In 2025, Nano (XNO) leads with $0 fees and instant confirmations, ideal for micropayments. Stellar (XLM) follows at ~$0.000004 per tx, perfect for remittances. Other top low-fee cryptos: Ripple (XRP) at $0.00003, Solana (SOL) at $0.00025, and Tron (TRX) under $0.01. L2s like Base (~$0.10) slash Ethereum costs 90%+. Factors: Block times (Nano: instant; SOL: 0.4s), scalability (SOL: 65K TPS), hidden fees (priority boosts). Use Baltex.io for cross-chain swaps on low-fee routes, saving 0.1-0.3% vs. traditional bridges. Key: Match use case—speed for DeFi (SOL), privacy for payments (XMR). Always DYOR; fees fluctuate with congestion.

Crypto fees in 2025 aren't just numbers—they're the gatekeepers to efficient, everyday blockchain use. With Ethereum's gas averaging $3.78 post-Dencun, high costs still sideline beginners from DeFi swaps or active users from frequent transfers. But low-fee alternatives shine: Nano's zero-cost model powers instant P2P, while Solana's sub-cent txs fuel NFT booms. This guide compares 2025's cheapest cryptos, dissecting real transfer costs, block times, network designs, scalability, hidden pitfalls, and use cases. We'll pit L1s like XRP against L2s like Arbitrum, using tables for snippet-friendly scans (e.g., "Cheapest crypto to transfer 2025?").

Optimized for queries like "Solana vs. Stellar fees," expect actionable insights: Save 99% on remittances via XLM or scale DeFi on Base for pennies. Internal link: Jump to L1 vs. L2 comparison. By article's end, you'll swap smarter—perhaps via Baltex.io's low-fee routing.

Transaction fees (gas, miner rewards) compensate validators for processing. In 2025, they're dynamic: Congestion spikes them, but designs like Proof-of-Stake (PoS) keep them low. Average global fee? $0.05—down 70% from 2024 thanks to L2s and upgrades.

Block time (seconds to confirm) ties to scalability (TPS). Low fees demand high throughput—e.g., Nano's DAG avoids blocks entirely. Internal link: See top low-fee table.

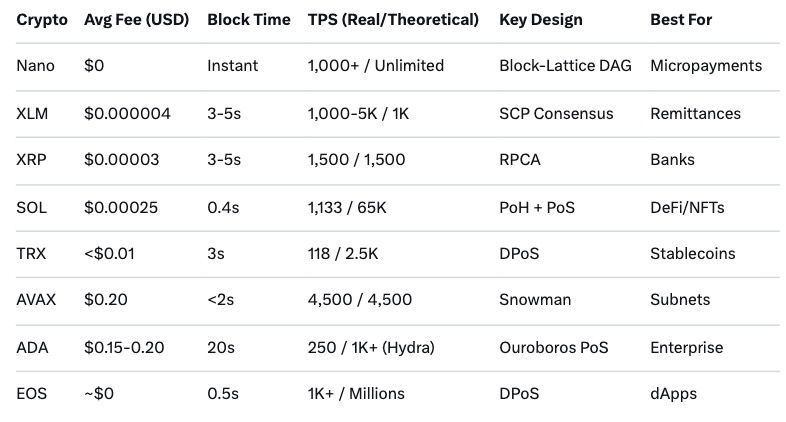

Based on 2025 data (e.g., Token Terminal, Solscan), here are the standouts. Fees averaged over Q3-Q4, assuming $100 SOL/$0.50 XLM prices.

Nano's block-lattice (DAG) lets users "vote" on txs asynchronously—no miners, no fees. Avg cost: $0. Block time: Instant (<1s). Scalability: 1,000+ TPS, eco-friendly (PoS-like).

2025 Use Cases: Micropayments (e.g., tipping creators $0.01), IoT vending. Drawback: Limited dApps vs. EVM chains.

Stellar's SCP consensus enables ~$0.000004 txs (0.00001 XLM). Block time: 3-5s. Scalability: 1,000-5,000 TPS, with anchors for fiat on-ramps.

2025 Use Cases: Cross-border sends (MoneyGram partnerships saved $100M fees YTD). Hidden: Minimal, but bridge to ETH adds 0.5%.

XRP Ledger's RPCA yields $0.00003 txs. Block time: 3-5s. Scalability: 1,500 TPS, up 20% post-2024 upgrades.

