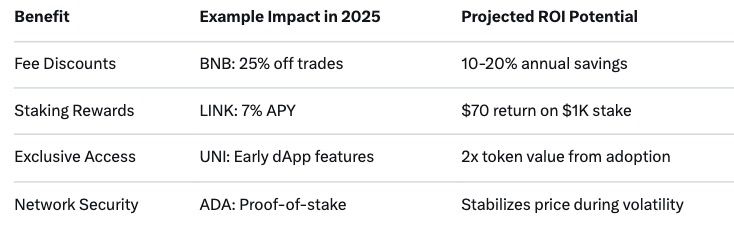

Utility coins shine in 2025's utility-driven bull market, where adoption trumps hype. Here's why they're essential:

Overall, utilities align incentives, fostering sustainable growth over pump-and-dumps.

Internal link: Counterbalance with risks.

No reward without risk—utility coins face amplified threats in 2025's regulated, AI-hacked landscape. Losses hit $1.8B from exploits last year.

Weigh benefits against these—utilities reward patience, not FOMO.

Tokens aren't monolithic; classification impacts legality, use, and returns. In 2025, SEC guidelines emphasize function over hype.

Hybrids exist (e.g., UNI blends utility/governance), but misclassification led to 2024's $200M fines. Internal link: Explore top utilities.

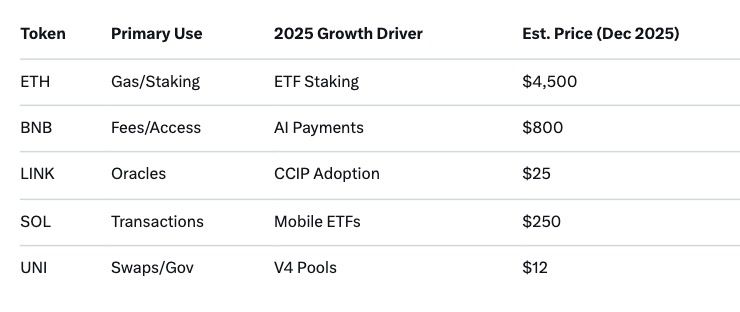

2025's standouts blend proven utility with innovation. Selected by TVL, adoption, and growth (data: CoinMarketCap/DeFiLlama).

ETH powers 60% of dApps, with $250B TVL post-Pectra upgrade (May 2025). Use: Gas fees, staking (5% APY). 2025 Highlight: ETF staking approvals boosted price 150%. Market Cap: $450B.

BNB fuels Binance Smart Chain: Trades, Launchpad access, 20% fee cuts. 2025: Expanded to AI payments, 300M users. Yield: 8% staking. Market Cap: $90B.

LINK connects blockchains to real data for DeFi/oracles. Use: Secure feeds, CCIP cross-chain. 2025: Integrated with 500+ dApps, $10B secured. Staking: 6% APY. Market Cap: $15B.

SOL enables 65K TPS for gaming/NFTs. Use: Fees, mobile dApps. 2025: Shopify integration, ETF launch—price up 400%. Market Cap: $80B.

UNI governs/swaps on Ethereum L2s. Use: Fees, liquidity mining (10% rewards). 2025: V4 hooks for custom pools, $50B volume. Market Cap: $8B.

FIL rents storage space. 2025: Web3 archiving boom, 20% YOY growth. Market Cap: $4B.

These drive 70% of utility volume—focus here for balanced exposure.

In 2025's fragmented multi-chain world, swapping utilities like ETH to SOL shouldn't mean bridge hacks or high fees. Enter Baltex.io, the non-custodial aggregator revolutionizing utility trades.

Connect wallet at baltex.io, select pair, confirm—zero custody, full control. With zero exploits since 2024 launch, it's utilities' fast lane. Internal link: Back to benefits.

A utility coin provides access to blockchain services like fees or features (e.g., ETH for Ethereum transactions)—not ownership like securities.

Utilities focus on function (access/rewards); governance emphasizes voting (e.g., UNI for Uniswap decisions), often overlapping.

ETH, BNB, LINK, SOL, UNI—powering DeFi, exchanges, oracles, and DEXs with $700B+ combined cap.

Yes for long-term: Benefits like yields outweigh volatility if you pick adopted projects; risks include regulation.

Non-custodial atomic swaps across 20+ chains, private routes, low fees—e.g., ETH to SOL in seconds without bridges.

Utilities: Service access, low regulation. Securities: Asset ownership, high compliance (e.g., dividends).

Utility coins in 2025 aren't just crypto—they're the engines of Web3, turning blockchains into vibrant economies. From ETH's DeFi dominance to SOL's speed, their benefits (efficiency, yields) far eclipse risks when approached wisely. Compared to securities' stability or governance's power, utilities offer accessible entry for beginners building intermediate strategies.

Dive in: Research via CoinGecko, stake for rewards, and swap via Baltex.io. What's your first utility play—ETH staking or UNI liquidity? The ecosystem grows with you—trade smart, stay secure.