Bitcoin Ordinals enable on-chain NFTs (inscriptions) directly on Bitcoin by attaching data to individual satoshis, offering unmatched permanence compared to Ethereum or Solana NFTs. In 2025, with over 75 million inscriptions and tools like Xverse Wallet and Magic Eden marketplace, creating one costs $10–$50 in fees. Follow our step-by-step guide to inscribe safely, compare ecosystems, and mitigate risks like network congestion. For seamless BTC swaps post-inscription, try baltex.io for fixed-rate, low-fee exchanges across 1,000+ assets.

In the ever-evolving world of cryptocurrency, Bitcoin has long been the unchallenged king of digital money. But by 2025, it's no longer just about holding BTC—it's about owning unique digital artifacts inscribed directly onto the blockchain. Enter Bitcoin Ordinals: a protocol that transforms the smallest units of Bitcoin, satoshis, into non-fungible tokens (NFTs) known as inscriptions. This innovation, born in 2023, has exploded, with over 75 million inscriptions minted and trading volumes hitting $11.5 million on peak days. For crypto users, NFT creators, and Bitcoin enthusiasts, Ordinals represent a paradigm shift: bringing the creativity of NFTs to Bitcoin's rock-solid security without sidechains or smart contracts.

This guide dives deep into Bitcoin Ordinals in 2025. We'll explain how inscriptions work, break down fees and tools, recommend wallets and marketplaces, provide a step-by-step inscription tutorial, compare Ordinals to Ethereum and Solana NFTs, highlight risks and best practices, and wrap up with an FAQ and conclusion. Whether you're inscribing your first meme or building a collection, this is your roadmap to the Bitcoin NFT ecosystem.

At its core, Bitcoin Ordinals is a numbering system that gives each satoshi—a tiny fraction of Bitcoin (1 BTC = 100 million sats)—a unique identity. Developed by Casey Rodarmor, the protocol assigns ordinal numbers to sats based on mining order: the first sat mined gets #0, the next #1, and so on. This creates rarity tiers, from "common" sats to "epic" or "mythic" ones tied to historic events like halvings.

Inscriptions take this further by embedding arbitrary data—text, images, audio, video, or even code—directly onto a sat using Bitcoin's Taproot upgrade (activated in 2021). Taproot allows efficient data storage in transaction "witness" sections without altering Bitcoin's core rules. The result? A fully on-chain NFT that's as immutable and decentralized as Bitcoin itself.

Unlike off-chain metadata in traditional NFTs, inscriptions are stored entirely on Bitcoin, ensuring they survive as long as the network does—no IPFS links to break, no centralized servers to fail. In 2025, advancements like recursive inscriptions (allowing one inscription to reference others) and BRC-721E (for Ethereum-to-Bitcoin NFT migration) have pushed the file size limit beyond 4MB, enabling richer content like interactive art or short films.

The process relies on a two-phase transaction: "commit" (locking data in a Taproot output) and "reveal" (embedding it publicly). Once mined, the inscription gets a unique ID (transaction hash + index) for tracking. This on-chain purity makes Ordinals "digital artifacts"—collectibles with Bitcoin's scarcity baked in.

Inscribing isn't free, but 2025's matured ecosystem has made it more accessible. Fees vary with network congestion: during peaks (e.g., hype around new collections), expect $20–$50 for a 20KB image; off-peak, as low as $10. Total inscription fees have topped $24 million historically, driven by demand for block space. Miners love it—fees now rival block rewards post-2024 halving—but it can spike average BTC transaction costs to $30+.

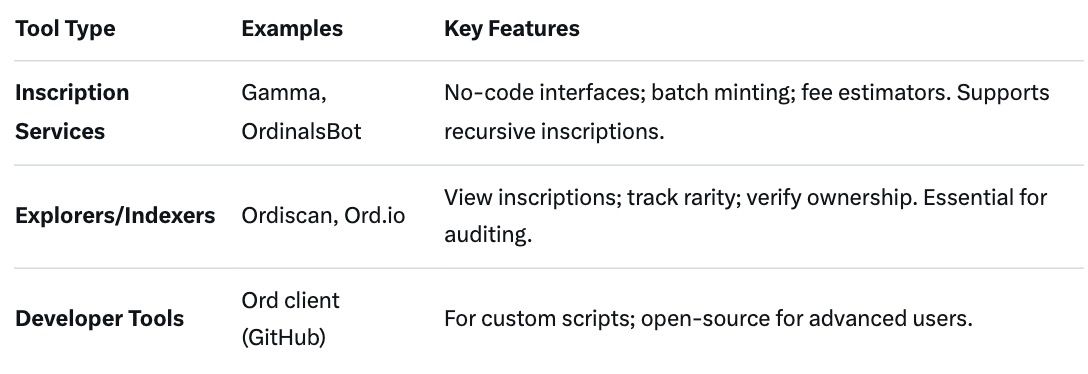

To cut costs, inscribe hashes pointing to IPFS/Arweave storage instead of full files, though this trades some decentralization. Tools have evolved too:

These tools integrate seamlessly, with mobile apps now handling 80% of inscriptions. Pro tip: Use fee estimators on mempool.space to time your inscription during low congestion.

Wallets must support Taproot addresses (starting with "bc1p") and sat control to avoid accidentally spending inscribed sats. Marketplaces focus on Bitcoin-native trading, with low royalties (0–2%) compared to Ethereum's 5–10%.

