Sending Bitcoin in 2025 is simpler than ever, thanks to improved wallet interfaces, lower fees, and enhanced security features like multi-signature support and biometric verification. But with Bitcoin's price hovering around $95,000 and scams evolving faster than the network, one wrong move—like pasting the incorrect address—can cost you thousands. This comprehensive guide is tailored for crypto beginners and BTC holders who want to transfer funds securely across hardware, mobile, and exchange wallets.

Whether you're moving BTC from a cold storage device to a friend's mobile app or withdrawing from an exchange to your personal vault, we'll cover everything: address formats, safety checklists, fees, confirmations, step-by-step instructions, common pitfalls, and scam prevention. By the end, you'll send Bitcoin with confidence, minimizing risks in this maturing yet volatile market.

For quick swaps between Bitcoin and altcoins without full transfers, consider baltex.io— a seamless, non-custodial platform for cross-chain exchanges with built-in security audits.

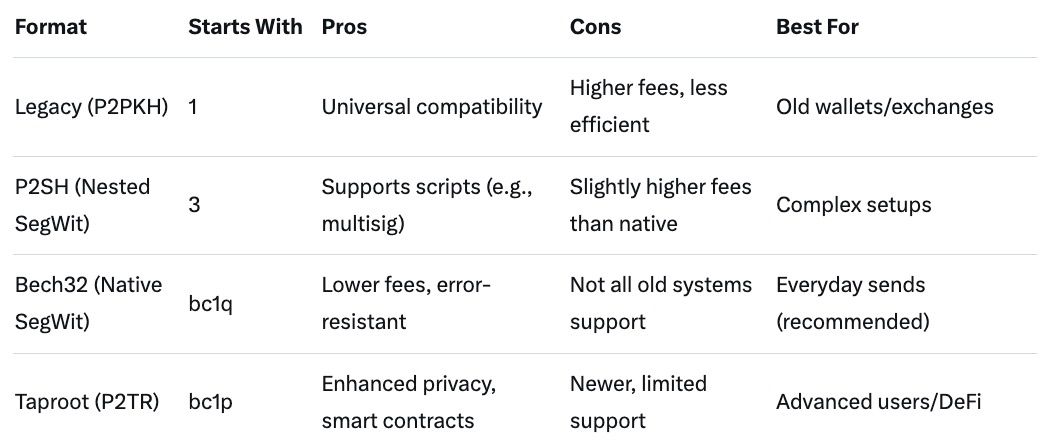

Bitcoin addresses are like unique bank account numbers—strings of letters and numbers that direct funds precisely. In 2025, with the Taproot upgrade fully integrated, addresses are more efficient and private. Using the wrong format can lead to higher fees or failed transactions.

Here's a quick comparison table of common formats:

Recommendation: Always request and use Bech32 or Taproot for 2025 transfers—they're case-insensitive, include built-in checksums to catch typos, and save 20–30% on fees. Legacy addresses are fading; many exchanges now default to SegWit.

Step-by-Step: Generating and Sharing a Safe Address

Bitcoin transactions are irreversible—once broadcast, you can't claw back funds. In 2025, phishing attacks via AI-generated deepfakes and fake wallet apps are rampant, with over $2 billion lost to scams last year alone.

Universal Pre-Send Checklist

For extra layers, use multisig wallets requiring 2-of-3 approvals. In 2025, apps like Casa offer easy setup for beginners.

Pro Tip: If swapping BTC for ETH mid-transfer, baltex.io's atomic swaps ensure funds don't touch custodians, reducing hack risks.

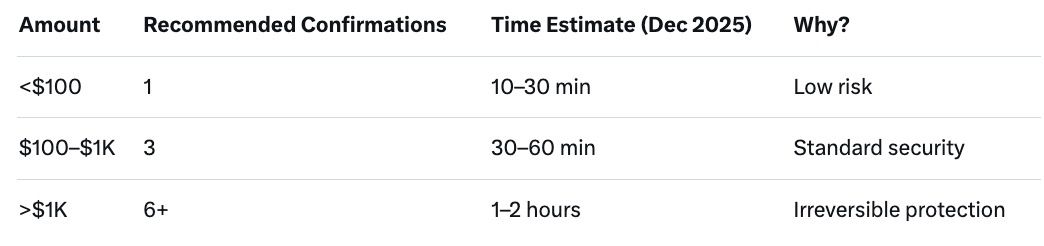

Fees pay miners to include your transaction in a block—think of it as a tip for priority. As of December 2025, the average fee is about $0.90 USD (4–5 sats/vB), down from 2024 peaks due to Layer 2 solutions like Lightning Network siphoning off small txs. Fees spike during congestion (e.g., ETF inflows), so check estimators like BitInfoCharts.

Confirmations are blocks added after yours—each ~10 minutes.

Hardware wallets like Ledger or Trezor keep keys offline, ideal for large holdings. We'll use Ledger Nano X (top-rated for 2025 usability and Bluetooth).

