How to Buy Monero (XMR) with Fiat: Best 2026 On-Ramps

In 2026, the global regulatory landscape for privacy-preserving assets has shifted dramatically. With the full implementation of the European MiCA (Markets in Crypto-Assets) regulations and the tightening of FinCEN guidelines in the United States, finding a direct path from fiat currency (USD, EUR, GBP) to Monero (XMR) has become more complex—but certainly not impossible.

For privacy advocates, the goal isn't just to buy XMR; it’s to do so without leaving a permanent digital trail that compromises their financial sovereignty. Whether you are looking for the lowest fees, the fastest transaction speed, or a strictly No-KYC (Know Your Customer) experience, this guide ranks the best Monero on-ramps available today.

The Evolution of the Monero Market in 2026

Since major exchanges like Kraken and Binance delisted XMR in the UK and EEA (European Economic Area) in late 2024 and 2025, the community has migrated toward decentralized and non-custodial solutions. The "old ways" of buying XMR directly with a credit card on a major CEX are largely gone in Western markets, replaced by P2P networks and Atomic Swaps.

1. Haveno DEX: The Gold Standard for P2P Fiat-to-XMR

Haveno has emerged in 2026 as the spiritual successor to LocalMonero and the Monero-native version of Bisq. It is a decentralized, peer-to-peer exchange built on the Monero network and Tor.

How it works: You download the Haveno client, which connects you directly to other individuals. You can buy XMR using bank transfers (SEPA, Zelle, Venmo), cash in person, or even postal mail.

- KYC Requirement: None. Haveno is a protocol, not a company. There is no central authority to collect your ID.

- Fees: Extremely low protocol fees (approx. 0.1% + XMR network fees). However, sellers often charge a premium (3% to 8%) for the convenience of No-KYC fiat trades.

- Pros: Maximum privacy, no censorship, non-custodial.

- Cons: Higher learning curve; requires you to keep the app open during the trade.

2. The "Two-Step" Wallet Swap (Cake Wallet & Monero.com)

For most users in 2026, the easiest "on-ramp" isn't buying XMR directly, but buying a "transparent" coin like Litecoin (LTC) or Bitcoin (BTC) and instantly swapping it.

How it works: Use a standard on-ramp (like Apple Pay or Debit Card) inside Cake Wallet to buy LTC. Once the LTC arrives, use the internal "Trade" feature (powered by aggregators like Trocador) to swap it for XMR.

- KYC Requirement: Low to Medium. Buying the initial BTC/LTC via card usually requires basic KYC (email + billing address), but the subsequent swap to XMR is typically anonymous.

- Fees: 1.5% to 4% (on-ramp fee) + 0.5% to 1% (swap spread).

- Pros: Extremely user-friendly, fast, and accessible on mobile.

- Cons: Not "pure" No-KYC, as the initial fiat-to-LTC purchase is tracked by the payment processor.

3. Atomic Swaps: The Technical Privacy Route

Atomic Swaps have matured in 2026, allowing for trustless exchange between Bitcoin and Monero without any third-party intermediary.

How it works: You buy Bitcoin on any regulated exchange (with KYC). You then use an Atomic Swap provider (like UnstoppableSwap) to trade that BTC for XMR.

- KYC Requirement: None (for the swap). While your BTC purchase is KYC-linked, the swap itself leaves no linkable trail on the Monero side.

- Fees: Very low (0.1% - 0.5% spread) + network mining fees.

- Pros: Mathematically secure, no middleman, best for large volumes.

- Cons: High technical requirement; requires a synchronized Bitcoin and Monero node or a "light" provider.

4. Non-Custodial Instant Ramps (Guardarian & Changelly)

These services act as a bridge between the traditional banking system and the crypto world. In 2026, they remain one of the few places where you can still find a "Buy Monero" button with a credit card.

How it works: You select XMR, enter your wallet address, and pay via Visa/Mastercard or SEPA.

- KYC Requirement: Mandatory (Tiered). Small purchases (under $150–$300) might only require an email/phone, but anything larger will trigger a full ID check.

- Fees: High (4% to 7%).

- Pros: The fastest way to get XMR in your wallet.

- Cons: High fees and significant data collection.

5. Bisq Network (BTC to XMR)

While Haveno is forked for XMR, the original Bisq remains a powerhouse for fiat-to-BTC trades, which can then be converted to XMR.