Top Wallets:

Top Marketplaces:

After trading, swap BTC or inscribed assets effortlessly on baltex.io—a privacy-focused DEX with fixed-rate swaps across 1,000+ cryptos, no slippage, and AML compliance dashboards.

Ready to create? Here's a beginner-friendly walkthrough using Gamma (adapt for others). Time: 30–60 minutes. Cost: $10–$50.

Set Up a Compatible Wallet: Download Xverse or UniSat. Create a new Taproot address (bc1p...). Fund with 0.001 BTC (~$100 at $100K/BTC) for fees. Backup your seed phrase offline.

Choose Your Data: Prepare a file <4MB (e.g., PNG image, text). For rarity, target "uncommon" sats via wallet tools. Use Ord.io to preview ordinal numbers.

Connect to an Inscription Service: Visit Gamma.io. Connect your wallet. Select "Inscribe." Upload file or enter text. Set MIME type (e.g., image/png).

Configure Fees and Sat Selection: Use Gamma's estimator—aim for 10–20 sat/vB during low traffic. Choose a specific sat if desired (e.g., rare one from your wallet).

Commit and Reveal: Approve the commit transaction (funds locked). Wait for confirmation (5–30 mins). Approve reveal—data embeds on-chain.

Verify and Manage: Check on Ordiscan using your inscription ID. View in wallet; list on Magic Eden for sale.

Internal link: Compare to Ethereum minting here.

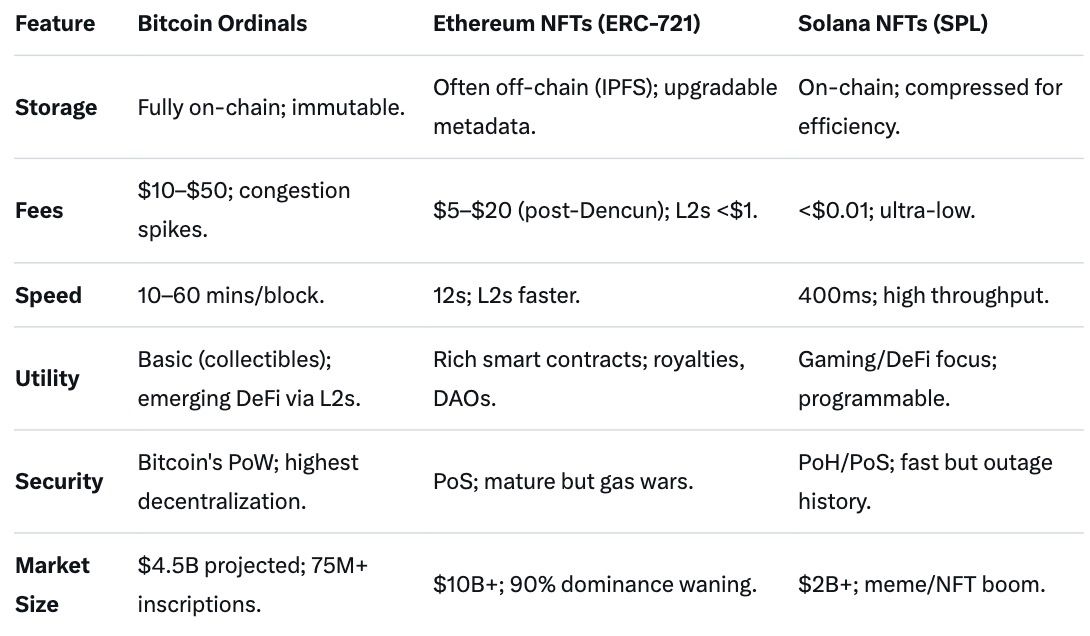

Ordinals shine in permanence but lag in speed/utility. Here's a 2025 breakdown:

Ordinals win on security—leveraging Bitcoin's $1T+ network—but Ethereum's ecosystem (e.g., royalties) and Solana's speed (for gaming) offer more interactivity. In 2025, cross-chain bridges (e.g., BRC-721E) blur lines, letting Ethereum NFTs "migrate" to Bitcoin. For pure scarcity, Ordinals edge out; for utility, Solana leads.

Ordinals aren't risk-free. Key threats:

Best practices:

For swaps without custody risks, baltex.io ensures private, fixed-rate trades—perfect for Ordinals holders.

Q: Are Ordinals real NFTs? A: Yes—unique, on-chain digital artifacts. Unlike Ethereum's, they're Bitcoin-native.

Q: How much does it cost to inscribe in 2025? A: $10–$50, depending on file size and network load.

Q: Can I bridge Ordinals to Ethereum? A: Partially via BRC-721E; full cross-chain is emerging.

Q: What's the future of Ordinals? A: DeFi integration via L2s; projected $4.5B market by year-end.

Q: Is baltex.io safe for Ordinals swaps? A: Yes—non-custodial, fixed rates, supports 1,000+ assets including BTC.

Bitcoin Ordinals in 2025 aren't just a trend—they're Bitcoin's renaissance as a creative powerhouse. By inscribing data on sats, you've unlocked on-chain NFTs with unparalleled durability, all while fueling network security through fees. Whether you're a creator eyeing Gamma's launchpad or an enthusiast collecting rares on Magic Eden, the ecosystem's tools (Xverse, UniSat) and practices empower safe participation.

As Ethereum grapples with scalability and Solana with outages, Ordinals remind us: true innovation thrives on Bitcoin's foundations. Dive in, inscribe boldly, and swap wisely on baltex.io. The blockchain's canvas awaits—what will you etch into history?