Prerequisites: Ledger Live app installed, device updated, BTC account set up.

Time: 2–5 minutes prep + confirmation wait. Cost: Device ~$150, but reusable.

Safety Note: Never enter seed on any site. If using Trezor Safe 7 (another 2025 leader), steps are similar via Trezor Suite.

Mobile wallets offer convenience for everyday sends. Muun is beginner-friendly with hybrid Lightning/mainchain support and recovery via email—no seed hassle.

Prerequisites: Download from official app store, back up recovery key.

Exchanges like Coinbase hold your BTC custodially—great for trading, risky for long-term. Always withdraw to personal wallets. Using Coinbase as example (user-friendly with 2025 ENS name support).

Prerequisites: Verified account, 2FA enabled, BTC balance.

Time: 3–10 minutes + confirmation. Withdrawal limits: $10K/day for verified.

Key Warning: Test with $10 first—exchanges charge extra for errors. For Kraken/Gemini, steps mirror but add "Memo" for XRP-like assets (not needed for BTC).

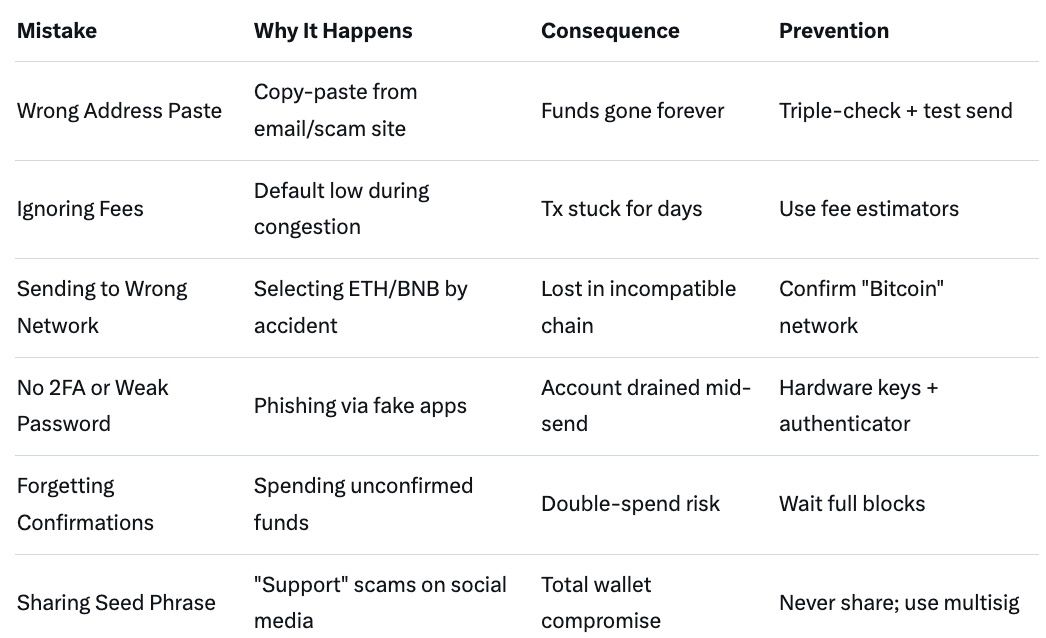

Beginners lose billions yearly to simple errors. Here's a table of top pitfalls:

In 2025, AI scams mimic wallet UIs—always verify URLs (e.g., ledger.com, not ledgerr.com). Another rising error: Falling for "address poisoning" where scammers send dust to poison your clipboard.

Full BTC sends shine for peer-to-peer, but if you're converting to USDT or ETH for DeFi, swaps are faster and cheaper. Baltex.io stands out in 2025: zero-KYC, 0.1% fees, and supports 50+ chains with slippage protection.

Quick Swap Steps on Baltex.io:

No bridges needed—perfect for avoiding send risks altogether.

Q: How long does a Bitcoin send take in 2025? A: 10–60 minutes for 1 confirmation; up to 2 hours for 6. Lightning: instant.

Q: What's the safest wallet type for sending large amounts? A: Hardware like Ledger Nano X—offline signing prevents hacks.

Q: Can I reverse a Bitcoin transaction? A: No, but if unconfirmed, contact recipient for RBF help.

Q: Why use Bech32 addresses? A: Lower fees and typo protection—standard for modern wallets.

Q: Are exchange sends free?

Sending Bitcoin safely in 2025 boils down to preparation: verify addresses, choose efficient formats, manage fees wisely, and layer on security like test sends and 2FA. Whether from a Ledger's cold steel, Muun's mobile ease, or Coinbase's dashboard, these steps empower you to move value globally without fear.

Remember, crypto's power is self-custody—start small, educate relentlessly, and treat every satoshi like gold. For seamless BTC-to-altcoin moves, baltex.io bridges the gap effortlessly. Trade responsibly, HODL tight, and here's to your secure financial future.