How it works: Buy BTC via Bisq using fiat, then use Bisq's XMR/BTC market to get Monero.

- KYC Requirement: None.

- Fees: 0.1% - 1% depending on trade size.

- Pros: Deep liquidity and a decade-long reputation for security.

- Cons: You must buy BTC first, which doubles the network fees.

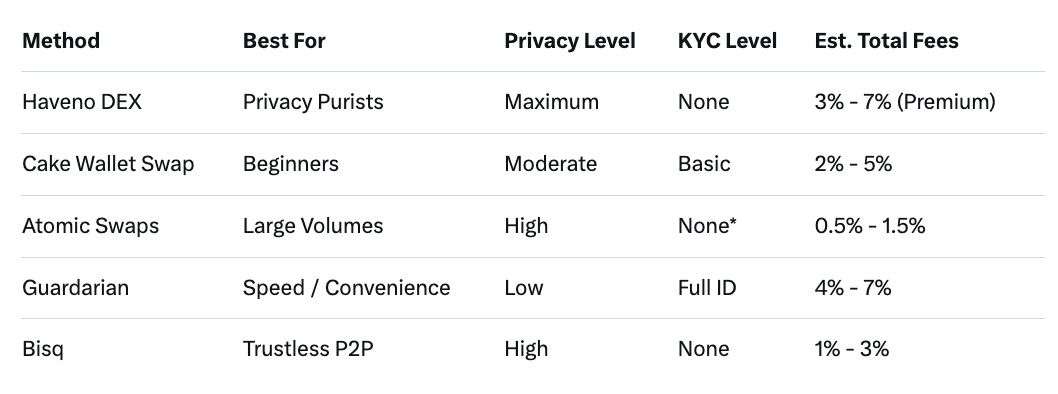

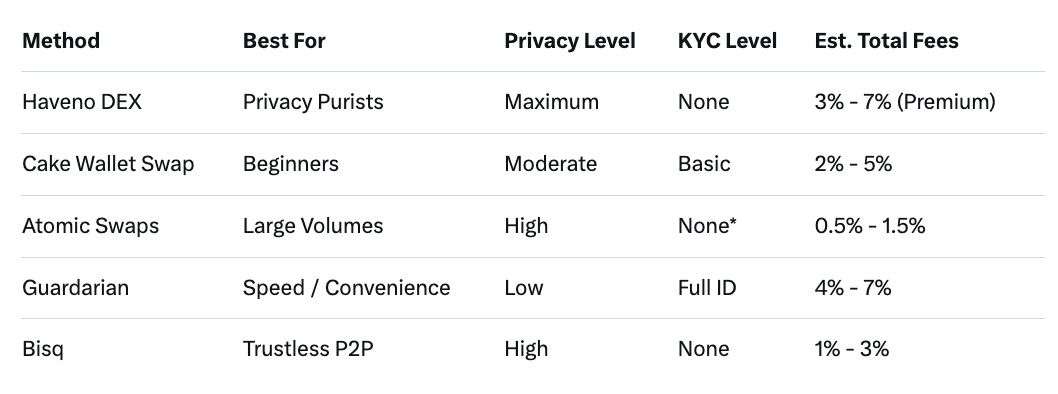

Comparative Analysis: 2026 Monero On-Ramps

*Note: While the swap is No-KYC, the initial BTC must be acquired elsewhere.

KYC vs. No-KYC: Which Should You Choose?

In 2026, the choice between KYC and No-KYC is a trade-off between cost and anonymity.

