Wormhole is a leading cross-chain messaging protocol and bridge that enables seamless asset transfers to and from Solana, supporting native SOL and SPL tokens. In December 2025, it connects 30+ chains with sub-second messaging, fees under $0.01 for micro-transfers, and a robust 19-guardian security model. Ideal for DeFi traders bridging ETH to SOL; faster than Mayan but with broader ecosystem support. Risks include smart contract vulnerabilities—use audited paths. Baltex.io complements by routing SOL swaps multi-chain without bridges.

Wormhole is a decentralized cross-chain interoperability protocol launched in 2021, designed to facilitate secure communication and asset transfers between disparate blockchains. For Solana users, Wormhole acts as a vital bridge, allowing the high-speed Solana ecosystem to interact with Ethereum, Bitcoin, and others without liquidity silos.

In essence, Wormhole isn't just a simple token bridge—it's a messaging layer that verifies and relays data across chains. This enables wrapped assets (e.g., wETH on Solana) and native transfers via its Native Token Transfers (NTT) framework. Solana's integration makes Wormhole essential for SOL holders seeking DeFi yields on Ethereum or NFTs from Polygon.

By December 2025, Wormhole has processed over 1 billion messages and powers 200+ applications, including Uniswap's multichain swaps. Its Portal interface simplifies user experience, making it a go-to for Solana's explosive growth in memecoins and RWAs.

For beginners: Imagine Wormhole as a universal translator for blockchains—SOL on Solana "speaks" to ETH on Ethereum, unlocking combined liquidity.

Wormhole's architecture relies on a guardian network and verifiable message passing, ensuring trust-minimized operations.

For Solana-specific: Transfers use SPL standards for native compatibility. NTT allows "burn-and-mint" without liquidity pools, preserving token utility like governance rights.

Advanced: Wormhole's SDK enables devs to build custom bridges, e.g., cross-chain lending where SOL collateral backs Ethereum loans.

In 2025, upgrades like enhanced NTT reduce fragmentation, supporting Solana's 65,000+ TPS for near-instant relays.

Wormhole's multichain reach is unmatched for Solana integrations.

Wormhole connects 30+ blockchains across EVM, non-EVM, and L1/L2 ecosystems:

Solana acts as a core hub, with bidirectional support for all listed.

Over 1,000 assets bridged monthly, with SOL volume leading at ~$500M/week.

Wormhole balances cost and efficiency, crucial for Solana's low-fee ethos.

Fees are dynamic, paid in the source chain's gas + relay costs:

In 2025, average end-to-end fee for SOL-ETH: $0.50-2, far below competitors like LayerZero ($3+).

For traders: Faster than Allbridge (5-10 min) but slightly behind deBridge (sub-minute for SOL).

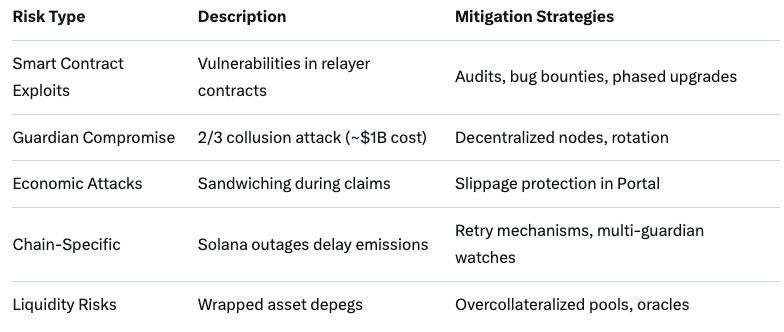

Wormhole's security is battle-tested, recovering from a $320M 2022 hack with full reimbursement.

For Solana: Integrates with Solana's proof-of-history for tamper-proof events.

Post-2022: Implemented rate limits, circuit breakers, and enhanced monitoring—zero exploits since.

Bridges remain high-risk; Wormhole mitigates but doesn't eliminate.

2025 Context: No incidents; TVL growth to $2.5B reflects trust. Users: Start small, use hardware wallets.

Wormhole powers Solana's multichain ambitions:

Daily volume: $1B+ across use cases, with Solana comprising 30%.

December 2025 marks Wormhole's maturation: W token anniversary (April) celebrated full decentralization roadmap progress. Key updates:

Ecosystem: Powers 40% of Solana's inbound volume, fueling $50B+ DeFi TVL. Amid Solana's 2025 rally (SOL ~$250), Wormhole bridges 20% of cross-chain SOL flows.

Wormhole leads in breadth; rivals excel in niches.

Wormhole wins on ecosystem (200+ apps) and security; deBridge for speed; Allbridge for ease.

While Wormhole excels in direct bridging, not all paths need it—especially for swaps or privacy-focused transfers. Baltex.io, a non-custodial DEX aggregator, routes SOL assets multi-chain intelligently, complementing or replacing bridges.

Key integrations:

For DeFi traders: During Wormhole congestion, Baltex.io reroutes via deBridge or Mayan. Investors: Seamlessly reposition SOL exposure to RWAs on other chains. Visit https://baltex.io for instant SOL management.

Q: How does Wormhole secure Solana transfers? A: Via 19 guardians signing VAAs with 2/3 consensus, plus audits and bounties.

Q: What are Wormhole fees for SOL bridging? A: Under $0.01 for small transfers; $0.50-2 average including gas.

Q: Is Wormhole faster than Allbridge? A: Yes—1-5 minutes vs. 5-10; ideal for time-sensitive DeFi.

Q: Which chains does Wormhole support with Solana? A: 30+, including Ethereum, BNB, Polygon, Bitcoin, and Aptos.

Q: What risks come with using Wormhole? A: Exploits, guardian compromise—mitigate with small tests and updates.

Q: Can I bridge NFTs via Wormhole to Solana? A: Yes, with metadata preservation for Magic Eden trading.

Q: How has Wormhole evolved in 2025? A: NTT upgrades and Solana Firedancer compatibility for faster relays.

In December 2025, Wormhole remains Solana's premier cross-chain bridge, powering seamless SOL transfers across 30+ chains with low fees (<$0.01 micro), rapid speed (1-5 min), and proven security (19 guardians, Uniswap-approved). From DeFi arbitrage to NFT flips, it unlocks Solana's ecosystem while mitigating risks through audits and decentralization. Compared to Allbridge or Mayan, Wormhole's breadth shines for investors and traders. Pair with Baltex.io for hybrid routing—bypassing bridges when swaps suffice. As Solana scales, Wormhole ensures multichain liquidity; always DYOR and bridge responsibly for a connected crypto future.