2025 Use Cases: Bank transfers (RippleNet processed $50B Q3). Hidden: Escrow fees for complex ops (~$0.001).

Proof-of-History + PoS: $0.00025 avg (base $0.0005 + tips). Block time: 0.4s. Scalability: 65,000 TPS theoretical, 1,133 real-world.

2025 Use Cases: NFT mints (Magic Eden: 10M txs/month), gaming. Hidden: Jito tips spike to $0.01 in memes frenzy.

DPoS: <$0.01 txs. Block time: 3s. Scalability: 2,000+ TPS, boosted by USDT dominance ($60B supply).

2025 Use Cases: Stablecoin swaps (JustSwap: low-slippage). Hidden: Bandwidth/energy "freezes" for heavy users.

Snowman consensus: $0.20 avg (C-Chain), but subnets ~$0.01. Block time: <2s. Scalability: 4,500 TPS.

2025 Use Cases: Custom DeFi (Aave on subnets). Hidden: Cross-subnet ~0.5 AVAX ($0.50).

Ouroboros PoS: $0.15-0.20 txs post-Hydra. Block time: 20s. Scalability: 250 TPS base, 1,000+ with L2.

2025 Use Cases: Enterprise (African IDs). Hidden: Hydra off-chain adds setup fees.

DPoS: Near $0 (resource model). Block time: 0.5s. Scalability: Thousands TPS.

2025 Use Cases: dApps (Voice social). Hidden: CPU/RAM staking required.

This table optimizes for "lowest fee crypto comparison 2025"—Nano wins pure cost, SOL scalability.

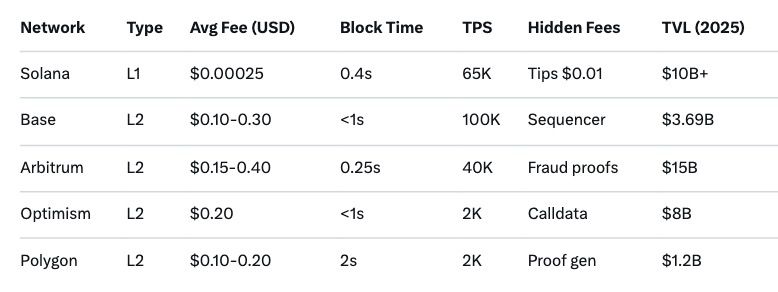

L1s (base layers) like Solana are native low-fee; L2s (Ethereum scalers) slash ETH's $3.78 to cents via rollups. Post-Pectra (May 2025), L2 fees dropped 50%, processing 1.9M daily txs.

Top L2s (2025 avgs):

L1s edge for pure transfers; L2s for ETH ecosystem. Internal link: Baltex for cross-chain.

In 2025, low fees drove 50% DeFi growth to $500B TVL—e.g., Solana's meme surge hit $100M daily fees (still <1% of ETH).

Even "free" chains bite:

Mitigate: Use aggregators, monitor via Dune, avoid peaks.

Swapping in 2025? Bridges bleed 1-2%, but Baltex.io flips the script with non-custodial atomic swaps across 20+ low-fee chains—no intermediaries, no holds.

Connect at baltex.io: Wallet link, pair select, swap. Zero exploits, AML-safe. In a $2T market, Baltex turns fees from foe to footnote. Internal link: Back to L2 table.

Nano (XNO) at $0, followed by Stellar (XLM) at $0.000004—ideal for instant, fee-free transfers.

Solana: $0.00025 native. L2s like Base: $0.10-0.30—90% cheaper than ETH's $3.78, with EVM compatibility.

Ripple (XRP) or Stellar (XLM): <$0.00003, 3-5s confirms, vs. 6% bank fees.

Priority tips (SOL: +$0.01 peaks), bridges (1%), slippage (0.5% low-liq)—use aggregators like Baltex.io.

L1s (SOL: 65K TPS) for native speed; L2s (Arbitrum: 40K) for ETH security—match to use case.

Atomic routing on low-fee chains (e.g., TRX paths): 0.1% fees, no bridges—saves 80% vs. CEXs.

2025's low-fee cryptos—Nano's free flights, Solana's speed rails, Base's ETH bridge—democratize blockchain, slashing costs from dollars to dust. L1s win raw efficiency; L2s, ecosystem depth. Pitfalls like tips exist, but tools like Baltex.io route around them, enabling seamless, sub-cent swaps.

For beginners: Start with XLM for sends. Active users: SOL for DeFi. DYOR, diversify, and transact boldly—low fees mean high potential. What's your go-to low-fee play? The chain revolution rolls on.