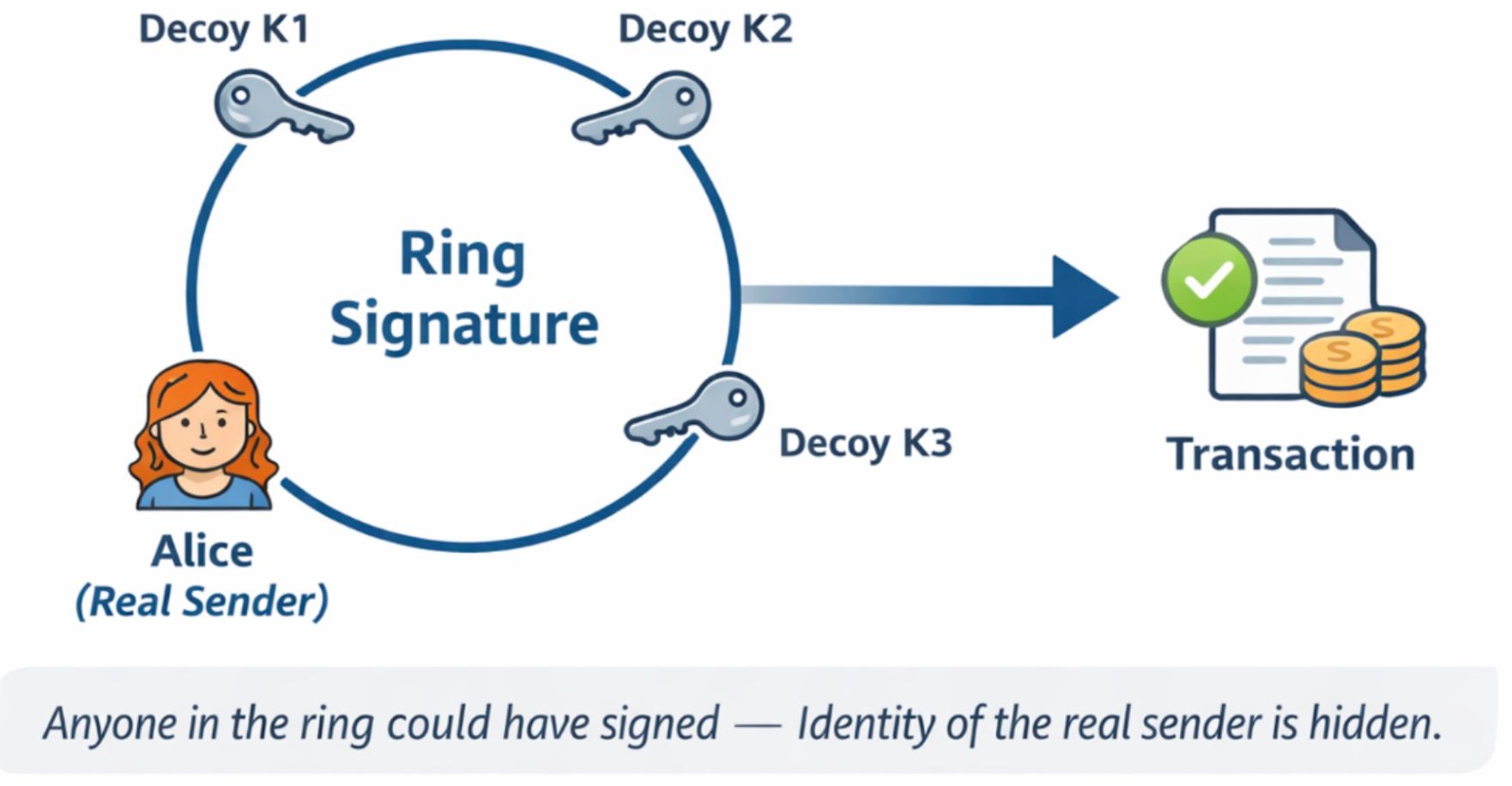

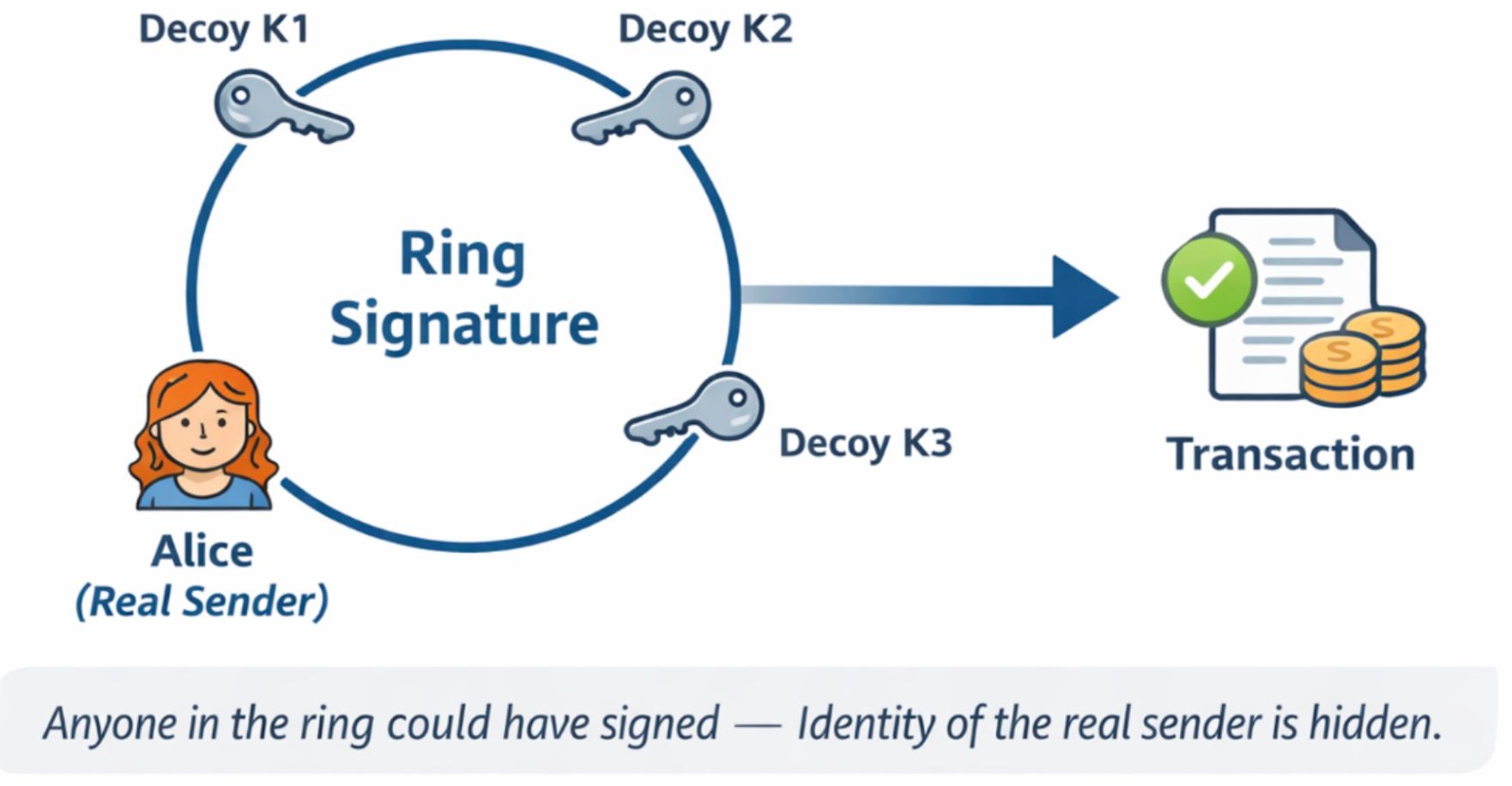

- Choose KYC-linked Ramps if you are a casual user, buying small amounts, and don't mind the government knowing you own some cryptocurrency. Once you hold XMR, its default privacy features (Ring Signatures, Stealth Addresses) protect your subsequent transactions anyway.

- Choose No-KYC Ramps (Haveno, Bisq) if you want to prevent the "on-ramp" itself from knowing you own Monero. This is essential for individuals in high-risk jurisdictions or those who adhere to the strict philosophy of "Circular Monero Economies."

Pro-Tips for Buying XMR in 2026

- Avoid Centralized Exchanges for Storage: Never leave your XMR on a CEX like KuCoin or MEXC. In 2026, exchanges are under immense pressure to freeze "suspicious" privacy coin accounts. Move your funds to a self-custody wallet (GUI, Feather, or Cake) immediately.

- Monitor the Premium: On P2P platforms, the "Monero Premium" fluctuates. If the premium is over 10%, consider buying Litecoin and swapping it—it’s often cheaper even with the extra fees.

- Check the "MiCA" Status: If you are in Europe, ensure your chosen on-ramp is compliant or accessible via Tor, as many websites are now geo-blocked for EEA IP addresses.

Conclusion

Buying Monero with fiat in 2026 requires a bit more effort than it did five years ago, but the ecosystem is more resilient than ever. Haveno is the future of decentralized acquisition, while Cake Wallet remains the king of convenience. By choosing the right on-ramp for your specific needs, you can maintain your financial privacy in an increasingly transparent world.